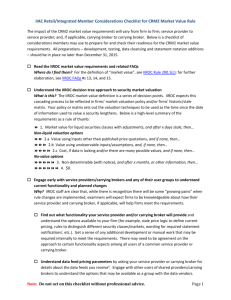

Exceptions to asset-class-specific market value aging matrix

advertisement

FRAMEWORK FOR SECURITIES MARKET VALUE VALUATION: CONSIDERATIONS Note: If your firm is using these considerations in the preparation or updating of your market valuation policies and procedures, be sure to avoid concerns IIROC raised in its 2014/2015 Annual Consolidated Compliance Report, namely, that examiners continue to find that some firms’ internal control policies: Describe Inaccurately or inadequately the firm’s policies and procedures Copy closely wording in the Rule 2600, Internal Control Policy Statements 2 through 8 requirements Lack effective descriptions of processes, responsibilities, supervisory and monitoring documentation, etc. Caution: Members using this considerations framework should: Use their own policy/procedures format Ensure the policy and processes developed are appropriate for their business model Use their own words Cite sources considered that are relevant (see attached Endnotes) Train staff on the purpose of the requirements so they can explain the reason for choices made Ensure appropriate executives sign off on and annually review and (re-)approve the policy and procedures Consult their own legal counsel. Summary of <Name of Investment Dealer> Policy and Procedures for Valuation of Securities Purpose: These are <firm name’s> policy and procedures for the valuation of securities held for clients, for example, to record on client account statementsi. The values derived also form the basis of performance reporting. Basis for Policy: Our market valuation policy and procedures take into account IIROC Rule 200.1(c) and: Our requirement under IIROC Rules to act fairly, honestly and in good faith. Our business model <describe model – recognize resource constraints – and client profile (e.g., mainly looking for advice on traded securities; efforts to ensure clients understand market valuation process; other). <Insert relevant references, as recommended by IIROCii; examples may include CRAiii, IFRS iv, IOSCOv, etc.vi]. Roles and Responsibilities: <Tailor based on firm business model, size, service provider, carrying broker, etc.> Role Qualifications Responsibility <e.g., management team excluding executive responsible> <Executive responsible> <Senior executive, requisite knowledge, experience and independence> <Senior executive, requisite knowledge, experience> <Review and (re-)approve policy annually> <Set policy and procedures that establish securities pricing hierarchy under IIROC Rule 200.1(c) Ensure appropriate staffing and require separation of duties of staff Develop and review market value aging matrix (MVAM) against IIROC Rule 200.1(c),FAQs and any new IIROC requirements or guidance Review results of periodic market value tolerance testing Annually review data sources, flags set by firm, any issues that have arisen during the year Annually review business continuity plan internally and with key vendors Approve any policy or procedure exceptions with the CCO, CEO, CFO or UDP and document> Page 1 Role Qualifications Responsibility <Conducting or overseeing processes> <Enter requisite qualifications, training> <Compliance under CCO direction> <Enter requisite qualifications, training> <Identify and document the methodology(ies) to be used for valuing each type of security held Identify and document market value aging matrix, including regular intervals at which securities, appropriate to their nature, must be valued Develop any necessary definitions (e.g., stale, observable inputs per security type) Identify steps to follow to prevent, detect, and correct errors in valuation on a timely basis Develop schedule for tolerance testing Conduct testing, document results, review and report any anomalies to senior responsible executive and develop plan to improve Maintain documentation Support Compliance and IIROC examiners Annually prepare review of policy, feed sources, etc. with any recommendations for change for senior executive review> <Review policy against IIROC Rule 200.1(c) Review processes adopted, including methodologies Test that the valuation methods identified in the market value aging matrix are consistently applied by security type Review test results Conduct monthly after-the-fact review of price overrides and associated documentation Sample …> Market Valuation Procedures: Permitted Data Sources (update annually): We use reputable data sources that we believe to provide reasonably current, consistent, and reliable securities market values. We identify/review <e.g., with service provider or carrying broker user group> third-party or other primary and secondary data sources used and assumptions for pricing/valuing client securities. <complete and update annually> Data Source For Asset Classes… Comments Listed SVC IDC <List> OTC <List> <List> Manual/House Pricing Third-party valuation letter Audited financial statements with net asset value (NAV) Independent accountant or business valuation letter Subscription agreement (new issues) <x, y, z> <x, y, z> <x, y, z> <widely-used in industry, Google for complaints> <x, y, z> <x, y, z> <often may be included with SVC, IDC> <x, y, z> Preferred due to independence and