Balance-of-Payment

Adjustments

Chapter 13

Copyright © 2009 South-Western, a division of Cengage Learning. All rights reserved.

Price Adjustments

o Hume: balance of payment moves towards

equilibrium automatically as national price

levels adjust

o gold standard

• each nation’s money supply consisted of

gold or paper money backed by gold

• each nation set price of gold in terms of its

currency

• free import and export of gold

o balance of payments surplus causes nation to

acquire gold and increase its money supply

Quantity Theory of Money

o equation of exchange:

MV = PQ

M = nation’s money supply

V = velocity of money

P = average price level

Q = volume of final goods

o classical economists assumed V and Q were

constant

o implication is that balance of payments is

linked to money supply which is linked to

domestic price level

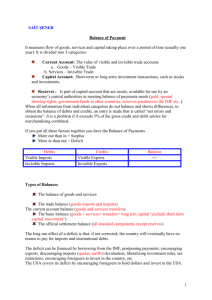

Balance of Payments Adjustment

o assuming balance of payments deficit

• gold outflow (under classical gold standard)

• decrease money supply

• reduce domestic price level

• increase international competitiveness

• increase exports and decrease imports

• return to balance of payment equilibrium

o assuming balance of payments surplus

• opposite movements in each variable

would lead to fewer exports

• again returns to equilibrium

Counterarguments

o nation’s money supply no longer linked to its

gold supply

o central banks can offset a gold outflow through

expansionary monetary policy or a gold inflow

through restrictive monetary policy

o if full employment does not exist prices may

not rise in response to an increase in money

supply

o prices and wages may be inflexible in a

downward direction

Interest Rate Adjustments

o nation with a balance of payments surplus has

increase in money supply leading to lower

interest rates

o nation with deficit sees decrease in money

supply leading to higher interest rates

o interest rate differential leads to flow of

investment capital from surplus nation to

deficit nation

o facilitates balance of payments equilibrium

• exception – if central bankers reinforced

interest rate adjustments

Financial Flows

Financial Flows (cont.)

o higher U.S. interest rates leads to a net financial

inflow represented by point B

o lower interest rates would lead to a net outflow

represented by

point C

o CFA0 implies

interest rate

differentials

are sole

determinant of

financial flows

Income Adjustments

o Keynesian assertion

o income determination

• nation with surplus will have increased

income leading to increased imports

• nation with deficit will see income decline

leading to fewer imports

• assumption of fixed exchange rates

o foreign repercussion effect – increase in

income stimulates imports causing an

expansion abroad which in turn increases

demand for home country’s exports

Monetary Adjustments

o quantity of money demanded

• directly related to income and prices

• inversely related to interest rates

o money supply as multiple of monetary base

• domestic component – credit created by

monetary authority

• international component – result of foreign

balance of payments disequilibrium

results:

o excess money supply => deficit

o excess money demand => surplus