Welcome Personal Financial Planning By Kim Handy

advertisement

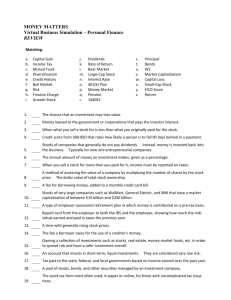

Welcome Personal Financial Planning By Kim Handy The Financial Plan Thanks to healthier lifestyles and breakthroughs in medical technology, life expectancy for Americans has increased significantly during the past half-century. While it's good news that you can expect to live longer in retirement and have a better quality of life, it also means your investment portfolio may need to last for 30 years or more. https://personal.vanguard.com. 2014 At retirement, $1 million in savings could potentially generate about $40,000 in before-tax annual income (adjusted for inflation). Withdraw more than that amount from the $1 million annually and you'll run the risk of running out of money. www.dailyfinance.com. 2014 While the published tuition and fees at public and private colleges still increased in 2013, the growth was smaller than it has been in past years. At public, four-year colleges, for example, published tuition and fees increased by 2.9 percent – the smallest one-year increase since the mid-1970s. But net prices – what students and families actually pay after grant aid, scholarships and tax credits are subtracted – have increased since 2010 because the growth in financial aid has not kept pace with the increase in college tuition. www.usnews.com, 2013. “If you look at people who are financially successful,” he said, “most of them have been making very smart financial decisions all their life. The sooner you start making smart decisions, the sooner you know where you want to go, and if you have a plan to get there, the more likely you are to attain it. www.forbes.com, 2013 Do I need one? Some questions to ask yourself… Do I have clear financial goals? Do I honestly know where all my money goes each month? Do I know the return I made on my investment accounts, retirement accounts, bank accounts last year? Do I understand my investments or my investment options? Do I have the right amount and type of insurance? Am I financially “set” for retirement? Should I pay off my credit card or my student loan? Do I have “financial peace of mind?” The Financial Planning Process (six steps) 1. Establish how you will develop a 2. 3. 4. 5. 6. financial plan Gather financial information and establish financial goals Analyze and evaluate financial status Develop an action plan Implement the plan Monitor and update on a regular basis 1. How will you develop your plan? Options: Find a professional to assist you (costs money) Take a class (costs significantly less money, but takes time) Do-it-yourself (costs very little money, but takes significant time) 2. Gather Information/Establish Goals Information needs include: Account balances (savings, investment, retirement, etc.) Statements for any financial account (including credit card, student loans, car loan, etc.) Insurance policies Mortgage information Tax returns Social Security information 2. Establish Goals Examples Emergency fund with 10k Retirement salary of 75k each year House down payment of 20k College fund for two years Zero credit card debt Family vacation Buy a new car 3. Analyze/Evaluate Financial Status Develop a balance sheet – This is your starting point. Develop a cash flow statement – this answers the question, “Where does my money go?” Balance Sheet Sample Balance Sheet - June 2014 Assets Description Home Liabilities June 2014 Description 350,000 Mortgage Chase VISA Amount 290,000 4,200 Personal Investments Schools MMA 2,000 Retirement Investments Vanguard 403b CalPers Pension 113,196 3000/month College Investment Scholarshare 529 Total Assets 1,300 Total Liabilities $294,200 Total Assets minus $466,496 Total Liabilities $294,200 466,496 Net Worth $172,296 Cashflow Statement Sample Cashflow Worksheet July Description In August Out In September Out In Out Fixed: Mortgage/rent 1200 1200 1200 Car payment 400 400 400 Car Insurance 130 130 130 1030 990 875 300 136 260 0 175 50 25 125 50 Variable: Grocery Eating out Clothing Gifts Income: Salary Total Surplus or (Deficit) 3100 $3,100 3100 $3,085 $15 $3,115 3100 $3,156 -$41 $3,059 $2,965 $94 Evaluate Investments What investments do I own? How have they been performing over time? Do I have online access to my account? How do I read this? 4. Develop an action plan (for each goal) Goal - Save 250k in retirement funds over the next 20 years. Action plan: 1. 2. 3. 4. Contribute $5,500 or maximum amount to Roth IRA. Contribute $2,500 to my 403b Plan for 5-6% annual average return over the next 20 years. Invest in an appropriate asset allocation for my risk profile. 