Understanding financial statements

advertisement

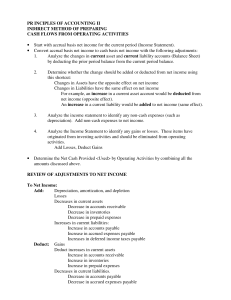

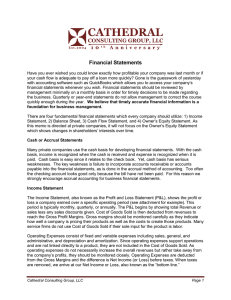

UNDERSTANDING FINANCIAL STATEMENTS BASIC OBJECTIVES • Accounting Basics • Types of Financial Statements • What do all these numbers mean? ASSETS = LIABILITIES + EQUITY Assets – Things that a company owns that have value. (Cash, inventory, plants, equipment, investments, trademarks) Liabilities – Amounts of money that a company owes to others. (Accounts payable, loans, payroll owed to employees, taxes owed) Equity – Money left if a company sold all assets & paid all liabilities (Net worth, capital) CURRENT OR LONG TERM Assets Can it be converted to cash in less than 1 year? Liabilities Is it expected to be paid in less than a year? GENERALLY ACCEPTED ACCOUNTING PRINCIPLES • Common set of standards used to compile financial statements • Creates at least a minimum of consistency • Must be used to report financial statements to the public • Requires assets to be valued at their purchase price, not at their market value • Requires use of accrual accounting method ACCRUAL VS. CASH METHODS Cash method • Recognizes revenues when cash is received & expenses when they are paid • Does not recognize accounts receivable or accounts payable • Simple to maintain • Bank account shows the exact amount of resources available • Income is not taxed until it’s in the bank ACCRUAL VS. CASH METHODS Accrual method • Revenues and expenses are recorded when they earned • Most commonly used method • Gives a more realistic idea of income & expenses during a period of time • Doesn’t provide awareness of cash flow TYPES OF FINANCIAL STATEMENTS • Balance Sheet • Income Statement • Cash Flows Statement BALANCE SHEET Gives a detailed snapshot of the financial health of a company on a specific date • Assets • Listed on the left-side or at the top • Listed in order of liquidity • Liabilities • Listed on the right-side or after the assets • Listed in order of due date • Equity • Listed after the liabilities • Totals of left and right sides must balance INCOME STATEMENT Shows revenue and expenses over a period of time • Revenues or sales are shown at the top • Total amount of money brought in • Costs of Sales • Amount spent to produce the goods or services • Total of Revenue minus Cost of Sales is called Gross Profit • Operating Costs are deducted from Gross Profit • Includes costs to support operations • Includes administration, marketing, research • Income Tax is deducted from Operating Profit • Net profit is what’s left after all deductions CASH FLOWS STATEMENT Reports the inflows and outflows of cash for a period of time • Will show whether the company generated cash • Reorders information from the balance sheet & income statement • Operating activities • Reconciles net income to the actual cash received or used • Adjust for non-cash items, receivables, and liabilities • Investing Activities • Financing Activities • Bottom line reflects net change in cash for the period • A cash flow forecast will show whether cash balances are sufficient OTHER THINGS TO CONSIDER • Comparisons to historical statements can be very helpful • The creation of financial statements is an art not a science • Financial Statements alone don’t tell you everything about the condition of a company • There are many industry ratios and calculations that will help to evaluate financial strengths and weaknesses • Some companies are required to have their financial statements audited • Footnotes provide lot of other information • Included opinions, analysis, and other disclosures