Chapter six Practice questions

advertisement

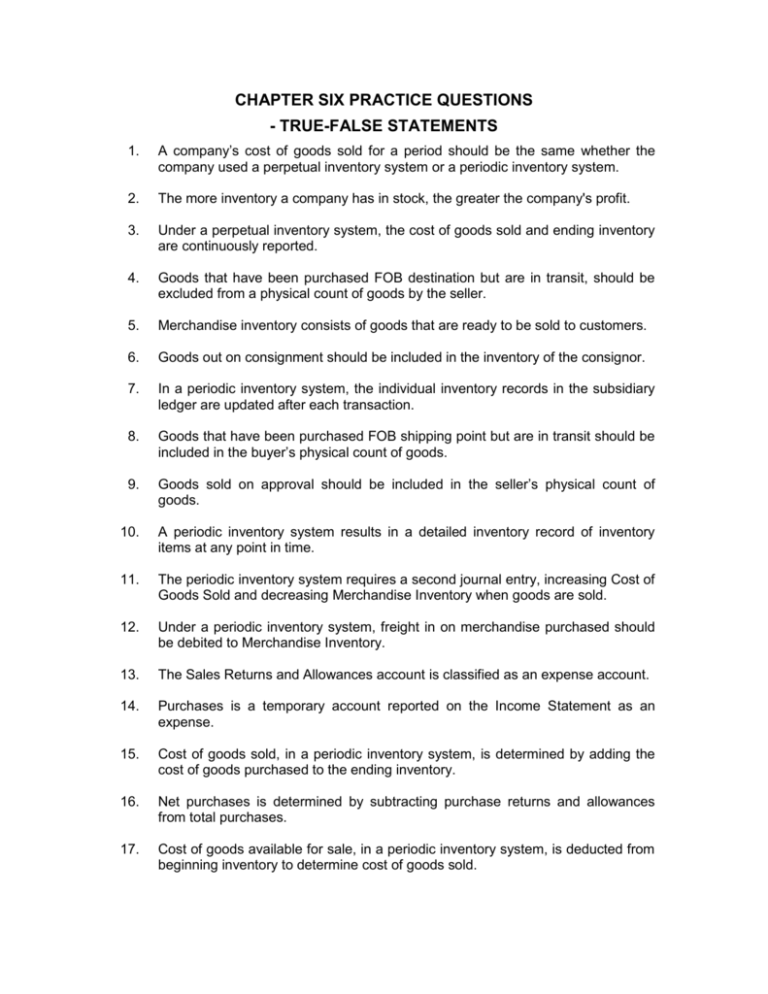

CHAPTER SIX PRACTICE QUESTIONS - TRUE-FALSE STATEMENTS 1. A company’s cost of goods sold for a period should be the same whether the company used a perpetual inventory system or a periodic inventory system. 2. The more inventory a company has in stock, the greater the company's profit. 3. Under a perpetual inventory system, the cost of goods sold and ending inventory are continuously reported. 4. Goods that have been purchased FOB destination but are in transit, should be excluded from a physical count of goods by the seller. 5. Merchandise inventory consists of goods that are ready to be sold to customers. 6. Goods out on consignment should be included in the inventory of the consignor. 7. In a periodic inventory system, the individual inventory records in the subsidiary ledger are updated after each transaction. 8. Goods that have been purchased FOB shipping point but are in transit should be included in the buyer’s physical count of goods. 9. Goods sold on approval should be included in the seller’s physical count of goods. 10. A periodic inventory system results in a detailed inventory record of inventory items at any point in time. 11. The periodic inventory system requires a second journal entry, increasing Cost of Goods Sold and decreasing Merchandise Inventory when goods are sold. 12. Under a periodic inventory system, freight in on merchandise purchased should be debited to Merchandise Inventory. 13. The Sales Returns and Allowances account is classified as an expense account. 14. Purchases is a temporary account reported on the Income Statement as an expense. 15. Cost of goods sold, in a periodic inventory system, is determined by adding the cost of goods purchased to the ending inventory. 16. Net purchases is determined by subtracting purchase returns and allowances from total purchases. 17. Cost of goods available for sale, in a periodic inventory system, is deducted from beginning inventory to determine cost of goods sold. 18. Cost of goods sold, in a periodic inventory system, is determined by recording the purchases of merchandise, determining the cost of goods purchased, beginning, and ending inventory. 19. The income statement for a merchandising company using a periodic inventory system contains less detail for the cost of goods sold. 20. The balance in the Merchandise Inventory account, when using a periodic inventory system, requires two closing entries. 21. Using a periodic inventory system, the beginning Merchandise Inventory account balance is debited to the Purchases account. 22. The specific identification method of costing inventories tracks the actual physical flow of the goods available for sale. 23. Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company. 24. The First-in, First-out (FIFO) inventory method results in an ending inventory valued at the most recent cost. 25. The matching principle requires that the cost of goods sold be matched against the ending merchandise inventory in order to determine income. 26. The specific identification method of inventory valuation is desirable when a company sells a large number of low-unit cost items. 27. If a company has no beginning inventory and the unit cost of inventory items does not change during the year, the value assigned to the ending inventory will be the same under the FIFO and average cost flow assumptions. 28. The costs of purchasing, receiving, and warehousing departments are generally inventoriable costs. 29. There is an accounting requirement that the cost flow assumption be consistent with the physical movement of the goods. 30. The average cost method assumes that the goods available for sale are homogeneous. 31. In the periodic inventory system, using the First-in, First-out (FIFO) inventory method, we allocate the inventory cost at the beginning of the period. 32. If the unit price of inventory is increasing during a period, a company using the LIFO inventory method will show less gross profit for the period, than if it had used the FIFO inventory method. 33. If a company has no beginning inventory and the unit price of inventory is increasing during a period, the cost of goods available for sale during the period will be the same under the LIFO and FIFO inventory methods. 34. A company may use more than one inventory costing method concurrently. 35. Use of the LIFO inventory valuation method is not permitted for income tax purposes. 36. If a company changes its inventory valuation method, the effect of the change should be disclosed in the financial statements. *37. If a company uses the FIFO cost assumption, the cost of goods sold for the period will be the same under a perpetual or periodic inventory system. 