Cost of Capital

advertisement

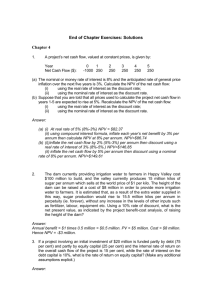

Long term decision making Corporate Strategic Decision 1. Growth decision Source: Ansoff Matrix (Igo Ansoff) Financial Feasibility • Evaluating the financial feasibility of such a decision will ensure that share holders money are invested in a profitable investment opportunity. Investment Appraisal Methods Discounted Cash Flow Methods Net Present Value (NPV) Internal Rate of Return (IRR) Non-Discounted Cash Flow Methods Payback Method Accounting Rate of Return Discounted Cash Flow Methods NPV - the sum of discounted future cash flows less the initial cost IRR - the discount rate where NPV = 0 Net Present Value (NPV) NPV = C1 (1 + r)1 + C2 (1 + r)2 Discounted cash flows C1, C2, C3 = the project cash flows, r = discount rate (related to risk of the project) C0 = initial cost + C3 (1 + r)3 - C0 Initial Cost Investment Decisions The board of directors of Magoo plc. is considering investing in a new machine that is expected to have a three year life and will cost £80,000. The machine is used to produce a good that is expected to have the following cash flows over the three years of the machine’s life - Year 1 = £30,000; Year 2 = £50,000; Year 3 = £40,000. Cost of capital is 8% Should it purchase the machine? Fundamental Rule of Finance/Financial Economics A capital investment decision is only worthwhile if it adds value. Thus, invest only in projects with a positive net present value Projections • This is the most crucial part of the long term investment decision evaluation. Accurately forecast the cost and the revenue for given period will have significant impact to the decision. Student Activity You are the financial manager advising the board of Alpha plc. on potential investment projects and have the choice between two projects of the same risk classification whose cash flows are given below: Year Cash flow of Project X Cash flow of Project Y 0 -120,000 -80,000 1 20,000 40,000 2 60,000 40,000 3 100,000 30,000 Given that the firm expects to obtain a 10% return on projects of this level of risk, provide a recommendation to the board on the viability of the two projects INTERNAL RATE OF RETURN (IRR) • Also based on Discounted Cash Flow, but calculates the discount rate that will give a Net Present Value of zero. • This also represents the return that the project is giving on the original investment, expressed in DCF terms. • The simplest way is to use trial and error - trying different rates until the correct rate is found. But this is laborious. • There is a formula, using linear interpolation. • Projects should be accepted if their IRR is greater than the cost of capital or hurdle rate. IRR – Interpolation method NL H L IRR L NL NH o Where: o o o L is the lowest discount rate H is the higher discount rate NL is the NPV of the lower rate NH is the NPV of the higher rate NPV and IRR Gullane plc. are considering investing in a new machine that will cost £1 million. They estimate the machine will lead to an increase cash flow for the next three years of £500,000 in year 1, £600,000 in year 2, and £400,000 in year 3. Given that Gullane plc. determine that the risk-adjusted cost of capital is 10%, calculate the Net Present Value of the machine and recommend whether to ahead with the investment or not Calculate the Internal Rate of Return of the machine Internal Rate of Return Decision Rules If k > r reject. If the opportunity cost of capital (k) is greater than the internal rate of return (r) on a project then the investor is better served by not going ahead with the project and using the money to the best alternative use If k < r accept. Here, the project under consideration produces the same or higher yield than investment elsewhere for a similar risk level Payback • • • • Consider Cash flows and NOT Profits Evaluation based on period of recovery of the initial investment ie. Number of years it takes to cover the cost of investment Firms should look for early payback of capital invested Decision criteria • Compare target payback with actual payback • If actual payback period < target payback - Accept project • If actual payback period > target payback - Reject project 15 Discount factor • Cost of capital of firm • Minimum rate of return, the firm must earn on its investments • Hence also the Required rate of return • Also considered as Opportunity cost • The required rate of return must cover, the cost of all long term sources of funds • Computed as the Weighted average cost of capital 16 Cost of capital (COC) • Cost of capital is the company cost of long term source of finance which is generally used to capitalized the asset. • There are tow major sources of long term funds. • Equity and Debt capital Cost of equity The cost of equity is the return that stockholders require for their investment in a company. The traditional formula for cost of equity (KE) is the dividend capitalization model: If the project is equity funded appropriate cost of capital is Ke Compounding annual growth rate (CAGR) • The year-over-year growth rate of an variable over a specified period of time. The compound annual growth rate is calculated by taking