Economics Principles and Applications

advertisement

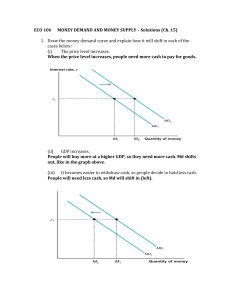

The Demand For Money Don’t people always want as much money as possible? Yes But when we speak about demand for something, we don’t mean amount people would desire if they could have all they wanted Without having to sacrifice anything for it Demand for money does not mean how much money people would like to have in best of all worlds Rather, it means how much money people would like to hold, given constraints they face 1 An Individual’s Demand for Money At any given moment, total amount of wealth we have is given If we want to hold more wealth in form of money, we must hold less wealth in other forms (which are those?) These two facts determine an individual’s wealth constraint An individual’s quantity of money demanded Amount of wealth individual chooses to hold as money Rather than as other assets Why do people want to hold some of their wealth in form of money? Money is a means of payments- other forms of wealth are not used for purchase But the other forms of wealth provide a financial return to their owners Money pays either very little interest (where?) or none at all When you hold money, you bear an opportunity cost 2 Interest you could have earned by holding other assets instead An Individual’s Demand for Money Individuals choose how to divide wealth between two assets Money, which can be used as a means of payment but earns no interest Bonds, which earn interest, but cannot be used as a means of payment What determines how much money an individual will decide to hold? While tastes vary from person to person, three key variables have rather predictable impacts on most of us Price level Real income Interest rate – opportunity cost of money? When we add up everybody’s behavior, we find a noticeable and stable tendency for people to hold less money when it is more expensive to hold money that is when the interest rate is higher 3 The Demand for Money by Businesses Some money is held by businesses Stores keep some currency in their cash registers Firms generally keep funds in business checking accounts They have only so much wealth, and they must decide how much of it to hold as money rather than other assets They want to hold more money when real income or price level is higher Less money when opportunity cost (interest rate) is higher 4 The Economy-Wide Demand For Money Just as each person and each firm in economy has only so much wealth There is a given amount of wealth in the economy as a whole at any given time Total wealth must be held in one of two forms Money or bonds Economy-wide quantity of money demanded Amount of total wealth all households and businesses, together, choose to hold as money rather than as bonds Demand for money depends on the same three variables that we discussed for individuals A rise in the price level will increase demand for money A rise in real income (real GDP) will increase demand for money A rise in interest rate will decrease demand for money 5 The Money Demand Curve Figure 1 shows a money demand curve Tells us total quantity of money demanded in economy at each interest rate Curve is downward sloping As long as other influences on money demand don’t change A drop in interest rate—which lowers the opportunity cost of holding money—will increase quantity of money demanded 6 Figure 1: The Money Demand Curve 7 Shifts in the Money Demand Curve What happens when something other than interest rate changes quantity of money demanded? Curve shifts A change in interest rate moves us along money demand curve 8 Figure 2: A Shift in the Money Supply Curve 9 Figure 3: Shifts and Movements Along the Money Demand Curve—A Summary 10 The Supply of Money Just as for money demand, we would like to draw a curve showing quantity of money supplied at each interest rate Interest rate can rise or fall, but money supply will remain constant unless and until Fed decides to change it Suppose Fed, for whatever reason, were to change money supply Would be a new vertical line Showing a different quantity of money supplied at each interest rate Open market purchases of bonds inject reserves into banking system Shift money supply curve rightward by a multiple of reserve injection Open market sales have the opposite effect Withdraw reserves from system Shift money supply curve leftward by a multiple of reserve withdrawal 11 Figure 4: The Supply of Money Interest Rate 6% 3% s M1 s M2 E J 500 700 Money ($ Billions) 12 Equilibrium in the Money Market Key Step #3 Combines what you’ve learned about money demand and money supply to find equilibrium interest rate in economy We are interested in how interest rate is determined in short-run In short-run we look for the equilibrium interest rate in money market Interest rate at which quantity of money demanded and quantity of money supplied are equal Important to understand what equilibrium in money market actually means Remember that money supply curve tells us quantity of money that actually exists in economy Determined by Fed 13 Equilibrium in the Money Market Money demand curve tells us how much money people want to hold at each interest rate Equilibrium in money market occurs when quantity of money people are actually holding (quantity supplied) is equal to quantity of money they want to hold (quantity