ACT500: Managerial Accounting

advertisement

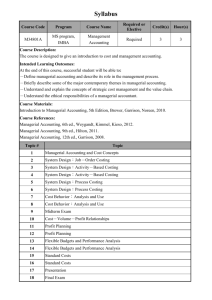

ACT500: Managerial Accounting Credit Hours: 3 Contact Hours: This is a 3-credit course, offered in a 14 week format. The exact number of hours per week that you can expect to spend on each course will vary based upon the weekly coursework, as well as your study style and preferences. You should plan to spend 10-12 hours per week in each course reading material, interacting on the discussion boards, writing papers, completing projects, and doing research. Faculty Information Name: Phone: CSU-GC Email: Virtual Office Hours: Course Description and Outcomes In ACT500, Managerial Accounting, students will learn how to use accounting concepts from a management perspective to make sound financial decisions that will enhance the strategic planning process of an organization. Analytical tools will become familiar to the student that can be applied to real-world situations in order to drive sales, reduce costs, and maximize profit. Students will become familiar with different types of analyses, ratios, costing, and budgeting. The course highlights what effective managers need in building a strong financial foundation so they can make decisions that will positively affect current and future operations of a business. The course will bring the basic framework of Generally Accepted Accounting Principles (GAAP) into one integrated process that will allow the student to understand why and how these principles are practiced today in both public and privately held entities. All of the major financial statements will be studied with students learning how they relate to one another and how collectively they can be used as management tools in decision making and driving profits. The course reviews and builds upon a student’s knowledge of basic math, basic accounting, spreadsheet, and word processing programs. Although accounting theory is learned, one important element of the course is learning the practical application of those theories. Course Learning Outcomes: 1. Describe the qualitative characteristics of accounting information and the supporting framework. 2. Prepare and analyze financial statements using vertical and horizontal analysis, liquidity, and profitability ratios. 3. Identify cost classifications, cost allocation, cost objects, cost pools, and cost drivers. 4. Identify cost behaviors, perform cost-volume-profit analysis and sales mix decisions. 5. Compare costing systems. 6. Prepare a master budget. 7. Evaluate cost centers, profit centers and investment centers and understand how a balanced scorecard aligns performance with organizational goals. 8. Perform incremental analysis for outsourcing, segment profitability. 9. Perform capital investment evaluations including different capital budgeting techniques including net present value and internal rate of return. Participation & Attendance Prompt and consistent attendance in your online courses is essential for your success. For some reason you would like to drop a course, please contact Saudi Electronic University. Online classes have deadlines, assignments, and participation requirements just like on-campus classes. Budget your time carefully and keep an open line of communication with your instructor. If you are having technical problems, problems with your assignments, or other problems that are impeding your progress, let your instructor know as soon as possible. Any assignment not completed within 7 days of the due date will not be graded and a score of zero (0) will be assigned. Course Materials Required: Crosson, S. V., & Needles, B. E., Jr. (2010). Managerial accounting (9th ed.). Boston, MA: Houghton-Mifflin Company. ISBN-13: 9780538742801 Course Schedule Due Dates The Academic Week begins on Sunday and ends the following Saturday. All assignments are due by Saturday at midnight KSA time of the week assigned. Any assignment not completed within 7 days of the due date will not be graded and a score of zero (0) will be assigned. Discussion Activities: Application of knowledge is an important step in the learning experience and every course has key discussions wherein students can apply and analyze content as well as move toward synthesis. This course has Discussion Forums that provide learners an extended opportunity to interact with one another in an instructor-facilitated dialogue that focuses on key course themes. Students will apply and synthesize knowledge learned to case studies simulating real-world decisionmaking. Mastery Exercises: These exercises will assess learner knowledge in each topic area. Critical Thinking Application Assignments: each assignment will require students to apply their knowledge learned in the module to real-world scenarios. Week # 1 2 Assignments Readings Chapters 1 & 2 in Managerial Accounting Miller, P. B.W., & Bahnson, P. R. (2009, July 20). Implementing fair values: Overcoming ghosts and zombies. Accounting Today, 23(11), 18-19. Discussion Board (20 points) Chapter 3 in Managerial Accounting Discussion Board (20 points) Cooper, R. & Kaplan, R. S. (1991). Profit priorities from activity-based costing. Harvard Business Review, May-June, 130-135. Longbrake, W. A. (1973). Statistical cost analysis. Financial Management, 2, 48-55. Video series from Professor Crosson (available at http://dept.sfcollege.edu/business/susan.crosson/Fall%202007/YouTube. htm) Chapter 4 in Managerial Accounting Chapter 5 in Managerial Accounting 3 4 5 6 Chapter 6 in Managerial Accounting Discussion Board (20 points) Chapter 9 in Managerial Accounting Mastery Exercise (0 points) Critical Thinking (110 points) Chapter 8 in Managerial Accounting Review Chapter 8 in Managerial Accounting 