Virtual Classroom Test Review

advertisement

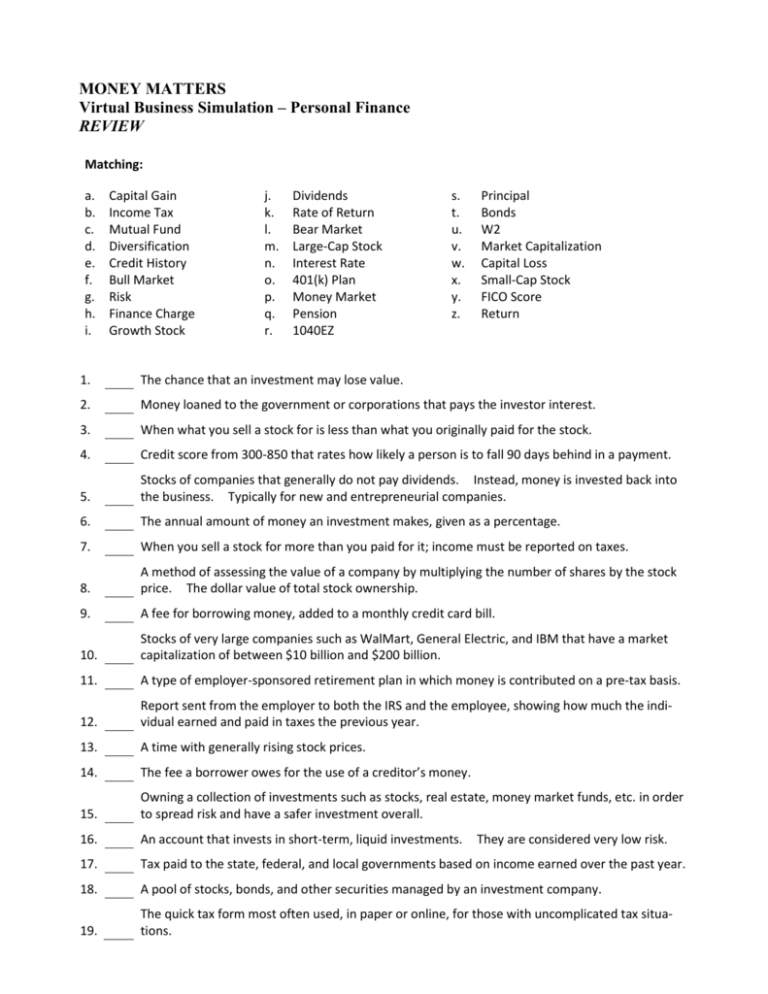

MONEY MATTERS Virtual Business Simulation – Personal Finance REVIEW Matching: a. b. c. d. e. f. g. h. i. Capital Gain Income Tax Mutual Fund Diversification Credit History Bull Market Risk Finance Charge Growth Stock j. k. l. m. n. o. p. q. r. Dividends Rate of Return Bear Market Large-Cap Stock Interest Rate 401(k) Plan Money Market Pension 1040EZ s. t. u. v. w. x. y. z. Principal Bonds W2 Market Capitalization Capital Loss Small-Cap Stock FICO Score Return 1. G The chance that an investment may lose value. 2. T Money loaned to the government or corporations that pays the investor interest. 3. W When what you sell a stock for is less than what you originally paid for the stock. 4. Y Credit score from 300-850 that rates how likely a person is to fall 90 days behind in a payment. 5. I Stocks of companies that generally do not pay dividends. Instead, money is invested back into the business. Typically for new and entrepreneurial companies. 6. K The annual amount of money an investment makes, given as a percentage. 7. A When you sell a stock for more than you paid for it; income must be reported on taxes. 8. V A method of assessing the value of a company by multiplying the number of shares by the stock price. The dollar value of total stock ownership. 9. H A fee for borrowing money, added to a monthly credit card bill. 10. M Stocks of very large companies such as WalMart, General Electric, and IBM that have a market capitalization of between $10 billion and $200 billion. 11. O A type of employer-sponsored retirement plan in which money is contributed on a pre-tax basis. 12. U Report sent from the employer to both the IRS and the employee, showing how much the individual earned and paid in taxes the previous year. 13. F A time with generally rising stock prices. 14. N The fee a borrower owes for the use of a creditor’s money. 15. D Owning a collection of investments such as stocks, real estate, money market funds, etc. in order to spread risk and have a safer investment overall. 16. P An account that invests in short-term, liquid investments. 17. B Tax paid to the state, federal, and local governments based on income earned over the past year. 18. C A pool of stocks, bonds, and other securities managed by an investment company. 19. R The quick tax form most often used, in paper or online, for those with uncomplicated tax situations. They are considered very low risk. 20. L A time with generally falling stock prices. 21. S The amount of money borrowed. bought with the card. 22. E A summary of a person’s borrowing and repayment history. 23. Z Monetary increase that an investment makes. 24. Q A fixed sum paid regularly by an employer to an employee after retirement. 25. J Quarterly payout of profits by a company to all shareholders. 26. X Stocks of largely unknown companies with smaller market capitalization of between $300 million and $2 billion. On a credit card bill, this is the purchase price of all items Multiple Choice Identify the letter of the choice that best completes the statement or answers the question. 27. B 28. D You ran short of cash and borrowed $50 from your rich cousin. insisted that you owed $60. What is the extra $10 called? a. Bribery c. Principal b. Interest d. Credit You are paying 11% interest on a cred card balance of $2,000. you are paying each month? a. $11.00 c. $13.33 b. $15.33 d. $18.33 When you pad her back, she Which of the following best estimates the intere 29. C A paycheck has withholding tax taken out: a. If a person earns more than c. That is paid to state and federal taxing authorities $600 a year b. That is always equal to $9.54 d. That is automatically refunded to workers even without filing a 1040EZ form 30. C An associate degree is a a. 4-year degree b. 6-year degree 31. B c. d. 2-year degree None of these You put $1,000 in an interest bearing bank account that pays 1% per year but has a fee of $2 per month. Are you getting ahead? a. Yes b. No 32. C You forgot