demanded) Can we have faith that interest rate will reach its equilibrium value in money market? Yes 14 Figure 5: Money Market Equilibrium 15 How the Money Market Reaches Equilibrium If people want to hold less money than they are currently holding, then, by definition They must want to hold more in bonds than they are currently holding An excess demand for bonds When there is an excess supply of money in economy There is also an excess demand for bonds Can illustrate steps in our analysis so far as follows Conclude that, when interest rate is higher than its equilibrium value, price of bonds will rise 16 An Important Detour: Bond Prices and Interest Rates A bond, in the simplest terms, is a promise to pay back borrowed funds at a certain date or dates in the future When a large corporation or government wants to borrow money, it issues a new bond and sells it in the marketplace Amount borrowed is equal to price of bond The higher the price, the lower the interest rate General principle applies to virtually all types of bonds When price of bonds rises, interest rate falls When price of bonds falls, interest rate rises Relationship between bond prices and interest rates helps explain why government, press, and public are so concerned about the bond market Where bonds issued in previous periods are bought and sold 17 Back to the Money Market Complete sequence of events Can also do the same analysis from the other direction Would be an excess demand of money, and an excess supply of bonds In this case, the following would happen 18 What Happens When Things Change? Focus on two questions What causes equilibrium interest rate to change? What are consequences of a change in the interest rate? Fed can change interest rate as a matter of policy, or Interest rate can change on its own As a by-product of other events 19 How the Fed Changes the Interest Rate Changes in interest rate from day-to-day, or week-to-week, are often caused by Fed Fed officials cannot just declare that interest rate should be lower Fed must change the equilibrium interest rate in the money market Does this by changing money supply The process works like this Fed can raise interest rate as well, through open market sales of bonds Setting off the following sequence of events 20 How the Fed Changes the Interest Rate If Fed increases (decreases) money supply by buying (selling) government bonds, the interest rate falls (rises) By controlling money supply through purchases and sales of bonds, Fed can also control the interest rate What is the effect of this change in the economy? 21 Figure 6: An Increase in the Money Supply 22 How Do Interest Rate Changes Affect the Economy? If Fed increases money supply through open market purchases of bonds Interest rate will fall How is the macroeconomy affected? A drop in the interest rate will boost several different types of spending in the economy 23 How the Interest Rate Affects Spending Lower interest rate stimulates business spending on plant and equipment Remember that the interest rate is one of the key costs of any investment project A firm deciding whether to spend on plant and equipment compares benefits of project—increase in future income—with costs of project Interest rate changes also affect spending on new houses and apartments that are built by developers or individuals Loan agreement for housing is called a mortgage Mortgage interest rates tend to rise and fall with other interest rates 24 How the Interest Rate Affects Spending Interest rate affects consumption spending on big ticket items Such as new cars, furniture, and dishwashers Economists call these consumer durables because they usually last several years Can summarize impact of money supply changes as follows When Fed increases money supply, interest rate falls, and spending on three categories of goods increases Plant and equipment New housing Consumer durables (especially automobiles) When Fed decreases money supply, interest rate rises, and these categories of spending fall 25 Monetary Policy and the Economy Fed—through its control of money supply—has power to influence real GDP When Fed controls or manipulates money supply in order to achieve any macroeconomic goal it is engaging in monetary policy To find final equilibrium in economy, would need quite a bit of information about how sensitive spending is to drop in the interest rate As well as how changes in income feed back into money market to affect interest rate This is what happens when Fed conducts open market purchases of bonds Open market sales by Fed have exactly the opposite effects Equilibrium GDP would fall by a multiple of the initial decrease in spending 26 Figure 7(a): Monetary Policy and the Economy 27 Figure 7(b): Monetary Policy and the Economy 28 An Increase in Government Purchases What happens when government changes its fiscal policy Say, by increasing government purchases Increase in government purchases will set off multiplier process Increasing GDP and income in each round Increase in government purchases, which by itself shifts the aggregate expenditure line upward Also sets in motion forces that shift it downward 29 An Increase in Government Purchases At the same time as the increase in government purchases has a positive multiplier effect on GDP Decrease in a and I have negative multiplier effects In