Essentials of Accounting for Governmental

and Not-for-Profit Organizations

Chapter 4: Accounting for the

General and Special Revenue

Funds

McGraw-Hill/Irwin

©2007, The McGraw-Hill Companies, All Rights Reserved

4-2

Overview of Chapter 4

•

•

•

•

Accounting for Nonexchange Transactions

Modified Accrual Basis

Common Entries during the year

The closing process

4-3

Exchange vs Nonexchange

Transactions

GASB Statement No. 33 indicates the timing

will be different for

– Exchange and exchange-like transactions

• These are like true sales — you pay a certain

amount and receive equivalent value in return

– nonexchange transactions

• For taxes and certain other transactions you pay

more or less than the value of services received

4-4

Exchange Transactions

• Revenue resulting

from exchange

transactions is

recognized in the

period(s) that it is

earned

• For example, revenue

from the rental of

government property

would be recognized

over the term of the

lease

4-5

Types of Nonexchange Transactions

1. Imposed nonexchange revenues

property tax, special assessments, fines/forfeits

2. Derived tax revenues

sales, income, motor fuel taxes

3. Government mandated transactions

federal government requires lower level

expenditures

4. Voluntary nonexchange transactions

grants, donations

4-6

Imposed Nonexchange Revenue

• Taxes and other assessments that do not result

from an underlying transaction. Examples include

property taxes and special assessments imposed on

property owners. Also includes fines and forfeits

4-7

Imposed Nonexchange Revenue

Revenue Recognition

– Modified Accrual

(Fund Basis

Statements)

Record the receivable (and an allowance for

uncollectibles) when an enforceable claim exits.

Revenues should be recognized in the period for

which the taxes are levied (i.e. budgeted), but

are also subject to the 60 day rule. Revenues

expected to be collected > 60 days after yearend are deferred.

Revenue Recognition

– Accrual

(Government-wide

Statements)

Record the receivable (and allowance) when an

enforceable claim exits.

Revenues should be recognized in the period for

which the taxes are levied – not subject to the

60 day rule.

4-8

Derived Tax Revenues

• These are taxes assessed on exchange

transactions conducted by businesses or

citizens. Examples include sales, income,

and excise taxes.

4-9

Derived Tax Revenue

Revenue Recognition

– Modified Accrual

(Fund Basis

Statements)

Revenue Recognition

– Accrual

(Government-wide

Statements)

Record the receivable when the taxpayer’s

underlying transaction takes place.

Revenues should be recognized when available

and measurable. Revenues not expected to be

collected in time to settle current liabilities are

deferred (i.e. available and measurable criteria).

Record the receivable when the underlying

transaction takes place.

Revenues should be recognized when the

taxpayer’s underlying transaction takes place,

regardless of when it is to be collected.

4-10

Government Mandated

Nonexchange transactions

• Grants from higher levels of government

(federal or state) given to support a

program. Since the program is required, the

lower-level government has no choice but to

accept. For example, a state may require

schools to mainstream certain students and

provide funds to carry out this mandate.

4-11

Government-Mandated

Nonexchange Revenue

Revenue Recognition

– Modified Accrual

(Fund Basis

Statements)

Revenue Recognition

– Accrual

(Government-wide

Statements)

Record the receivable and the revenue when all

eligibility requirements have been met. Many of

these are reimbursement grants. In this case,

revenue is recognized only when qualified

expenditures have been incurred. Advance

receipts are deferred until expenditures are

incurred. Revenue recognition is subject to the

available and measurable criteria.

The recognition criteria for grants under accrual

accounting are generally the same as modified

accrual. However, recognition in the

government-wide statements does not require

revenues to be collected in time to settle current

liabilities (i.e. available and measurable criteria

do not apply).

4-12

Voluntary Nonexchange

Transactions

• Donations and grants given to support a

program. Since the program is not required,

the receiving government voluntarily agrees

to participate.

4-13

Voluntary Nonexchange Revenue

Revenue Recognition The recognition rules are the same as

– Modified Accrual

mandated grants.

