A Review of the Accounting Cycle

advertisement

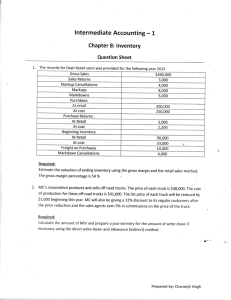

Inventory Valuation at Other Than Cost 2 Learning Objectives Apply the lower-of-cost-or-market (LCM) rule to reflect declines in the market value of inventory. Use the gross profit method to estimate ending inventory. Compute estimates of FIFO, LIFO, average cost, and lower-of-cost-or-market inventory using the retail inventory method. 3 Learning Objectives Determine the financial statement impact of inventory recording errors. EXPANDED MATERIAL Combine the retail inventory method and dollar-value LIFO to compute ending inventory using the dollar-value LIFO retail method. 4 Learning Objectives Account for the impact of changing prices on purchase commitments. Record inventory purchase transactions denominated in foreign currencies. 5 Inventory Estimation Methods Methods for valuing inventory at other than cost Lower-of-Cost-or-Market Method Gross Profit Method Retail Inventory Method Dollar-Value LIFO Retail Method 6 Lower of Cost or Market (LCM) What is market? 7 Lower of Cost or Market (LCM) In lower of cost or market, market means replacement cost within limits. 8 Lower of Cost or Market (LCM) • When goods remaining in inventory can be replaced with identical goods at a lower cost, the lower (market) cost must be used to value the inventory. • What are the replacement cost limits? – Upper limit: Net realizable value. – Lower limit: Net realizable value minus a normal profit. 9 LCM Examples A company’s unit of inventory has the following characteristics: Selling price $165 Packaging cost 10 Transportation cost 15 Profit margin 40 10 LCM Examples Net realizable value Selling price $165 Cost of completion (10) Transportation cost (15) Ceiling (NRV) $140 Ceiling (NRV) Normal profit Floor $140 (40) $100 Example 1 11 LCM Examples Selling price $165 Cost of completion (10) Transportation cost (15) Ceiling (NRV) $140 Current Replacement Cost, $150 Ceiling (NRV) Normal profit Floor Cost $155 Market $140 $140 (40) $100 LCM is market, $140 12 LCM Examples Example 2 Selling price $165 Cost of completion (10) Transportation cost (15) Ceiling (NRV) $140 Current Replacement Cost, $120 Ceiling (NRV) Normal profit Floor Cost $110 Market $120 $140 (40) $100 LCM is cost, $110 13 LCM Example Example 3 Selling price $165 Cost of completion (10) Transportation cost (15) Ceiling (NRV) $140 Current Replacement Cost, $75 Ceiling (NRV) Normal profit Floor Cost $110 Market $100 $140 (40) $100 LCM is market, $100 14 Recording LCM Revaluations LCM may be applied to each individual inventory item or to the inventory as a whole. If LCM is applied to individual items, the difference between cost and market is credited directly to Inventory. If LCM is applied to the inventory as a whole, the difference is recorded in an allowance account. LCM--Example: Recording Revaluation (data for valuation) Item A Ind Mkt Original Total Cost Market LCM LCM Qty Cost 20 $10 $200 $11 $200 $220 B 10 $10 $100 $9 $90 $90 C 10 $10 $100 $8 $80 $80 D 20 $10 $200 $9 $180 $180 $550 $570 $600 15 LCM--Example: Recording Revaluation (applied individually) Item A Ind Mkt Original Total Cost Market LCM LCM Qty Cost 20 $10 $200 $11 $200 $220 B 10 $10 $100 $9 $90 $90 C 10 $10 $100 $8 $80 $80 D 20 $10 $200 $9 $180 $180 $550 $570 $600 $50 Journal Entry Loss from Decline in Value of Inventory..... 50 Inventory............................................ 50 16 LCM--Example: Recording Revaluation (applied as a whole) Item A Ind Mkt Original Total Cost Market LCM LCM Qty Cost 20 $10 $200 $11 $200 $220 B 10 $10 $100 $9 $90 $90 C 10 $10 $100 $8 $80 $80 D 20 $10 $200 $9 $180 $180 $550 $570 $600 $30 Journal Entry Loss from Decline in Value of Inventory.............. 30 Allowance for Decline in Value of Inventory.. 30 17 18 Gross Profit Method The gross profit method is an estimation technique to determine the inventory count... when a physical count is not practical, and as a validity check. 19 Gross Profit Method Steps Determine gross profit percentage. Determine estimated sales. Determine estimated cost of goods sold. Determine estimated goods available for sale. Determine estimated inventory. Gross Profit Method-Example: Basic Data 20 Use the following information to estimate ending inventory: • • • • • • • • Gross Profit Percentage 50% of sales Accounts Receivable Collections $ 5,000 Ending Accounts Receivable $ 1,000 Beginning Accounts Receivable $ 2,000 Beginning Inventory $ 6,000 Payments to Suppliers $ 10,000 Ending Accounts Payable $ 3,000 Beginning Accounts Payable $ 1,000 Gross Profit Method-Solution Step No.1 Determine Gross Profit Percentage Given as 50%, and management does not feel any changes are warranted. 