Social Accounting Matrices for supporting policy decision processes

advertisement

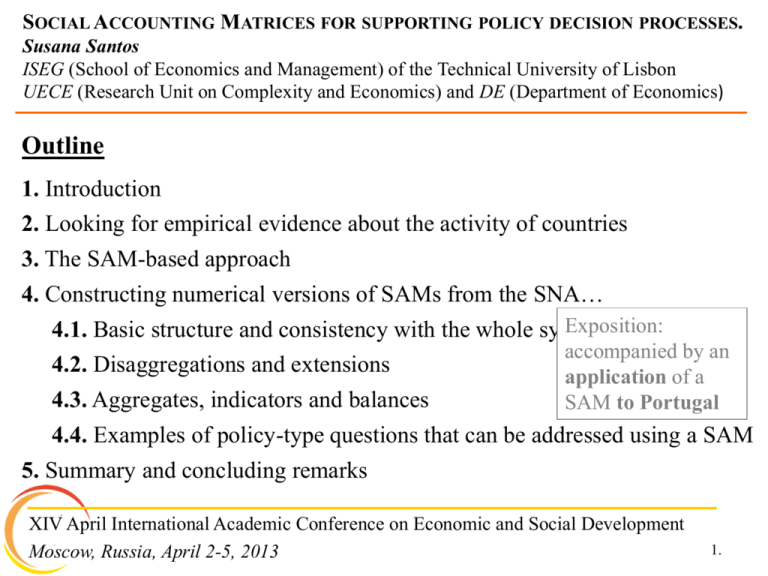

SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos ISEG (School of Economics and Management) of the Technical University of Lisbon UECE (Research Unit on Complexity and Economics) and DE (Department of Economics) Outline 1. Introduction 2. Looking for empirical evidence about the activity of countries 3. The SAM-based approach 4. Constructing numerical versions of SAMs from the SNA… Exposition: 4.1. Basic structure and consistency with the whole system 4.2. Disaggregations and extensions 4.3. Aggregates, indicators and balances accompanied by an application of a SAM to Portugal 4.4. Examples of policy-type questions that can be addressed using a SAM 5. Summary and concluding remarks XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 1. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos Social Accounting Matrix (SAM): square matrix, in which the sum of the rows is equal to the corresponding sum of the columns – entries made in the rows represent resources, incomes, receipts or changes in liabilities and net worth – entries made in columns represent uses, outlays, expenditures or changes in assets tool for measuring the society’s activity underlying which there are systems that can be worked upon in different ways description SAM-based approach • empirical SAM numerical version SAM algebraic version [methodological framework based on the works of R.Stone and G.Pyatt] • theoretical XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 2. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos A SAM can have two versions: → a numerical version - describes the activity of a society empirically - each cell has a specific numerical value, with the sums of the rows being equal to the sums of the columns → an algebraic version - describes that same activity theoretically - each cell is filled with algebraic expressions that, together with those of all the other cells, form a SAM-based model, the calibration of which involves a replication of the numerical version XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 3. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos SAMs are tools that have specific features for studying the activity of countries. allow for the reading and interpretation of the reality under study leading to the production of an empirical work that is • not only capable of highlighting specific aspects of that activity • but also offers the chance to experiment with different interventions in regard to its functioning ... proposal for a basic SAM, together with an explanation of possible alternative taxonomies, showing how SAMs can be used – as an alternative support for studies being undertaken in several areas – for the work of those taking part in the policy decision process XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 4. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos national accounts the core of the statistics representing the activity of countries their adoption is recommended, at least as a starting point (for any study that is looking for empirical evidence about the activity of countries) basic structure is proposed for a numerical version of a SAM from the 2008 SNA a summary set of the flows that the SNA assumes to be observed and the controlling totals for other levels of disaggregation from which, it is possible to study specific aspects and maintain the consistency of the whole system XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 5. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos accounts represented by its rows and columns • production: products (goods and services), activities (industries) and factors • (domestic) institutions: current, capital and financial • rest of the world consistency is only possible when production and institutions are worked on together Disaggregations … do not affect the consistency of the whole system Extensions … pass through the convenient adjustment to, or the connection with, the whole system in order to maintain its consistency Concern with .. is a condition for ensuring that the network of linkages that underlies the activity of countries is complete besides the generation of income, the distribution, redistribution and use of income, as well as the redistribution and accumulation of wealth, have to be included. XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 6. