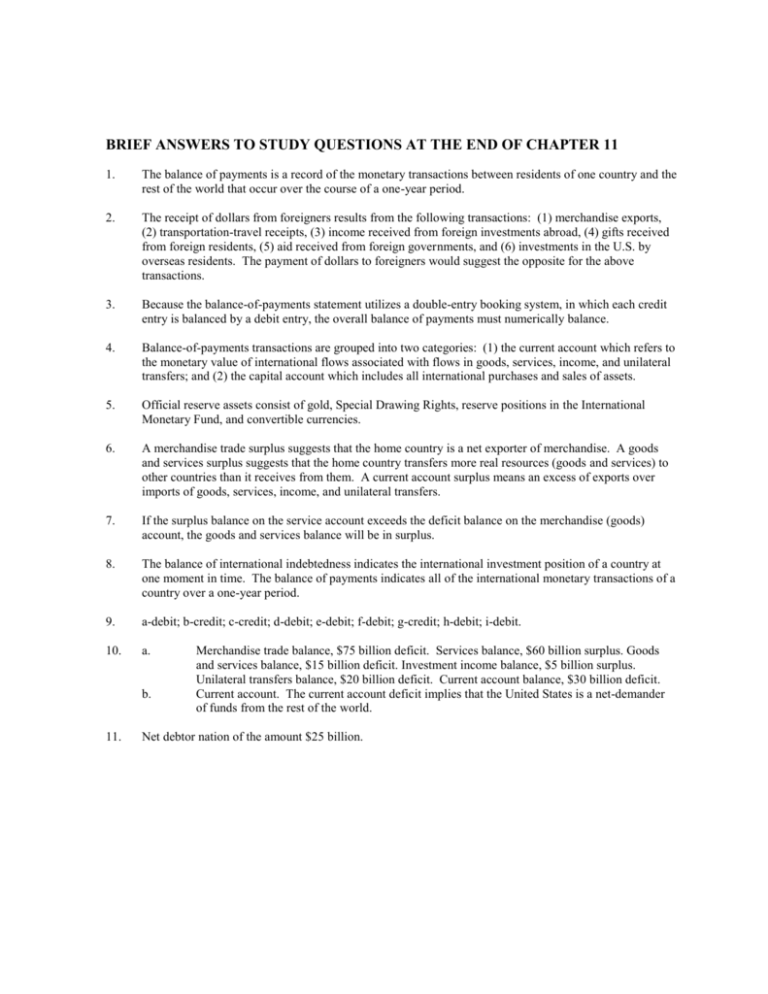

BRIEF ANSWERS TO STUDY QUESTIONS AT THE END OF CHAPTER 11

1.

The balance of payments is a record of the monetary transactions between residents of one country and the

rest of the world that occur over the course of a one-year period.

2.

The receipt of dollars from foreigners results from the following transactions: (1) merchandise exports,

(2) transportation-travel receipts, (3) income received from foreign investments abroad, (4) gifts received

from foreign residents, (5) aid received from foreign governments, and (6) investments in the U.S. by

overseas residents. The payment of dollars to foreigners would suggest the opposite for the above

transactions.

3.

Because the balance-of-payments statement utilizes a double-entry booking system, in which each credit

entry is balanced by a debit entry, the overall balance of payments must numerically balance.

4.

Balance-of-payments transactions are grouped into two categories: (1) the current account which refers to

the monetary value of international flows associated with flows in goods, services, income, and unilateral

transfers; and (2) the capital account which includes all international purchases and sales of assets.

5.

Official reserve assets consist of gold, Special Drawing Rights, reserve positions in the International

Monetary Fund, and convertible currencies.

6.

A merchandise trade surplus suggests that the home country is a net exporter of merchandise. A goods

and services surplus suggests that the home country transfers more real resources (goods and services) to

other countries than it receives from them. A current account surplus means an excess of exports over

imports of goods, services, income, and unilateral transfers.

7.

If the surplus balance on the service account exceeds the deficit balance on the merchandise (goods)

account, the goods and services balance will be in surplus.

8.

The balance of international indebtedness indicates the international investment position of a country at

one moment in time. The balance of payments indicates all of the international monetary transactions of a

country over a one-year period.

9.

a-debit; b-credit; c-credit; d-debit; e-debit; f-debit; g-credit; h-debit; i-debit.

10.

a.

b.

11.

Merchandise trade balance, $75 billion deficit. Services balance, $60 billion surplus. Goods

and services balance, $15 billion deficit. Investment income balance, $5 billion surplus.

Unilateral transfers balance, $20 billion deficit. Current account balance, $30 billion deficit.

Current account. The current account deficit implies that the United States is a net-demander

of funds from the rest of the world.

Net debtor nation of the amount $25 billion.