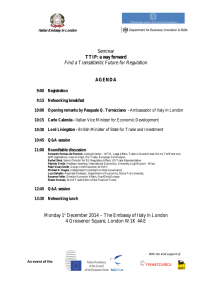

EUCOMED and Medical Technology Industry

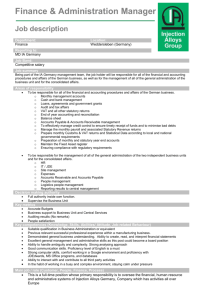

advertisement

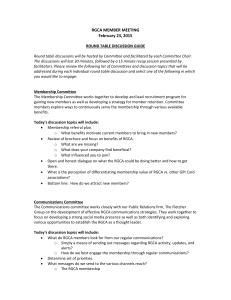

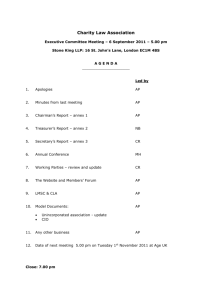

EUCOMED HEALTH GOVERNANCE , 19th April 2012 Dario Pirovano Consultant Regulatory Affairs - Eucomed A diverse sector 2 An exciting future Patch with Cells Drug device combinations Miniaturization Next generation imaging Implantable electronics Medical Devices Harvester /Collector Technology convergence and smart devices Mincer Molecular and cellular diagnostics Kidney Reconstruction New biomaterials (incl. biosurgicals) Contact lens with chip Cartilage Repair 3 Comparison with Pharmaceuticals Pharmaceuticals Industry with longer history Primarily large multinationals Medical Devices Relatively young industry 80% are small- and mediumsized companies 4 Comparison with Pharmaceuticals Pharmaceuticals Limited number of products Development by trial and selection on the basis of quality, safety and efficacy Therapeutic Based on pharmacology, chemistry, biotechnology, and genetic engineering Biologically active and effective when absorbed by the body Medical Devices More than 10,000 products (different sizes, models, etc.) Designed specifically to perform certain functions based on quality, safety and performance Diagnostic, therapeutic, monitoring Based on mechanical, electrical and/or materials engineering Generally act by physical means 5 Comparison with Pharmaceuticals Pharmaceuticals Continuous innovation and some improvements based on new science and technology Innovation primarily the result of laboratory work Extensive product lifetime and long investment recovery period “Breakthrough drugs” Medical Devices Continuous innovation and iterative improvements based on new science, technology and available materials Innovation primarily the result of insights from clinicians Short product lifetime and investment recovery period (~18 months) New devices bring added functions and clinical value based on incremental improvements 6 Comparison with Pharmaceuticals Pharmaceuticals Low distribution cost No service or maintenance Limited training required (compared to high-tech medical devices) Medical Devices High cost of distribution Training and education essential High cost of training and education Extensive service requirements 7 Comparison with Pharmaceuticals Pharmaceuticals Randomized control trials are ‘gold standard’ Efficacy and efficiency can be largely demonstrated prior to market Drugs either work or don’t work: efficacy and efficiency easy to demonstrate Medical Devices Randomized control trials not always scientifically informative or possible and hence not ‘gold standard’ Efficacy and efficiency can be only truly be demonstrated through actual use and uptake in the market Medical devices are part of whole system and their efficacy relies on the skills and experience of the physician, the quality of the hospital, and other factors 8 EU Regulatory Framework for Medical Devices Last update 10 April 2012 CLASSIFICATION OF MEDICAL DEVICES (MD): Manufacturer determines the CLASSIFICATION of his MD based on Annex IX of MDD and related guidelines (Meddev) PRE-market Class I (low risk) Class IIa (low/medium risk) Class IIb (medium/high risk) Class III (high risk) CONFORMITY ASSESSMENT PROCEDURE (ART. 11): ’Technical documentation’ (TD): to be created by the manufacturer. It demonstrates the safety and performance of the device by proving that all ‘Essential Requirements’ laid down in the MDD are met (Annex I) and includes a clinical evaluation (Annex X) and a risk assessment . All are based on clinical data. ‘Quality Assurance System’ (QAS): to be set up by the manufacturer. Ensures that each individual device fully meets the standards defined in the technical documentation. Achieved through clearly defined procedures for every step of the manufacturing process, from design phase to final inspection (Annex II or V). Notified Body (NB) audit: NB assesses the TD and the QAS through an on-site inspection of the manufacturing premises, which takes 2-5 days. NB issues a Conformity Assessment ‘Certificate’ (Annex II 3.3. or Annex V 