2013 Tax Rates Schedule X

advertisement

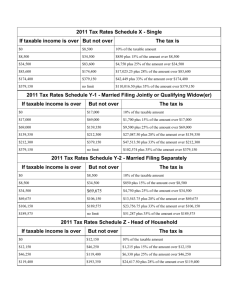

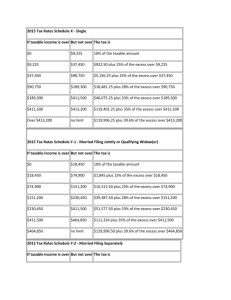

2013 Tax Rates Schedule X - Single If taxable income is over But not over The tax is $0 $8,925 10% of the taxable amount $8,925 $36,250 $892.50 plus 15% of the excess over $8,925 $36,250 $87,850 $4,991.25 plus 25% of the excess over $36,250 $87,850 $183,250 $17,891.25 plus 28% of the excess over $87,850 $183,250 $398,350 $44,603.25 plus 33% of the excess over $183,250 $398,350 $400,000 $115,586.25 plus 35% of the excess over $398,350 Over $400,000 no limit $116,163.75 plus 39.6% of the excess over $400,000 2013 Tax Rates Schedule Y-1 - Married Filing Jointly or Qualifying Widow(er) If taxable income is over But not over The tax is $0 $17,850 10% of the taxable amount $17,850 $72,500 $1,785 plus 15% of the excess over $17,850 $72,500 $146,400 $9,982.50 plus 25% of the excess over $72,500 $146,400 $223,050 $28,457.50 plus 28% of the excess over $146,400 $223,050 $398,350 $49,919.50 plus 33% of the excess over $223,050 $398,350 $450,000 $107,768.50 plus 35% of the excess over $398,350 $450,000 no limit $125,846 plus 39.6% of the excess over $450,000 2013 Tax Rates Schedule Y-2 - Married Filing Separately If taxable income is over But not over The tax is $0 $8,925 10% of the taxable amount $8,925 $36,250 $892.50 plus 15% of the excess over $8,925 $36,250 $73,200 $4,991.25 plus 25% of the excess over $36,250 $73,200 $111,525 $14,228.75 plus 28% of the excess over $73,200 $111,525 $199,175 $24,959.75 plus 33% of the excess over $111,525 $199,175 $225,000 $53,884.25 plus 35% of the excess over $199,175 Over $225,000 no limit $62,923 plus 39.6% of the excess over $225,000 2013 Tax Rates Schedule Z - Head of Household If taxable income is over But not over The tax is $0 $12,750 10% of the taxable amount $12,750 $48,600 $1,275 plus 15% of the excess over $12,750 $48,600 $125,450 $6,652.50 plus 25% of the excess over $48,600 $125,450 $203,150 $25,865 plus 28% of the excess over $125,450 $203,150 $398,350 $47,621 plus 33% of the excess over $203,150 $398,350 $425,000 $112,037 plus 35% of the excess over $398,350 $425,000 no limit $121,364.50 plus 39.6% of the excess over $425,000 2013 Tax Rates Estates & Trusts If taxable income is over But not over The tax is $0 $2,450 15% of the taxable income $2,450 $5,700 $367.50 plus 25% of the excess over $2,450 $5,700 $8,750 $1,180 plus 28% of the excess over $5,700 $8,750 $11,950 $2,034 plus 33% of the excess over $8,750 $11,950 no limit $3,090 plus 39.6% of the excess over $11,950 Social Security 2013 Tax Rates Base Salary $113,700 Social Security Tax Rate 6.2% Maximum Social Security Tax $7,049.40 Medicare Base Salary unlimited Medicare Tax Rate 1.45% Education 2013 Tax Rates American Opportunity Tax Credit $2,500 Lifetime Learning Credit $2,000 Student Loan Interest Deduction $2,500 Coverdell Education Savings Contribution $2,000 Miscellaneous 2013 Tax Rates Personal Exemption $3,900 Business Equipment Expense Deduction $500,000 Prior-year safe harbor for estimated taxes of higher-income 110% of your 2012 tax liability Standard mileage rate for business driving 56.5 cents Standard mileage rate for medical/moving driving 24 cents Standard mileage rate for charitable driving 14 cents Child Tax Credit $1,000 Unearned income maximum for children before kiddie tax applies $1,000 Maximum capital gains tax rate for taxpayers in the 10% or 15% bracket 0% Maximum capital gains tax rate for taxpayers above the 15% bracket 15% Capital gains tax rate for unrecaptured Sec. 1250 gains 25% Capital gains tax rate on collectibles 28% Maximum contribution for Traditional/Roth IRA $5,500 if under age 50 $6,500 if 50 or older Maximum employee contribution to SIMPLE IRA $12,000 if under age 50 $14,500 if 50 or older Maximum Contribution to SEP IRA 25% of compensation up to $51,000 401(k) maximum employee contribution limit $17,500 if under age 50 $23,000 if 50 or older Self-employed health insurance deduction 100% Estate tax exemption $5,250,000 Annual Exclusion for Gifts $14,000