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos matrix format increased analytical content possibility of capturing and working with networks of linkages not captured and worked on otherwise network of linkages can only be identified and worked on in a matrix form in a tool like the SAM • can be worked on not only for the observed but also for the nonobserved activity of countries through the national accounts The convenient coverage of that network of linkages is a necessary condition for capturing multiplier effects in subsequent modelling, which can provide important knowledge XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 7. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos aggregates, indicators and balancing items, can be calculated outside the matrix format different forms of analysis Depending on the detail of the SAM, we can e calculate more or less detailed • aggregates, such as Gross Domestic Product (GDP), Gross National Income, Disposable Income, etc. • structural indicators of the functional and institutional distribution of generated income, as well as the indicators of the use of disposable income. • the main items in the revenue and expenditure of the institutional sectors and of the rest of the world (extracted from the respective rows and columns of the SAM) XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 8. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos Extracted from a SAM which can be the numerical version of → the reality under study → the replication(s) after running a SAM-based model(s) in order to try out policy measures ↓ one or more scenarios representing the impacts of those policy measures ↓ when compared with can support the processes of policy decision-making and policy decision-taking XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 9. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos two examples of policy-type questions that can be addressed using the proposed version → under the scope of the social policy measures → working with specific flows in which government and households intervene directly (namely the current transfers between them both) A. the case of the direct taxes on income, paid by the households to the government B. the case of the social benefits, paid by the government to the households first step: identification of the absolute and relative importance of these flows in the main items of the revenue and expenditure of the these institutional sectors XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 10. Revenue and expenditure of Portuguese Government in 2009 and the relative importance of current taxes on income, wealth, etc., (transactions D5) received from households and of social benefits other than social transfers in kind (transaction D62) paid to the households. Resources or Revenue (SAM row) 106 euros Relative importance of D5 in.. 106 euros (%) 1. Current Account (a) 58 407 Gross National Income 70 102 37 160 522 Current transactions to domestic institutions - D62 paid to households 31 215 28 483 Net taxes on products 19 694 Current transactions to the RW 1 726 Current transactions from domestic institutions - D5 received from households 37 610 10 107 2. Capital Account 106 euros 40.6 -11 695 91.2 26.9 615 1 246 Capital transactions from domestic institutions Capital transactions from the RW 3 = 1 + 2 (b) 17.3 Final Consumption Current transactions from the RW Relative importance of D62 in.. (%) - 34 Net taxes on production Balancing item Uses or Expenditure (SAM column) 6 687 128 1 181 59 653 Gross Capital Formation 5 071 Capital transactions to domestic institutions 1 301 Capital transactions to the RW 315 16.9 Sources: Table 3 (rows/columns 8 and 13); Statistics Portugal (INE) (a) Balancing item = Gross saving; (b) Balancing item = - Net lending (+)/borrowing (-) 76 788 -5 441 37.1 -17 135 11 Revenue and expenditure of Portuguese Households in 2009 and the relative importance of current taxes on income, wealth, etc., (transactions