Taxes - Business Ed 4u

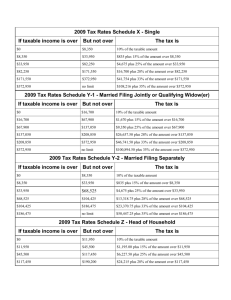

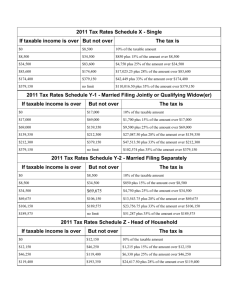

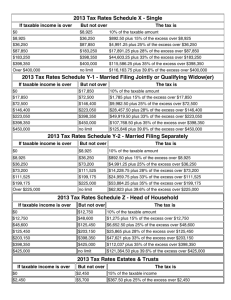

advertisement

Personal Finance Nobody enjoys paying taxes; however, taxes help pay for: • Roads • Military • Fire/Police Services • Schools • Libraries • Parks, Zoos, etc… So, how does the government GET our money? Income Tax: tax on earned (employment) and unearned (investments/savings) income Payroll Tax: tax on earned income that supports Social Security and Medicare (a.k.a. FICA) Property Tax: tax on property, such as land, buildings (including homes), and motor vehicles Sales Tax: tax on items purchased in retail stores Excise Tax: tax charged on certain consumption items (gas, cigarettes, alcohol) W4: Form you fill out when you gain employment that helps the government estimate how much money should be withheld from your paycheck for taxes You will receive a W4 from your employer when you are hired. This document will help estimate how much should be withheld from your paycheck for taxes. Every paycheck a certain amount of money is withheld as an “estimate” of how much taxes you will owe. A Form W4 will help the government determine how much to withhold from your paychecks to cover your taxes. The amount of income tax withheld depends on your wages, marital status, and number of dependents. W2: Form received at the end of the year detailing how much money you earned throughout the course of the year from a particular employer At the end of every year, you will receive a W2 from your employers. This document will tell you how much you made the previous year. This document also tells you how much was taken out of your paycheck for taxes 1040/1040EZ: Form you fill out at the end of the year to determine the difference between what you’ve paid the government for taxes and the amount you actually owe in taxes Form 1040 is the beginning document when filing taxes. This is the document you send to the IRS that will determine if you will receive a refund, or if you owe money in taxes. Pay the government or refund? Electronically or by hand Use TurboTax or other sites to help 2012 Income Tax Rate Schedule (Single) Over But Not Over Marginal Tax Rate $0 $8,700 10% $8,700 $35,350 15% $35,350 $85,650 25% $85,650 $178,650 28% $178,650 $388,350 33% $388,350 And Over 35% 2012 Income Tax Rate Schedule (Married) Over But Not Over Marginal Tax Rate $0 $17,400 10% $17,400 $70,700 15% $70,700 $142,700 25% $142,700 $217,450 28% $217,450 $388,350 33% $388,350 And Over 35% John is single. His taxable income last year was $7,500. How much is John’s tax bill? $7,500 x 10% = $750 2012 Income Tax Rate Schedule (Single) Over But Not Over Marginal Tax Rate $0 $8,700 10% $8,700 $35,350 15% $35,350 $85,650 25% $85,650 $178,650 28% $178,650 $388,350 33% $388,350 And Over 35% Pat and Christina are married. Last year their taxable income was $16,750 between the two of them. How much will they owe in taxes this year? $16,750 x 10% = $1,675 2012 Income Tax Rate Schedule (Married) Over But Not Over Marginal Tax Rate $0 $17,400 10% $17,400 $70,700 15% $70,700 $142,700 25% $142,700 $217,450 28% $217,450 $388,350 33% $388,350 And Over 35% Harvey is single. His taxable income last year was $24,000. How much is Harvey’s tax bill? $8,700 x 10% = $870.00 $15,300 x 15% = $2,295.00 Total Tax Bill $3165.00 2012 Income Tax Rate Schedule (Single) Over But Not Over Marginal Tax Rate $0 $8,700 10% $8,700 $35,350 15% $35,350 $85,650 25% $85,650 $178,650 28% $178,650 $388,350 33% $388,350 And Over 35% Anthony and Jamie are married. Last year they made $500,000 between the two of them. How much will they owe in taxes this year? 17,400 x 10%= $1,740.00 $53,300 x 15% = $7,995.00 $72,000 x 25% = $18,000.00 $74,750 x 28% = $20,930.00 $170,900 x 33%= $56,397.00 $111,650 x 35% = $39,077.50 $500,000 $144,139.50 2012 Income Tax Rate Schedule (Married) Over But Not Over Marginal Tax Rate $0 $17,400 10% $17,400 $70,700 15% $70,700 $142,700 25% $142,700 $217,450 28% $217,450 $388,350 33% $388,350 And Over 35% Jack is a single accountant. When he was hired, he filled out at W4 form. The government then looked at his W4 form, his marital status, and his number of dependents to determine that Jack will have $300 taken from his paycheck each month. Over the course of the next year, Jack will pay $3600 in taxes. (12 months x $300/mo.=$3600) ***Remember: This is only an ESTIMATE of how much Jack will owe in taxes!*** After completing his taxes, the government determines that Jack should pay $4000 for taxes. Since Jack has only paid $3600 throughout the year, John must pay $400 at tax time! Jill is a nurse. She is married and has one child. When she was hired, she filled out at W4 form. The government then looked at her W4 form, her marital status, and her number of dependents to determine that Jill will have $250 taken from her paycheck each month. Over the course of the next year, Jill will pay $3000 in taxes. (12 months x $250/mo.=$3000) ***Remember: This is only an ESTIMATE of how much Jill will owe in taxes!