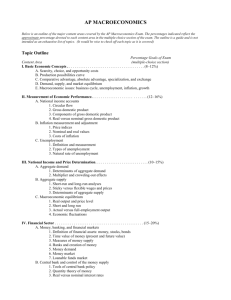

Effect on debt

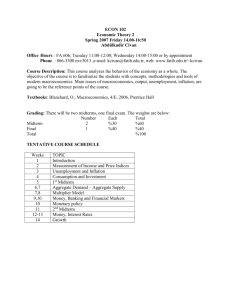

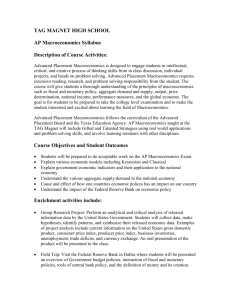

advertisement