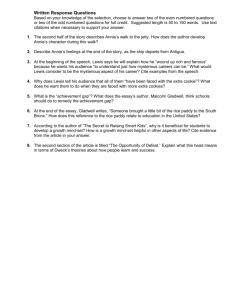

PowerPoint Presentation - Iowa State University Extension and

advertisement

Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Insurance Basics Adapted from Money Talk: Women’s Financial Education Series www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Objectives • increase your awareness of the financial cost of various risks in life • discuss key characteristics of different types of insurance policies • help formulate questions to ask insurance professionals • help identify your current insurance strengths and weaknesses www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Life is Full of Risks…Many Have Financial Consequences • Damage to truck in accident • Fire that destroys home, farm buildings and/or possessions • Loss of income due to disability • Death of an earner/key personnel • Loss of a homemaker’s services • Large medical bills for disease or injury • A court judgment of liability for damages www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension People Manage Risks in Five Ways: • Risk avoidance • Risk reduction • Risk acceptance (Unknowingly accepting risk with no plan is called do nothing and hope for the best) • Risk transfer (insurance) • Self-Insure www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension In The Five Areas of Risk Management Production Marketing Financial Legal Insurance Contracts www.extension.iastate.edu/annie Human Resources Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Insurance Basics • Protect against risks by paying premium • “Large Loss Principle” (size of loss matters) • Major “large-loss” risks: – Loss of income due to disability – Death of an earner/key personnel – Destruction of structures (fire, flood, etc.) – Liability losses due to a court judgment – Large medical expenses (e.g., cancer treatment) www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Generally Unnecessary Insurance • Credit insurance (life, disability, unemployment) • Life insurance for children • Cancer insurance • “Double Indemnity” insurance riders • Hospital indemnity policies • Flight insurance • Car rental collision-damage waivers www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension General Insurance Tips • Check policies for “owner”, “Insured”, & “beneficiaries” • Insure for major losses • Choose a highly rated insurance company • Select the highest deductible you can afford • Pay premiums annually or semi-annually • Avoid duplicating coverage • Ask about available discounts • Follow “The Rule of Three” www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Parts of an Insurance Contract • Declarations page • Insuring Agreements • Exclusions • Endorsements and Riders www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Policy Features That Limit Coverage • Benefit coordination clauses • Deductible • Elimination period • Co-payment • Co-insurance • Policy limit www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Life Insurance • Protects against loss of earner’s/key personnel income • Provides money to replace homemaker’s services • Factors to consider include: – current assets and debts – earning power of surviving spouse – other sources of income – projected expenses www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Types of Life Insurance • Term Life – Level term – Decreasing term • Permanent Life (cash value) – Whole life – Variable life – Universal life www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension General Life Insurance Tips • Avoid simplistic formulas • Never cancel existing policy until you have new one in hand • Review beneficiary designations • Buy credit life coverage only if you cannot get life insurance elsewhere • Compare policies: interest-adjusted net cost www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Two Primary Types of Health Insurance – Indemnity or “traditional” • Annual deductible • Co-insurance up to stop-loss limit – Managed care (HMOs, PPOs) • Read “the fine print” for details • Emphasizes preventative care and screenings • Require use of in-network medical providers www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension General Health Insurance Tips • Look for a policy that is “guaranteed renewable”or “noncancellable” • Inquire about post-retirement coverage • Note pre-existing condition clauses • Be cautious about switching policies • Keep good records! www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Other Health Benefit Programs • SHIP (State Health Insurance Program) • COBRA – Extends group coverage for up to 18 months – Covers employers with 20 or more workers – Ex-worker must pay full cost, plus 2% • Free/low cost screenings & immunizations www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Disability Insurance • Covers income loss from inability to work • Maximum coverage: 60% -70% gross pay • Particularly important for self-employed • Key factors: – Definition of disability • Own Occupation • Any Occupation – Waiting period www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Disability Insurance Tips • Base elimination period on – Adequacy of emergency savings – Accrual (if any) of employer sick leave • Buy a noncancellable policy to age 65 • Request that an ex-spouse buy coverage to protect support payments • Try to get benefit of 100% of net income www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension More Disability Insurance Tips • Look for a policy with residual benefits • Consider a cost-of-living rider • Avoid gender-based policies (women pay more) • Purchase a waiver of premium rider • Look for a “recurrent disability” clause www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Long Term Care Insurance • “LTC” means wide range of services: – Home health care – Nursing home care • Three ways to handle risk of LTC costs: – Retain it (self-insure) – Avoid it (no guarantees) – Transfer it (LTC insurance) www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Who Should Buy LTC Insurance • If premiums are no > 10% of annual income • If you’re able to handle 20% -30% increase • If > $75,000 of assets per person (excluding house) • If > $30,000 annual income per person • Around age 60 (55-65) • Couples concerned about well spouse www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Additional LTC Insurance Tips • Understand how to trigger benefits (ADLs) • Buy a “compound” inflation rider • Consider key policy features: – Elimination period – Length of time benefits will be paid – Benefit amount ($ per day) www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Auto Insurance Basics • Factors that affect coverage • Two parts: – Liability coverage • Single limit (e.g., $300,000) • Split limit (e.g., 100/300/50) – Physical damage (collision & comprehensive) • Liability coverage is most important part • State minimum liability is often inadequate www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Auto Insurance Tips • Increase liability to at least 100/300/50: for self and uninsured motorists • Evaluate physical damage coverage on older cars • Take advantage of available discounts • Buy a less expensive car to insure • Notify insurer if driving patterns change www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Homeowner’s Insurance Basics • Five sections to a HO policy: – Damages to house or other structures – Loss of personal property – Living expenses while home is repaired – Personal liability – Medical payments to others • Different types of “HO” policies www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Three Important Tips • Photograph or videotape home contents – List brands and serial numbers – Store documentation away from home • Make sure home is insured for at least 80% of replacement cost – Otherwise, you’ll get partial payment for losses • Buy a “guaranteed replacement cost” rider for home (if available) and contents www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Other Homeowner’s Insurance Tips • Pay the premium annually • Check on discounts for safety devices – Alarm system – Smoke detectors • Don’t select low ($250) deductibles • Consider flood insurance • Document damages www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Umbrella Liability Coverage • Supplements liability limits of homeowner’s and auto policy • Also covers libel, slander, defamation of character, false arrest, boat or aircraft accidents, damages on another’s property • $1 million policies cost $150 to $250 • Sold in $1million increments www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Umbrella Insurance Tips • Buy required underlying coverage • Check to see if service on non-profit boards is covered • Check exclusions (e.g., overseas coverage, business coverage) • Check discount for all property coverage with one insurer www.extension.iastate.edu/annie Annie’s National Network Initiative for Educational Success (ANNIES) at Iowa State University Extension Questions? Comments? Experiences? www.extension.iastate.edu/annie