38. When the value of inventory is lower than its cost, the inventory is written down to its market value. 39. Accountants believe that the write down from cost to market should not be made in the period in which the price decline occurs. *40. The use of the gross profit method in estimating ending inventory is an example of the accounting principle of conservatism. *41. Under generally accepted accounting principles, management has the choice of physically counting inventory on hand at the end of the year or using the gross profit method to estimate the ending inventory. *42. The retail inventory method requires a company to value its inventory on the balance sheet at retail prices. 43. An error that overstates the ending inventory will also cause net income for the period to be overstated. *44. If inventories are valued using the retail inventory method, they should not be classified as a current asset on the balance sheet. 45. The use of different cost flow methods has little impact on inventory ratios. Answers to True-False Statements Item 1. 2. 3. 4. 5. 6. 7. Ans. T F T F T T F Item 8. 9. 10. 11. 12. 13. 14. Ans. T T F F F F T Item 15. 16. 17. 18. 19. 20. 21. Ans. F T F T F T F Item 22. 23. 24. 25. 26. 27. 28. Ans. T F T F F T F Item 29. 30. 31. 32. 33. 34. 35. Ans. Item Ans. Item Ans. F T F T T T T 36. *37. 38. 39. *40. *41. *42. T T T F F F F 43. *44. 45. T F F MULTIPLE CHOICE QUESTIONS 46. The factor which determines whether or not goods should be included in a physical count of inventory is a. physical possession. b. legal title. c. management's judgement. d. whether or not the purchase price has been paid. 47. If goods in transit are shipped FOB shipping point to a carrier named by the buyer a. the seller has legal title to the goods until they are delivered. b. the buyer has legal title to the goods when a public carrier accepts the goods from the seller. c. the transportation company has legal title to the goods while the goods are in transit. d. no one has legal title to the goods until they are delivered. 48. If goods in transit are shipped FOB destination a. the seller has legal title to the goods until they are delivered. b. the buyer has legal title to the goods when a public carrier accepts the goods from the seller. c. the transportation company has legal title to the goods while the goods are in transit. d. no one has legal title to the goods until they are delivered. 49. Merchandise inventory is a. reported under the classification of Capital Assets on the balance sheet. b. often reported as a miscellaneous expense on the income statement. c. reported as a current asset on the balance sheet. d. generally valued at the price for which the goods can be sold. 50. “Goods on Approval” a. are considered sold when removed from the seller’s premises regardless of whether or not legal title has transferred to the buyer. b. should be included in the seller’s physical inventory unless legal title has passed to the buyer. c. are also called consigned goods. d. are not considered to be sold until the buyer has paid a cash deposit to the seller. 51. Independent internal verification of the physical inventory process occurs when a. the employee is required to count all items twice for sake of verification. b. the items counted are compared to the inventory account balance. c. a second employee counts the inventory and compares the result to the count made by the first employee. d. all prenumbered inventory tags are accounted for. 52. An employee assigned to counting computer monitors in boxes should a. estimate the number if there are a large quantity to be counted. b. read each box and rely on the box description for the contents. c. open each box and check that the box contains a monitor. d. rely on the warehouse records of the number of computer monitors. 53. After the physical inventory is completed, a. quantities are listed on inventory summary sheets. b. quantities are entered into various general ledger inventory accounts. c. the accuracy of the inventory summary sheets is checked by the person listing the quantities on the sheets. d. unit costs are determined by dividing the quantities on the summary sheets by the total inventory costs. 54. A recommended internal control procedure for taking physical inventories is that the counting should be done by employees who do not have custodial responsibility for the inventory. This is an example of what type of internal control procedure? a. Authorization b. Documentation c. Independent verification d. Segregation of duties 55. Westcoe Company's goods in transit at December 31 include sales made (1) FOB destination (2) FOB shipping point and purchases made (3) FOB destination (4) FOB shipping point Which items should be included in Westcoe's inventory at December 31? a. (2) and (3) b. (1) and (4) c. (1) and (3) d. (2) and (4) 56. The term "FOB" denotes a. free on board. b. freight on board. c. free only (to) buyer. d. freight charge on buyer. 