Document

advertisement

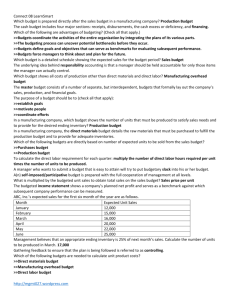

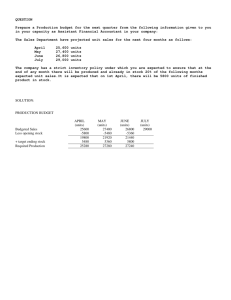

Chapter 20 The Budgeting Process Planning and the Use of Budgets • Companies spend a lot of time on _______ planning, which requires Setting goals and objectives. • Long and short term. Developing strategies to achieve those goals. • Budgets are a ______ statement of a company’s future plans show how _______ will be used to implement the strategy. The Budget • A budget is a quantified statement of an entity’s _______ plans (typically 1 year). • Its components include data that can be financial (budgeted sales activity) or nonfinancial (budgeted production levels). • It allows companies to formally set _____ for _______. • The budget provides a means of performance _______. Advantages of Budgets • It requires management to ___ ____ Identify goals and objectives Evaluate risks and opportunities • It serves as an early warning system if deviations from the budgets are examined • It _______ documents management plans and specific action plans. Informal communication of business plans can create uncertainty and confusion Advantages of Budgets • It _______ employees in a positive way if implemented correctly: – Based on realistic level of performance – Prepared using participatory budgeting – Evaluated carefully and allowing employees to provide explanations for variances • Effective Management Tool – All departments should contribute to meeting company-wide goals. – Budgeting achieves coordination. Advantages of Budgets • Provides performance criteria __________. Compare actual results to the past results or budget (expected results) and assign responsibility. Assists in identification of problems and corrective actions. Provides _______ for future decisions. Things to Watch for • ____ levels of management should be involved in developing the budget so they buy into the budget. • _______ _______ should be tied, in part, to meeting budgetary goals. • Conditions are not static, and the company must be able to respond to unforeseen events. Time Horizon for Budgeting • The _______ length of time will depend on the events being budgeted. Single event (party). On-going activities – short-term. • Annually, quarterly, monthly. On-going activities – long-term. • 5 year business plan. Continuous or Rolling Budgets Master Budgets • A formal, _________ plan for a company’s future. • Contains several _______ budgets that are linked to each other. • Sequencing of preparation is essential. Master Budgets • Master budgets consist of the following elements: _______ Budgets • Those supporting budgets which contribute directly to the budgeted income statement _______ _______ Budget _______ Budgets • Cash budget which leads to • Budgeted balance sheet and cash flow statements • Budgeted Income Statement Sales or Revenues Budget • This is the _______ of the operating budgets to determine. • It is important to set accurate sales estimates because everything else is based on this one . • Budgeted revenue = (units sold)*(price). • Sales budgeting is complex and depends on many things such as; Economy, competition, competing products, capacity, price of product, new products. P1 Sales Budget In September 2008, Hockey Den sold 700 hockey sticks at $100 each. Hockey Den prepared the following sales budget for the next four months: Sales Budget P1 Exh. 20-6 HOCKEY DEN Monthly Sales Budget October 2008 – January 2009 September 2008 (actual) October 2008 November 2008 December 2008 Total January 2009 Budgeted Unit Sales 700 Budgeted Budgeted Unit Price Total Sales $ 100 $ 70,000 1,000 $ 800 1,400 3,200 $ 100 $ 100 100 100 $ 100,000 80,000 140,000 320,000 900 $ 100 $ 90,000 Merchandise Purchases Budget • Budgeted future sales volume is the primary factor in inventory management decisions Merchandise Purchase Budget (retailer) Production Budget (manufacturer) P1 Merchandise Purchases Budget Exh. 20-7 Inventory to be purchased = Budgeted ending inventory + Budgeted cost of sales for the period – Budgeted beginning inventory Hockey Den buys hockey sticks for $60.00 each and maintains an ending inventory equal to 90 percent of the next month’s budgeted sales. 