(Fund Basis

Statements)

The recognition rules are the same as

Revenue Recognition mandated grants.

– Accrual

(Government-wide

Statements)

4-14

Review: Modified Accrual vs. Accrual

• Accrual

– Recognize revenues when earned

– Match expenses against the revenues

• Modified Accrual

– Recognize revenues when measurable and available (available

to pay this year’s bills— for example, property taxes received

within 60 days of year end)

– Recognize expenditures when the liability is incurred — no

attempt to match to revenues, match to period of occurrence

only

• Exception — recognize interest and principal payments as

expenditures when DUE

4-15

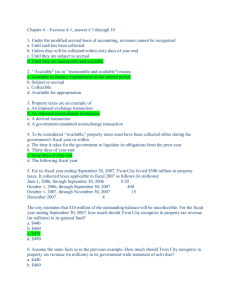

Modified Accrual Revenue Cycle

• Property tax for 2007 levied = $1,000,000;

$800,000 is collected in calendar year 2007

$120,000 is collected in January and February 2008

$80,000 in collected in March and April 2008

• ENTRIES DURING 2007:

– Record levy:

– 2007 collections

Taxes receivable

Revenue (tentative)

Cash

1,000,000

800,000

Taxes Receivable

– Year end adjustment: Revenue

80,000

Deferred Revenue

•

1,000,000

800,000

80,000

(Receipts of property taxes over 60 days after year end will be a 2008 revenue)

4-16

Modified Accrual Expenditure Cycle

Supplies are ordered at an estimated cost of $ 3,000

Supplies are received with an actual cost of $ 3,000 plus shipping of $ 250

Invoice from the supplies is paid

• Journal Entries

–

Place Order

Receive Goods

Encumbrances

3,000

Budgetary Fund Balance

Reserve for Encumbrances

3,000

Expenditures

Accounts Payable

3,250

Budgetary Fund Balance

Reserve for Encumbrances

Encumbrances

Payment

Accounts Payable

Cash

3,250

3,000

3,000

3,250

3,250

4-17

Quasi-External Transactions

• These are between funds but they are exchangelike transactions with an objective basis for

determining the amount

• Treated as revenue and expense or expenditure

• Example, sale of electricity by the Electricity Enterprise

fund to the General Fund

• Would be treated as revenue for Enterprise Fund and

expenditure for General Fund

• GASB 34 calls these “Interfund Services

Provided & Used” instead of quasi-external

4-18

Reimbursements

• Assume the UPS delivers a $10,000 shipment of supplies

which are initially recorded in the General Fund as follows:

GF: Expenditures

Accounts Payable

$10,000

$10,000

• Later, it is discovered that $2,000 of these supplies were for

the Electricity Enterprise fund, and the supplies are given

to the Electricity fund. The following would be recorded:

GF: Due from Electricity

Expenditures

EF: Expenditures

Due to General Fund

$2,000

$2,000

$2,000

$2000

4-19

Reimbursements Cont’d

• Reimbursements

do not show up

separately on the

Activity or Budget

statement, but are

internal balance

corrections

• When the reimbursement

is made, the expense or

expenditure is recorded

in the correct fund and

the incorrect expense or

expenditure is decreased

4-20

Transfers

• Any shifting of resources from one fund

to another where there is no expectation

that the amounts will be repaid.

• Transfers In are considered Other

Financing Sources

• Transfers Out are considered Other

Financing Uses

• Recurring Transfers such as for debt

service may be built into the budget

4-21

The Closing Process - Slide 1

• Background — the business closing

process

– Close revenues and expenses to income

summary, close income summary and

withdrawals to Retained Earnings or Capital

4-22

The Closing Process - Slide 2

• Closing process for government type funds

needs to accomplish the following:

– Close budgetary accounts

– Close Revenues, expenditures, encumbrances,

and related other financing sources or uses to

Fund Balance

– Reclassify the Budgetary Fund Balance –

Reserved for Encumbrances to Fund Balance –

Reserved for Encumbrances