57. Under a consignment arrangement, the a. consignor has ownership until goods are sold to a customer. b. consignor has ownership until goods are shipped to the consignee. c. consignee has ownership when the goods are in the consignee's possession. d. consigned goods are included in the inventory of the consignee. 58. All of the following are internal control procedures related to a physical inventory count except a. employees who do not have custodial or record keeping responsibility for the inventory should do the counting. b. prenumbered inventory tags should be used and all tags accounted for. c. inventory that has been counted should be removed to a separate warehouse to prevent double counting. d. at the end of the count, a supervisor should ensure that all inventory items are tagged. 59. A company just starting in business purchased three merchandise inventory items at the following prices. First purchase $80; Second purchase $95; Third purchase $85. If the company sold two units for a total of $200 and used FIFO costing, the gross profit for the period would be a. $25. b. $35. c. $20. d. $10. 60. The FIFO inventory method assumes that the cost of the latest units purchased are a. the last to be allocated to cost of goods sold. b. the first to be allocated to ending inventory. c. the first to be allocated to cost of goods sold. d. not allocated to cost of goods sold or ending inventory. Use the following information for questions 61–64. A company just starting business made the following four inventory purchases in June: June 1 June 10 June 15 June 28 150 units 200 units 200 units 150 units $ 780 1,170 1,260 990 $4,200 A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand. The company uses a periodic inventory system. 61. Using the LIFO inventory method, the value of the ending inventory on June 30 is a. $1,365. b. $1,620. c. $2,580. d. $2,835. 62. Using the FIFO inventory method, the amount allocated to cost of goods sold for June is a. $1,620. b. $2,290. c. $2,580. d. $2,835. 63. 64. Using the average cost method, the amount allocated to the ending inventory on June 30 is a. $4,200. b. $2,700. c. $1,150. d. $1,500. The inventory method which results in the highest gross profit for June is a. the FIFO method. b. the LIFO method. c. the weighted average unit cost method. d. not determinable. Use the following information for questions 65–66. The Singh Computer Shop begins operations on June 1 and uses a periodic inventory system. During June, the company had the following purchases and sales for its Model 10 Fastback Computer System: Purchases Date Units Unit Cost Sales (Units) June 1 4 $2,000 5 2 9 9 $2,600 16 3 65. Using the FIFO inventory method, the amount allocated to cost of goods sold for June is a. $10,000. b. $10,600. c. $13,000. d. $20,800. 66. Using the average cost method, the amount allocated to the ending inventory on June 30 is a. $19,323. b. $11,473. c. $20,800. d. $10,600. 67. A company purchased inventory as follows: 200 units at $9 300 units at $10 The average unit cost for inventory is a. $9.00. b. $9.50. c. $9.60. d. $10.00. 68. Which of the following items will increase the cost of goods purchased for the buyer of goods? a. Purchase returns and allowances granted by the seller b. Volume discounts taken by the purchaser c. Freight charges paid by the seller d. Freight charges paid by the purchaser 69. 70. Inventoriable costs may be thought of as a pool of costs consisting of which two elements? a. The cost of beginning inventory and the cost of ending inventory b. The cost of ending inventory and the cost of goods purchased during the year c. The cost of beginning inventory and the cost of goods purchased during the year d. The difference between the costs of goods purchased and the cost of goods sold during the year What are the effects of respective balances in Freight In, Purchase Returns, and Purchases on inventoriable costs? a. b. c. d. Freight in Increase Decrease Increase Decrease Purchase Returns Decrease Increase Decrease Increase Purchases Decrease Increase Increase Decrease 71. The cost of goods available for sale is allocated between a. beginning inventory and ending inventory. b. beginning inventory and cost of goods on hand. c. ending inventory and cost of goods sold. d. beginning inventory and cost of goods purchased. 72. Levy's Used Cars uses the specific identification method of costing inventory. During March, Levy purchased three cars for $5,000, $6,500, and $8,000, respectively. During March, two cars are sold for $7,500 each. Levy determines that at March 31, the $8,000 car is still on hand. What is Levy's gross profit for March? a. $2,000. b. $3,500. c. $500. d. $7,000. 