D5) paid to the government and of social benefits other than social transfers in kind (transaction D62) received from the government. Resources or Revenue (SAM row) 106 euros Relative importance of D62 in.. 106 euros (%) 1. Current Account (a) 160 747 Gross National Income Current transactions from domestic institutions - D62 received from the government Current transactions from the RW 2. Capital Account 17.7 147 019 120 015 Final Consumption 106 206 36 949 28 483 Current transactions to 77.1 domestic institutions - D5 paid to the government 39 468 10 107 Current transactions to the RW 3 783 369 106 euros 6.9 13 728 25.6 1 345 5 093 Capital transactions from domestic institutions 192 Gross Capital Formation Capital transactions from the RW 177 Capital transactions to domestic institutions 161 116 Relative importance of D5 in.. (%) Capital transactions to the RW 3 = 1 + 2 (b) Balancing item Uses or Expenditure (SAM column) 17.7 -4 724 7 269 3 -2 179 152 112 6.6 9 004 Sources: Table 3 (rows/columns 5, and 10); Statistics Portugal (INE) (a) Balancing item = Gross saving; (b) Balancing item = - Net lending (+)/borrowing (-) 12 SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos ..proposal is intended to contribute towards a more detailed and complete study of the activity of countries → → with greater knowledge being provided about the whole and the corresponding interactions of its parts will allow for subsequent interventions to be carried out in relation to the parts while remaining aware of the impacts that this will have on the whole .. a possible way of introducing empirical evidence into the work being carried out at the macroeconomic level where the network of linkages within the socioeconomic groups that intervene in the activity of countries should not continue to be neglected so completely XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 13. SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos The adoption of this principle could even allow for • further contributions to be made towards the improvement of the SNA • ensure the greater commitment on the part of countries to adopt and adapt this system with greater collaboration between macroeconomists and statisticians. x Thank you for your attention! (ssantos@iseg.utl.pt) XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 14. The Basic SAM by blocks p – products a – activities f – factors dic – (domestic) institutions’ current account dik – (domestic) institutions’ capital account dif – (domestic) institutions’ financial account rw – rest of the world total p TTM (tp,p) P (ta,p) a IC (tp,a) 0 f dic FC (tp,dic) dik GCF (tp,dik) 0 0 0 0 0 0 0 NTP (tdic,p) CFP_GAV (tf,a) NTA (tdic,a) CFP_GNI (tdic,f) CT 0 0 0 0 0 IM&NTP (trw,p) AS (t.p) NTA (trw,a) VCT (t.a) 0 0 (tdic,dic) S (tdik,dic) (tdik,dik) 0 0 0 CFP (trw,f) AFIP (t.f) CT KT (trw,dic) AIP (t.dic) (trw,dik) AINV (t.dik ) KT dif rw EX (tp,rw) total AD 0 (tp.. ) VPT 0 0 (ta. ) AFIR 0 CFP (tf,rw) (tf. ) CT AI 0 (tdic,rw) (tdic. ) NLB KT INVF (tdik,dif) (tdik,rw) (tdik. ) FT FT TFTR (tdif,dif) (tdif,rw) (tdif.) FT TVRWP 0 (trw,dif) (trw.) TVRWR TFTP (t.dif) (t..rw) Source: Santos (2009; 2010) 15 Block: Production – P (cell: ta,p) (transaction P1 of the National Accounts) the output of goods and services p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 KT NLB (tdik,dif) (tdik,rw) FT FT (tdif,dif) (tdif,rw) NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) (tdik,dik) CT (tdic,rw) KT 0 16. Block: Domestic Trade of goods and services (domestically produced or imported) − Intermediate Consumption – IC (cell: tp,a) (transaction P2 of the National Accounts) − Final Consumption – FC (cell: tp,dic) (transaction P3 of the National Accounts) − Gross Capital Formation – GCF (cell: tp,dik) (transaction P5 of the National Accounts). p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) KT (tdik,dik) CT (tdic,rw) KT NLB (tdik,dif) (tdik,rw) FT FT (tdif,dif) (tdif,rw) 0 17. Block: External Trade of goods and services – imports – IM (cell: trw,p) (transaction P7 of the National Accounts) – exports – EX (cell: tp,rw) (transaction P6 of the National Accounts) p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 KT NLB (tdik,dif) (tdik,rw) FT