Benefits/Total Rewards Plan

advertisement

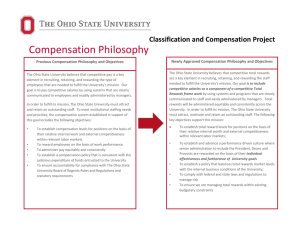

Running head: REWARDS PLAN 1 Benefits/Total Rewards Plan Erin Buell Concordia University Human Resources Management MPH 548 Hollie Pavlica November 28, 2014 REWARDS PLAN 2 Benefits/Total Rewards Plan Recruiting and retaining talent in the workforce is essential for successful operation of a company or organization. An employer can strategically consider a wide variety of tools that make the job appealing to applicants, as well as create value and increase motivation for the existing staff. Employees can be motivated by intrinsic or extrinsic rewards. Intrinsic reward may come from recognition from coworkers and management, a sense of personal gratification for the work produced, or a feeling of comradery among coworkers. Extrinsic rewards are more tangible and come from salaries and other compensation such as retirement and health care plans or stock options (Fried & Fottler, 2011, p. 184). The employer must carefully formulate a balance of both extrinsic and intrinsic rewards so that the employees are motivated, engaged and productive, and perceive their compensations to be equitable in terms of similar jobs both within and outside the organization, and in terms of individual output, effort and productivity. Employers must maintain the balance of financial responsibilities of the organization by being ever mindful of maintaining a stable bottom line. While extrinsic rewards of salaries and benefits can be costly, an employer who is too frugal with these benefits may risk losing valuable and talented personnel. A benefits and total rewards plan should be designed to attract and retain employees. The most basic of benefits are the wages paid. However, retirement plans, health insurance, vacation and sick pay, employee assistance plans, profit shares, and stock options are frequently offered within a benefits plan. Further rewards might include day care provisions, gym memberships, mileage reimbursements, bonuses, and training and educational opportunities. An employer is also responsible for legally required benefits, including Social Security, state and Federal unemployment insurance and workers’ compensation. An organization needs to first calculate a REWARDS PLAN 3 budget that allows for legally required and other employee compensation; from there, a benefits total reward plan can be strategically formulated. To assure success in designing a benefits package, a strong benefits planning team should be formed. This team should have an experienced project manager, and should include team members with expertise from inside the organization for true representation, as well as from outside the organization for objectivity. The team should include benefits specialists, financial experts, executive leadership including human resources management, and employee representation (Heneman & Coyne, 2007, p. 5). The formation of the total benefits plan will include budget allocation, development and determination of salary ranges, identification of employee performance goals and appraisal systems, understanding of legal implications and requirements, and an administrative strategy for maintaining and auditing the plan (Lotich, 2011). The percentage of an organization’s budget that goes to compensation will vary depending in part upon the industry. For example, retail industries as a whole spent 9% of revenues on annual employee compensation in 2007, and healthcare and social assistance spent 39% on payroll in the same year ("Economic census," 2012). The percentage of compensation that is allocated to benefits is also significant. The Bureau of Labor Statistics (BLS) in a 2014 report states that an average of nearly 70% of employee compensation goes to wages, with the remaining 30% applied to benefits within private industry; civilian and government workers have a slightly higher reward in benefits at 31% and 36% respectively ("Employer costs," 2014). To put this into perspective, according to this BLS report, an employee who earned $20 per hour cost the employer an average of an additional $8.57 for benefits that were applied to retirement and savings benefits, paid time off, and insurance benefits. The BLS report states that legally REWARDS PLAN 4 required benefits accounted for 8.1% of the benefits costs, or an average of $2.44 per employee ("Employer costs," 2014). An organization can use statistics and reporting tools such as this as a guideline for budgeting, while having the ability to create a unique and appropriate benefits plan that suits the specific needs and mission of the organization. Creating a Plan Consider a hypothetical healthcare organization called Choice Care Clinic (CCC). The clinic sits in a suburban area and competes for staff and patients with two other clinics nearby, and a larger hospital and clinic organization in a neighboring urban