73. Of the following companies, which one would not likely employ the specific identification method for inventory costing? a. Music store specializing in organ sales b. Farm implement dealership c. Antique shop d. Hardware store 74. A problem with the specific identification method is that a. inventories can be reported at actual costs. b. management can manipulate income. c. matching is not achieved. d. the lower of cost and market basis cannot be applied. 75. The selection of an appropriate inventory cost flow assumption for an individual company is made by a. b. c. d. 76. the external auditors. the CICA. the internal auditors. management. Which of the following is not a common cost flow assumption used in costing inventory? a. First-in, first-out b. Middle-in, first-out c. Last-in, first-out d. Average cost 77. The accounting principle that requires that the cost flow assumption be consistent with the physical movement of goods is a. called the matching principle. b. called the consistency principle. c. nonexistent; that is, there is no accounting requirement. d. called the physical flow assumption. 78. Which of the following statements is true regarding inventory cost flow assumptions? a. A company may use more that one costing method concurrently. b. A company must comply with the method specified by industry standards. c. A company must use the same method for domestic and foreign operations. d. A company may never change its inventory costing method once it has chosen a method. 79. Which of the following statements is correct with respect to inventories? a. The FIFO method assumes that the costs of the earliest goods acquired are the last to be sold. b. It is generally good business management to sell the most recently acquired goods first. c. Under FIFO, the ending inventory is based on the latest units purchased. d. FIFO seldom coincides with the actual physical flow of inventory. *80. When valuing ending inventory under a perpetual inventory system, the a. valuation using the LIFO assumption is the same as the valuation using the LIFO assumption under the periodic inventory system. b. moving average requires that a new average be calculated after every sale. c. valuation using the FIFO assumption is the same as under the periodic inventory system. d. earliest units purchased during the period using the LIFO assumption are allocated to the cost of goods sold when units are sold. *81. The Jeter Company uses the perpetual inventory system and the moving average method to value inventories. On August 1, there were 5,000 units valued at $15,000 in the beginning inventory. On August 10, 10,000 units were purchased for $6 per unit. On August 15, 8,000 units were sold for $12 per unit. The amount charged to cost of goods on August 15 was a. $35,000. b. $40,000. c. $48,000. d. $36,000. *82. Under a perpetual inventory system, acquisition of inventory items is debited to a. an Inventory account. b. a Cost of Goods Sold account. c. a Purchases account. d. Cost of Goods Sold after a physical count of goods on hand is taken. *83. Under a perpetual inventory system, a. cost of goods sold is recognized when a sale occurs. b. a physical count of goods must be taken at the end of the month. *84. c. only the FIFO or LIFO methods can be used. d. the average method is not acceptable. In a perpetual inventory system, the Inventory account is a. added to the Purchases account to determine cost of goods available for sale. b. found in the subsidiary ledger. c. a control account in the general ledger. d. credited when making closing entries. *85. In a perpetual inventory system, the cost of goods sold is recorded a. on a monthly basis. b. on a daily basis. c. on an annual basis. d. with each sale. *86. If a physical count of inventory is taken and it shows fewer units than the inventory ledger cards in a perpetual system, then the journal entry to record the discrepancy is a. Purchase Returns and Allowances Inventory b. Cost of Goods Sold Inventory c. Inventory Gain on Inventory d. Inventory Losses Inventory 87. The journal entry to record a return of merchandise purchased on account under a periodic inventory system would be a. Accounts Payable Purchase Returns and Allowances b. Purchases Returns and Allowances Accounts Payable c. Accounts Payable Inventory d. Inventory Accounts Payable 88. When contrasting a perpetual inventory system to a periodic system, the a. perpetual system requires less clerical work. b. perpetual system provides better control over inventories. c. periodic system requires more clerical work. d. periodic system provides better control over inventories. *89. 