3.3.) Pre-market approval for class III: Manufacturer submits TD as a ‘Design dossier’ to the NB. NB assesses it and issues a ’Design-examination Certificate’ (Annex II or III) Manufacturer’s self-assessment of his device 1 DECLARATION OF CONFORMITY AND CE MARKING: POST-market Manufacturer issues a declaration of conformity stating that each device is in compliance with the all applicable Directives and affixes the CE marking Manufacturer must keep TD and QAS updated and adapt according to all gained post-market experience . NB regularly audits both, typically once per year (Annex II, paragraph 3.1) POST- MARKET SURVEILLANCE (preventive): a) The manufacturer must have a post-market surveillance system in place, as an integrated part of the ‘quality assurance system’ and audited by a NB, in order to collect, review and assess all information gained on a device in the post-market phase (Annex II, paragraph 3.1) b) Competent Authorities are responsible to monitor all devices on the market , i.e. through audits, product samples, complaints (Article 2) a) Manufacturer is obliged to REPORT any incident related to his devices to the Competent Authority (Article10 and Annex II, paragraph 3.1) b) A Member State may decide to WITHDRAW, RESTRICT or PROHIBIT the marketing of the device (Safeguard Clause, Art. 8) VIGILANCE SYSTEM (in case of incidents): 1 For devices with measuring function or which are sold sterile there is an intervention from the Notified Body Revision could sort out weaknesses of current system? Lack of Transparency = Lack of trust in System Overly “confidential” system Different expertise/performance of Notified Bodies Perception that Authorities are divorced from the process, particularly for complex class III devices Transparency of overall system, in particular no visibility of what’s on the market Poor perception of system by those external to EU Challenges to Innovation = Threat to patients’ choice Public Health Authority understanding of new technologies Lack of Guidance including regulatory predictability and agreed clinical guidelines, in particular on innovative new technology Fragmented Market = Threat to legal market access Multiple national registrations and overly bureaucratic processes National ‘safeguard’ measures create multiple national requirements Multiple national approaches to vigilance, borderline and classification 10 6 steps to a smarter legal framework for medical devices: 2 1 One approach to vigilance and market surveillance Only the best Notified Bodies 4 3 5 Consistent implementation of guidelines Strengthened harmonized standards 6 Increased transparency An integrated approach: Better coordination and management October 2011: Eucomed favours JRC Coordinating Committee of Member States with Administrative Support from: Option 1 Oversight by Member States Option 2 Assistance of DG Research’s Joint Research Centre and/or DG SANCO’s Executive Agency for Health and Consumers Option 3 Option 4 Standalone Agency Directorate in EMA = Commission = Member States (Heads of Agency approach) = Agency 12 Expected timeline for the MDD revision EU Presidencies Commission: Public consultation / Impact Assessment 08/2008 DK, CY Commission: Legislative Proposal Q2/2012 08/2011 IE, LT Parliament and Council: First reading EL, IT LV, LU NL, SK June 2014 EP Elections 2014/15 Parliament and Council: Second reading (and Conciliation) National and local authorities: Implementation Commission and Court of Justice: Surveillance / enforcement 2017/18 Why a European Trade Association? The rules of the game are changing Increasingly, policy-makers are staying ahead of industry What to do to stay engaged? More frequent exchange of views and updates on key policy dossiers are vital Early warning on evolving crises Coordinate messages and timing on advocacy on key issues Eucomed Secretariat Organisational Chart Luciano Cattani Chief Executive Florence Poncin Senior Manager HR & Administration Sonja Kropidlowska All-round Assistant John Brennan Director Regulatory & Technical Affairs Merlin Rietschel Manager Regulatory & Technical Affairs Dario Pirovano Consultant Regulatory Affairs Andy Vaughan Consultant Environnement (Part-time) Thecla Sterk