setting. CCC has a total operating expense budget of $6.75 million. Leaders could use the census information as a guideline and consider a starting payroll budget. Perhaps to play it safe, the organization establishes a payroll budget less than the census marker at 32%, or $2,160,000 annually. The benefits planning team will need to look at what staff is necessary for success, and research comparable wages and talent in the region. Assuming that CCC leaders did a comparable analysis of salaries in their region for the positions in their organization, Table 1 could represent a delineation of a budget framework from which to formulate a benefits plan. Table 1 Position General practitioner Registered nurse Administrative Staff Housekeeping, maintenance Social Worker Director, HR manager Clinic manager Total salary Number staff needed 6 Annual wage/salary 180,000 Total Annual Expense 6 50,000 300,000 3 30,000 90,000 2 25,000 50,000 1 1 1 1 60,000 150,000 90,000 70,000 60,000 310,000 1,080,000 1,890,000 REWARDS PLAN expense Benefits budget TOTAL COMPENSATION 5 270,000 2,160,000 CCC has a mission to promote whole health among patients, and utilizes the clinical staff and social workers in collaborative efforts of a check and balance system to connect patients to social services, clinical specialist services, and mental and emotional services to support patients as appropriate. They value the health, family values and quality of life for employees. They hold a philosophy that attention to recruitment and hiring plus specific efforts for staff retention through fair extrinsic rewards and meaningful intrinsic reward supports can increase employee motivation and performance, patient satisfaction, uphold industry standards, and achieve positive public reputation. While small in comparison, CCC utilizes models such as the software analytics and business intelligence corporation SAS to put employee satisfaction and commitment as a priority. In February 2014, SAS was reported for the eighth time to earn a place on the list of best places to work by the UK paper The Sunday Times ("SAS," 2014), as well as named by The Great Place to Work Institute as the world’s best multinational workplace (Crowley, n.d.). The model of employee engagement and supportive management practices is a guiding force for CCC, and will drive the choice of total benefits for the organization. CCC is choosing to go with market averages for health care and retirement benefits and place more resource allocation into unique perks and incentives, such as vacation pay allotments, day care allowance, employee assistance plans, bonuses, flex schedules and training opportunities. Using the BLS figures, 8.1% of the benefits budget will go toward legally required benefits. For CCC, this will be about $22,000 annually, which leaves $248,000 for other non- REWARDS PLAN 6 wage benefits. CCC has worked with an insurance company and a benefits specialist to procure a health insurance plan for all full time employees that is slightly higher than the BLS average of 7.8%. At 8%, or $21,600 per year, CCC can offer health insurance for employees, spouses and dependents at a better cost than competitive, similar health care employers. Employees will have a choice of health insurance plans within the program in order to customize for personal need and out of pocket expenses; in addition, pre-tax options for auto and home insurance are available. Dental insurance is also offered. Based on estimates from Savitz Employee Benefit Report, dental insurance premiums can be covered in full for employees and at 50% rate for family members, which carries an average amount of $900 per person annually; this is slightly over $10,000 annually ("Savitz," 2012, p. 16-17). Retirement benefits are offered and include both a defined benefit and a defined contribution program. Defined benefit considers employee years on the job and salary earned, while a defined contribution program will allow the employee to partake in profit sharing and tax deferred savings (Fried and Fottler, 2011). While the private industry average for combined defined benefit and contribution programs is listed as about 4% in the private industry, CCC offers a higher contribution at 6% ("Employer costs," 2014). This annual expense of $16,200 is viewed as part of a retention strategy for CCC. Additionally, paid leave, or vacation time, is provided for all staff beginning at one year of employment, starts with 2 weeks and maximizes at 3.5 weeks paid leave after 5 years. The estimated annual cost is 7% or $20,250. CCC offers daycare subsidies of up to $300 monthly, or $3600 per year per child under the established preschool age and based on the average regional cost of $900 per month. An estimated average of 5% of staff needing this provision at an average of 1.5 children brings the budgeted allotment to $8,100 per year. Employee assistance