FT (tdif,dif) (tdif,rw) NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) (tdik,dik) CT (tdic,rw) KT 0 18. Block: Trade and Transport Margins – TTM (cell: tp,p) p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) CT (tdic,rw) KT NLB (tdik,dik) (tdik,dif) (tdik,rw) KT FT FT (tdif,dif) (tdif,rw) 0 19. Block: Net taxes on production and imports − Net Taxes on Production – NTA (cells: tdic,a; trw,a) (transactions D29-D39 of the N. Acc.) − Net Taxes on Products – NTP (cells: tdic,p; trw,p) (transactions D21-D31 of the N. Acc.) p – products a – activities f – factors dic – (domestic) institutions’ current account dik – (domestic) institutions’ capital account dif – (domestic) institutions’ financial account rw – rest of the world p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) S (tdik,dic) (tdic,p) (tdic,a) CFP_GNI (tdic,f) 0 0 0 IM&NTP (trw,p) NTA EX (tp,dik) NTA 0 rw 0 NTP 0 dif 0 0 0 (tdic,rw) KT NLB (tdik,dik) (tdik,dif) (tdik,rw) KT FT 0 0 CT KT FT (trw,dik) (trw,dif) (trw,a) CFP (trw,f) (trw,dic) CT FT (tdif,dif) (tdif,rw) 0 20. Block: Compensation of factors of production – CFP (cells: tf,a; tdic,f; tf,rw; trw,f) − compensation of employees (transaction D1 of the National Accounts) − “ of own assets (transaction D4, balances B2g and B3g of the N. Acc.) p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) KT (tdik,dik) CT (tdic,rw) KT NLB (tdik,dif) (tdik,rw) FT FT (tdif,dif) (tdif,rw) 0 21. Block: Current Transactions - CT (cells: tdic,dic; tdic,rw; trw,dic) current taxes on income.., social contributions, social benefits in cash, other current transfers, the adjustment made for the change in the net equity of households in pension fund reserves (transactions D5, D61, D62, D7, D8 of the National Accounts) p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) KT (tdik,dik) CT (tdic,rw) KT NLB (tdik,dif) (tdik,rw) FT FT (tdif,dif) (tdif,rw) 0 22. Block: Capital Transactions - KT (cells: tdik,dik; tdik,rw; trw,dik) − capital transfers (transaction D9 of the National Accounts); − acquisitions less disposals of non-financial non-produced assets (transaction NP1-3) p – products a – activities f – factors dic – (domestic) institutions’ current account dik – (domestic) institutions’ capital account dif – (domestic) institutions’ financial account rw – rest of the world p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 S (tdik,dic) (tdic,p) (tdic,a) CFP_GNI (tdic,f) 0 0 0 IM&NTP (trw,p) NTA (trw,a) EX (tp,dik) NTA 0 rw 0 NTP 0 dif 0 CFP (trw,f) CT (tdic,rw) KT NLB (tdik,dik) (tdik,dif) (tdik,rw) KT 0 0 CT KT (trw,dic) (trw,dik) FT FT (tdif,dif) (tdif,rw) FT (trw,dif) 0 23. Block: Financial Transactions – FT (cells: tdif,dif; tdif,rw; trw,dif) (transactions F1-8 of the National Accounts) p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) KT (tdik,dik) CT (tdic,rw) KT NLB (tdik,dif) (tdik,rw) FT FT (tdif,dif) (tdif,rw) 0 24. Block: Gross Saving – S (cell: tdik,dic) (balance B8g of the National Accounts) p – products a – activities f – factors dic – (domestic) institutions’ current account dik – (domestic) institutions’ capital account dif – (domestic) institutions’ financial account rw – rest of the world p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 S (tdik,dic) (tdic,p) (tdic,a) CFP_GNI (tdic,f) 0 0 0 IM&NTP (trw,p) NTA (trw,a) EX (tp,dik) NTA 0 rw 0 NTP 0 dif 0 CFP (trw,f) CT (tdic,rw) KT NLB (tdik,dik) (tdik,dif) (tdik,rw) KT FT 0 0 CT KT FT (trw,dic) (trw,dik) (trw,dif) FT (tdif,dif) (tdif,rw) 0 25. Block: Net borrowing/lending – NLB (cell: tdik,dif) (balance B9 of the National Accounts) p – products a – activities f – factors p a TTM IC (tp,p) P (ta,p) 0 f dic dik FC GCF (tp,a) 0 (tp,dic) 0 0 CFP_GAV (tf,a) dif (tp,dik) (tp,rw) 0 0 0 0 0 0 0 0 CFP (tf,rw) CT (tdic,dic) 0 0 NTA (tdic,p) (tdic,a) CFP_GNI (tdic,f) dik – (domestic) institutions’ capital account 0 0 0 S (tdik,dic) dif – (domestic) institutions’ financial account 0 0 0 0 0 IM&NTP (trw,p) NTA CT KT FT (trw,dic) (trw,dik) (trw,dif) rw – rest of the world (trw,a) EX 0 NTP dic – (domestic) institutions’ current account rw CFP (trw,f) KT (tdik,dik) CT (tdic,rw) KT NLB (tdik,dif) (tdik,rw) FT FT (tdif,dif) (tdif,rw) 0 26. Basic SAM of Portugal in 2009 (unit: 106 euros) p