Estimating Continuing Value

advertisement

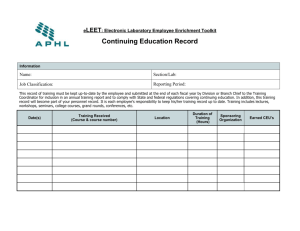

Estimating Continuing Value What is Continuing Value? • To estimate a company’s value, we separate a company’s expected cash flow into two periods and define the company’s value as follows: Home Depot: Estimated Free Cash Flow $ millions 12,000 Present Value of Cash Flow 10,000 during Explicit Forecast Period + $ millions Value = 8,000 6,000 Present Value of Cash Flow 4,000 after Explicit Forecast Period 2,000 0 • The second term is the continuing value: the value of the company’s expected cash flow beyond the explicit forecast period. 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Explicit Forecast Period 2014 2015 2016 2017 2018 2019 Continuing Value 1 The Importance of Continuing Value • A thoughtful estimate of continuing value is essential to any valuation because continuing value often accounts for a large percentage of a company’s total value. • Consider the continuing value as a percentage of total value for companies in four industries. In these examples, continuing value accounts for 56% to 125% of total value. Continuing Value as a Percentage of Total Value 125 100 Explicit period cash flow 81 56 Continuing value 44 19 0 Tobacco Sporting goods High tech Skin care -25 * Valuations use an eight-year explicit forecast period 2 Approaches to Continuing Value Recommended Approaches: Key value driver (KVD) formula • The key value driver formula is superior to alternative methodologies because it is cash flow based and links cash flow to growth and ROIC. Economic profit model • The economic profit leads to results consistent with the KVD formula, but explicitly highlights expected value creation in the continuing value period. Other Methods: Liquidation Value and Replacement Cost • Liquidation values and replacement costs are usually far different from the value of the company as a going concern. In a growing, profitable industry, a company’s liquidation value is probably well below the going-concern value. Exit Multiples (such as P/E and EV/EBITA) • Multiples approaches assume that a company will be worth some multiple of future earnings or book value in the continuing period. But multiples from today’s industry can be misleading. Industry economics will change over time and so will their multiples! 3 The Key Value Driver Formula • Although many continuing value models exist, we prefer the key value driver model. • We believe the key value driver formula is superior to alternative methodologies because it is cash flow based and links cash flow to growth and ROIC. After-tax operating profit in the base-year RONIC equals return on invested capital for new investment. ROIC on existing investment is captured by NOPLATt+1 g NOPLATt 1 1 RONIC Continuing Value t WACC g The weighted average cost of capital, based on long-run target capital structure. Expected long-term growth rate in revenues & cash flows • The continuing value is measured at time t, and thus will need to be discounted back t years to compute its present value. 4 How Growth Affects Continuing Value • Continuing value can be highly sensitive to changes in the continuing value parameters. • Let’s examine how continuing value (calculated using the value driver formula) is affected by various combinations of growth rate and rate of return on new investment. Continuing value is extremely sensitive to longrun growth rates when RONIC is much greater than WACC 5 Continuing Value when Using Economic Profit • When using the economic profit approach, do not use the traditional key value driver formula, as the formula would double-count cash flows. • Instead, a formula must be defined which is consistent with the economic profit-based valuation method. The total value of a company is as follows: Value of operations Invested capital at = beginning of + forecast Present value of forecasted economic profit during explicit forecast period + Present value of forecasted economic profit after the explicit forecast period Explicit Forecast Period Continuing value only represents long-run value creation, not total value. 6 Continuing Value when Using Economic Profit • The continuing value formula for economic profit models has two components: CVt IC t ROIC t 1 - WACC PV(Economc Profit t 2 ) WACC WACC g Value created on current capital, based on ROIC at end of forecast period (using a no growth perpetuity). Value created (or destroyed) on new capital using RONIC. New capital grows at g, so a growing perpetuity is used. • The present value of economic profit equals EVA / WACC (i.e. no growth) New Investment Economic Spread g NOPLATt 1 RONIC - WACC RONIC PV(Economi c Profit t 2 ) WACC Value using Perpetuity 7 Comparison of KVD and Economic Profit CV • Consider a company with $500 in capital earning an ROIC of 20%. Its expected baseyear NOPLAT is therefore $100. If the company has a RONIC of 12%, a cost of capital of 11%, and a growth rate of 6%, what is the company’s (continuing) value? • Using the KVD formula: 6% $100 1 12% Continuing Value t $1,000 11% 6% • Using the Economic Profit-based KVD, we arrive at a partial value: 6% 100 12% - 11% 12% PV(Economi c Profit t 2 ) $4.54 11% CVt $50020% - 11% $4.54 11% 11% 6% Step 1 Step 2 CVt 409.1 90.9 500.0 8 Other Approaches to Continuing Value • Several alternative approaches to continuing value are used in practice, often with misleading results. • A few approaches are acceptable if used carefully, but we prefer the methods recommended earlier because they explicitly rely on the underlying economic assumptions embodied in the company analysis Continuing value $ Million Technique Assumptions Book value Per accounting records 268 Liquidation value 80 percent of working capital 70 percent of net fixed assets 186 Price-to-earnings ratio Industry average of 15.0x 624 Market-to-book ratio Industry average of 1.4x 375 Replacement cost Book value adjusted for inflation 275 You can not base continuing value on multiples from today’s industry. Industry economics will change over time and so will their multiples! 