Regulatory Affairs Officer In Interim (as of January 2012) Rubie Santos Admin. Assistant Tanja Valentin Senior Manager Public Affairs Valentina Ancona Public Affairs Officer Yves Verboven Consultant EHTI VACANT Director Economic Affairs Ingmar de Gooijer Director Communications Cristian Manoiu Manager Economic Affairs – Data Analyst Petra Grigorovova Data Analyst Jelena Merkurjeva Data Analyst Christopher Breyel Manager Membership Services & Events Aline Lautenberg Senior Legal Counsel Kristina Smailyte Junior Legal Officer Laurence Couturier Communication & Events Officer Zuzana Fikarova Economic Affairs Officer Thomas Lindemans Senior Communications Officer Sophie Koettlitz Economic Affairs Officer – EHTI (Part-time) Brett Kobie Communications Officer 15 EUCOMED and Medical Technology Industry Eucomed represents the medical technology industry in Europe. Our mission is to make modern, innovative and reliable medical technology available to more people. Based in Brussels, Belgium 24 staff Members: 25 national industry associations 3 associate Members 58 direct corporate members Medical technology industry in the EU About 22,500 medical technology companies in EU 80% SMEs 95 billion EUR annual sales; 8% re-invested in EU Nearly 500,000 employees > 500,000 products (10,000 generic groups) One new European patent every 38 minutes* * OECD 2010; European Patent Office 2006 European MedTech Industry Source: World Bank, EDMA, Espicom and Eucomed calculations, 2009 Europe refers to EU-27 plus Norway and Switzerland 17 Global Healthcare Expenditure The total Global healthcare expenditure accounts for 5.7 trillion US$ in 2009* 18 Total Healthcare vs. Medical Device Expenditure, Europe Source: Espicom, World Bank, Eucomed calculations, 2009 *IVD are not included 19 Eucomed is active in the following spheres: Economic affairs; including market data collection, health economics, funding and reimbursement, health technology assessment and new trends (homecare) Regulatory affairs; including vertical legislation (such as medical devices directives and advanced products regulation), horizontal legislation (e.g. environmental) and standards Science and innovation; including medical nanotechnology and other emerging technologies, research and innovation projects International affairs; including global regulatory harmonization (GHTF), relations with the US, Japan, China and India Ethics; including enforcement of the Eucomed Code of Business Practice Public affairs; including outreach to and relations with the European institutions and the Member States Communications and external relations; including partnerships with patient groups and medical associations, events, publications and media relations. 20 Main sector groups at Eucomed are: 1. Ophthalmic surgery & vision care 2. Orthopaedic 3. Cardiovascular 4. E-health 5. Patient Safety Groups 6. Community Care 7. Surgical care 21 Ambition Be a center of competency for policymakers; Show and demonstrate that the medical technology industry offers innovative and cost-effective solutions to improve patient lives; Engage healthcare influencers across government, industry, patient advocacy, healthcare professionals to work toward consensus on health policy issues. Strategic Actions Short Term 1. Demonstrating the value proposition of the industry is critical • • • • Communications (Eucomed/NA) Public Affairs Machine (Eucomed/NA) Ethical Campaign (Eucomed/NA/ADV) Data generation 2. Address threats and opportunities to address value • Regulatory burden (MDD Revision) (Eucomed) • Reimbursement / Procurement / Late Payment (Eucomed/NA) • Shaping HTA Environment (Eucomed/NA) Alignment of actions Eucomed and NA Likely scenario to support all sectors Mid Term of validations and trends/scenarios by key internal groups (NA, sector…) 1. 2. 3. 4. Determine the optimum scenario Align future position of the industry Define action plan of Eucomed / NA Build value proposition thorough targeted stakeholders • Patients • HCP • Governments • Payers 5. Monitor e-Health Development React Influence Drive Programme and registration at www.medtechforum.eu Early bird rates: Save up to 20% by registering before 30 June! GRAZIE PER L’ATTENZIONE