expertise/designationvii Prepared by qualified professional From a law, accounting firm or other recognized business valuation professional/firm Confirm experience of underwriter Page 2 Data Source Call issuer for latest arm’s-length trade price <List> For Asset Classes… <x, y, z> Comments Note: Do not use in security master; use only for “confirming” value as value ages <x, y, z> Decision/Valuation Hierarchy Structure (review/re-familiarize annually): We follow and train appropriate staff to understand and follow IIROC Rule 200.1(c): 1. Market value for liquid securities classes with adjustments IIROC Rule 200.1(c)(i) Non-liquid market valuation 2.a Value using inputs other than published price quotations <add, amend, delete any/all of the following as appropriate> Restricted shares linked to underlying non-restricted share (with or without a discount) Physical securities linked to underlying security (with or without a discount) 2.b Value using unobservable inputs/assumptions Grid to price OTC fixed income securities (for firms that have such desks) Non-exchange-traded private security linked to publicly-traded security (with or without a discount) Discount below national government debt for subnational debt “Historic” or “stale” price unless new negative information is known Option pricing model 2.c Cost if data is lacking and/or there are many possible values New issues Flow-through shares No value options 3. Non-determinable (with notice) 4. $0. “Historic” or “stale” price unless new negative information is known. Data Feed Parameter-Setting Review (update annually): <Reconfirm where firm can set market valuation flags independently after discussion with service provider/carrying broker; how the flags are set; and whether updates are needed; document> Market Value Aging Matrix (update annually): Review and update the Market Value Aging Matrix (MVAM), <see alternative IIAC examples: Market Valuation Aging Matrix by Pricing Source and Market Valuation Aging Matrix by IIAC Asset Class Schema, which specifies that, where prices have not been: (i) updated in a maximum number of days (as defined by asset <category, class or subclass>)viii or (ii) reconfirmed as remaining reasonable in the appropriate period by other reasonable methods, we will mark the value as <not available (NA)> or <not determinable (ND)> or < require/may require clients to obtain an independent valuation, at their expense, for reporting purposes> And Where the prices of securities have not been updated, reconfirmed or derived according to regulatory guidelines in 365 days <or other> , the value of the securities will be $0, unless <two> senior officers have approved the exception and the exception is documented. Page 3 <If using> Tolerance Testing Last Price Continues to Be Materially Similar to Bid/Ask For Liquid Securities (<set frequency): E.g., annual to start, reducing after two years of member experience to semi-annual to confirm that last traded price remains “comparable” to last bid/ask. For liquid securities, it might be 10%; a higher tolerance might be appropriate for some part of the remainder (e.g., where the absolute price is low, say $10 or less, a higher percentage would apply)>. Due Diligence Testing (<set frequency>): We review data sources, flags set by our firm and any issues that have arisen during the year and assess the reliability of valuation inputs and of third parties that provide price feeds or valuation services and any house-pricing methodologies, including updating (respectively) the data sources as new reliable data sources are identified and the methodologies. Temporary special-case processes (update annually): <e.g., o pricing for transfers in of assets until valuation is confirmed o pricing at “not determinable” or zero in the event of cease-trade orders or delisted securities (note that these may vary by province; also, some may still trade on foreign markets)ix o pricing methodologies for new products, etc. – perhaps cost?) and related documentation> Permitted Overrides (update annually): <e.g., o Pricing on public CUSIPs can only be manually overwritten at month-end for statements including when the dealer member challenges pricing if the price provided by the third-party vendor differs materially from what IA teams quote from alternate sources, e.g., tolerance for government debt – 1%; for investment grade/strips – 2%; high-yield – 5% (intraday corporate or market/economic announcements affecting valuations cannot be assessed until the following business day as some pricing occurs overnight. Systematic overnight pricing then continues.