a p – products 0 a – activities 311 365 162 661 dic dik dif 146 934 34 051 19 694 rw total 47 236 390 882 311 365 149 403 f – factors dic – (domestic) institu-tions’ current account dik – (domestic) institu-tions’ capital account dif – (domestic) institu-tions’ financial account f 522 141 423 9 039 158 443 4 581 251 931 16 222 2 232 35 856 36 659 37 209 73 868 85 711 15 865 1 536 rw – rest of the world 59 823(a) - 1 222 17 019 3 421 268 20 987 total 390 882 311 365 158 443 251 931 35 856 73 868 100 297 100 297 Sources: Statistics Portugal (INE); Portuguese Central Bank (Banco de Portugal). (a) 59 717 (imports) + 106 (net taxes on products sent to the institutions of the European Union) 27 SAM of Portugal in 2009, with disaggregated factors of production and the (domestic) institutions’ current and capital accounts (unit: 106 euros) Outlays (expenditures) PRODUCTION INSTITUTIONS FACTORS PRODUCTS 1 2 Labour (employees) Other 3 4 Households Total 5 Nonfinancial Financial Government corporations corporations 6 7 NPISH 8 9 Total 0 162 661 0 0 0 106 206 0 0 37 160 3 568 146 934 ACTIVITIES 2 311 365 0 0 0 0 0 0 0 0 0 3 0 85 888 0 0 0 0 0 0 0 0 0 0 Other 4 0 0 63 515 149 403 0 0 0 0 0 0 0 0 0 0 0 34 258 120 015 0 801 0 0 0 0 0 1 830 5 226 28 998 95 36 949 FACTORS 1 Labour (employees) CURRENT ACCOUNT PRODUCTS Households 5 0 0 0 85 757 Nonfinancial corporations 6 0 0 0 14 615 14 615 1 830 0 613 171 0 2 613 Financial corporations 7 0 0 5 990 5 990 5 289 519 131 42 32 6 013 Government NonProfitInstitutionsServing Households(NPISH) Total 8 19 694 0 522 0 - 34 - 34 31 224 5 684 671 8 22 37 610 9 0 0 0 837 837 324 154 50 1 997 0 2 525 19 694 522 85 757 55 666 141 423 39 468 8 187 6 690 31 215 150 85 711 Households 10 0 0 0 0 0 13 728 0 0 0 0 13 728 Nonfinancial corporations 11 0 0 0 0 0 0 8 903 0 0 0 8 903 Financial corporations 12 0 0 0 0 0 0 0 5 283 0 0 5 283 Government NonProfitInstitutionsServing Households(NPISH) Total FINANCIAL ACCOUNT 13 0 0 0 0 0 0 0 0 - 11 695 0 - 11 695 14 0 0 0 0 0 0 0 0 0 - 354 - 354 0 0 0 0 0 8 903 5 283 - 11 695 - 354 15 865 0 0 0 0 0 0 16 59 823 0 - 1 222 0 0 13 728 15 0 0 370 16 649 17 019 1 345 240 110 1 726 0 3 421 390 882 311 365 86 127 72 315 158 443 160 747 17 331 12 082 58 407 3 363 CAPITAL ACCOUNT INSTITUTIONS PRODUCTION Incomes (receipts) ACTIVITIES CURRENT ACCOUNT Total REST OF THE WORLD TOTAL Sources: Statistics Portugal (INE); Portuguese Central Bank (Banco de Portugal). 251 931 28 SAM of Portugal in 2009, with disaggregated factors of production and the (domestic) institutions’ current and capital accounts (unit: 106 euros) (continued) Outlays (expenditures) INSTITUTIONS CAPITAL ACCOUNT Households Nonfinancial corporations Financial corporations Government NPISH 10 11 12 13 14 FINANCIAL ACCOUNT WORLD 15 16 TOTAL Total 7 269 19 812 1 064 5 071 834 34 051 0 47 236 390 882 ACTIVITIES 2 0 0 0 0 0 0 0 0 311 365 3 0 0 0 0 0 0 0 239 86 127 Other 4 0 0 0 0 0 0 0 8 800 72 315 0 0 0 0 0 0 0 9 039 158 443 FACTORS 1 Labour (employees) CURRENT ACCOUNT PRODUCTS Households 5 0 0 0 0 0 0 0 3 783 160 747 Nonfinancial corporations 6 0 0 0 0 0 0 0 103 17 331 Financial corporations 7 0 0 0 0 0 0 0 79 12 082 Government NonProfitInstitutionsServing Households(NPISH) Total 8 0 0 0 0 0 0 0 615 58 407 9 0 0 0 0 0 0 0 1 3 363 0 0 0 0 0 0 0 4 581 251 931 Households 10 0 0 53 139 0 192 - 9 004 177 5 093 Nonfinancial corporations 11 0 0 0 795 0 795 11 407 924 22 029 Financial corporations 12 0 0 53 24 0 77 - 4 157 0 1 202 Government NonProfitInstitutionsServing Households(NPISH) Total 13 3 95 28 0 2 129 17 135 1 118 6 687 14 0 0 0 344 0 344 840 14 844 3 95 135 1 301 2 1 536 16 222 2 232 35 856 15 0 0 0 0 0 0 36 659 37 209 73 868 16 - 2 179 2 122 3 315 8 268 20 987 5 093 22 029 1 202 6 687 844 35 856 73 868 CAPITAL ACCOUNT INSTITUTIONS PRODUCTION Incomes (receipts) REST OF THE Total FINANCIAL ACCOUNT REST OF THE WORLD TOTAL Sources: Statistics Portugal (INE); Portuguese Central Bank (Banco de Portugal). 100 297 100 297 29 SOCIAL ACCOUNTING MATRICES FOR SUPPORTING POLICY DECISION PROCESSES. Susana Santos Thank you for your attention! (ssantos@iseg.utl.pt) XIV April International Academic Conference on Economic and Social Development Moscow, Russia, April 2-5, 2013 30.