Lesson 5

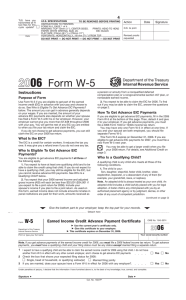

advertisement

Lesson 5 Earned Income Credit (EIC) Objectives • Determine which taxpayers are eligible for the earned income credit using Publication 4012 and Form 13614 • Determine when a taxpayer has a qualifying child for the EIC • Calculate and report the credit using the EIC worksheet • Explain how to request advance earned income credit (AEIC) payments • Report AEIC payments on the tax return Intake/Interview Process Form 13614 – Intake and Interview Sheet – Credits Section Military Combat Pay Inclusion of combat pay as earned income Who Can Claim The EIC General Eligibility Rules • • • • • • Earned income and adjusted gross income limited Have valid SSN No MFS filing status A US citizen or resident alien Not file Form 2555 or 2555-EZ Investment income limitation Who Can Claim The EIC General Requirements - continued • • Have earned income Cannot be qualifying child of another person Investment Income Includes: – Taxable interest – Tax-exempt interest – Ordinary dividends – Capital gain net income – Certain net income form rents and royalties – Net income from passive activities Earned Income • Review notes – While an inmate – While an household employee – Disability benefits – Disability insurance payments • Examples of Earned Income EIC Interview Tips EIC General Eligibility Rules Who Can Claim The Credit With A Qualifying Children Must meet all 3 tests – Relationship Test – Age Test – Residency Test Definitions • • • • Eligible foster child Adopted child Permanently and totally disabled Child who was kidnapped Qualifying Child of More than One Taxpayer • Cannot be used by more than one person • EIC Tie-Breaker Rule Children of Divorced or Separated Parents • If the rules for Divorced or Separated Parents apply: – The custodial parent can claim the EIC benefit even if he or she cannot claim the child as a dependent Interview Tips EIC With A Qualifying Child Who Can Claim the EIC Without a Child • Lived in the United States more than half the tax year. • At least 25 but under age 65 on Dec. 31. • Not qualify as the dependent of another person. EIC Eligibility Requirements Summary • Rules for Everyone • Rules If You Have a Qualifying Child • Rules If You Do Not Have a Qualifying Child • Earned Income and AGI Limitations Determining Eligibility and Figuring the Credit • EIC Worksheets • EIC Tables Schedule EIC for Qualifying Child(ren) Reporting Qualifying Child Information EIC – General Information • EIC – Eligibility Tools • Common EIC Return Errors • Disallowed Earned Income Credit • Advance Earned Income Credit Payments (AEIC) Quality Review (QR) Form 8158 – Quality Review Checklist Adjustments, Deductions, and Credits Section Lesson Summary • General EIC Requirements & Eligibility Rules • Schedule EIC • Common EIC Return Errors • Disallowed EIC • Advance EIC Payments