> Page 4 Attachment SAMPLE MARKET VALUATION AGING MATRIX • Note: This is for consideration purposes only and frequencies, maximum days, etc. do NOT reflect any firm’s current practices or such data from the industry market value aging matrix currently in preparation. See also alternative IIAC examples: Market Valuation Aging Matrix by Pricing Source and Market Valuation Aging Matrix by IIAC Asset Class Schema. The IIAC Market Value Working Group will be seeking comments/non-disapproval of a Market Valuation Aging Matrix with “generous” timelines to allow firms to prepare and then there is an expectation that the timeliness will tighten as more experience with the greater specificity IIROC seeks continues. Security Class & Code Listed, OTC or House Range Listed Shares and Options(#) OTC House range Listed Bonds (#) Mutual Funds (excluding ETFs, CEFs) CCPCs, Other Unlisted Complete as desired (e.g., non- traded options/ warrants valued at $0) OTC Primary Pricing Source SVC/Service Provider SVC/Service Provider Manual SVC/Service Provider SVC/Service Provider Second Source Manual Manual N/A Manual Manual House range Manual N/A Listed N/A N/A House range SVC/Service Provider N/A Listed N/A OTC SVC/Service Provider House range Manual OTC Pricing Method N/A N/A N/A Action if Price Stale Daily 35 TBD Daily 35 TBD Ad hoc TBD TBD Daily 35 TBD Daily 35 TBD Ad hoc TBD TBD N/A N/A N/A Daily 35 TBD N/A N/A N/A N/A N/A N/A # # # Ad hoc 365 TBD N/A N/A # Max. Days Price Reused IIROC Rule 200.1(c)(i)(A) IIROC Rule 200.1(c)(i)(B), (C) IIROC Rule 200.1(c)(i)(C) IIROC Rule 200.1(c)(i)(A) IIROC Rule 200.1(c)(i)(B), (C) IIROC Rule 200.1(c)(i)(C) IIROC Rule 200.1(c)(i)(B) N/A Manual Pricing Frequency # IIROC Rule 200.1(c)(i)(C) Listed OTC House range Exceptions to asset-class-specific market value aging matrix: • Trade halts: Usually will restart trading in short period so usual market value aging matrix likely to apply). • Cease-trade orders: Leave for x months, or mark ND; then mark to $0 after a further x months) • Delisted: Same as unlisted, but tag to monitor if still trades on bulletin board • GICs: No change in current practice (face plus accrued interest) Page 5 Endnotes i The valuation policy may cover, in addition to client statement and performance reporting, also dealer member solvency reporting covering under-margined client accounts and inventory of proprietary positions or these could be covered separately. ii IIROC’s 2014 Annual Consolidated Compliance Report suggests dealers document reference sources that require or imply a higher standard in literature (e.g., see endnotes iii, iv, v and vi below), comments made by auditors or regulators, or industry practices (examples could be IOSCO principles for the valuation of securities, referred to by the IIAC in the preparation of these considerations, IFRS requirements (see below), etc.). Dealers may want to be prepared to explain variances between such sources and their policy, and reference what the firm may be doing to move towards any higher standard – for example, improving on the industry market value aging matrix. iii International Financial Reporting Standards (IFRS): IFRS IAS 13 states that: “IFRS 13 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., an exit price).” An exit price would commonly be defined as a closing price, or typically a price between bid and offer; see also following extract, provided by a source believed to be reliable”. “Topic 820 - IFRS 7 & 13 Overview U.S. Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 820 and International Accounting Standards Board (IASB), International Financial Reporting Standards (IFRS) 7 and 13 apply to fair value measurements and disclosures included in financial statements. Topic 820 and IFRS 13 each define fair value, establish a framework for measuring fair value, and (along with IFRS 7) require statement preparers to disclose information about their fair value determinations in their financial statements. Topic 820, IFRS 7 and 13 establish a fair value hierarchy based on the nature of data inputs for fair value determinations, under which a statement preparer is required to value each asset using assumptions that market participants would employ to value that asset. When a preparer uses its own assumptions to value an asset, these standards require the preparer to disclose additional information about the assumptions used and the effects of the measurements on earnings or changes in net assets for the period. Inputs to Fair Value Determinations Topic 820 defines inputs as “the assumptions that market participants would use when pricing the asset or liability, including assumptions about risk….”7 IFRS 13 states that inputs used in fair value measurement “should be consistent with the inputs that market participants would use in pricing the asset or liability.” Each standard characterizes inputs as observable or unobservable, and requires that statement preparers “maximize the use of relevant observable inputs and minimize the use of unobservable inputs.”” iv Canada Revenue Agency (CRA): The CRA states that “Fair market value generally means the highest price, expressed in dollars, that a property would bring in an open and unrestricted market, between a willing buyer and a willing seller who are knowledgeable, informed, and prudent, and who are acting independently of each other.” v IOSCO Principles for Financial Benchmarks: The Final Report (July 2013), determined by the IOSCO Board Task Force on Financial Market Benchmarks, while not precluding use of bid or ask, requires in Section 8, Hierarchy of Data Inputs (page 23), that “a Benchmark be based upon (i.e., anchored in) an active market having observable Bona Fide, Arm’s-Length Transactions.” The Report continues that: “The data used to construct a Benchmark determination should be sufficient to accurately and reliably