seminar in finance formulas final

advertisement

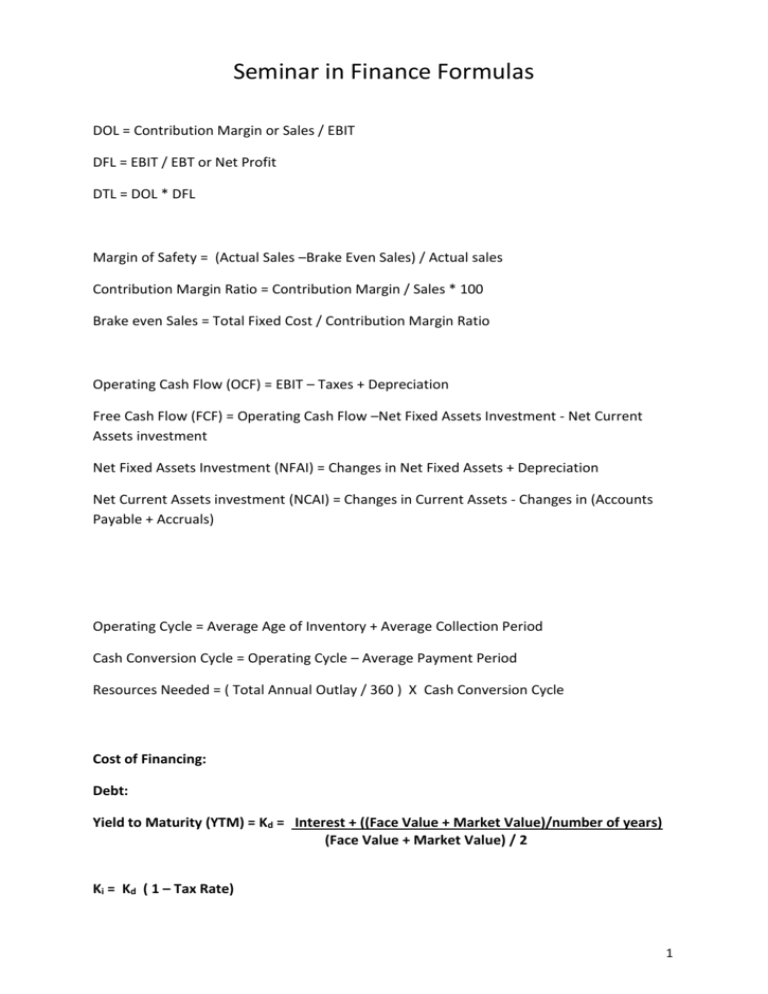

Seminar in Finance Formulas

DOL = Contribution Margin or Sales / EBIT

DFL = EBIT / EBT or Net Profit

DTL = DOL * DFL

Margin of Safety = (Actual Sales –Brake Even Sales) / Actual sales

Contribution Margin Ratio = Contribution Margin / Sales * 100

Brake even Sales = Total Fixed Cost / Contribution Margin Ratio

Operating Cash Flow (OCF) = EBIT – Taxes + Depreciation

Free Cash Flow (FCF) = Operating Cash Flow –Net Fixed Assets Investment - Net Current

Assets investment

Net Fixed Assets Investment (NFAI) = Changes in Net Fixed Assets + Depreciation

Net Current Assets investment (NCAI) = Changes in Current Assets - Changes in (Accounts

Payable + Accruals)

Operating Cycle = Average Age of Inventory + Average Collection Period

Cash Conversion Cycle = Operating Cycle – Average Payment Period

Resources Needed = ( Total Annual Outlay / 360 ) X Cash Conversion Cycle

Cost of Financing:

Debt:

Yield to Maturity (YTM) = Kd = Interest + ((Face Value + Market Value)/number of years)

(Face Value + Market Value) / 2

Ki = Kd ( 1 – Tax Rate)

1

Preferred Stock:

