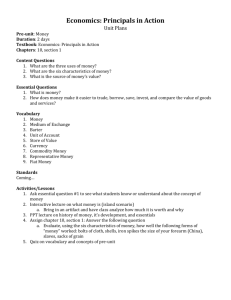

UNIT FOUR OUTLINE Unit Four is a study of Money and Banking

advertisement

UNIT FOUR OUTLINE Unit Four is a study of Money and Banking within the U.S. economy. Upon completion of this unit you will be able to: (SSEMA2a,b,c: SSEMA3a,b; SSEMA1f; SSEMI1b) Define macroeconomics. Explain how the government raises revenues and allocates resources. SSEMA 3a Identify the principles of taxation. SSEMA 3b Differentiate between proportional, progressive, and regressive taxes. SSEMA 3b Describe federal, state, and local tax systems. SSEMA 3b Describe fiscal policy tools and options. SSEMA 3a Identify the difference between budget deficit and national debt. SSEMA1f Describe the organization and function of the Fed. SSEMA 2a Describe monetary policy tools and options. SSEMA2b, c Describe the functions and characteristics of money. SSEMA Differentiate between the greenback, gold, and inconvertible fiat money standards. SSEMA Explain how the U.S. money supply is measured. SSEMA2c WEEK ONE/TWO: Define vocabulary terms given on cards. Read Chapter 10 (SSEMA2c) and then complete the following assignments: Questions 1- 4 on page 248; Questions 1 and 3 on page 256; Questions 1, 3, 5, and 6 on page 264; Questions 10, 11, 13, and 17 on page 267. WEEK TWO/THREE: Define vocabulary terms given on cards. Read Chapter 14 (SSEMA3a,b) and then complete the following assignments: Questions 2, 3, 4, and 5 on page 363; Questions 3, 5, and 6 on page 369; Questions 2, 3, 4, and 6 on page 374; Questions 2, 3, and 5 on page 380; and Questions 12, 13, 14, and 15 on page 383. WEEK THREE/FOUR: Define vocabulary terms given on cards. Read Chapter 15 (SSEMA1f,3a)and then complete the following assignments: Questions 1, 2, 4, 5, and 6 on page 393; Skills for Life on page 394; Questions 1, 3, 4, and 5 on page 401; Questions 1- 3 on page 408; Case Study on page 409; Questions 9, 10, 12, 13, 14, and 21-23 on page 411. WEK FOUR/FIVE: Define vocabulary terms given on cards. Read Chapter 16 (SSEMA2a,b,c)and then complete the following assignments: Questions 2, 4, and 5 on page 418; Questions 3, 4, and 6 on page 423; Questions 2-7 on page 429; Questions 1, 2, 5, and 6 on page 434; Case Study on page 435; Questions 9, 10, 13, 15, and 16 on page 437. You can expect a vocab quiz on the terms of each chapter and will likely be collected upon the completion of each chapter. No portfolio required. UNIT 3 VOCABULARY TERMS CHAPTER 10 CHAPTER 14 Money Currency Commodity money Representative money Fiat money Greenback standard Gold standard Inconvertible fiat standard Federal Reserve FDIC Liquidity Demand deposit Fractional reserve Interest Principal Income tax Sales tax Property tax Proportional tax Progressive tax Regressive tax FICA Tariff Mandatory spending Discretionary spending Entitlement CHAPTER 15 CHAPTER 16 Fiscal policy Expansionary policy Contractionary policy Demand-side economics Supply-side economics Keynesian economics Classical economics Budget deficit T-Bill T-Note T-Bond National debt Monetary policy FAC FOMC Federal funds rate Discount rate RRR Prime rate Monetarism Easy money policy Tight money policy