Money Demand, the Equilibrium Interest Rate, and Monetary Policy

advertisement

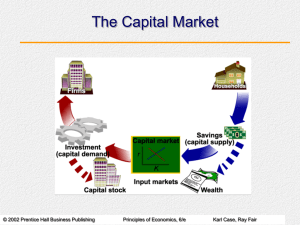

CHAPTER 11 Money Demand, the Equilibrium Interest Rate, and Monetary Policy Appendix A and Appendix B Prepared by: Fernando Quijano and Yvonn Quijano © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy Monetary Policy and Interest • Monetary policy is the behavior of the Federal Reserve concerning the money supply. • Interest is the fee that borrowers pay to lenders for the use of their funds. • Interest rate is the annual interest payment on a loan expressed as a percentage of the loan. interest received per year Interest rate x100 amount of the loan © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 2 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Demand for Money • The main concern in the study of the demand for money is: • How much of your financial assets you want to hold in the form of money, which does not earn interest, versus how much you want to hold in interestbearing securities, such as bonds. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 3 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Total Demand for Money • The total quantity of money demanded in the economy is the sum of the demand for checking account balances and cash by both households and firms. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 4 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Total Demand for Money • The quantity of money demanded at any moment depends on the opportunity cost of holding money, a cost determined by the interest rate. • A higher interest rate raises the opportunity cost of holding money and thus reduces the quantity of money demanded. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 5 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy Transactions Volume and the Price Level • The total demand for money in the economy depends on the total dollar volume of transactions made. • The total dollar volume of transactions, in turn, depends on the total number of transactions, and the average transaction amount. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 6 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy Transactions Volume and the Price Level © 2004 Prentice Hall Business Publishing • When output (income) rises, the total number of transactions rises, and the demand for money curve shifts to the right. Principles of Economics, 7/e Karl Case, Ray Fair 7 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy Transactions Volume and the Price Level • When the price level rises, the average dollar amount of each transaction rises; thus, the quantity of money needed to engage in transactions rises, and the demand for money curve shifts to the right. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 8 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Determinants of Money Demand: Review Determinants of Money Demand 1. The interest rate: r (negative effect) 2. The dollar volume of transactions (positive effect) a. Aggregate output (income): Y (positive effect) b. The price level: P (positive effect) • Money demand is a stock variable, measured at a given point in time. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 9 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Determinants of Money Demand: Review • Money demand answers the question: • How much money do firms and households desire to hold at a specific point in time, given the current interest rate, volume of economic activity, and price level? © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 10 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Equilibrium Interest Rate © 2004 Prentice Hall Business Publishing • The point at which the quantity of money demanded equals the quantity of money supplied determines the equilibrium interest rate in the economy. Principles of Economics, 7/e Karl Case, Ray Fair 11 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Equilibrium Interest Rate © 2004 Prentice Hall Business Publishing • At r1, the amount of money in circulation is higher than households and firms wish to hold. They will attempt to reduce their money holdings by buying bonds. Principles of Economics, 7/e Karl Case, Ray Fair 12 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy The Equilibrium Interest Rate © 2004 Prentice Hall Business Publishing • At r2, households don’t have enough money to facilitate ordinary transactions. They will shift assets out of bonds and into their checking accounts. Principles of Economics, 7/e Karl Case, Ray Fair 13 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy Changing the Money Supply to Affect the Interest Rate © 2004 Prentice Hall Business Publishing • An increase in the supply of money lowers the rate of interest. Principles of Economics, 7/e Karl Case, Ray Fair 14 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy Increases in Y and Shifts in the Money Demand Curve © 2004 Prentice Hall Business Publishing • An increase in aggregate output (income) shifts the money demand curve, which raises the equilibrium interest rate. • An increase in the price level has the same effect. Principles of Economics, 7/e Karl Case, Ray Fair 15 of 29 C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy Looking Ahead: The Federal Reserve and Monetary Policy • Tight monetary policy refers to Fed policies that contract the money supply in an effort to restrain the economy. • Easy monetary policy refers to Fed policies that expand the money supply in an effort to stimulate the economy. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 16 of 29