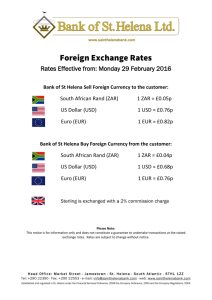

The South African Rand

advertisement

The South African Rand ZAR Recent Currency History • 1961 Introduction – Traded below 1ZAR/USD until 1982 – Political pressure and Apartheid – Reached over 13 in 2001 – Investigation brought it back around 6 • Common currency – – – – South Africa Namibia Swaziland Lesotho Technical Analysis • The Rand is quoted in European terms so the charts are inverted. • Exchange rate as of 4/27 6.1568 ZAR/USD • One week forecast 6.25 ZAR/USD • Even based on this forecast of 6.25 U.S. companies should hedge with one week forward – Only the hedge fund managers and traders should hold an open position One Year • 90 day average – Consistency bouncing between Bollinger bands – Carried momentum once crossing the moving average Three Month • Moving average seems to be an excellent predictor. – ZAR recently approached upper Bollinger Band – Rand also recently depreciated across the 30 day moving average 30 Days • The Rand crossed the moving average over the 25th and 26th • We forecast it continues this depreciation over the next 7 days • It should approach the low Bollinger band • Reaching projection of 6.25 ZAR/USD in the next 7 Days Implications • U.S. Company with a 7 day receivable in South African Rand (selling into S.A.) – For Transaction exposure lock in a forward • U.S. Company with a 7 day payable in ZAR (buying from S.A.) – Hold the position open-short in Rand • Hedge Fund Manager or Currency Speculator – Sell Rand short for 7 days – Hold dollars long compared to Rand for 7 days • Both U.S. based companies should hedge with forward contracts – Currency speculation is not their core business and holdong any open position might lose money Short Term 3 months into the Future: • Interest Rates South Africa/United States US Bonds 3 Month 4.61 4.62 4.57 4.52 (Yahoo Finance) Treasury bills-91 day (tender rates) 6.64 6.64 6.64 6.7 http://www.reservebank.co.za/ • South Africa has relatively higher short term interest rates than the United States. • They should experience increased short term capital inflows, thus demand for their currency increases. • Inflows of short term capital, resulting in demand increases, will strengthen the currency’s spot rate. Balance of Payments Imports in Rand Millions -8999 Exports in Rand Millions 7433 Balance of Payments Balance deficit: -1566 South Africa has a high trade and current account deficit and the country will need a lot of foreign capital to finance these deficits. • This will put downward pressure on the exchange rate of the Rand. CPI Findings • The 2005 CPI score relates to perceptions of the degree of corruption as seen by business peiople and country analysts and ranges between 10 (highly clean) and 0 (highly corrupt) • TI 2005 Corruption Perceptions Index • 2005 CPI score 4.5 • Confidence range 4.2 - 4.8 http://www.transparency.org/policy_research/surveys_indices/cpi/2005 • This score is neither highly corrupt nor highly clean so government intervention should not play a huge role in affecting the Rand. 3 month Analyses and Recommendation • Based on Interest Rate Parity a currency trader would want to have an open long position in Rand because the currency is strengthening. If they hold a short they want to cover their short position. • Based on Balance of Payments a currency trader would want to have an open short position in Rand. Due to this method predicting a weakening of the rand over the next three months South African Rand “The achievement and maintenance of price stability” SARB Forecasting the Rand using the Relative PPP • South African Inflation rate- %3.9 – http://www.reservebank.co.za • United States Inflation rate-%3.36 – www.inflationdata.com Current Spot Rate- 6.0538 -YahooFinance South Africa’s Inflation Rate • The SARB has set an inflation target between 3-6% • They have remained in the target spread for the past 25 consecutive months. • Their Central Bank-SARB credits the robust domestic Demand and healthy economy for the stable inflation rates. Inflationary Concerns • For both the U.S. and South African rising international oil prices put upward pressure on inflation. • Big Ben said “Among the factors restraining core inflation are ongoing gains in productivity, which have helped to hold unit labor costs in check, and strong domestic and international competition in product markets, which have restrained the ability of firms to pass cost increases on to consumers. “ Forecasting 5 Years into the future • European Terms – PPP Spot Rate = Current Spot Rate x (1 + infhome)n/(1 + infforeign)n) PPP Spot Rate=6.0538 X (1+.039)^5/(1+.0336)^5 =6.0538 X 1.2108/1.1796 =6.0538 X 1.02645 = 6.21 Rand to the U.S. Dollar Impacts on a U.S Global Firm with operations in South Africa • It appears the Rand is going to weaken against the Dollar – Transaction Exposure-Acct. Receivable will be less valuable in the future unless an exchange rate is locked in. – Economic Exposure- Assets and Operating Income from South Africa will be less valuable in terms of the USD – Translation Exposure- Translation losses would occur from the depreciation of the Rand. Implications of the PPP exchange rate on Global companies • Since the inflation rates of the two countries are fairly close the parity does not suggest a large movement in the spot rate, therefore it is not a major dilemma for any global company. • It appears to be a unfortunate time for U.S. companies to enter into the South African market since their assets will become less valuable. • Current companies should hedge their risk by globally diversifying their operations. • A firm manufacturing in South Africa would experience profit gains from the cheaper variable costs in home currency terms. International Fisher Effect 10 Year Bond U.S. = 4.985 South Africa = 7.370 South Africa current spot rate = 6.0538 Future Spot Rate = Current Spot Rate * (1 + int. home) ^n/ (1 + int. foreign) ^n) = 6.0538 *(1 + .0737) ^ 5/ (1 + .04985) ^ 5 = 6.0538 *(1.42697) / (1.27537) = 6.0538 *(1.11887) = 6.77340 International Fisher Effect cont… • This suggests: – The rand will weaken against the U.S. dollar. – Inflation and interest rates with increase. • A company selling or manufacturing products – Exporter-good – Importer-not so hot The End