the nth root of the total percentage growth rate, where n is the number of years in the period being considered. Cost of Equity • The most commonly accepted method for calculating cost of equity comes from the Nobel Prize-winning capital asset pricing model (CAPM): The cost of equity is expressed formulaically below: • Re = rf + (rm – rf) * β • Where: Re = the required rate of return on equity • rf = the risk free rate • rm – rf = the market risk premium • β = beta coefficient = unsystematic risk Cost of debt • This is the cost of borrowing , which is the interest cost. • Interest is tax shield Therefore cost of debt , Where, Kd= I(1-T) Costs and benefits of debt • Benefits of Debt – Tax Benefits – Adds discipline to management • Costs of Debt – Bankruptcy Costs – Loss of Future Flexibility 22 Risk vs. Cost of Capital Type of Funding Risk to the Provider Cost of funds Venture Capital Finance Extremely High Extremely High Ordinary Shares Very High Very High Preference Shares High High Unsecured Debentures Low Low Bank Loans / Secured Debentures Very Low Very Low Internal Funding Neutral Medium 23 Cost of Capital Type of Funding Cost of Capital Equity / VC Finance Expected Rate of Return by the future share holders to compensate risk Preference Shares Fixed dividends stated in the prospectus. Debentures Interest Rates stated in the prospectus Bank Loans Commercial interest rates set in the loan agreement Internal Funding Current Return on Investment (ROI) of the company Weighted Average Cost of Capital (WACC) If more than one tool is used to finance the project , then WACC ( Weighted Average Cost of Capital) is used to discount the project’s cash flow. 24 Weighted Average Cost Of Capital (WACC • Weighted average cost of capital (WACC) is a calculation of a firm's cost of capital in which each category of capital is proportionately weighted. All capital sources - common stock, preferred stock, bonds and any other long-term debt - are included in a WACC calculation. • All else equal, the WACC of a firm increases as the beta and rate of return on equity increases, as an increase in WACC notes a decrease in valuation and a higher risk. WACC • Where, WACC= KeVe + KdVd Ve+Vd Ke=Cost of equity Ve=Value of equity Vd=Value debt Kd=Cost of debt Target Capital Structure Re Cost of capital WACC Re Rd Rd 0 Target Capital Structure Debt-equity ratio, D/E Assumption of WACC • Capital structure should be reasonably constant. • The new investment should not carry a significant different risk profile from the existing one. • If the new investment is marginal to the business Opportunity cost of capital • Opportunity cost of capital is the expected rate of return offered in capital by equivalent risk asset. Effect of Inflation on Investment decisions Real & Nominal Interest Rates • Cost of borrowing the funds is the nominal interest rate or money interest rate (i). – It is also the funds supplier’s required rate of return. • Interest rate adjusted for the effects of inflation (Inf) is the real interest rate (r). 1+nominal interest rate 1 real interest rate = 1+inflation rate r (1 i ) (1 Inf ) 1 30 Example 1 Assume that inflation is expected to be 5% per annum and the prevailing market interest rate is 10% per annum. What is the real rate of interest? (1 0.1) (1 0.05) 0.0476 1 or 4.76% 31 Real vs. Nominal Cash flows Real Cash flow • accounts for all cash flow for the future at its present value. ie: assumes a zero inflationary position Nominal Cash flow • accounts for inflation, which affects the price of goods by altering the value of currency. Inflation Rule • • • • Be consistent in how you handle inflation!! Use nominal interest rates to discount nominal cash flows. Use real interest rates to discount real cash flows. You will get the same results, whether you use nominal or real figures http://www.fao.org/docrep/w4343e/w4343e07.htm#TopOfPage32 Inflation • Typically discount rate is the money cost of capital which includes the adjustment for inflation. • Cash flows are normally in real terms • Fundamental is inflated cash flows should be discounted by the money cost of capital. • Real and money cost of capital is embodied by Fishers formula. (1+nominal)=(1+Real)x(1+Inflation) Capital allowances • This is the standard tax allowances given for the depreciation of a fixed asset at standard rates given by the inland revenue. • It will save the substantial amount of tax and should be adjusted as a saving of the current tax liability. Risk adjusted discount rate • If the project is exposed to different risk profile corporate cost of capital may not be sufficient to discount the cash flow. • Risk adjusted discount rate is the applicable rate to discount the excess of risk. • Cap m is the base to determine the risk adjusted COC. • Even past experience may help to determine it. Capital Rationing • Selecting most viable projects when the funds are become a limiting factor. • Management's approach to allocating available funds among competing investment proposals; only the proposals that maximize the total net present value (NPV) of the investment are selected. • Therefore capital rationing is the method to allocate limited funds