FAFSA

advertisement

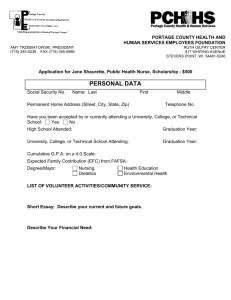

Financial Aid: Finding Money for College Elizabeth LeMaster Student Services Counselor 419-372-2651 Bowling Green State University www.bgsu.edu Agenda PART I Financial Aid Overview PART II Introduction to Filling out the Free Application for Federal Student Aid (FAFSA) How do I pay for college? Financial Aid: FAFSA (loans/grants), Scholarships, 529 savings plan, etc. Out of pocket: payment plan Additional Loans: Alternative student and/or parent PLUS Where Do I Start? Different schools require different applications, check with the financial aid office at each school. Some standard applications are: 1. Admission Application 2. Free Application for Federal Student Aid (FAFSA) 3. Institutional Application Free Application for Federal Student Aid (FAFSA) www.fafsa.ed.gov To ensure maximum consideration for federal, state, & institutional aid, students should complete their FAFSA as soon after January 1st as possible. You may estimate your 2008 tax information, but are required to verify the information is accurate after April 15th, when your taxes are due. Request a Federal PIN Both the Student and at least one Parent must apply for a 4-digit PIN www.pin.ed.gov START A FILE! PIN USED TO: • Sign the Free Application for Federal Student Aid (FAFSA) • Submit Electronic Signatures on Promissory Notes…and more! FAFSA Expected Family Contribution (EFC) Collects family’s personal & financial information used to calculate a student’s Expected Family Contribution (EFC). This number is used by the school to determine needbased aid eligibility. EFC = A measure of the family’s capacity over time to absorb educational costs Expected Family Contribution (EFC) The EFC is determined by a formula created by Congress called the Federal Methodology. EFC = minimum amount a family should be able to pay out-of-pocket without financial assistance. You can finance your EFC if this number is not realistic for your family. EXPECTED FAMILY CONTRIBUTION PARENT'S CONTRIBUTION $10,000 STUDENT'S CONTRIBUTION $500 If the parent has multiple children in college at once, their contribution is split between all eligible dependents, thus reducing the EFC for each! What happens after a FAFSA is submitted? The Student Receives notification from FAFSA and is issued a summary of the FAFSA in a Student Aid Report (SAR), including the calculated EFC. The Financial Aid Office receives the information and will process the application and award students a financial aid package based on their EFC. Financing Your Education How a Financial Aid Package is created based on your EFC Definition of Need Cost of attendance (COA) – Expected family contribution (EFC) = Financial need Need Comparison Higher Cost Institution Cost of Attendance $30,000 - *EFC $2,500 =Need-based Eligibility $27,500 Mid Cost Institution $20,000 $2,500 $17,500 Lower Cost Institution $13,000 $2,500 $10,500 Financial Aid Sources What aid is available to cover my cost of attendance if I file a FAFSA? Federal Stafford LOANS Primary source of aid offered to students upon filling out a FAFSA 1. Unsubsidized –Interest accrues on this NON need-based loan while in school. 2. Subsidized – No interest accrues on this need-based loan while in school. Interest rates are currently fixed at 6.8% Dependent Undergraduate (08/09 Annual Loan Limits) Freshman - $5,500 Sophomore - $6,500 Junior - $7,500 Senior - $7,500 (Subsidized Maximum:$3,500) (Subsidized Maximum:$4,500) (Subsidized Maximum:$5,500) (Subsidized Maximum:$5,500) Repayment begins 6 months after the student: 1. Graduates 2. Leaves School 3. Falls below ½ time Federal Perkins LOAN Need-based loan issued by the institution. Limited Funding* Interest rate: 5% Fixed 9-month grace period Deferment & cancellation provisions available *File FAFSA as soon after January 1, 2009 for maximum aid consideration! Federal GRANTS PELL: $445-$4731, ( EFC: $0-$4041) FSEOG: Must be Pell eligible, limited funds, award may vary between schools ACG: $750/freshman $1300/sophomore with min. 3.0 GPA, attend a 2 or 4 year degree granting institution, attended rigorous High School program & Pell eligible SMART: $4000/junior & senior year with min. 3.0 GPA, attend a 4 year degree granting institution, Pell eligible & Major in: physical, life, or computer science, engineering, mathematics, technology, or a critical foreign language -Based on 08/09 Guidelines- State GRANTS OCOG: Need based, Ohio Board of Regents, Must file FAFSA by October 1st, $78-$2496 ( EFC: $0-$2190) CHOICE: Private Schools ONLY, Ohio Board of Regents, $660 -Based on 08/09 Guidelines- GRANTS-loan *TEACH Grant-loan: • Up to $4,000 per year to students who intend to teach in a public or private elementary or secondary school that serves low-income families. • Must serve for a min. of 4 years within an 8 year time frame. IMPORTANT • If you fail to complete this service obligation, all amounts of TEACH Grants that you received will be converted to a Federal Direct Unsubsidized Stafford Loan. • You will be charged interest from the date the grant was disbursed. For more information: studentaid.ed.gov WORK STUDY Federal Work Study (FWS) is a federally-funded program that provides work opportunities to graduate and undergraduate students with financial need. Eligibility is determined based on the submitted FAFSA information. FACTS FWS funds will be provided to the student in the form of a paycheck for the hours they actually work. *Earnings are not automatically applied to your Bursar billing account. When the student applies for financial