90. Which of the following is not true of a perpetual inventory system? a. It allows for the monitoring of the quantities of inventory on hand. b. Two entries are required when a sale is made. c. Inventory subsidiary ledgers make computers less essential. d. It allows for greater control over inventories. The cost of goods available for sale is allocated to the cost of goods sold and the a. b. c. d. beginning inventory. ending inventory. cost of goods purchased. gross profit. 91. In periods of rising prices, the inventory method which results in the inventory value on the balance sheet that is closest to current cost is the a. FIFO method. b. LIFO method. c. average cost method. d. tax method. 92. Two companies report the same cost of goods available for sale but each employs a different inventory costing method. If the price of goods has increased during the period, then the company using a. LIFO will have the highest ending inventory. b. FIFO will have the highest cost of good sold. c. FIFO will have the highest ending inventory. d. LIFO will have the lowest cost of goods sold. 93. If companies have identical inventoriable costs but use different inventory flow assumptions when the price of goods have not been constant, then the a. cost of goods sold of the companies will be identical. b. cost of goods available for sale of the companies will be identical. c. ending inventory of the companies will be identical. d. net income of the companies will be identical. 94. In a period of increasing prices, which inventory flow assumption will result in the lowest amount of cash before income tax? a. FIFO b. LIFO c. Average Cost d. Cash will be the same under all assumptions. 95. The specific identification method of costing inventories is used when the a. physical flow of units cannot be determined. b. company sells large quantities of relatively low cost homogeneous items. c. company sells large quantities of relatively low cost heterogeneous items. d. company sells a limited quantity of high-unit cost items. 96. The specific identification method of inventory costing a. always maximizes a company's net income. b. always minimizes a company's net income. c. has no effect on a company's net income. d. may enable management to manipulate net income. 97. The managers of Tong Company receive performance bonuses based on the net income of the firm. Which inventory costing method are they likely to favour in periods of declining prices? a. LIFO b. Average Cost c. FIFO d. Physical inventory method 98. LIFO is seldom used in Canada because a. LIFO does not provide the best income statement valuation. b. LIFO does not match current costs with current statement valuation. c. LIFO is not permitted to be used for income tax purposes in Canada. d. in periods of price declines, LIFO will produce a lower net income that any other cost flow assumption. 99. Selection of an inventory costing method by management does not usually depend on a. the fiscal year-end. b. income statement effects. c. balance sheet effects. d. tax effects. 100. The accountant at Kramer Company is figuring out the difference in income taxes the company will pay depending on the choice of either FIFO or average cost as an inventory costing method. The tax rate is 30% and the FIFO method will result in income before taxes of $4,370. The average cost method will result in income before taxes of $3,950. What is the difference in tax that would be paid between the two methods? a. $420. b. $294. c. $126. d. Cannot be determined from the information provided. 101. The accountant at Baxter Company has determined that income before income taxes amounted to $6,000 using the FIFO costing assumption. If the income tax rate is 30% and the amount of income taxes paid would be $300 greater if the average cost assumption were used, what would be the amount of income before taxes under the average cost assumption? a. $6,300. b. $7,000. c. $5,000. d. $5,700. 102. The manager of Worley is given a bonus based on net income before taxes. If the manager adopts the FIFO method, the net income after taxes is $5,600 for FIFO and $4,900 for average cost. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of average cost? a. $250. b. $140. c. $200. d. $700. 103. The consistent application of an inventory costing method is essential for a. conservatism. b. accuracy. c. comparability. d. efficiency. 104. The least conservative valuation of inventories on the balance sheet is obtained by applying the lower of cost and market basis to a. the average inventory. b. total inventory. c. major inventory categories. d. individual inventory items. 105. The lower of cost and market basis of valuing inventories is an example of a. comparability. b. the cost principle. c. conservatism. d. consistency. 