for the most competing projects in the company. Limiting factor • Limiting factor is the factor which limits the organization operation. • Limiting factor is also referred to as a “Constrain”. • It may be labour hours, material, machine hours or organization funds Hard capital rationing • This is where funds are become limited due to external limiting factors. Funds may be limited in the money market due to poor economic performance in the economy, thus funds are limited in the banks or cost of borrowing is relatively high. • Lack of collaterals either fixed or floating • Higher gearing level of the company is limited the access to the borrowings. Soft capital rationing • This is where funds are limited inside the organization. • It is become a budget constrain. • Business is running out of cash or not having sufficient retained profits to funds the new projects. Capital rationing with single period • This is where funds are limited in a single period where company has to select most viable investment opportunities among many. • There are two basic projects. • Divisible or indivisible projects • Divisible projects are undertaken in a percentage based on the availability of the funds. • Indivisible projects are not undertaken on a partly basis and it undertakes the full project Profitability Index(PI) • Profitability Index is the main method of undertaking projects when the funds are limited. • Profitability Index= NPV of the project Investment • PI indicates return per one Rupee investment • Higher PI projects are adding value to the business. Example • ABC Ltd has identified following projects for the implementation in 2015. But organization capacity of accepting those projects are limited by the funds constrain of USD 2,000,000. Project Investment NPV A USD 800,000.00 650,000.00 B USD 500,000.00 420,000.00 C USD 400,000.00 150,000.00 D USD 600,000.00 400,000.00 USD 2,300,000.00 1,620,000.00 Total All the projects are divisible. What is the best project mix which can maximize the value? Mutually exclusive projects. • A Project whose cash flows have no impact on the acceptance or rejection of other projects is termed as Independent Project. Thus, all such Projects which meet this criterion should be accepted. • Investment A Discount Rate NPV Investment B Discount Rate NPV 0 10 0 10 11.16 % $2,000 180 0 14.33 % $6,000 1,414 0 Continue • In mutually exclusive projects exist where the acceptance of one project exclude the acceptance of the other project. • Therefore, such projects cannot be undertaken simultaneously. Hence, while choosing among Mutually Exclusive Projects, more than one project may satisfy the Capital Budgeting criterion. • However, only one project can be accepted. Which project should be accepted depends on different factors like initial investment, time period required for completion, strategic importance of the project, etc. usually the project which adds more value to the business in the long run will be selected. Example Investment Cash flow Cash flow Cash flow Cash flow Project X 700,000 343,000 343,000 343,000 Project Y 1,200,000 552,000 552,000 552,000 Company cost of capital is 10%. Which project should the company accept? Net present value profile with crossover PPT 12-21 Net present value ($) Dis.rate B 7,000 0 Investment B 6000 2979 0 NPV A NPV B A Investment C 60 70 5 43.13 47.88 10 29.08 29.79 15 17.18 14.52 20 7.06 2.31 25 -1.63 -8.22 Investment C IRRC = 22.49% Investment B 10% IRRB = 21% Crossover point Discount rate (percent) B 25% C Net present value profile with crossover Cross-Over Rate is the discount rate where NPV profiles of two (or more) projects intersect, meaning that they are equal. When this occurs ranking projects will have different results depending on what discount rate is used. A rate below the Cross-Over Rate will produce one ranking, a rate above it will produce another ranking. Adjusting for risk • Risk is The chance that an investment's actual return will be different than expected. Risk includes the possibility of losing some or all of the original investment. • Risk may change the expected outcome of the project. • A modeling and risk assessment procedure could mitigate the risk of the planned outcome. • There are different risk modeling techniques are used to evaluate the risk of a long term investment opportunity. Risk assessment techniques in capital budgeting • Sensitivity analysis • Risk adjusted cost of capital • Decision tree Are widely used … Sensitivity analysis • It evaluates the sensitivity of the variables in the cash inflows and out flows to the planned NPV out come. Sensitivity of the sales volume Sensitivity of the cost Sensitivity of the cost of capital • An analysis can be made of all the factors to ascertain by how much each factor must change before the NPV reaches zero, the indifference point. Example • The initial outlay of a equipment is Rs.100,000.It is estimated that it will generate 10000 units per annum for next 4 years. Contribution per unit 6.00 and the fixed cost are expected to be Rs.26,000 PA. COC 5%. 1. Calculate the NPV 2. By how much can each factor change before the company becomes indifferent to the project?