to pay last month’s credit card bill. Your creditor will probably: a. Cancel your account b. Send you a reminder to pay the bill c. Add finance charges and late d. Reduce your minimum payment fees to your bill 33. A Improving your credit score will let you get a. Lower interest rates on loans b. Higher interest rates on savings accounts 34. B 35. A 36. C You invest $5,000 in a fund. You check your statement at the end of March and you have lost 15%. When the statement for April comes, you see you have gained 15% in April. What is the value of your account? Round to the nearest dollar. a. $5,000 c. $5,150 b. $4,888 d. $4,500 Tax refunds: a. Occur when a taxpayer’s income tax withhold exceeds what they owe b. Come to taxpayers regardless of whether they file an income tax return or not c. Come from extra money the federal government has left over at the end of the year d. Include interest paid to the taxpayer by the federal government based on hold that money throughout the tax year You earn $22,000. The tax table says you owe $3,456 in taxes. During the year, your tax withholdings were $5,333. What happens next? a. You owe an additional $3,456 c. You will receive a refund of $1,877 b. You owe an additional $1,877 d. Nothing, you’re even. 37. D Someone who can tolerate a risky investment would: a. Wake up in the middle of the c. Be very concerned that a downturn would wipe night worrying about the out the long-term gains investment b. Keep all money in a savings d. Understand that an investment that fell when the account at a bank for long-term entire market fell was not necessarily a bad growth investment 38. B A resume is generally _____ page(s) in length. a. Two to five c. Three b. One d. Any of these page counts 39. B If you buy enough different stocks, you can diversify out all risk in the stock market. a. True b. False 40. A Diversification is good because: a. It spreads the risk of investment b. Interest rates rise and fall 41. C 42. A c. Mutual funds have higher fees than individual stocks d. It focuses investments on a single stock to take advantage of growth potential The penalty for not paying taxes owed: a. Can’t be calculated if you do c. not file taxes b. Can be determined by the d. Social Security Administration even if withholding is not taken from your paycheck Includes penalty fees and interest calculated starting April 15 of the year the taxes are owed Will be $600 plus interest starting April 15 if you do not file a tax return, regardless of the amount of your wages Why is it harder to estimate expenses than to estimate income? a. Expenses often change more c. You can never truly know how much you spend from month to month b. Your income will never change d. None of these 43. B You have some cash. You can either invest it in a mutual fund that pays approximately 6% of payoff some credit card debt at 10%. Which should you do? a. Invest in the mutual fund b. Pay off the credit card 44. A When should you begin saving for retirement? a. As soon as you enter the c. In your 30s workforce b. In your 50s d. Right before you retire 45. B Savings accounts generally offer a higher yield than stock investments. a. True b. False 46. A If you have a long-time horizon for investing, you should: a. Lean toward high-risk c. Keep at least 75% cash or money market funds for immediate investments with high-return availability potential b. Own only one stock d. Diversify into savings accounts and U.S. savings bonds 47. C What is the official retirement age, according to the US government? a. 55 c. 67 b. 65 d. 70 48. D 49. B 50. C You invested $2,300 in a stock. Your account now has a value of $2,643. gain on the investment (rounded to the nearest percent) was ? a. 0% c. 10% b. 5% d. 15% Your percentage All investments eventually increase in value if held long enough. a. True b. False You expect that an investment could gain or lose as much as 20% in a year. is $15,000. What is the lowest value you expect at the end of the year? a. $3,000 c. $12,000 b. $7,000 d. $15,000 Your investment