The difference between accounting and finance is:

advertisement

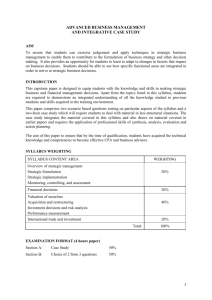

FINANCE, AN EXCITING CAREER School of Business, LeTourneau University Dr. Castro I have been asked by potential finance students some questions about finance such as what finance is and the difference between finance and accounting. Accounting: Accountant’s (sometimes called: Controller) primary function is to develop and provide data measuring the performance of the firm, assessing its financial position, and paying taxes. The accountant is responsible for preparing financial statements such as the income statement, balance sheets, and cash flows. It is normally passive work, in the sense that, the work has a very independent nature to it such as preparing forms and financial statements. It is a good job for people who want to work independently and are very organized (this is only a very brief description, if you are interested in accounting, consult your accounting instructor for more information). Finance: The financial manager or consultant places primary emphasis on decision making. It uses the financial statements prepared by accountants to make decisions about the firm’s financial condition and to advise others about possible losses and profits. In some cases, finance is more a type of leadership position. A financial manager has to deal not only with finance, but also with economics, accounting, statistics, math, and management. For example, people working with stocks and bonds have to understand and analyze how the underlying companies are performing. How a given company is going to perform during recession? Should they sell or buy stocks or bonds. How a decrease in the interest rate in England may affect the projects a company has in that country. Finance also deals a lot with risk. Derivative securities (options, futures, swaps, etc) are used to hedge against possible increase in risk. Risk managers are in great demand everywhere. Most finance majors find jobs in banks and other financial institutions, government, real estate, consultant companies, insurance, investment companies, stock market exchanges, fundraising, and any firm that needs someone to make financial decisions. Description of Finance Students will find the major in Finance particularly well-suited for careers in commercial and investment banking, real estate, corporate control and treasury functions, and insurance organizations. In addition, finance is important for generalists seeking careers in organization planning, management consulting, general line management, and small business management. Students seeking careers in the industries of health care, public and nonprofit management will also benefit from a strong knowledge of finance. Analytical finance such as risk management, investment, and derivative securities provide a more rigorous understanding of financial modeling, the theory and tools that underlie modern financial practice (derivative finance is sometimes called Financial Engineering.). International finance provides the quantitative and analytical foundation for a career in financial analysis, with an emphasis on the international aspects and economic foundations of financial theory and practice. A thorough understanding of the theory of financial markets is combined with institutional detail, hands-on experience with financial analysis, and familiarity with financial applications. What courses to take depends a lot on your own background, interests, experience, strengths, and weaknesses. Having taken the finance core will leave you with a solid understanding of the key building blocks of real-world finance. The other core courses are crucial elements of this foundation. Firm valuation, corporate finance, investment banking, and most sell-side jobs require a real knowledge of GAAP accounting. Asset pricing, portfolio allocation, and risk management are impossible without a real knowledge of economics and basic statistics. Furthermore, your in depth exposure to international finance give you a comparative advantage (maybe even an absolute advantage) in understanding today's trends, tomorrow's changes, and -- in particular -- the impact of exchange rates -- that is, the "international" in international finance. Going beyond the core, applications and the more practical and more specialized courses give you exposure to realworld experiences and a breadth of experiences. Business courses are particularly relevant for integrating your finance knowledge into the decisions of the firm -- finance is a crucial business input and firms are a key financial environment. Everything is tied together. I obtained the following information from the Internet Banking Investment, Commercial, and Insurance and Real Estate Main Activities: Valuation and company/segment analysis for mergers, spin-offs, acquisitions, LBO's, and so forth. Issuance and placement of securities such as loans, bonds, and equity including corporate valuation, due diligence, credit analysis, security design, and security valuation. Risk management including security sales and structuring, client advising, derivatives valuation, exposure determination (say to foreign exchange fluctuations), VAR, and portfolio allocation. Research/Strategy/Analysis of sectors, macro-trends, regions, or firms in support of the above activities. Consulting (Strategic/Valuation) Main Financial Activities: Project, business-line, market, and/or financial advice which all center around valuation exercises designed to help the client make better decisions. Management Consulting (and General Management) Main Financial Activities: Internal financing decisions involving the allocation of capital as above, but also decisions on the capital structure and the raising of additional capital, as well as in the overall allocation of risk. Money Management -- "buy side", because you buy securities Main Financial Activities: Security valuation, risk/return measurement, and portfolio allocation. Risk management in support of the above. Research/Strategy/Analysis in support of the above. Sales and Trading -- "sell side" because you sell securities Main Financial Activities: Same as above. "Trading" typically is for the firm's own account and in support of their role of making a market in that security. "Sales" is what it sounds like, except that the product is often structured in response to the client's needs. Sales often requires maintaining client relations. Entrepreneur/Venture Capital Main Financial Activities: Valuation of firm, business line, and market. Fund raising. International Capital Markets and Banking Cases in International Finance, International Banking, Foreign Exchange Markets, Credit Analysis, Country Risk Analysis, National Financial Markets and Capital Flows Corporate Finance and Valuation Creating and Managing Value, Financial Strategies, Mergers and Acquisitions, Topics in Financial Engineering, Financial Innovation and Structured Finance, Managerial Accounting, Options and Derivatives, Financial Modeling, Mergers and Acquisitions Law, Competitive Strategy, Alliance Strategy Risk Management Computer Simulations and Risk Assessment, Credit Analysis, Country Risk Analysis, Options and Derivatives, Financial Modeling Buy Side and Trading Options and Derivatives, International Portfolio Management, Fixed Income Securities, Hedge Fund Management, Foreign Exchange Markets Sales Transnational Negotiations, Financial Product Marketing, Options and Derivatives, Fixed Income Securities, Foreign Exchange Markets, Topics in Financial Engineering