aid for the next academic year, through FAFSA, the government will not include work study income in their calculations to determine the Expected Family Contribution (EFC). What if I am not awarded enough money through the FAFSA? Bowling Green State University: January 15th Ohio State University: December 1st University of Toledo: January 5th SCHOLARSHIPS Start your search now! Institutional: To obtain specific institutional scholarship applications, contact the office awarding them. TIP: Check to see if your institution has an online, Searchable Scholarship Guide Non-Institutional/Outside: Check locally for applications and begin a national search online! (REMEMBER: check with any organization/business the student or parent is affiliated with for scholarships. i.e. Churches, places of employment, clubs/lodges like The Elks, 4-H, etc.) AVOID BEING SCAMMED! Better Business Bureau: http://www.bbb.com U.S. Department of Education: http://studentaid.ed.gov/students/publications/lsa/index.html Federal Trade Commission: www.ftc.gov/bcp/conline/publs/alerts/ouchart.htm Parent PLUS and Alternative Student 1. Federal Parent Loan for Undergraduate Students (PLUS) Loan in parent’s name 2 Repayment choices begins while student is in college (60 days after the full disbursement) begins 6 mos. after the student graduates, leaves school or drops below ½ time Interest Rate: currently 7.9-8.5% Fixed 2. Alternative loan programs Loan in student’s name Repayment typically begins 6 months after graduation/leave school Various terms, credit-worthy signer or co-signer Check for maximum/capped Interest Rate, Pre-Payment Penalties, etc. www.certifiedprivateloans.com Satisfactory Academic Progress Meet minimum cumulative grade point average per grade level. (FRESHMAN: 1.50) Successfully complete at least 67% of cumulative credit hours attempted. Complete the degree/certificate program within the maximum attempted hours. How Can I Be Considered Independent? By answering “yes” to one of these questions. 1. Were you born before Jan. 1, 1986? 2. As of today, are you married? 3. Will you be working on a master’s/doctorate program? 4. Are you currently serving on active duty in the U.S. Armed Forces for purposes other than training? 5. Are you a veteran of the U.S. Armed Forces? 6. Do you have children who will receive more than half of their support from you between July 1, 2009, and June 30, 2010? 7. Do you have dependants (other than your children/spouse) who live with you and receive more than half of their support from you, now and through June 30. 2010? 8. When you were age 13 or older, were both your parents deceased were you in foster care or were you a dependent/ward of the court? 9. Are you an emancipated minor? 10. Are you in a legal guardianship? 11. At any time on or after July 1, 2008, did your high school or school district homeless liaison determine that you were an unaccompanied youth who was homeless? 12. At any time on or after July1, 2008, did the director of an emergency shelter program funded by the U.S. Depart. Of Housing and Urban Development determine that you were an unaccompanied youth who was homeless? 13. At any time on or after July 1, 2008, did the director of a runaway or homeless youth basic center or transitional living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk for being homeless? What if my parents are divorced? File your FAFSA with the parent that you live with most. If the parent you are required to file with is remarried, you must also include your step-parent’s financial information. The parent you file with does not have to be the parent that claims you for tax purposes. Unusual Circumstances? Discuss with your college financial aid office Examples include: Change in family income - loss of job Death, illness of family member Unusual expenses—medical, catastrophic event Colleges view eligibility differently. The Financial Aid administrator’s decision is final and cannot be appealed to the U.S. Department of Education. Part II Introduction to Filling out the Free Application for Federal Student Aid (FAFSA) •Commonly Asked Questions •Frequently Made Mistakes Records You Will Need to File the FAFSA Federal PIN www.pin.ed.gov 2008 US Income Tax Returns W-2 Forms Untaxed Income Information Bank Statements Driver’s License # Investment Information Business Records Farm Records FAFSA on the Web’s Homepage www.fafsa.ed.gov FAFSA ON THE WEB WORKSHEET (Should be available by December) Section 1 –Student Information Section 3 –Parent Information Section 5 – Colleges to Receive Information DO NOT MAIL THE FAFSA ON THE WEB WORKSHEET! CAUTION! Avoid being charged a fee to file the FREE Application for Federal Student Aid Completing & Processing the FAFSA is FREE www.fafsa.ed.gov Questions? FAFSA 1-800-433-3243 Financial Aid Office HELP!!!!!! COLLEGE GOAL SUNDAY February 08, 2009 •Line by line instruction for completing the FAFSA •Have an expert review a completed or nearly completed FAFSA 40 sites in 33 Ohio Counties Find locations and register online soon! www.ohiocollegegoalsunday.org www.studentaid.ed.gov General Financial Aid CHECKLIST Apply for Admission: Check for Freshman scholarship Deadlines! Search and Apply for SCHOLARSHIPS! Complete 09/10 FAFSA www.fafsa.ed.gov Beginning January 1, 2009 Review award letters sent from schools you applied to, to see if you need to apply for additional loans (Parent PLUS/Alternative) Any Questions? If you are considering BGSU, please fill out an Information Request Card to be considered for a BGSU Scholarship! Please turn this card into me before you leave.