21 Gross Profit Method-Solution 22 Step No.2 Determine Estimated Sales Accounts receivable collections Add ending accounts receivable Deduct beginning accounts receivables Estimated sales $ 5,000 1,000 $ 6,000 (2,000) $ 4,000 Gross Profit Method-Solution 23 Step No. 3 Determine Estimated Cost of Goods Sold Estimated sales Times gross profit percentage Estimated cost of goods sold $ 4,000 x 50% $ 2,000 Gross Profit Method-Solution Step No. 4 Determine Estimated Goods Available for Sale Beginning inventory $ 6,000 Add payments to suppliers $10,000 Add ending accounts payable 3,000 $13,000 Deduct beginning accts. pay. (1,000) Estimated purchases 12,000 Estimated goods available for sale $18,000 24 Gross Profit Method-Solution Step No.5 Determine Estimated Inventory Estimated goods available for sale Estimated cost of goods sold Estimated inventory $18,000 2,000 $16,000 25 Gross Profit Method Sales Estimated Cost of Goods Sold Cost of Goods Available for Sale Estimated Cost of Goods Sold Estimated Gross Profit Estimated Ending Inventory 26 27 Salad Oil Swindle Tino DeAngelis rented a petroleum tank farm in Bayonne, New Jersey. 28 Salad Oil Swindle He convinced auditors, investors, and investment bankers that the tanks contained $100 million in vegetable oil. 29 Salad Oil Swindle The tanks actually were primarily filled with sea water. There was very little vegetable oil in the tanks. 30 Salad Oil Swindle Tino would pump vegetable oil from one tank to another, depending on his advance knowledge of the auditor’s verification plan. 31 Retail Inventory Method 1. Determine goods available for sale at cost and retail. 2. Determine cost percentage. 3. Determine ending inventory at retail. 4. Determine ending inventory at cost. Retail Inventory Method-Different Cost Methods Lower-of-Cost-or-Market Approximation: Markups but not markdowns are included in the calculation of goods Average Cost Method: available Markupsfor andsale. markdowns are included in calculation of goods available for sale. 32 Retail Inventory Method-Example Use the following information to estimate ending inventory: Cost Retail Beginning inventory $1,000 $2,000 Purchases 5,000 8,000 Markups 2,000 Sales 6,000 Markdowns 600 33 Retail Inventory Method--Solution34 for LCM Approximation Step No.1 Determine Goods Available for Sale at Cost and Retail--LCM Approximation Cost Retail Beginning inventory $1,000 $ 2,000 Purchases 5,000 8,000 Markups 2,000 Goods available for sale $6,000 $12,000 Retail Inventory Method--Solution35 for LCM Approximation Step No. 2 Determine Cost Percentage Goods available for sale at cost Divided by goods available for sale Cost percentage $ 6,000 12,000 50% Retail Inventory Method--Solution36 for LCM Approximation Step No.3 Determine Ending Inventory at Retail Goods available for sale Less sales Less markdowns Ending inventory at retail $12,000 (6,000) (600) $ 5,400 Retail Inventory Method--Solution for LCM Approximation 37 Step No.4 Determine Ending Inventory at Cost Ending Inventory at Retail Times Cost Percentage Ending Inventory at Cost $5,400 x 50% $2,700 Retail Inventory Method--Solution38 for Average Cost Method Step No.1 Determine Goods Available for Sale Cost Retail Beginning inventory $1,000 $ 2,000 Purchases 5,000 8,000 Markups 2,000 Markdowns (600) Goods available for sale $6,000 $11,400 Retail Inventory Method--Solution39 for Average Cost Method Step No. 2 Determine Cost Percentage Goods available for sale at cost $ 6,000 Divided by goods available for sale at retail 11,400 Cost percentage 52.6% Retail Inventory Method--Solution40 for Average Cost Method Step No. 3 Determine Ending Inventory at Retail Goods available for sale Less sales Less markdowns Ending inventory at retail $11,400 (6,000) (600) $ 4,800 Retail Inventory Method--Solution41 for Average Cost Method Step No.4 Determine Ending Inventory at Cost Ending inventory at retail Times cost percentage Ending inventory at cost $4,800 x 52.6% $2,525 Retail Inventory Method Goods Available for Sale: At Retail Beginning Inventory + Purchases = Goods Available for Sale To calculation of cost percentage Continued Less Sales Estimated Ending Inventory at