Analyzing Changes in Financial Position

advertisement

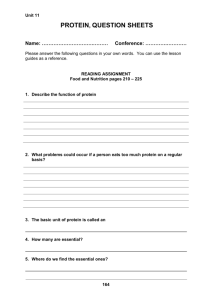

Analyzing Changes in Financial Position Bad news guys… • Balance sheets… Business Transactions • Anything that causes the financial position of the business to change is called a business transaction. • When Stephen goes to buy a bottle of coke and a bag of chips from the gas station, what happens? Business Transactions • If a company buys a car worth $25,000, what happens? • If we owe $8000 to the city for taxes, and we pay $1000 off tomorrow, what happens? • If we bring in a company to inspect the building and they recommend replacing the windows, changing the light bulbs, and getting new doors, is this a transaction? Source Documents • ANY time an asset, a liability, or equity item is recorded for accounting purposes, we need some sort of proof/evidence that we did not just make up the number. This is called a source document. • This is an original record of the transaction, and it gives the information needed for the accounting clerk to process properly. • Cell phone bills, internet bills, electricity bills, copies of cheques, store receipts, credit card slips, cash register summaries. • These all have to be filed. They may need to be looked at later by owners, managers, or auditors. Source Documents • What you need to know for now is the following: • 1. Accounting entries are made from business papers known as source documents. • 2. Source documents are kept on file for reference purposes and are proof of transactions. Ready for another Accounting Standard? • The Objectivity principle. • Basically, accounting needs to be recorded using clear, verifiable evidence. • If 15 different people look at the same evidence…they should all arrive at the same piece of evidence. • Transactions should be recorded on fact, not opinion. Objectivity Principle • Receipts from the source are the absolute best source of information. • There is no room for false interpretation. Let’s go over some things. • • • • • 1. What is a business transaction? 2. What are some examples of transactions? 3. Give an example of an event in a business that is not a transaction? 4. What is a source document? 5. What happens to source documents after the accounting entries have been completed? • 6. What is the objectivity principle? Equation Analysis Sheets • So…how do transactions impact balance sheets? • Let’s look at one from September 29th. Equation Analysis Sheets • We need a new way of recording changes to the balance sheet. • We will be using Equation Analysis Sheets. Equation Analysis Sheets Equation Analysis Sheets • What if Metropolitan Movers makes a payment on its loan? Equation Analysis Sheets • What if one of the Accounts Receivable pays some of their debts to Metropolitan Movers? Equation Analysis Sheets • What if Metropolitan Movers purchases $1950 worth of equipment? Equation Analysis Sheets • Metro Movers buys a truck for $18,000. They pay $10,000 of it in cash, and get an $8000 loan for the rest. Equation Analysis Sheets • Metro Movers performs a service for B. Cava worth $1500. They send a bill to him saying he owes that much. Equation Analysis Sheets • Two ways to look at the increase in capital. • 1. Metro Movers is a service business. When they do the move for B. Cava, he legally owes $1500. This is a gain for Metro Movers. Therefore, the Owner’s Equity (capital) is increased (J. Hofner). • 2. The owner gets to claim whatever is left after liabilities are paid. Assets went up, liabilities did not, so the Owner’s capital goes up. Homework: