Ch 8 - 8th Ed

advertisement

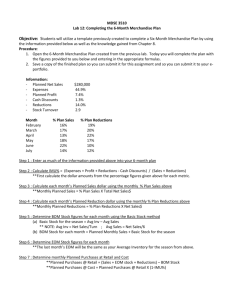

Dunne, Lusch, & Carver Chapter 8 Managing a Retailer’s Finances What is Merchandising? What is Merchandising? • Retailing ≠ Merchandising. • It consists of the planning and control of the buying and selling of goods and services to help the retailer realize its objectives. • Financial planning and control is critical for success. • Poor choice of merchandise leads to lessened profits or loss. • The tool: • The Merchandise Budget (e.g., 3- and 6-month) The Merchandise Budget • A formal outline of all merchandising activities for an upcoming selling season. • A seasonal plan comprising… 1. Projected sales for an upcoming season, 2. When and how much merchandise is to be purchased, and 3. What markups and reductions are likely to occur. Development of a Merchandise Budget • Five Questions Must be Answered... 1. What are the anticipated sales for the department, division, or store? 2. How much stock on hand is needed to achieve this sales plan, given the level of inventory turnover expected? 3. What reductions, if any, from the original retail price are likely to be needed in order to dispose of all merchandise brought into the store? 4. What additional purchases must be made during the season? 5. What gross margin is the department, division, or store likely to contribute to the overall profitability of the company, given this merchandising plan? Four General Rules of Budget Preparation 1. It should always be prepared in advance of the selling season. 2. The language of the budget must be easy to understand. 3. It must be planned for a relatively short period of time. 4. The budget should be flexible enough to permit changes. Step 1: Determining Planned Sales • Initially based upon the previous year’s recorded sales. • Adjustments made after considering: 1. 2. 3. 4. 5. The Retail Reporting Calendar Holidays (e.g., Easter, Thanksgiving, & Christmas) The weather The economy (e.g., inflation, exit of competition, etc.) Type of product (i.e., good vs. service) sold • Simple equation for planning: • Total Sales = Average Sale X Total Transactions Step 2: Determining Planned BOM & EOM Stock • Planned average beginning-of-the-month (BOM) stock-to-sales ratios are based on either industry averages or calculated from one’s planned turnover goals. • Stock-to-sales (STS) ratio: amount of stock to have at the beginning of each month to support forecasted sales for that month. • Things to remember about the STS ratio: 1. 2. 3. Not static, but fluctuate from month to month. Always express inventory levels at retail, not cost. The BOM for one month is equal to the previous month’s EOM. Step 3: Determining Planned Retail Reductions • Three general categories of reductions: 1. Markdowns 2. Employee discounts 3. Stock shortages. • Two major reasons for inclusion in the budget: 1. Reflect additional purchases needed for sufficient inventory to begin the next month • If extra free or marked-down merchandise isn’t purchased before the retailer will run out of needed for full-priced sales 2. Underscores point that taking a reduction is not a bad thing • Neglecting to take an early markdown can lead to even lower profit Step 4: Determining Planned Purchases at Retail & Cost • Inventory must cover: • • • • Planned sales (line 2), Planned reductions (line 3), and Planned EOM stock (line 4) Amount not covered by BOM (line 1) must be purchased • Are additional purchases needed? • “New Math” • 2+3+4-1=5 • The numbers denote separate lines in the budget (see exhibit 8.2) Step 4: Determining Planned Purchases at Retail & Cost • Planned purchases are first determined at retail price • Retail price is a combination of cost plus a markup • Calculating the cost compliment • 100% - MUsp = CC • Where: • MUsp is the markup percentage on selling price, and • CC is the cost compliment • Planned purchases at cost equal: • Planned purchases at retail times the cost compliment Step 5: Determining the Buyer’s Planned Gross Margin • Buyer’s gross margin reflects the amount of gross margin that the buyer’s actions will contribute to the firm • Calculated as: • Planned initial markup (line 7) minus planned reductions (line 3) • Retail buyers are responsible for: • • • • Purchases made, Expected selling price of those purchases, Cost of the purchases, and Reductions incurred to unload remaining merchandise Retail Accounting Statements • Three most commonly-used financial statements: 1. Income statement 2. Balance sheet 3. Statement of cash flow Income Statement • Provides a summary of the sales and expenses for a given time period (e.g., month, quarter, season, or year). • Allows for comparison and identification of trends pertaining to: • • • • Sales, Returns and/or allowances, Expenses, and Profits. • What’s the general format of an income statement? • See exhibit 8.5a Balance Sheet • Shows the financial condition of a retailer’s business at a particular point in time. • It identifies and quantifies all the firm’s assets and liabilities • The basic equation for a balance sheet: • Assets = Liabilities + Net worth • Comparisons across balance sheets highlights changes in the firm’s overall financial condition. Statement of Cash Flow • Lists, in detail, the sources and types of all cash revenue and cash expenditures for a given time period. • Positive cash flow – when cash inflows exceed cash outflows • Negative cash flow – when cash outflows exceed cash inflows • The number one cause for retail bankruptcy… • Inadequate cash flow Inventory Valuation • Consists of two major decisions: 1. Which accounting inventory system to use • • The cost method The retail method 2. What inventory-pricing system to use • • LIFO FIFO The Cost Method • Provides a book valuation of inventory based solely on the retailer’s cost of merchandise (including freight). • Limitations: • Difficult to do daily inventories or even monthly inventories. • Difficult to cost out each sale. • Difficult to allocate freight charges to each item’s cost of goods sold. • Better for big-ticket items and a limited number of sales per day. • Often involves the use of the alphabet (e.g., HEAD) The Retail Method • Values merchandise at current retail prices, which are then converted to cost based on a formula. • Three basic steps: 1. Calculation of the cost compliment • Total cost valuation / Total retail valuation 2. Calculation of reductions from retail value • • Markdowns, discounts, stock shortages, etc. Requires a physical count to determine 3. Conversion of adjusted retail value to cost (approximated by) • Adjusted retail inventory X Cost compliment Retail vs. Cost Method • Advantages of the retail method over the cost method: 1. Accounting statements can be drawn up at any time, and inventories need not be taken for preparation of these statements. 2. Physical inventories using retail prices are less subject to error and can be completed in a shorter amount of time. 3. It provides an automatic, conservative valuation of ending inventory as well as inventory levels throughout the season. • Disadvantages of the retail method: 1. It is a ‘‘method of averages’’ 2. It places a heavy burden on bookkeeping activities Inventory Pricing Systems 1. FIFO (first in, first out) • Values inventory based on the assumption that the oldest merchandise is sold before the more recent merchandise. • Allows for “inventory profits” 2. LIFO (last in, first out) • Values inventory based on the assumption that the most recent merchandise is sold first and the oldest is sold last. • • • Accurately reflects replacement costs Allows for tax savings during inflationary times Obama administration proposal may end LIFO as of Jan. 2011 (see CFO Mag. – 7/15/10)* What You Should Have Learned… Chapter’s Learning Objectives 1. The importance of a merchandise budget and how to prepare a merchandise budget. 2. The differences between, and uses of, an income statement, balance sheet, and statement of cash flow. 3. The different approaches to value inventory.