Retail 42 Retail Inventory Method To calculation of cost percentage Goods Available for Sale: At Cost Beginning Inventory + Purchases = Goods Available for Sale Continued 43 Retail Inventory Method Estimated Ending Inventory at Retail Cost Percentage: Cost/Retail x Cost Percentage Estimated Ending Inventory at Cost 44 Retail Inventory Method Freight-in is added to the cost of purchases. Purchase discounts are subtracted from the cost of purchases. Purchase returns are subtracted from both the cost and retail amount of purchases. Purchase allowances normally are subtracted only from the cost of purchases. Sales returns are subtracted from retail sales. Sales discounts and sales allowances are not subtracted from retail sales. 45 Dollar-Value LIFO Retail Inventory Method Steps 1. Determine inventory at base-year retail prices. 2. Determine dollar-value LIFO inventory layers at retail. 3. Determine dollar-value LIFO inventory layers at cost. 46 Dollar-Value LIFO Retail Inventory Method--Example 47 Use the following data to estimate Ending Inventory for 2000, 2001, and 2002 (assume 1999 is the base year). Year 1999 2000 2001 2002 Inventory at Year-End Incremental Year-End Price Index Cost Percentage Retail Prices 1.00 .60 $60 1.05 .62 $69 1.10 .64 $77 1.12 .65 $71 Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 1999 $60 ÷ 1.00 = $60 48 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 1999 $60 ÷ 1.00 = $60 49 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost $60 x 1.00 x 0.60 = $36 Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 1999 $60 ÷ 1.00 = $60 2000 $69 ÷ 1.05 = $66 50 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost $60 x 1.00 x 0.60 = $36 Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 1999 $60 ÷ 1.00 = $60 2000 $69 ÷ 1.05 = $66 51 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost $60 $60 6 $66 x 1.00 x 0.60 = $36 x 1.00 x 0.60 = $36 x 1.05 x 0.62 = 4 $40 Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 1999 $60 ÷ 1.00 = $60 2000 $69 ÷ 1.05 = $66 2001 $77 ÷ 1.10 = $70 52 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost $60 $60 6 $66 x 1.00 x 0.60 = $36 x 1.00 x 0.60 = $36 x 1.05 x 0.62 = 4 $40 Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 1999 $60 ÷ 1.00 = $60 2000 $69 ÷ 1.05 = $66 2001 $77 ÷ 1.10 = $70 53 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost $60 $60 6 $66 $60 6 4 $70 x 1.00 x 0.60 = $36 x 1.00 x 0.60 = $36 x 1.05 x 0.62 = 4 $40 x 1.00 x 0.60 = $36 x 1.05 x 0.62 = 4 x 1.10 x 0.64 = 3 $43 Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 2001 $77 ÷ 1.10 = $70 2002 $71 ÷ 1.12 = $63 54 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost $60 6 4 $70 x 1.00 x 0.60 = $36 x 1.05 x 0.62 = 4 x 1.10 x 0.64 = 3 $43 Dollar-Value LIFO Retail Inventory Method--Example Inv @ Inv @ BaseEoY Price Year Year Retail Index Retail 2001 $77 ÷ 1.10 = $70 2002 $71 ÷ 1.12 = $63 55 DollarValue Incr. Incr. LIFO Layer Cost Retail Layers Index % Cost $60 6 4 $70 $60 3 $63 x 1.00 x 0.60 = $36 x 1.05 x 0.62 = 4 x 1.10 x 0.64 = 3 $43 x 1.00 x 0.60 = $36 x 1.05 x 0.62 = 2 $38 Foreign Currency Transactions-Terminology • Foreign Currency Transaction: For a U.S. company, a transaction denominated in a currency other than the U.S. dollar. • Spot Rate: The exchange rate at which currencies can be traded immediately. 56 Foreign Currency Transactions-Example: Scenario On March 1, Able, a U.S. company, buys inventory worth 1 million DM from Kraus, a German company. Payment is due on April 30. Able closes its books every month. Using the following exchange rates, prepare all necessary journal entries: March 1 Rate: $.58/DM March 31 Rate: $.60/DM April 30 Rate: $.59/DM 57 Foreign Currency Transactions-Example: Solution March 1 Inventory..................... 580,000 Accounts Payable.... 580,000 Calculation: DM payable Exchange rate Accounts payable 1,000,000 x .58 $ 580,000 58 Foreign Currency Transactions-Example: Solution March 31 Exchange Loss................ 20,000 Accounts Payable......... 20,000 Calculations: Accounts payable (3/1) Accounts payable (3/31) ($1,000,000 x 0.60) Exchange loss $580,000 600,000 $ 20,000 59 Foreign Currency Transactions-Example: Solution 60 April 30 Accounts Payable............... 600,000 Exchange Gain................ 10,000 Cash................................ 590,000 Calculations: Accounts payable (3/31) Cash ($1,000,000 x 0.59) Foreign exchange gain $600,000 590,000 $ 10,000 61 The End