5. Implement the plan 6. Monitor and Update Semi annual preferred Annual required Update goals Rebalance accounts Evaluating Mutual Funds By Kim Handy Investment Goals Save enough money to retire on $85k per year for 30 years. Have a $50k college fund for my son. Save $20k for a family vacation in two years. Build an emergency fund of 5k. Save $20 per month at Etrade to begin my investment in a Roth IRA account (I have a little job). Use this money to invest in commission free ETFs. This is from a student, and it is priceless. Investment Decision Factors Life situation – age, family, income, etc. Time – investors with a greater time horizon can assume more risk. Risk tolerance – really, just how much risk can you tolerate before you lose sleep, feel sick, or even shut-down and ignore your mail? Investment Pyramid Asset Allocation How an investor distributes investments among the different levels of the pyramid. Percentage allocation among cash equivalents (savings, MMA, CDs, MMMFs, etc.), bonds, and stocks. No simple formula for selecting the perfect allocation, but this is so important! Why Mutual Funds? Popular way to invest in stocks and bonds is through mutual funds. Key advantages are diversity and professional management Other advantages include simplicity, liquidity, and economies of scale Mutual Funds Investment company that pools money from many investors and invests in stocks, bonds, short-term investments, etc. Investments in the funds are determined by the investment objectives. Making Money w/Mutual Funds Bond interest Stock dividends Capital gains on stocks and bonds in fund Fund per share price Popular Fund Types Money Market Funds – contain short-term debt instruments, usually treasury bills. Very low return, but very safe. Bond/Income Funds – contain government or corporate debt. Primary goal is to provide a steady stream of income. Primary risk factor is interest rates. Balanced Funds – contain a balance of safety, income, and capital appreciation (stock). Many are called asset allocation or target date funds. Popular Fund Types cont. Equity – contain stocks generally with the objective of long-term capital growth and some income. The style box below illustrates the categories of equity funds. Global/International – invests anywhere in the world (including the US) and an international fund invest outside of the US only. Popular Fund Types cont. Specialty Funds – can either focus on a specific sector (healthcare, technology, energy, real estate), or a specific region (Latin America, Canada), or socially responsible companies. Index Funds - This type of mutual fund replicates the performance of a broad market index such as the S&P 500 or Dow Jones Industrial Average (DJIA). An investor in an index fund figures that most managers can't beat the market. An index fund merely replicates the market return and benefits investors in the form of low fees. Selecting a Mutual Fund – Step 1 What is your desired asset allocation? You should choose one based on your time horizon, risk tolerance, and financial situation. Examples - Individual who is within 10 years of retirement Motley Fool 50% stocks 15% international 35% bonds Fidelity 51% stocks 18% international 31% bonds Vanguard 45% stocks 19% international 36% bonds Selecting a Mutual Fund – Step 2 Has the fund made money Review historical returns Compare the returns with the index benchmark. Is the fund outperforming the benchmark? Review 5yr, 10yr, and since inception returns Selecting a Mutual Fund – Step 3 Fund Fees – two types: Ongoing yearly fees captured in the expense ratio. We like a very low expense ratio. Transaction fees when you buy or sell the fund shares (loads). We don’t like these! Selecting a Mutual Fund – Step 3 Expense Ratio Includes management fees, administrative costs, and 12B-1 advertising costs. Can range from .2% (index funds) to 2%. Again, these costs take away from your profits. The Securities and Exchange Commission’s website quotes: "Higher expense funds do not, on average, perform better than lower expense funds." Selecting a Mutual Fund – Step 3 Transaction Costs Front-end loads – sales commission. If you contribute $100 to a fund with a 5% front-end load, then $5 will be the charge, and $95 will be invested in the fund. That’s just wrong Back-end loads (deferred load) – charged when you sell shares of the fund. The percent of sales charge decreases with time. Mostly wrong No load – no front-end or back-end sales charge. This is for us! Selecting a Mutual Fund – Step 4 Risk Factors Review Morningstar ratings and risk Look at Sharpe ratio. Should be higher than index. Look at Alpha. Should be higher than category. Selecting a Mutual Fund – Step 5 Manager history – has he/she been around a while? It’s usually a good sign. Now, let’s evaluate some funds!