900 hockey sticks are on hand on September 30. Let’s prepare the purchases budget for Hockey Den. P1 Merchandise Purchases Budget Exh. 20-8 HOCKEY DEN Merchandise Purchases Budget October 2008 – December 2008 Next month's unit sales Ending inventory percentage Budgeted ending inventory units Add current month's unit sales Total units needed Deduct beginning inventory units Number of units to be purchased Budgeted cost per unit Budgeted cost of purchases October 800 × 90% 720 November 1,400 × 90% 1,260 December 900 × 90% 810 P1 Merchandise Purchases Budget Exh. 20-8 HOCKEY DEN Merchandise Purchases Budget October 2008 – December 2008 Next month's unit sales Ending inventory percentage Budgeted ending inventory units Add current month's unit sales Total units needed Deduct beginning inventory units Number of units to be purchased Budgeted cost per unit Budgeted cost of purchases October 800 × 90% 720 1,000 1,720 November 1,400 × 90% 1,260 800 2,060 December 900 × 90% 810 1,400 2,210 P1 Merchandise Purchases Budget Exh. 20-8 HOCKEY DEN Merchandise Purchases Budget October 2008 – December 2008 Next month's unit sales Ending inventory percentage Budgeted ending inventory units Add current month's unit sales Total units needed Deduct beginning inventory units Number of units to be purchased Budgeted cost per unit Budgeted cost of purchases October 800 × 90% 720 1,000 1,720 900 820 × $ 60 $ 49,200 November 1,400 × 90% 1,260 800 2,060 Beginning inventory is last month's ending inventory. December 900 × 90% 810 1,400 2,210 P1 Merchandise Purchases Budget Exh. 20-8 HOCKEY DEN Merchandise Purchases Budget October 2008 – December 2008 Next month's unit sales Ending inventory percentage Budgeted ending inventory units Add current month's unit sales Total units needed Deduct beginning inventory units Number of units to be purchased Budgeted cost per unit Budgeted cost of purchases October 800 × 90% 720 1,000 1,720 900 820 × $ 60 $ 49,200 November 1,400 × 90% 1,260 800 2,060 720 1,340 × $ 60 $ 80,400 Beginning inventory is last month's ending inventory. December 900 × 90% 810 1,400 2,210 1,260 950 × $ 60 $ 57,000 Production Budgets (Appendix 20A) • What production levels must be achieved to support the sales budget? Production = budgeted sales + desired ending inventory - beginning inventory • Production costs include: Materials costs Direct labor Manufacturing overhead • We will need budgets for _____ of these • • • • Production Budget: Direct Materials Purchases How much material do we need to support the production level? How much do we need to purchase to maintain desired inventory level? Units purchased = projected material usage + desired ending inventory level – beginning inventory. Calculate in units first, then convert to cost. Production Budget: Direct Materials Purchases • Steps to prepare a direct materials purchasing budget 1. Calculate each period’s total production needs in units of direct materials 2. Determine the total number of units of direct materials to be purchased during each accounting period in the budget Total Units of Direct = Materials to Be Purchased Total Production Needs in Units of Direct Materials Desired Units of Ending + Direct Materials Inventory – Desired Units of Beginning Direct Materials Inventory 3. Calculate the cost of the direct materials purchases Production Budget: Direct Labor • Direct labor costs will depend on the units to be produced and the time allowed for each unit in the various departments. • Figure the time to complete the units and then convert them to costs. Production Budget: Direct Labor • Steps in preparing a direct labor budget 1. Estimate the total direct labor hours – Multiply estimated direct labor hours per unit by the anticipated units of production 2. Calculate the total budgeted direct labor cost Total Budgeted Direct Labor Cost = Estimated Total Direct Labor Hours x Estimated Direct Labor Cost per Hour Production Budget: Factory Overhead • Using the relationships which exist and the estimated cost functions, determine what overhead costs will be incurred in producing the number of units needed. Variable overhead costs per unit. Fixed overhead costs per period. • Determine budgeted overhead and divide by the estimated activity level to come up with the overhead application rate. Other Elements of Operating Budgets • Using cost behavior analysis, calculate the budgeted nonmerchandising or nonmanufacturing manufacturing costs Selling Expense Budget General & Administrative Expense Budget Financial Budget Components • Capital Budgeting – budget of capital expenditures needed