9 10 Chapter 10 in Managerial Accounting Chapter 11 in Managerial Accounting 11 12 Chapter 12 in Managerial Accounting Chapter 13 in Managerial Accounting 13 14 Discussion Board (20 points) Mastery Exercise (0 points) Discussion Board (20 points) 7 8 Mastery Exercise (0 points) Critical Thinking (110 points) Chapter 14 in Managerial Accounting Discussion Board (25 points) Mastery Exercise (0 points) Discussion Board (25 points) Discussion Board (25 points) Mastery Exercise (0 points) Critical Thinking (110 points) Discussion Board (25 points) Mastery Exercise (0 points) Critical Thinking (120 points) Portfolio Assignment (350 points) Assignment Details This course includes the following assignments/projects: Week 3 Critical Thinking: Process Costing (110 points) Complete the questions following Process Costing: FIFO Costing Method P-7 from your textbook. Week 7 Critical Thinking: Breakeven Analysis (110 points) Prepare breakeven analysis and a C-V-P analysis planning future sales using the information below. Breakeven Analysis and Planning Future Sales Write Company has a maximum capacity of 200,000 units per year. Variable manufacturing costs are $12 per unit. Fixed overhead is $600,000 per year. Variable selling and administrative costs are $5 per unit, and fixed selling and administrative costs are $300,000 per year. The current sales price is $23 per unit. Required 1. What is the breakeven point in (a) sales units and (b) sales dollars? 2. How many units must Write Company sell to earn a profit of $240,000 per year? 3. A strike at one of the company's major suppliers has caused a shortage of materials, so the current year's production and sales are limited to 160,000 units. To partially offset the effect of the reduced sales on profit, management is planning to reduce fixed costs to $841,000. Variable cost per unit is the same as last year. The company has already sold 30,000 units at the regular selling price of $23 per unit. a. What amount of fixed costs was covered by the total contribution margin of the first 30,000 units sold? b. What contribution margin per unit will be needed on the remaining 130,000 units to cover the remaining fixed costs and to earn a profit of $210,000 this year? Week 9 Portfolio Project The Portfolio Project is based on concepts learned in this module. Though there is nothing to submit this week, you should begin the Portfolio Project during this module. Final Portfolio Project: Students will prepare a master budget for a manufacturing organization with given financial information. The project will include: Executive Summary Sales Budget Production Budget Direct Materials Budget Direct Labor Budget Overhead Budget Selling and Administrative Expense Budget Cost of Goods Manufactured Budget Budget and Income Statement Go to the Week 8 Assignments page to view the full Portfolio Project guidelines and case study details. Also, you may want to view the Portfolio Project Rubric to see how you will be evaluated. Week 11 Critical Thinking: Understanding Practical Business and Organizational Research (110 Points) Using the CSU-GC virtual library, locate two (2) research articles published within the last five (5) years. One article should deal with measuring performance and one article should relate to incremental analysis. Complete the Research Evaluation Tables and post completed tables (one for each scholarly article) to the Discussion Board for others to observe. Choose one of the two articles to write a one-to-two-page introduction to the article. Include the following sections and include no opinions, judgments, or beliefs about the study. Only present the facts. Topic – State the broad organizational or field of study topic and establish the overall context for the study. Problem or Opportunity – Describe the problem or opportunity that the researcher was trying to address. Purpose of the Study – Discuss the intent of the study and list any research questions or hypotheses that were used. Research Approach and Design – Describe the overall research approach and information that you find related to the research design. Research design might include such things as the setting (field, laboratory, etc), the type of data that was collected, the sample and sample selection, the way data was prepared, analyzed, or presented, for example. Audience – Identify the individual or groups that might be interested in the findings of the study. Summary – Present the main points that you have covered in your paper; introduce no new information or concepts. Your paper should meet the following requirements: Use academic writing style, clear and concise language, and well-developed paragraphs (minimum of three sentences required to develop a paragraph) Ensure graduate APA formatting standards Be 1-2 pages in length Portfolio Project Remember to work consistently on your final Portfolio Project. It is due by the end of Week 14. At this point you should have the sales forecast completed. How is your progress coming? If you have questions about the project, reach out to your instructor. Week 13 Critical Thinking: Sales Mix Decision (120 points) Click HERE for assignment details. Submit your Excel spreadsheet to the View/Complete link below. Week 14 Portfolio Assignment (350 points) Students are required to create comprehensive master budget for a fictitious company. For project details, see the Portfolio Project Description, which can be accessed from the Week 14 Assignments page. Course Policies Course Grading 20% Discussion Participation 45% Critical Thinking Activities 35% Final Portfolio Paper Any assignment not completed within 7 days of the due date will not be graded and a score of zero (0) will be assigned.