Essentials of Accounting for

Governmental and

Not-for-Profit Organizations

Chapter 4

Accounting for the General and

Special Revenue Funds

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

Overview of Chapter 4

Accounting for Nonexchange Transactions

Modified Accrual Basis

Common Entries during the year

The closing process

4-2

Exchange vs Nonexchange

Transactions

GASB Statement No. 33 indicates the timing

will be different for

Exchange and exchange-like transactions

These are like commercial sales — you pay a

certain amount and receive equivalent value in

return

Nonexchange transactions

For taxes and certain other transactions you pay

more or less than the value of services received

4-3

Exchange Transactions

Revenue resulting

from exchange

transactions is

recognized in the

period(s) that it is

earned

For example, revenue

from the rental of

government property

would be recognized

over the term of the

lease

4-4

Types of Nonexchange Transactions

1.

Imposed nonexchange revenues

property tax, special assessments, fines/forfeits

2.

Derived tax revenues

sales, income, motor fuel taxes

3.

Government mandated transactions

federal government requires lower level

expenditures

4.

Voluntary nonexchange transactions

grants, donations

4-5

Imposed Nonexchange Revenue

Taxes and other assessments that do not result

from an underlying transaction.

Examples include property taxes and special assessments

imposed on property owners.

Also includes fines and forfeits.

4-6

Imposed Nonexchange Revenue

Modified Accrual

Basis Recognition

Record the receivable (and an allowance for

uncollectibles) when an enforceable claim exits.

Revenues should be recognized in the period for

which the taxes are levied (i.e. budgeted), but

are also subject to the 60 day rule. Revenues

expected to be collected > 60 days after yearend are deferred.

1. Property taxes levied

1. Taxes Receivable ………Dr

Estimated Uncollectible Taxes ….…..Cr

Revenues Control ……………….…Cr

2. Revenues Control ………Dr

Deferred Revenues – Property Taxes Cr

2. Deferral of portion

expected to be collected >

60 days after year end

4-7

Derived Tax Revenues

These are taxes assessed on exchange

transactions conducted by businesses or

citizens.

Examples include sales, income, and excise

taxes.

4-8

Derived Tax Revenue

Revenue Recognition –

Modified Accrual

Record the receivable when the taxpayer’s underlying

transaction takes place.

Revenues should be recognized when available and

measurable. Revenues not expected to be collected in

time to settle current liabilities are deferred (i.e.

available and measurable criteria).

1. Income tax withholdings 1. Cash …………………….Dr

Revenues Control ……………………Cr

are received.

2. Additional income taxes 2. Taxes Receivable ……….Dr

Revenues Control ……………………Cr

expected to be received

Deferred Revenues – Income Taxes ……Cr

after year end. Part of this

will not be received in time

to be avail-able for current

liabilities.

4-9

Government Mandated

Nonexchange Transactions

These are commonly grants from higher levels of

government (federal or state) given to support a

program.

Since the program is required, the lower-level government

has no choice but to accept.

For example, a state may require schools to mainstream

certain students and provide funds to carry out this mandate.

4-10

Voluntary Nonexchange

Transactions

These include donations and grants given

to support a program.

Since the program is not required, the receiving

government voluntarily agrees to participate.

4-11

Government-Mandated and Voluntary

Nonexchange Revenues

Revenue

Recognition –

Modified Accrual

Record the receivable and the revenue when all

eligibility requirements have been met.

Many of these are reimbursement grants. In this

case, revenue is recognized only when qualified

expenditures have been incurred.

Reimbursement type

grants

1. Expenditures Control …..Dr

Accounts Payable/Cash ……………..Cr

2. Due from grantor ……… Dr

Revenues Control ……………………Cr

4-12

Government-Mandated and Voluntary

Nonexchange Revenues

Revenue

Recognition –

Modified Accrual

Advance receipts are deferred until expenditures

are incurred. Revenue recognition is subject to

the available and measurable criteria.

Advance funded

grant:

1.

1. Receipt of advance

funding.

2. Incur qualified

expenditures and

recognize revenue.

Cash ……………………Dr

Deferred Revenues – Grants ………..Cr

2a. Expenditures Control …...Dr

Accounts Payable/Cash ……………..Cr

2b. Deferred Revenues –

Grants .. ……… Dr

Revenues Control ……………………Cr

4-13

Review: Modified Accrual vs. Accrual

Accrual

Recognize revenues when earned

Match expenses against the revenues as assets and services are used

up.

Modified Accrual

Recognize revenues when measurable and available

(available to pay this year’s bills— for example, property taxes received within 60 days of

year end)

Recognize expenditures when the liability is incurred — no attempt to

match to revenues, match to period of occurrence only

Exception — recognize interest and principal payments as expenditures

when DUE

4-14

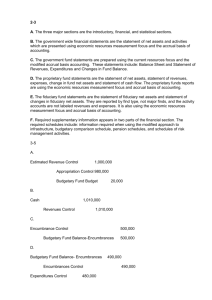

Modified Accrual Revenue Cycle

Assume

Property tax for 2009 levied = $1,000,000;

$800,000 is collected in calendar year 2009

$120,000 is collected in January and February 2010

$80,000 in collected in March and April 2010

ENTRIES DURING 2009:

Record levy:

Taxes receivable

1,000,000

Revenue (tentative)

2009 collections

Cash

1,000,000

800,000

Taxes Receivable

Year end adjustment: Revenue

80,000

Deferred Revenue

800,000

80,000

(Property taxes expected to be collected more than 60 days after year end will be a 2010 revenue)

4-15

Modified Accrual Expenditure Cycle

Supplies are ordered at an estimated cost of $ 3,000

Supplies are received with an actual cost of $ 3,000 plus shipping of $ 250

Invoice from the supplies is paid

Journal Entries

Place Order

Receive Goods

Payment

Encumbrances

3,000

Budgetary Fund Balance

Reserve for Encumbrances 3,000

Expenditures

3,250

Accounts Payable

3,250

Budgetary Fund Balance

Reserve for Encumbrances 3,000

Encumbrances

3,000

Accounts Payable

Cash

3,250

3,250

4-16

Quasi-External Transactions

These are between funds but they are exchangelike transactions with an objective basis for

determining the amount

They are treated as revenue and expense or expenditure

Example, sale of electricity by the Electricity Enterprise fund

to the General Fund

The sale would be treated as revenue for Enterprise Fund

and expenditure for General Fund

GASB 34 calls these “Interfund Services Provided &

Used” instead of quasi-external

4-17

Reimbursements

Reimbursements

do not show up

separately on the

Activity or Budget

statement, but are

internal balance

corrections

When the reimbursement is made, the

expense or expenditure

is recorded in the correct

fund and the incorrect

expense or expenditure

is reversed

4-18

Reimbursements

Assume the government receives a bill for

engineering services in the amount of $10,000; and it

is initially recorded in the General Fund as follows:

GF: Expenditures

Accounts Payable

$10,000

$10,000

Later, it is discovered that $2,000 of these services

were for the Electricity Enterprise fund. The following

would be recorded:

GF: Due from Electricity $2,000

Expenditures

EF: Expenditures

$2,000

Due to General Fund

$2,000

$2000

4-19

Transfers

Any shifting of resources from one fund to

another where there is no expectation that

the amounts will be repaid.

Transfers In are considered Other Financing

Sources

Transfers Out are considered Other Financing Uses

Recurring Transfers such as for debt service may be

built into the budget

4-20

The Closing Process

Closing process for government type

funds needs to accomplish the

following:

Close budgetary accounts

Close Revenues, expenditures,

encumbrances, and related other financing

sources or uses to Fund Balance

4-21