C H A P T E R 11

C H A P T E R 11

Managing Transaction

Exposure

Chapter Overview

A. Transaction Exposure

B. Hedging Exposure to Payables

C. Hedging Exposure to Receivables

D. Limitations of Hedging

E. Hedging Long-Term Transaction Exposure

F. Alternative Hedging Techniques

Chapter 11 Objectives

This chapter will:

A. Compare the commonly used techniques to hedge payables

B. Compare the commonly used techniques to hedge receivables

C. Explain how to hedge long-term transaction exposure

D. Suggest other methods of reducing exchange rate risk when hedging techniques are not available

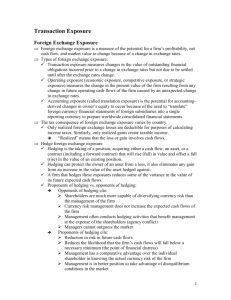

A. Transaction Exposure

1. Identifying Net Transaction

Exposure

2. Adjusting the Invoice Policy to

Manage a. Aligning Manager Compensation with Hedging Goals

B. Hedging Exposure to Payables

1. Hedging Techniques for Payables a. Futures b. Forward c. Money Market d. Currency option

B. Hedging Exposure to Payables

2. Forward or Futures Hedge contract specifies a. Fixed amount of currency b. Fixed exchange rate c. Fixed delivery date

3. Money Market Hedge involves taking a money market position to cover a future payables or receivables position.

a. Hedging with a Money Market Hedge versus a Forward

Hedge

B. Hedging Exposure to Payables

4. Currency Option Hedge a. Using Calls b. Cost of Using Calls to Hedge c. Cost of Hedging with Calls

Based on Currency Forecasts d. Consideration of Alternative

Call Options

Contingency Graph for Hedging Payables With Call Options

11.1

B. Hedging Exposure to Payables e. Selecting the Optimal Technique for

Hedging Payables: Steps to take a. since the futures and forward hedge are very similar, the MNC only needs to consider whichever one of these techniques it prefers. b. when comparing the forward (or futures) hedge to the money market hedge, the MNC can easily determine which hedge is more desirable

Graphic Comparison of Techniques to

Hedge Payables

11.4

B. Hedging Exposure to Payables

5. Optimal Hedge vs. No Hedge

6. Evaluating the Hedge Decision

C. Hedging Exposure to

Receivables

1. Forward or Futures Hedge

2. Money Market Hedge

3. Put Option Hedge a. Cost of Hedging with Put

Options b. Cost of Hedging with Puts

Based on Currency Forecasts c. Consideration of Alternative Put

Options

Contingency Graph for Hedging Receivable with Put Options

11.5

C. Hedging Exposure to

Receivables

4. Selecting the Optimal Technique for

Hedging Receivables

5. Optimal Hedge vs. No Hedge

6. Evaluating the Hedge Decision

7. Comparison of Hedging Techniques

8. Hedging Policies of MNCs a. Hedging Most of the Exposure b. Hedging None of the Exposure c. Selective Hedging

D. Limitations of Hedging

1. Limitations of Hedging an Uncertain

Amount

2. Limitation of Repeated Short-Term

Hedging

Illustration of Repeated

Hedging of Foreign

Payables When the

Foreign Currency is

Appreciating

11.10

11.11

Long Term Hedging of

Payables When the

Foreign Currency is

Appreciating

E. Hedging Long-Term Transaction

Exposure

1. Two Techniques: a. Long-term Forward Contract b. Parallel Loan

F. Alternative Hedging Techniques

1. Three Alternatives: a. Leading and Lagging b. Cross-Hedging c. Currency Diversification