Fiat case study powerpoint

advertisement

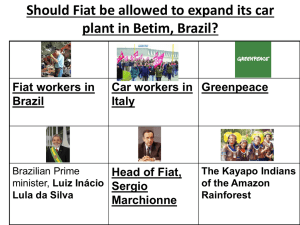

Fiat “ONE LESS WORRY” TEAM EH! William Chen, Mike Butterfield, Nicole Whiting, Jacquie Kine, Mike Xu, Ryan Briscoe INTRODUCTION Powerful company in the global automotive industry Although Fiat is successful in Europe, the Canadian market is different PROBLEM What product strategies can Fiat use to increase sales in Canada to 12,000 total units per year in the fiscal year of 2014? AGENDA 1. Introduction 2. Problem 3. Key facts 4. SWOT 5. Competitive analysis 6. Target market 7. Alternatives 8. Solution 9. Implementation plan KEY FACTS Fiat owns 54% stake in Chrysler 8464 Fiats sold in 2012 Chrysler controls distribution of Fiats in Canada Fiats marketing strategy is based on mass marketing in Canada with no specific target Increase car sales in 2012, over 2011 Loss of 1.41 million Euros in 2012 Major ownership in Ferrari, Maserati, and Alfa-Romeo SWOT STRENGTHS WEAKNESSES Financially, strong Operating at a loss Technologically advanced in subsidiaries No clear marketing in Canada Worldwide distribution Weak reputation OPPORTUNITIES THREATS Canadian Vehicle market grew 6% in 2012 Fiat faces a multitude of threats, including rising steel prices Upcoming Global Events Europe in economic crisis Longer Wait to Buy out minority Chrysler Shareholders Trend for more fuel efficient cars COMPETITIVE ANALYSIS CAR PRICE SEATS SAFETY RATING FUEL ECONOMY Jeep Grand Cherokee Overland $55,295 5 8/10 stars 9.8 L/100km city 7 L/100km hwy VW Touareg TDI Clean Diesel Comfortline $53,975 5 9/10 stars 10.8L/100km city 6.7L/100km/Hwy Ford Escape SE Eco Boost $26,499 5 8/10 stars 31/47 city/hwy mpg 9.1/6.0 city/hwy L/100km Hyundai Santa Fe XL $31,888 7 9/10 stars 3.3L Gas 9.9 L/100km TARGET MARKET MAIN DIMENSIONS VARIABLES TARGET Geographic Segmentation Region Urban Areas British Columbia, Quebec, Ontario, Alberta 81 % of population are “urban dwellers” TARGET MARKET Demographic Segmentation Age Gender Birth Era Income Marital Status Family Size 25-54 Female & Male Generation Y in their 25-45 93 700 average yearly income for 2 parent families , blended families with children 64 100 for one person earner Families Married or Living with a Common Law Partner 2-3 Persons Psychological Segmentation Personality Lifestyle PRIZM C2 “work hard , play hard mentality” Fast track families Blended families Behavioral Segmentation Value Value consciousness ALTERNATIVES OPTION 1-Bring the 500e to Canada ADVANTAGES Fills the Eco-friendly market DISADVANTAGES Electric cost more to manufacture (need research) Popular in California and New Dependant on marketing campaign for success (Competing model offers York better dashboard technology) Will fall in line with Fiat reputation Needs charging stations OPTION 2-Bring Freemont to Canada ADVANTAGES Fills a gap Fiat’s line up Priced equal or less than competitors Use existing Dodge manufacturing facilities DISADVANTAGES Fiat has never done a SUV in Canada Will need new marketing budget (starting from scratch) Crossover/SUV Market extremely competitive OPTION 3-Reposition & Rebrand 500L ADVANTAGES Guarantee increase in income due to repositioning the branding DISADVANTAGES Dependant on marketing campaign for success Minimal product changes necessary Will take a lot more money/time/effort to change people’s mind about the 500L Good, cheaper alternative to the Fiat Freemont for potential family Will need to fully redesign car to be cars successful Breadth & Depth Depth Fiat Freemont Fiat 500L Fiat 500E Depth Breadth Freemont Breadth Fiat 500E Fiat 500L SOLUTION Fiat Freemont Bring the Freemont to Canada Option 2, bring the Freemont to Canada Short term solution to increase sales and while building on a long term plan Backup plan: Reposition the 500L (no clear marketing direction) IMPLEMENTATION A Quick Primer on the 4 P’s The Freemont is a 7 seat SUV built on the Dodge Journey platform Dodge has manufacturing plants in Canada (Brampton and Windsor Ontario) Price: = $29,999 Australian price = $36,852 New product – high competition. “One Less Worry” campaign Marketing Budget Revenue 12000 units sold x (average vehicle cost) $22,000 = $260,000,000 Our marketing budget for the full year is $26, 000,000 Divided into two semi-annual periods 13,000 000 for (January 1,2014- June 1,2014) Step1: Retailer Promotional Allowance Program (January 1, 2014- February 31,2014) What is Chryslers Promotional Allowance Program? Current system gives 1:1 ratio in the first quarter The Plan: offer 2:1 in January and February to motivate dealerships (13% of Semi-annual period budget = $1,000,000) Step 2: Benefits, Commissions and Share Matching (January 1,2014-June 1,2013) It starts with internal motivation: Two training sessions and information packages Additional 5% commission for sales staff 30% Employee share matching program 35% of first semi-annual period budget= 4,500 000 Step 3: Promotional Hype Campaign (December 20,2013-January 20, 2014) Launch January first – “First to own a Freemont in Canada” Utilize McDonalds corporate alliance Campaign directed toward Fiatcanada.com/bethefirst Url for analytics and tracking 15% of the first semi-annual period budget=2,000,000 Step 4:Debut of Fiat Freemont (January 1st ,2014– March 31st ,2014) TV (primetime) ◦ Airing Tuesday, Thursday and Sunday (between 6-9pm 1 commercial per hour) ◦ Major news channels to mesh with our demographic (CBC) for Vancouverites ◦ Global, CBC, CTV 37% of the first semi-annual period budget ($4,500,000) Step 4:Debut of Fiat Freemont (January 1st ,2014– March 31st ,2014) Radio (7% radio $900,000) ◦ Airing morning commute (7-9am and 4-6pm) ◦ Targeting NEWS 1130am, coincides with our target market Online (1% of budget $132,000) ◦ SEM $11,000 per month (covers full city) Step 5: Continue with most effective campaigns (June 1, 2014- July 1, 2014) Scale back numbers for marketing budget Assess which mediums worked in which markets How did consumers respond? Focus remainder of budget on what works: $9,400,000 Step 6: Events promos/ SCR/ co-branding (June 1st ,2014– July 31st,2014) Sponsor local soccer (little league) FIFA Commercial (Events Budget = $3,600,000) Step 7: Year End Evaluation (December 2014) Review numbers and goals. Did we sell 12,000 units total in 2014 Were they feasible? What needs improving? Conclusion References Cain, T. (2013, July 3). Fiat brand sales figures . Retrieved from http://www.goodcarbadcar.net/2013/07/fiat-brand-usa-canada-sales-figures.html Fiat group's world. (2013, September 13). Retrieved from http://fiatgroupworld.com/2013/09/15/fiat-freemont-2012-full-year-analysis Fiat Freemont (2013, June, 28) Retrieved from http://www.fiat.com/com/freemont http://www.carsguide.com.au/news-and-reviews/car-reviews-road-tests/fiat_freemont_review1