short-run, increase in government purchases causes real GDP to rise But not by as much as if interest rate had not increased Aggregate expenditure line is higher, but by less than ΔG Real GDP and real income are higher But rise is less than [1/(1 – MPC)] x ΔG Money demand curve has shifted rightward Because real income is higher Interest rate is higher Because money demand has increased Autonomous consumption and investment spending are lower Because the interest rate is higher 30 Figure 8(a): Fiscal Policy and the Money Market 31 Figure 8(b): Fiscal Policy and the Money Market 32 Crowding Out Once Again When effects in money market are included in shortrun macro model An increase in government purchases raises interest rate and crowds out some private investment spending May also crowd out consumption spending In classical, long-run model, an increase in government purchases also causes crowding out In short-run, however, conclusion is somewhat different While we expect some crowding out from an increase in government purchases, it is not complete Investment spending falls, and consumption spending may fall, but together, they do not drop by as much as rise in government purchases 33 In short-run, real GDP rises Other Spending Changes Positive shocks would shift aggregate expenditure line upward Increases in government purchases, investment, net exports, and autonomous consumption, as well as decreases in taxes, all shift aggregate expenditure line upward Real GDP rises, but so does interest rate Rise in equilibrium GDP is smaller than if interest rate remained constant Negative shocks shift aggregate expenditure line downward Decreases in government purchases, investment, net exports, and autonomous consumption, as well as increases in taxes, all shift aggregate expenditure line downward Real GDP falls, but so does interest rate Decline in equilibrium GDP is smaller than if interest rate remained constant 34 What About the Fed? In our analysis of spending shocks, we’ve made an implicit but important assumption Assumed Fed does not change money supply in response to shifts in aggregate expenditure line While this assumption has helped us focus on the impact of spending shocks It is not the way Fed has conducted policy during past few decades Has used monetary policy to prevent spending shocks from changing GDP at all 35 Are There Two Theories of the Interest Rate? In classical model, interest rate is determined in market for loanable funds In this chapter you learned that interest rate is determined in money market Which theory is correct? Both Why don’t we use classical loanable funds model to determine the interest rate in short-run? Where people make decisions about holding their wealth as money and bonds Because economy behaves differently in short-run than it does in long-run In long run, we view interest rate as determined in market for loanable funds Where household saving is lent to businesses and government Where wealth holders adjust their wealth between money and bonds, and Fed participates by controlling money supply 36 In short-run, we view interest rate as determined in the money market Expectations and the Money Market Important insight of money market analysis in this chapter Inverse relationship between a bond’s price and interest rate it earns for its holder Therefore, if people expect interest rate to fall, they must be expecting price of bonds to rise Will affect money market A general expectation that interest rates will rise (bond prices will fall) in the future Will cause money demand curve to shift rightward in the present When public as a whole expects interest rate to rise (fall) in the future, they will drive up (down) interest rate in the present 37 Figure 9: Interest Rate Expectations 38 Using the Theory: The Fed and the Recession of 2001 Our most recent recession officially lasted from March to November of 2001 Starting in January 2001—three months before the official start of the recession—Fed began to worry What did policy makers do to try to prevent the recession, and to deal with it once it started? Why did consumption spending behave abnormally, rising as income fell, and preventing recession from becoming a more serious downtown? Investment spending had already decreased for two quarters in a row Fed decided to take action Beginning in January, Fed began increasing M1 rapidly Federal funds rate is interest rate banks with excess reserves charge for lending reserves to other banks Federal funds rate fell continually and dramatically during the year, from 6.4% down to 1.75% 39 Using the Theory: The Fed and the Recession of 2001 While Fed’s policy was able to completely avoid the recession It no doubt saved economy from a more severe and longer-lasting one Fed’s policy also helps us understand the other question we raised about the 2001 recession Continued rise in consumption spending throughout the period Lower interest rates stimulate consumption spending on consumer durables Why wasn’t Fed able to prevent recession entirely? Couldn’t Fed have reduced interest rate even more rapidly? There are, in general, good reasons for Fed to be cautious in reducing interest rates By historical standards, decrease in 2001 was quite dramatic 40 Most economists—despite recession of 2001—give Fed Figure 10: The Fed in Action—2001 41