106. In Canada, under the lower of cost and market basis in valuing inventory, the majority of Canadian companies define market as a. net realizable value. b. selling price. c. current replacement cost. d. selling price less markup. 107. The lower of cost and market basis may be applied to a. individual inventory items. b. major categories of inventory. c. total inventory. d. all of these. 108. The most common practice in applying the lower of cost and market to inventory valuation is to use a. average inventories. b. major categories of inventory. c. individual inventory items. d. total inventories. 109. Deerfield Company developed the following information about its inventories in applying the lower of cost and market (LCM) basis in valuing inventories: Product A B C Cost $ 70,000 50,000 100,000 Market $ 75,000 48,000 102,000 If Deerfield Company applies the LCM basis to the total inventory, the value of the inventory reported on the balance sheet would be a. $227,000. b. $220,000. c. $225,000. d. $218,000. 110. For a merchandising company, the net realizable value of its inventory is the a. original cost of the inventory. b. current selling price. c. current selling price less any costs required to make the goods ready for sale. d. original cost of the inventory less any costs required to make the goods ready for sale. *111. A company had sales of $150,000 and cost of goods available for sale of $300,000 during January. If its gross profit rate is estimated to be 40%, the ending inventory value at January 31 is estimated to be a. $90,000. b. $210,000. c. $180,000. d. $120,000. *112. A company has goods available for sale during a period at cost and at retail of $90,000 and $150,000, respectively. If sales during the period amounted to $120,000, an estimate of the ending inventory at cost at the end of the period under the retail method is a. $48,000. b. $72,000. c. $18,000. d. $30,000. *113. Inventories are estimated a. more frequently under a periodic inventory system than a perpetual inventory system. b. using the wholesale inventory method. c. more frequently under a perpetual inventory system than a periodic inventory system. d. using the net method. *114. Newman Department Store estimates inventory by using the retail inventory method. The following information was developed: Beginning inventory Goods purchased Net sales At Cost $160,000 500,000 At Retail $400,000 700,000 650,000 The estimated cost of the ending inventory is a. $390,000. b. $270,000. c. $490,000. d. $450,000. *115. Walters Department Store utilizes the retail inventory method to estimate its inventories. It calculated its cost to retail ratio during the period at 70%. Goods available for sale at retail amounted to $300,000 and goods were sold during the period for $160,000. The estimated cost of the ending inventory is a. $140,000. b. $210,000. c. $98,000. d. $200,000. *116. Hamil Company prepares monthly financial statements and uses the gross profit method to estimate ending inventories. Historically, the company has had a 40% gross profit rate. During June, net sales amounted to $50,000; the beginning inventory on June 1 was $15,000; and the cost of goods purchased during June amounted to $25,000. The estimated cost of Hamil Company's inventory on June 30 is a. $10,000. b. $30,000. c. $9,000. d. $20,000. An error in the physical count of goods on hand at the end of a period resulted in a $10,000 overstatement of the ending inventory. The effect of this error in the current period is Cost of Goods Sold Net Income a. Understated Understated b. Overstated Overstated c. Understated Overstated d. Overstated Understated 117. 118. If beginning inventory is understated by $10,000, the effect of this error in the current period is Cost of Goods Sold Net Income a. Understated Understated b. Overstated Overstated c. Understated Overstated d. Overstated Understated 119. A company uses the periodic inventory method and the beginning inventory is overstated by $4,000 because the ending inventory in the previous period was overstated by $4,000. The amounts reflected in the current end of the period balance sheet are Assets Owner's Equity a. Overstated Overstated b. Correct Correct c. Understated Understated d. Overstated Correct Answers to Multiple Choice Questions Item 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. Ans. b b a c b c c a d b a Item 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. Ans. a c a b a c d a b a c Item 68. 69. 70. 71. 72. 73. 74. 75. 76. 77. 78. Ans. Item Ans. Item Ans. Item Ans. Item Ans. d c c c b d b d b c a 79. *80. *81. *82. *83. *84. *85. *86. 87. 88. *89. c c b a a c d b a b c 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. b a c b d d d a c a c 101. 102. 103. 104. 105. 106. 107. 108. 109. 110. *111. b c c b c a d d b c b *112. *113. *114. *115. *116. 117. 118. 119. c a b c a c c b