Slides

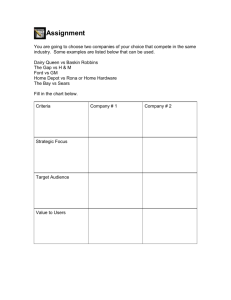

advertisement

Highlights: $66.1 billion in revenue for fiscal 2009 Inventory Turnover ratio of 4.20 Over $8.6 billion in LT Debt Inventory cycle repeats a little more than 4 times a year Looks very large, but HD does a great job of managing debt $867 million in net free cash flow Emphasizes both profitability and liquidity of firm Home Depot Lowe’s Quick Ratio (Acid Test) 0.23 .09 Debt to Equity 0.50 .27 Net Income $2.661 billion $1.783 billion COGS/PP&E 2.500 2.000 1.500 Home Depot Lowes 1.000 0.500 0.000 2006 2007 2008 2009 2010 Internal Programs “Trim the fat”: Close Home Depot Design and sell HD Supply Boost Employee Moral Success Sharing program, Homer Badges Program, Aprons on the floor program Revamp Supply Chain Multi-million dollar distribution centers External Programs Focus on better customer service Product Knowledge Recognition Program, Master Trade Specialist Program New marketing techniques New tagline “More Saving. More Doing” Holiday season marketing Curb Geographic Marketing Competing with online “How To” directions Google Competing with the housing slump Frank Blake “A downturn is a horrible thing to waste.” Home Depot Canada Early 1990’s partnership with Molson 1st Home Depot Market outside of U.S. Canada’s largest home-improvement retailer Home Depot South America Greenfield strategy bust Chile and Argentina targeted, but peso crisis forced HD to exit Only opened 50 stores before withdrawal Home Depot Mexico Return to acquisition strategy Bought out Total Home and Del-Norte 70% of homeowners in Mexico build own homes Stronger relations with U.S. aided successful growth Annual sales to exceed $50 billion Chinese economy growing at 20% annually Home ownership in cities equals 70% Will face already well established international retailer competition for the first time Tweak product sales to better serve Chinese consumer • SWOT analysis is a strategic planning tool used to evaluate strengths, weaknesses, opportunities, and threats involved in a business venture or company. • When analyzing The Home Depot’s SWOT, a great number of strengths were found with a slightly smaller list of weaknesses. There is also a great deal of opportunities for this company while threats are held to a minimum. Strengths Weaknesses Established brand Rapid growth name Corporate Structure Unique business Advertising model Rapid growth ability Extensive product line Opportunities Threats Market share High competition Going global Struggling economy The list of strengths The Home Depot holds is endless. Some of the top competitive factors that have enabled The Home Depot to make it to the top and remain there are: • • • • Established brand name Unique business model Rapid growth ability Extensive product line Other significant strong points of the company that are of value include: a superior corporate structure including bottom-up training, superb use of satellite communications and technology, differentiation based on service, decentralized management, and strategically placed, convenient store locations. Although The Home Depot has an astonishing list of strengths, the list is matched with a similar list of weaknesses. A few of the company’s strengths play dual roles serving as a hardship on the entity as well. A few of the significant weaknesses include: • Rapid growth • Corporate Structure • Advertising • MARKET SHARE: The market share for the home improvement industry is of a high magnitude. There is still an immense amount of market share out there to be soaked up with and utilized. Any successful company in this industry has the opportunity to gain this market share. • GOING GLOBAL: The Home Depot already has its foot in the markets of Canada and Mexico. While it has a foothold in number of markets around the world, there is always room to grow and new countries to open branches in. The company has more than enough manpower and means to expand to its desire. • COMPETITION: The Home Depot was able to penetrate a blue ocean in home improvement for a small period as it offered a new product of high value at fairly low prices. It didn’t take long, however, for others to realize it was a profitable market. It was soon infiltrated with a number of hardware, carpentry, and construction companies. • ECONOMY: One of the first areas of a person’s life that will be cut during hard times is luxuries and unnecessary expenses such as home improvements. This could potentially lead to a slow sales season for The Home Depot as unemployment rates are at an alltime high. Recession Affects 4Q 2009 Profit Sales increase 2.5% in 2010 2010=“Transitional Year” Cutting Costs New Ideas Lowe’s Menards Sutherlands Industry analysis to determine the competitive intensity and overall profitability Industry Sales 2007 2008 2009 2010 Home Depot 2.60% -2.12% -7.84% -7.17% Lowe’s 8.52% 2.89% -0.11% -2.09% Industry Average 5.56% 0.39% -3.97% -4.63% Negative Sales growth can suggest increased competition to gain market share Concentration The higher the concentration level, the fewer number of firms needed to get job done. Thus, there is less competition. Home Improvement Industry has high level of concentration. Market Share 70.00% 60.00% 50.00% 40.00% Home Depot 30.00% Lowes 20.00% 10.00% 0.00% 2006 2007 2008 2009 2010 Economies of Scale refer to a company’s ability to mass produce to drive down costs; the firm increases the scale of its operations By examining the total assets, we can see a firm’s ability to produce on a larger scale, which increases economies of scale. Total Assets (in millions) Company 2006 2007 2008 2009 2010 Home Depot 44,405 52,263 44,324 41,164 40,877 Lowe’s 24,639 27,767 30,869 32,625 33,005 Switching costs When switching costs are low, a consumer can easily go through a different company to get the same product. Because of the high competitiveness the home improvement retail industry is characterized by low switching costs and low differentiation of products. Exit Barriers: Exit barriers are high when it is hard to exit the industry The large amount of assets along with lease agreements allows for high exit barriers Economies of Scale If large scale economies are present, new firms can be forced to invest heavily to remain competitive In the retail home improvement industry, new firms must come in with a large amount of capital strength if they plan to sustain and be competitive with the Year Established larger corporations. Home Depot 1978 First Mover Advantage: Lowes 1934 Menards 1972 If the companies within an industry have already Sutherlands acquired an advantage in product innovation, new entrants may be deterred from entering the market. In the competitive home improvement industry, each company must keep up with the current market to meet customers’ wants and needs. 1917 A substitute product is any alternative a potential customer can find outside of the industry to satisfy their same need. Low: The only major substitute customers have to the home improvement industry is to buy professional builders and contractors. With the existence of several firms in the home improvement industry, buyers have a large amount of bargaining power. Conversely, customers of an industry that is dominated by a single firm have little to no bargaining power. Customers have a significant amount of bargaining power in the home improvement industry. This level of bargaining power drives prices down in the industry. the amount influence the suppliers to companies in the home improvement industry have. Companies are the customers the home improvement industry face low levels of bargaining power of suppliers. This is due mainly to the commodity-like products that suppliers sell. •Decentralized, •Allows lateral relationships for flexibility in each store •More costly, but allows for increased growth •Horizontal AND vertical linkages among management “orange blooded” company culture Guide behaviors for all employees Camaraderie and success among employees Full-time, salaried employees work best Core values stressed Entrepreneurial spirit encouraged With any success comes backlash The Home Depot and Wal-Mart faced similar criticisms for their methods of operation •Similarities: •Saturation Strategy •Low price policy •Anti-union policies •Forces mom-and pop-shops to close their doors Special Vision Your Total Value The Home Depot Foundation Keeping Employees Satisfied Meeting Individual and Family Needs Core Benefits Package Financial Benefits Affordable Housing Built Responsibly Sustainable Community Development Team Depot Corporate Social Responsibility “Going Green” The SER Program 9 Rules