K p = Dp / Np

Or

Kp = D1 / P0

Np = Net Proceeds From Sale of P/S

Common Stock Value:

Zero Growth:

Kp = D1 / P0

Constant Growth:

Ks = (D1 / P0 ) + G

G = Growth Rate

Variable Growth:

N

D

V0 ( Dt PVIF (k s , t per )) N 1 PVIF (k s , N per )

t 1

ks g 2

OR

PO =

[ { DO x (1 + g1)t } / (1 + KS) ] + [ { 1 / ( 1 + KS)N } X { ( DN + 1 ) / (KS-g2) } ]

Breaking Point (BPj) = AFj / Wj

AFj = Amount of Funds Available (from financing source j)

Wj = Capital Structure Weights (for financing source j)

Weighted Average Cost of Capital (WACC) = K = ( Wj *Kj ) + ( Wp *Kp ) + ( Ws *Ks )

2

Capital Asset Pricing Model (CAPM) = K = RF + β ( MR – RF )

RF = Risk Free Rate (Where beta is 0)

MR = Market Rate

β = Beta

K = Required Return = Real Rate + Inflation Premium + Risk Premium

RF = Real Rate + Inflation Premium

Risk Premium = K - RF

Present Value of Single Amount:

PVIF = Pv = Fv / ( 1 + K )n

Net Present Value = Sum of Total Present Values – Initial Investment

Present Value of Annuity:

PVIFA = Pmt [1- (1 / (1 + K)n ) ] / K

Annualized Net Present Value (ANPV) = NPV / PVIFA(k,n)

Initial Investment = cost of new machine + Installation Cost – after tax proceeds of old

machine + Change in Net Working Capital

Incremental Cash Flows = Earnings Before Tax – Tax + Depreciation – Old Machine Cash Flows

Terminal Cash Flow = after tax proceeds from sale of new machine - after tax proceeds from

sale of old machine + change in Net Working Capital

Internal Rate of Return (IRR):

Average of Total Cash Flows = sum of total cash flows / number of years

Factor = Initial Investment / Average of Total Cash Flows

3

Ratios

Liquidity Ratios

Current ratio

Quick ratio

Cash ratio

current assets/current liability

current assets-inventory/current liability

cash+ marketable securities/current liability

Activity Ratios

Inventory turnover

CGS/inventory

Avg. collection period

accounts receivable/avg. sales per day

Avg. payment period

accounts payable/avg. purchases per day

Account receivable turnover Annual credit sales/average account receivable

Account payable turnover

Annual credit purchase or CGS/Average account payable

Total assets turnover

sales/total assets

Fixed asset turnover

Annual sales/total fixed Assets

Debt Ratios

Debt ratio

Time interest earned ratio

Fixed Payment coverage ratio

total liabilities/total assets

EBIT/I

EBIT / (EBIT - Interest - Lease Payment - Before tax Preferred Dividend)

Profitability Ratios

Gross profit margin

gross profit/sales

Operating profit margin operating profits/sales

Net profit margin

EACS/sales

Earning per share

EACS/ shares outstanding

ROI

Net Profit / Average Total Assets or EBIT / Average Operating Assets

Return on total assets

EACS/ total assets

Return on common equity

EACS/common stock equity

Market ratios

Price/earning ratio

Market/book value ratio

Book value per share of c/s

Market / liquidation ratio

Mkt price per share/ EPS

Mkt price per share/book value per share

common stock equity/no. of share outstanding

Mkt price per share / liquidation value per share

Notes

CGS

Avg. stock

Capital

Fixed assets

Debtor’s

Account rec. turnover

Account payable turnover

Creditors

Closing stock

sales - gross profit

CGS/stock turnover

sales/capital turnover

sales/ fixed assets turnover

sales/ Account receivable turnover

12 or 365/debt collection period

12 or 365/credit payment period

CGS (including excess closing stock balance)/account payable turnover

op. stock + avg. stock+ excess balance of closing stock/ 2

4