income statement

INCOME STATEMENT

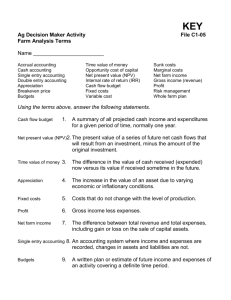

KEY CONCEPTS

NET INCOME IS THE BEST MEASURE OF BUSINESS

PERFORMANCE

ACCRUAL NET INCOME IS A MORE ACCURATE

MEASURE OF PROFITABILITY THAN CASH NET

INCOME

CASH RECEIPTS AND EXPENDITURES DO NOT

ALWAYS REPRESENT INCOME AND EXPENSES

EXPENSES SHOULD BE MATCHED TO THE

REVENUE THEY GENERATE IN THE SAME

ACCOUNTING PERIOD

NET INCOME

THE SINGLE MOST IMPORTANT

MEASURE OF PERFORMANCE FOR A

FARM BUSINESS

REPRESENTS A RETURN TO

UNPAID LABOR AND MANAGEMENT

AND OWNER EQUITY CAPITAL IN

THE BUSINESS

NET INCOME IS DEFINED TO

INCLUDE BOTH FARM AND

NONFARM INCOME ON AN AFTER-

TAX BASIS.

NET INCOME MAYBE THOUGHT OF

AS REVENUE MINUS EXPENSES.

CASH VS. ACCRUAL

THE IRS ALLOWS FARMERS AND RANCHERS TO

FILL THEIR INCOME TAX RETURNS ON A CASH

BASIS

THIS ALLOWS CONSIDERABLE FLEXIBILITY IN

MANAGING TAXES PAID IN A GIVEN YEAR

CASH BASIS ACCOUNTING WILL OFTEN DIFFER

FROM ACCRUAL RESULTS

MANAGEMENT DECISIONS CAN BEST BE MADE

FROM AN ACCRUAL BASED ACCOUNTING

SYSTEM

ACCRUAL VS. CASH ACCOUNTING

THE ACCRUAL METHOD OF ACCOUNTING

RECOGNIZES REVENUES AND EXPENSES AS

THEY OCCUR

THE CASH METHOD OF ACCOUNTING

RECOGNIZES REVENUES AND EXPENSES WHEN

CASH ACTUALLY CHANGES HANDS

ACCRUAL CONCEPT

INCOME IS MEASURED BY OPERATING

TRANSACTIONS THAT AFFECT OWNER EQUITY

ANY INCREASE IN OWNERS EQUITY RESULTING

FROM OPERATIONS IS TERMED REVENUE

ANY DECREASE IN OWNERS EQUITY IS CALLED

AN EXPENSE

NET INCOME IS THE DIFFERENCE BETWEEN THE

TWO

AN EXPENSE CAN BE EITHER A CASH OR NON-

CASH ITEM

WITH CASH-BASIS, REVENUE AND

EXPENSES ARE DETERMINED BY THE

TIMING OF PAYMENT.

WITH ACCRUAL-BASIS, IT MAKES NO

DIFFERENCE WHEN THE SALE IS

MADE.

INVENTORIES ARE VALUED AT

YEAR-END, AND COMPARED TO THE

INVENTORIES AT THE BEGINNING OF

THE YEAR.

IF INVENTORIES HAVE INCREASED,

THE AMOUNT OF INCREASE IS

CONSIDERED A POSITIVE REVENUE.

IF INVENTORIES HAVE DECREASED,

THE AMOUNT OF DECREASE IS

CONSIDERED A NEGATIVE REVENUE.

REVENUE

REVENUE IS GENERATED BY BOTH

CASH SALES AND CHANGES IN

INVENTORY.

FEEDER LIVESTOCK AND FEED

PURCHASES DURING THE YEAR ARE

SUBTRACTED FROM GROSS

REVENUE TO GET "VALUE OF FARM

PRODUCTION."

VALUE OF FARM PRODUCTION

A TERM UNIQUE TO FARM EARNINGS

STATEMENTS

COMPUTED AS THE GROSS

REVENUES OF AN OPERATION LESS

THE PURCHASES OF ASSETS THAT

ARE INCLUDED IN THE

CALCULATION OF GROSS REVENUE

ADVANTAGES:

GROSS REVENUE IS NOT DISTORTED BY

PURCHASES OF INVENTORY LATE IN

THE OPERATING CYCLE

MORE ACCURATE COMPARISONS

BETWEEN CERTAIN TYPES OF

OPERATIONS.

EXPENSES

CASH OPERATING EXPENSES

ACCRUAL EXPENSE ADJUSTMENTS

DEPRECIATION

INTEREST

CAPITAL ASSET ACCOUNT ADJUSTMENTS

NET INCOME FROM FARM OPERATIONS IS

TOTAL GROSS FARM REVENUE LESS

TOTAL FARM EXPENSES.

THE GAIN OR LOSS FROM THE SALE OF

CAPITAL ASSETS IS ACCOUNTED FOR TO

ARRIVE AT THE NET FARM INCOME.

NON-FARM REVENUE IS ADDED TO

NET FARM INCOME TO ARRIVE AT

INCOME BEFORE-TAXES.

INCOME TAXES ARE DEDUCTED TO

ARRIVE AT NET INCOME AFTER-

TAXES.

ACCRUAL INCOME

STATEMENT ADJUSTMENT

ACCRUAL ADJUSTMENTS TO REVENUE

INVENTORY CHANGE (crops, feed and livestock)

ACCOUNTS RECEIVABLE

ACCRUED INTEREST EARNED

FUTURES/OPTION ACCOUNT EQUITY

ACCRUAL ADJUSTMENTS TO EXPENSES

UNUSED ASSETS

• PREPAID EXPENSES

• SUPPLIES

• INVESTMENTS IN GROWING CROPS

UNPAID ITEMS

• ACCOUNTS PAYABLE

• ACCRUED PROPERTY TAXES AND WITHHOLDING

ACCRUED INTEREST

ACCRUED TAXS

• INCOME AND SOCIAL SECURITY

• DEFERRED TAXES ON CURRENT ASSETS

THE RELATIONSHIP OF THE

INCOME STATEMENT TO THE

BALANCE SHEET

NET FARM INCOME

LESS

FAMILY LIVING EXPENSES, INCOME AND

SOCIAL SECURITY TAXES AND OTHER

WITHDRAWALS

EQUALS

CHANGE IN COST BASIS EQUITY

ADJUSTMENTS FOR CHANGES IN MARKET

VALUATIONS

EQUALS

CHANGE IN MARKET BASIS EQUITY