9 Length of Explicit Forecast • While the length of the explicit forecast period you choose is important, it does not affect the value of the company; it only affects the distribution of the company’s value between the explicit forecast period and the years that follow. • In the example below, the company value is $893, regardless of how long the forecast period is. Short forecast periods lead to higher proportions of continuing value. Value of Operations 100% = Your estimate of enterprise value should not be affected by the length of the explicit forecast period. $893 $893 $893 $893 35 $893 26 46 Continuing value 60 79 65 Value of explicit free cash flow Horizon 74 54 40 21 5-year 10-year 15-year 20-year 25-year 10 The Difference between RONIC and ROIC • Let’s say you decide to use an explicit forecast period of 10-years, followed by a continuing value estimated with the KVD formula. In the formula, you assume RONIC equals WACC. Does this mean the firm creates no value beyond year 10? • No, RONIC equal to WACC implies new projects don’t create value. Existing projects continue to perform at their base-year level. ROIC Percent ROIC on existing capital Company-wide ROIC ROIC on new capital (RONIC) 11 An Example: Innovation, Inc. • Consider Innovation, Inc, a company with the following cash flow stream. Discounting the company’s cash flows at 11% leads to a value of $1,235. • Based on the cash flow pattern, it appears the company’s value is highly dependent on estimates of continuing value… Free Cash Flow at Innovation, Inc. Free cash flow $1,235 1,050 (85%) 185 (15%) Year Present value of continuing value Value of years 1-9 free cash flow DCF value at 11% 12 An Example: Innovation, Inc. • But Innovation Inc consists of two projects: its base business (which is stable) and a new product line (which requires tremendous investment). • Valuing each part separately, it becomes apparent that 71 percent of the company’s value comes from operations that are currently generating strong cash flow. Free Cash Flow at Innovation, Inc. $1,235 Free cash flow Free cash flow from new product line 358 (29%) New product line 877 (71%) Base business Base business free cash flow Year DCF value at 11% 13 An Example: Innovation, Inc. • By computing alternative approaches, we can generate insight into the timing of cash flows, where value is created (across business units), or even how value is created (derived from invested capital or future economic profits). • Regardless of the method chosen, the resulting valuation should be the same. 14 Common Pitfalls: Naïve Base Year Extrapolation • A common error in forecasting the base level of FCF is to assume the re-investment rate is constant, implying NOPLAT, investment, and FCF all grow at the same rate Year 11 (5% growth) Year 9 Year 10 1,000 1,100 1,155 (850) (935) (982) (982) EBIT 150 165 173 Cash taxes (60) (66) (69) 173 (69) NOPLAT 90 99 104 104 Depreciation 27 30 32 32 117 129 136 136 Capital expenditures 30 33 35 35 Increase in working capital 27 30 32 17 Gross investment 57 63 67 52 Free cash flow 60 66 69 84 300 330 362 347 30 30 31 30 Sales Operating expenses Gross cash flow Year-end working cap Working capital/sales (percent) Incorrect Correct 1,155 This level of investment was predicated on a 10% revenue growth rate When the company’s growth rate falls to 5%, required investment should fall as well! With naïve base-year extrapolation, FCF is too small! 15 Common Pitfalls: Overconservatism Naïve Overconservatism • The assumption that RONIC equals WACC is often faulty because strong brands, plants and other human capital can generate economic profits for sustained periods of time, as is the case for pharmaceutical companies, consumer products companies and some software companies. Purposeful Overconservatism • Many analysts err on the side of caution when estimating continuing value because of uncertainty, but to offer an unbiased estimate of value, use the best estimate available. The risk of uncertainty will already be captured by the weighted average cost of capital. • An effective alternative to revising estimates downward is to model uncertainty with scenarios and then examine their impact on valuation 16 Common Pitfalls: Distorting the Growing Perpetuity • Simplifying the key value driver formula can result in distortions of continuing value. Company-wide average ROIC NOPLAT CV = WACC-g NOPLAT CV = WACC Forecast period WACC Overly aggressive? Assumes RONIC equals infinity! Overly conservative? Assumes RONIC equals the weighted average cost of capital Continuing value period 17 Closing Thoughts • Continuing value can drive a large portion of the enterprise value and should therefore be evaluated carefully. • Several estimation approaches are available, but recommended models (such as the key value driver and economic profit models) explicitly consider: • Profits at the end of the explicit forecast period - NOPLATt+1 • The rate of return for new investment projects - RONIC • Expected long-run growth - g • Cost of capital - WACC • A large continuing value does not necessarily imply a noisy valuation. Other methods, such as business components and economic profit can provide meaningful perspective on how aggressive (or conservative) the continuing value is. • Common pitfalls to avoid: naïve extrapolation to determine the base year cash flows, purposeful overconservatism and naïve overconservatism (RONIC = WACC). 18