PPT2

advertisement

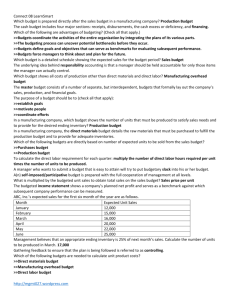

Budgetary Planning and Control Budgets The formal documents that quantify a company’s plans for achieving its goals. For many companies, the planning and control process is built around budgets. Use of Budgets in Planning Enhances communication and coordination Forces managers to consider: Goals Objectives Specify means of achieving them Use of Budgets in Control Provide a basis for evaluating performance by comparing the actual with the planned performance Deviations from planned performance have three potential causes: Plan or budget was poorly conceived Conditions have changed Managers have done a particularly good or poor job managing operations Developing the Budget Budgets are prepared for: Departments Divisions of a company For the entire company Developing the Budget Budget Committee Responsible for approval of various budgets Made up of senior managers (Presidents, CFO, controller, etc.) Typically works with departments to develop realistic plans Role of Budgets in Planning and Control Budget Time Period Management must first decide on a budget time period Long-run budgets (3-year, 5-year) Short-run budgets (month, quarter) Length of time period determines the amount of detail in a budget Five-Year Budgets Better Budgets Zero Base Budgeting Managers must start at zero in developing their budgets and justify budgeted amounts Provides validation for budgeted amounts Time consuming and expensive process Not widely used by business enterprises Master Budget Sales Budget First budget prepared since most budgets cannot be prepared without an estimate of sales A variety of methods are used to estimate sales: Economic models Sales trends Trade journals Sales force estimates Production Budget Quantity to be produced based on following formula: Example Exercise #1 VitaPup produces a vitamin-enhanced dog food that is sold in Kansas. The company expects sales to be 12,600 bags in January, 14,500 bags in February, and 19,000 bags in March. There are 1,260 bags on hand at the start of January. VitaPup desires to maintain monthly ending inventory equal to 10% of next month’s expected sales. Prepare the production budget for VitaPup for the months of January and February. Example Exercise #1 Solution Production Budget for January Expected Sales +Desired Ending Inventory - Beginning Inventory Total Production 12,600 1,450 (1,260) 12,790 Production Budget for February Expected Sales + Desired Ending Inventory - Beginning Inventory Total Production 14,500 1,900 (1,450) 14,950 Direct Material Purchase Budget Depends upon the amount needed for production and the amount needed for ending inventory The following formula can be used: Direct Labor Budget Direct labor can be calculated using the following formula: Number of units produced x Labor hours per unit x Rate per hour Once calculated, can be used to determine the approximate number of employees needed Manufacturing Overhead Budget Variable Costs Multiply variable cost per unit by quantity produced Fixed Costs Remain relatively constant Depreciation could fluctuate based on planned acquisitions Selling and Administrative Expense Budget Includes the following: Salaries Advertising Office Expenses Other General Expenses Budgeted Income Statement Compilation of information provided by previously prepared budgets Sales Budget Direct Materials Budget Direct Labor Budget Manufacturing Overhead Budget Selling and Administrative Expense Budget Capital Acquisitions Budget Acquisitions include: Property Plant Equipment Must be carefully planned due to the large amounts of cash that could be used Cash Receipts and Disbursements Budget Managers must plan for two items: Amount of Cash Flows Timing of Cash Flows Importance Differences between cash flows and income Anticipate cash shortages or surpluses Example Exercise #2 The Warrenburg Antique Mall budgeted credit sales in the first quarter of 2009 to be as follows: January $150,000 February $160,000 March $172,000 Credit sales in December of 2008 are expected to be $200,000. The company expects to collect 75% of a month’s sales in the month of sale and 25% in the following month. Estimate the cash receipts for January and February. Example Exercise #2 Solution January Estimated Cash Receipts December (200,000 x 25%) January (150,000 x 75%) Total $50,000 $112,500 $162,500 February Estimated Cash Receipts January (150,000 x 25%) February (160,000 x 75%) Total $37,500 $120,000 $157,500 Budgeted Balance Sheet Last budget prepared Sometimes referred to as the pro forma balance sheet Used to assess the effect of planned decisions on the future financial position of the firm Study Break #1 Which of the following statements regarding budgets is false? a. They are formal documents that quantify a company’s plans. b. They enhance communication and coordination. c. They are useful in planning but not in control. d. They provide a basis for evaluating performance. Answer: c. They are useful in planning but not in control Study Break #2 Which of the following items do not require a cash outflow? a. b. c. d. Salaries Purchase of raw materials Advertising Depreciation Answer: d. Depreciation Use of Computers in the Budget Planning Process Extremely useful in budgeting process Excel Spreadsheet Other specialized program Allows for company to determine effects of a decision on entire budget “What if” Analysis Budgetary Control Budgets as a Standard for Evaluation Actual amounts are compared with budgeted amounts Differences between actual and budgeted amounts are referred to as budget variances Budget variances should be investigated when they are material Budgetary Control Management must make sure the level of activity in the budget is equal to the actual level of activity Static Budget Not adjusted for the actual level of production Flexible Budget A set of budget relationships that can be adjusted for various production activity levels Spreadsheets Investigating Budget Variances Causes of Budget Variances Budget may not have been well conceived Conditions may have changed Managers may have performed particularly well or poorly Investigating Budget Variances Management by Exception Economical approach Only exceptional variances are investigated Must investigate both unfavorable and favorable exceptional variances “Unfavorable” Budget Variance Conflict in Planning and Control Uses of Budgets Budgets used for planning and control Focus of management on meeting or beating budgeted targets Compensation could be dependent upon this Creates an inherent conflict Common Budget-based Compensation Scheme Issues With Budget-based Compensation Managers have incentive to pad a budget Lower sales forecasts and increasing cost forecasts Makes budget targets easier to achieve creating budget slack Managers may have incentive to shift income from one period to another Study Break #3 Differences between budget and actual amounts are referred to as: a. b. c. d. An error A variance A flexible budget A static budget Answer: b. A variance Study Break #4 A ____ budget is not adjusted for the actual level of production. a. b. c. d. Static Flexible Pro forma None of the above Answer: a. Static Budget Padding