*** After completing her taxes, the government determines that Jill should pay $2300 for taxes. Since Jill has paid $3000 throughout the year, Jill is entitled to a refund of $700 at the end of the year! Standard Deduction: an “automatic” deduction you may claim regardless of your actual expenses • This lowers your taxable income by… Single: $5,950 Married: $11,900 Personal Exemption: a “write-off” for each person in your household • This lowers your taxable income by… $3800 per person Adjusted Gross Income -Standard Deduction -Personal Exemptions Taxable Income Pam & Jim work at Dunder Mifflin paper company. They have two children. Combined, they made $80,000 last year. What is their taxable income? Adjusted Gross Income -Standard Deduction -Personal Exemptions (4) Taxable Income $80,000 -$11,900 -$15,200 $52,900 ***Then, using the tax tables, use $52,900 to determine how much they owe.*** Every month John makes $2,000. After looking at John’s marital status, and number of dependants, the government decides to take out $300 for taxes. Over the course of the year, John has paid $3,600 in taxes. • ($300/month x 12 months) Remember, this is only an estimate of how much John roughly owes. After completing his taxes, the government determines that John should pay $4,000 in taxes. Because he has only paid $3,600 throughout the year, John must pay $400 at tax time. Throughout the year, Tim has paid $5,000 in estimated taxes. At the end of the year, the government determines that Tim only owes $3,900. Therefore, Tim refund. is entitled to a $1,100 For each person in your household, you are allowed to “write off” a personal exemption. If there are four people in your house, you may claim four personal exemptions. A personal exemption lowers your taxes by $3,650. You may claim yourself, your spouse, and your dependents. A family of four makes Four exemptions ($3,650) Taxable Income $40,000 $14,600 $25,400 In addition to person exemptions, you are allowed a standard deduction. The standard deduction is an "automatic" deduction you may claim regardless of your actual expenses. This lowers your taxable income by: Married Single- $10,900 $5,450 A family of four making Standard Deduction Four Exemptions ($3,650) Taxable Income $14,500 $40,000 -$10,900 -$14,600 $14,500 x 10% = $1,450 Owed in Taxes We now know that this family owes $1,450 in taxes. At the end of the year, the family receives a W2 from their employer that states $2,000 was withheld in taxes. Therefore, they $550. are entitled a refund of Instead of claiming the standard deduction of $10,900 (married) or $5,450 (single), you may decide to itemize your deductions. Thing you may “write off” include: • Health Care • Interest Paid on Mortgage • Childcare Expenses • Etc… Capital gains and losses happen when you buy and sell stocks. If you buy $1,000 of GOOG and sell it for $1,200, you have made a $200 capital gain. Capital gains are separated into short term and long term categories. Short term gains are any investment held under one year. Long term gains are any investment held over one year. Short term capital gains are taxed at your ordinary income bracket. • 10%, 15%, 25%, 28%, 33%, or 35% Long term capital gains are taxed at: • 0% for people in low tax brackets • 10% or 15% for people in higher tax brackets Capital gains can be “offset” by capital losses. If you make $1,000 on PEP, but lose $700 on GE, your capital gain for the year is: $300 One reason rich people stay rich is because they earn most of their income from stocks, which are taxed at 15%. One of the reasons poor people stay poor is because they earn most of their money from wages, which can be taxed at 35%! Keep more of your money by being taxed at 15%, rather than 35%! Most dividends are taxed at 15%. Income earned from wages can be taxed at 35%! Keep most of your money by investing in stocks that pay dividends! Warren Buffett is the third richest person in the world. Every Yet year he makes billions of dollars. he pays a lower tax rate than his secretary, who makes $70,000. How? Warren does not pay himself a salary from his company because it would be taxed at 35%. Instead, Warren makes all his money from dividends and capital gains. The most he pays in taxes is 15%! His secretary makes $70,000, which is taxed at 25%! Many Republicans favor lower taxes for some of the wealthiest Americans. Under President Reagan, the top tax bracket went from 70% to 28%. This lowered taxes for the richest Americans. At the same time, the bottom tax bracket was raised from 10% to 15%, which increased the taxes on the lowest Americans Under President George W. Bush, the top tax bracket was lowered from 38% to 35%. If we give money to the richest Americans, they will buy yachts and expensive luxury items. People will have to make those yachts and luxury items which will provide jobs “middle-class” Americans. If the rich are doing well, everyone will do well. Trickle Down Economics Many Democrats believe in giving tax breaks middle-class families, making less than $250,000 a year. Raise taxes on the wealthiest Americans to help the poorest Americans. If you give money to the middle class, they will be able to buy food, pay their utility bills, and provide for their family. This is thought to help stimulate the economy. If the middle class does well, everyone does well. Under President Obama, tax rates have stayed the same for 95% of Americans. Only the wealthiest 5% of Americans have seen a tax increase. Many republicans believe in small government. Many democrats believe in bigger government. Being respectful to your classmates, what are your thoughts???