Economics Principles and Applications - YSU

advertisement

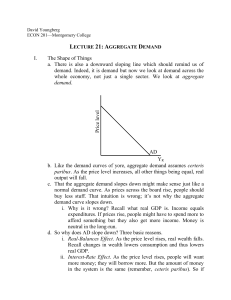

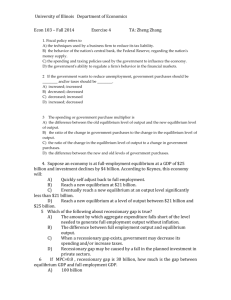

The Money Market and the Interest Rate 1 The Demand For Money • Demand for money does not mean how much money people would like to have. Rather, it means how much money people would like to hold, given constraints they face. 2 An Individual’s Demand for Money • At any given moment, total amount of wealth we have is given – Total wealth = Money + Other assets – If we want to hold more wealth in form of money, we must hold less wealth in other assets – So, an individual’s quantity of money demanded is the amount of wealth individual chooses to hold as money • Why do people want to hold some of their wealth in form of money? – Money is a means of payments – Other forms of wealth provide a financial return to their owners – Money pays either very little interest or none at all • When you hold money, you bear an opportunity cost – Interest you could have earned 3 An Individual’s Demand for Money • Individuals choose how to divide wealth between two assets – Money, which can be used as a means of payment but earns no interest – Bonds, which earn interest, but cannot be used as a means of payment • What determines how much money an individual will decide to hold? • Price level • Real income • Interest rate 4 The Money Demand Curve • Figure 1 - a money demand curve – Tells us total quantity of money demanded in economy at each interest rate – Curve is downward sloping – As long as other influences on money demand don’t change • A drop in interest rate—which lowers the opportunity cost of holding money—will increase quantity of money demanded 5 Figure 1: The Money Demand Curve 6 Shifts in the Money Demand Curve • What happens when something other than interest rate changes quantity of money demanded? – Curve shifts • A change in interest rate moves us along money demand curve 7 Figure 2: A Shift in the Money Supply Curve 8 Figure 3: Shifts and Movements Along the Money Demand Curve—A Summary 9 The Supply of Money • Money supply is determined by the Fed. And we assume that the quantity of money supplied is not related to interest rate. • So, interest rate can rise or fall, but money supply will remain constant unless and until Fed decides to change it • So, the relationship between interest rate and the quantity of money supplied can be described by a vertical line. 1 Change in Money Supply • Open market purchases of bonds – inject reserves into banking system – Shift money supply curve rightward by a multiple of reserve injection • Open market sales have the opposite effect – Withdraw reserves from system – Shift money supply curve leftward by a multiple of reserve withdrawal 11 Figure 4: The Supply of Money Interest Rate 6% 3% Ms1 Ms2 E J 500 700 Money ($ Billions) 1 Figure 5: Money Market Equilibrium 1 How money market reaches an equilibrium? • At a higher interest rate, supply of money is larger than demand of money • At a lower interest rate, demand of money is larger than supply of money 1 How the Fed Changes the Interest Rate • Fed officials cannot just declare that interest rate should be lower • Fed must change the equilibrium interest rate in the money market • Does this by changing money supply – The process works like this Fed can raise interest rate as well, through open market sales of bonds 1 Figure 6: An Increase in the Money Supply 1 How the Interest Rate Affects Spending • Lower interest rate stimulates business spending on plant and equipment • Interest rate changes also affect spending on new houses and apartments that are built by developers or individuals – Mortgage interest rates tend to rise and fall with other interest rates 1 How the Interest Rate Affects Spending • Interest rate affects consumption spending on big ticket items – Such as new cars, furniture, and dishwashers – Economists call these consumer durables because they usually last several years • Can summarize impact of money supply changes as follows – When Fed increases money supply, interest rate falls, and spending on three categories of goods increases • Plant and equipment • New housing • Consumer durables (especially automobiles) – When Fed decreases money supply, interest rate rises, and these categories of spending fall 1 Monetary Policy and the Economy – What happens when Fed conducts open market purchases of bonds – What happens when Fed conducts open market sales of bonds 1 Figure 7(a): Monetary Policy and the Economy 2 Figure 7(b): Monetary Policy and the Economy 2 An Increase in Government Purchases • What happens when government changes its fiscal policy – Say, by increasing government purchases • Increase in government purchases will set off multiplier process – Shifting the aggregate expenditure upward – Increasing GDP and income in each round • But ,also sets in motion forces that shift AE downward – As GDP rises, demand of money increases – As demand of money increases, interest rate rises – As interest rate becomes higher, consumption and investment spending decrease so that AE gets smaller 2 An Increase in Government Purchases • Interest rate is an automatic stabilizer • In short-run, increase in government purchases causes real GDP to rise – But not by as much as if interest rate had not increased – Aggregate expenditure line is higher, but by less than ΔG – Real GDP and real income are higher • But rise is less than [1/(1 – MPC)] x ΔG – Money demand curve has shifted rightward • Because real income is higher – Interest rate is higher • Because money demand has increased – Autonomous consumption and investment spending are lower • Because the interest rate is higher 2 An Increase in Government Purchases 2 Figure 8(a): Fiscal Policy and the Money Market 2 Figure 8(b): Fiscal Policy and the Money Market 2 Crowding Out Effect • When effects in money market are included in shortrun macro model – An increase in government purchases raises interest rate and crowds out some private investment spending – May also crowd out consumption spending • In the classical model, an increase in government purchases causes complete crowding out so that the fiscal policy has no effect on potential GDP • In short-run, however, conclusion is somewhat different – Crowding out is not complete – Investment spending falls, and consumption spending may fall, but together, they do not drop by as much as rise in government purchases – In short-run, real GDP rises 2 Other Spending Changes • Increases in G, IP, NX, and a, as well as decreases in taxes, all shift AE line upward – Real GDP rises, but so does interest rate – Rise in equilibrium GDP is smaller than if interest rate remained constant • Decreases in G, IP, NX, and a, as well as increases in taxes, all shift AE line downward – Real GDP falls, but so does interest rate – Decline in equilibrium GDP is smaller than if interest rate remained constant 2 Expectations and the Money Market • Important insight of money market analysis in this chapter – There is an inverse relationship between a bond’s price and interest rate it earns for its holder – Therefore, if people expect interest rate to fall, they must be expecting price of bonds to rise • A general expectation that interest rates will rise (bond prices will fall) in the future will cause money demand curve to shift rightward in the present • When public as a whole expects interest rate to rise (fall) in the future, they will drive up (down) interest rate in the present 2 Figure 9: Interest Rate Expectations 3