to support company activity • Cash Budget • Budgeted Income Statement Information comes from already prepared budgets. • Budgeted Balance Sheet & Cash Flow Final step Information comes from already prepared budgets. Cash Budgeting • Purpose of the cash budget is to determine whether or not there will be excess cash to invest and/or deficiencies of cash requiring short term borrowing. Beginning balance Plus: Budgeted Receipts Less: Budgeted Disbursements = Estimated ending cash balance. • Compare estimated ending balance with the required cash balance. Do we need to borrow money? Cash Budgeting Information • Budgeted Cash Receipts & Expected Collection Point Expected cash sales? Expected collections from credit sales? • Budgeted Cash Disbursements & Expected Disbursement Point SG&A Expenses Cash Purchases Cash Payments on Accounts Payable Cash purchases of fixed assets, Payment of interest costs, loan principal and income taxes? From the Sales Budget P2 Exhibit 20-14 HOCKEY DEN Budgeted Income Statement For Three Months Ended December 31, 2008 Sales (3,200 units @ $100) Cost of goods sold (3,200 units @ $60) Gross profit Operating expenses: Sales commissions Sales salaries Administrative salaries Equipment depreciation Interest expense Net income before taxes Income tax expense Net income $ 320,000 192,000 $ 128,000 $ 32,000 6,000 13,500 4,500 328 56,328 $ 71,672 28,669 $ 43,003 P2 From the Merchandise Purchases Budget Exhibit 20-14 HOCKEY DEN Budgeted Income Statement For Three Months Ended December 31, 2008 Sales (3,200 units @ $100) Cost of goods sold (3,200 units @ $60) Gross profit Operating expenses: Sales commissions Sales salaries Administrative salaries Equipment depreciation Interest expense Net income before taxes Income tax expense Net income $ 320,000 192,000 $ 128,000 $ 32,000 6,000 13,500 4,500 328 56,328 $ 71,672 28,669 $ 43,003 Exhibit 20-14 P2 HOCKEY DEN Budgeted Income Statement For Three Months Ended December 31, 2008 Sales (3,200 units @ $100) Cost of goods sold (3,200 units @ $60) Gross profit Operating expenses: Sales commissions $ 32,000 Sales salaries 6,000 Administrative salaries 13,500 Equipment depreciation 4,500 Interest expense 328 Net income before taxes From the Selling Income tax expense Expense Budget Net income $ 320,000 192,000 $ 128,000 56,328 $ 71,672 28,669 $ 43,003 Exhibit 20-14 P2 HOCKEY DEN Budgeted Income Statement For Three Months Ended December 31, 2008 Sales (3,200 units @ $100) Cost of goods sold (3,200 units @ $60) Gross profit Operating expenses: Sales commissions $ 32,000 Sales salaries 6,000 Administrative salaries 13,500 Equipment depreciation 4,500 Interest expense 328 From thetaxes General and Administrative Expense Net income before Budget Income tax expense Depreciation is a non-cash expense. Net income $ 320,000 192,000 $ 128,000 56,328 $ 71,672 28,669 $ 43,003 Exhibit 20-14 P2 HOCKEY DEN Budgeted Income Statement For Three Months Ended December 31, 2008 Sales (3,200 units @ $100) Cost of goods sold (3,200 units @ $60) Gross profit Operating expenses: Sales commissions $ 32,000 Sales salaries 6,000 Administrative salaries 13,500 Equipment depreciation 4,500 Interest expense 328 Net income before taxes Income tax expense From the Cash Budget Net income $ 320,000 192,000 $ 128,000 56,328 $ 71,672 28,669 $ 43,003 Exhibit 20-14 P2 HOCKEY DEN Budgeted Income Statement For Three Months Ended December 31, 2008 Sales (3,200 units @ $100) Cost of goods sold (3,200 units @ $60) Gross profit Operating expenses: Sales commissions Sales salaries Administrative salaries Equipment depreciation Interest expense Net income before taxes $71,672 × .40 Income tax expense Net income $ 320,000 192,000 $ 128,000 $ 32,000 6,000 13,500 4,500 328 56,328 $ 71,672 28,669 $ 43,003 Budgeted Balance Sheet • The budgeted account balances will depend on previous budget schedules cash balance: cash budget accounts receivable balance: sales budget and pattern of collections inventory amounts: operating budgets borrowing: cash budget retained earnings: effects of income and dividends Budget Process - Summary • Budgeting is a company-wide effort • Goals often come from the top • Different parts of the organization participate to budget specific activities/units. • All this information must be tied together in the master budget. This is where the accountants come in. Let’s take a closer look at this chapter!!!