represent the Interest measured by the Benchmark and should: a) Be based on prices, rates, indices or values that have been formed by the competitive forces of supply and demand in order to provide confidence that the price discovery system is reliable; and b) Be anchored by observable transactions entered into at arm’s length between buyers and sellers in the market for the Interest the Benchmark measures in order for it to function as a credible indicator of prices, rates, indices or values.” vi Material from FINRA: IIROC’s U.S. counterpart FINRA stated in Reg Notice 08-08 that firms should give careful consideration to characterizing Auction Rate Securities (ARS) securities as cash or cash equivalents on the customer statements. Note: This was at a time of market stress and many parties did not adjust the value of assets even when liquidity had dried up. Page 6 FINRA’s Annual Examination Priorities Letter (page 11 ), where the financial & operational priorities begin. Note: This explains why the NASD rule clarification was issued – brokers were leaving the flat price assets at $10, although fees and other costs had reduced their value. FASB website. See the “Fair Value Hierarchy” in Accounting Standards Codification (ASC) 820 that defines Fair Value, and establishes the framework for measuring fair value, including the hierarchy Note: You must sign up to get in, but can do so on a free (lower service) basis. FINRA Rule 2340 – Customer Account Statements http://finra.complinet.com/en/display/display.html?rbid=2403&element_id=3647 SEC Rules on Valuation for Investment Companies http://www.sec.gov/divisions/investment/icvaluation.htm Note: The Rules on Valuation is a long document focused on investment companies rather than dealers, with detail on, for example, variation between amortized and fair value of money market instruments, some restricted securities material, etc. Material from Members’ with IFRS Experience re Funds “In terms of putting together a straw man that would be acceptable to both the industry and regulators, perhaps the [following] may be somewhat useful. While not directly applicable as it was issued as guidance for investment funds where investors purchase and redeem at NAV, it has value on a number of fronts: 1. Issued by IOSCO. Canadian regulators may be more accepting of an approach that conforms to international security commission guidance. 2. Relatively current. As opposed to other guidance issued, this is relatively up to date, having been issued in May 2013. 3. Principles-based. Provides participants with ability to implement pricing standards for securities in a manner which is consistent with their client base and types of securities generally held. Again, not all of the principles noted would be directly applicable to dealer pricing of client accounts, but the general themes may useful. http://www.iosco.org/library/pubdocs/pdf/IOSCOPD413.pdf Another source of information (still relating to investment funds) can be found in this document. It is quite detailed/lengthy, however, does have some useful ways of looking at pricing (starting page 43) and less widely traded securities on pg 109. Given this is guidance for investment funds, it will again not be directly applicable but can provide insights into some of the methods, internal controls and processes used for pricing securities. http://www.cica.ca/applying-the-standards/financial-reporting/international-financial-reportingstandards/item72039.pdf Example of one member’s third-party valuation letter requirements 1. On company letterhead, executed by senior officer of corporation (e.g., Vice-President, President, CEO, CFO, etc.) and addressed to the trustee and the broker. 2. Specify that the officer providing the certificate has made such examinations and investigations as are necessary in his/her opinion to enable him/her to make the statement contained in the certificate. 3. Acknowledge that the certificate provided will be relied on conclusively by the trustee and broker regarding the acquisition of the shares as a qualified investment by the registered plan. 4. Certify in his/her capacity as officer that the fair market value of the shares of the corporation are of a specific date. viii Example of member process where primary and secondary sources are not available: 1. Look for price on as-of date; if valid price present, then price used; if not present, use most recent as-at price (bid, last-traded, ask) in 30-day period; if none present, move to #2; if none still present, move to #3. 2. If record available for as-of date plus one month, use price closest to as-of date. If not available, move on to #3. 3. If a valid older price is available, use the one closest to the as-of date. If none is available then “notdeterminable” and after x days, $0. . ix CTO Database: http://cto-iov.csaacvm.ca/SearchArticles.asp?Instance=101&Form=1&Attr3=1&Attr1=1&Attr1=2&Attr1=3&Attr1=4&Attr1=5&At trSet4=1 vii Page 7 CTO Database Advanced Search: http://cto-iov.csaacvm.ca/SearchArticles.asp?Instance=101&Attr7=1&Attr7=2&Attr2=1&Attr2=2&Attr2=3&Attr2=4&Attr2=5&At tr2=6&Attr2=7&Attr2=8&Attr2=9&Attr2=10&Attr2=11&Attr2=12&Attr2=13&Attr2=14&Attr3=1&Attr8=1&Attr8 =2&XSL=SearchArticlesAdvanced Page 8