plans are available to offer wellness REWARDS PLAN 7 support for emotional well-being and counseling, addiction and recovery, weight loss, parenting, aging parent issues, childbirth and parenting education, financial emergencies, and legal advice. Each employee is eligible for a $600 reimbursement to a qualified program, adding up to $12,600. Education and training is essential for improving health care. Annual education allowances are offered for approved learning opportunities to physicians ($6,000 each), leadership and management ($3000 each), nurses ($2000 each), and the social worker ($2,000) for a total cost of $59,000. Compliance and standards for health codes and ethics require ongoing training; these expenses are wrapped into other operational expenses will be budgeted with general operating costs, so the clinical staff will be able to use the education benefit monies specifically to expand medical training. Physicians receive a $10,000 sign-on bonus. This $60,000 is spread out in the budget in a five year plan, or $12,000 per year. After two years of employment, full time physicians receive $2,500 bonus annually. Nurses, social worker, leadership and management receive an annual bonus of $1000 after 2 years of employment. All other staff can receive bonuses of $400 each in the same time frame. Annual expense of bonus pay is $27,400. Other benefits include discounted phone plans at $30 per employee per month ($7,560 annually), an employee holiday gala ($10,000), summer appreciation dinner ($8,000), scholarship fund for employees and dependents ($20,000), fitness center memberships ($10,000), bus/subway passes ($8,000), and miscellaneous ($7,290). Table 2 summarizes the total benefits outside of salary and wages. Table 2 Benefit Legally required Annual Cost 22,000 REWARDS PLAN Health insurance Dental Retirement Paid Leave Day Care EAP Education/Training MD sign on bonus Bonuses Other Misc. TOTAL 8 21,600 10,000 16,200 20,250 8,100 12,600 59,000 12,000 27,400 73,560 7,290 270,000 This benefits total reward plan provides some attractive options with the intent of recruiting and retaining qualified and loyal talent while staying in the overall budget of compensation. However, there are some areas of this budget that could be cut should the organization need to do so in tough economic times. Options for cutbacks should the budget be cut by twenty percent, or $54,000, might include: 50% cut from scholarship fund. This still leaves a generous offering that may not be utilized every year and can build (-$10,000). 75% cut from summer dinner. Summer venues, entertainment options and food can be less expensive (-$6,000). 25% cut from winter gala (-$2,500). 60% cut from sign on bonuses. This will not be a loss to existing staff; recruiting team can work with other external benefits as well as intrinsic rewards to attract. (-$7,200) With supporting budget analysis that confirms that all staff continuing medical education requirements for licensure and certifications will be funded, a 40% cut from education and training. This can be a cut for a period of time, with annual review to reinstate or expand as necessary and affordable; furthermore, staff can petition for funding for specific training opportunities (+/-$23,600). 30% cut from EAP. Continues to allow for many support services (-$3,780). 50% cut from miscellaneous (-$3,645) REWARDS PLAN This creates a total reduction in the budget of $56,725 and meets a 20% cost reduction plan should one become necessary. 9 REWARDS PLAN 10 References 2012 survey of employer-provided health benefits. (2012). Retrieved from http://www.savitz.com/docs/2012_SurveyReport.pdf Crowley, M. C. (n.d.). How SAS became the world’s best place to work. Fast Company. Retrieved from http://www.fastcompany.com/3004953/how-sas-became-worlds-bestplace-work Economic census summary (NAIS 2002 basis): 2002 and 2007. (2012). Retrieved from http://www.census.gov/compendia/statab/2012/tables/12s0756.pdf Employer costs for employee compensation news release text. (2014). Retrieved from http://www.bls.gov/news.release/ecec.nr0.htm Fried, B. J., & Fottler, M. D. (2011). Fundamentals of human resources in healthcare. Chicago, IL: Health Administration Press. Heneman, R. L., & Coyne, E. E. (2007). Implementing total rewards strategies. SHRM Foundation’s Effective Practice Guidelines Series. Retrieved from http://www.shrm.org/hrdisciplines/benefits/documents/07rewardsstratreport.pdf Lotich, P. (2011, April 26). Compensation strategy - 7 things to consider when developing a compensation strategy. The Thriving Small Business. Retrieved from http://thethrivingsmallbusiness.com/compensation-strategy-7-things-to-consider-whendeveloping-a-compensation-strategy/ SAS UK makes Sunday Times top 100 best companies to work for. (2014). Retrieved from http://www.sas.com/en_gb/news/press-releases/2014/february/uk-times-great-workplace2014.html