Currency Futures & Options

advertisement

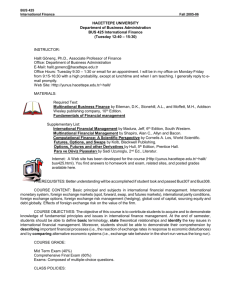

Currency Futures & Options Markets Objectives: to Understand • How currency futures and options contracts are used to manage currency risk & to speculate on future currency movements • The nature of currency futures and options contracts and • The difference between futures & options contracts • The factors that determine the value of an option Futures Fred Thompson 2 Currency Risk Definition • Currency Risk = Variability in the value of an exposure caused by uncertainty about exchange rate changes. Futures Fred Thompson 4 Currency Risk • Degree of risk is a function of 2 variables – Volatility of exchange rates – Amount of exposure • Degree of Risk – Low = rate fixed, low exposure – High = rate volatile, high exposure Futures Fred Thompson 5 What Happens if the Yen falls? QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. Futures Fred Thompson 6 Long and Short Exposures • A person that is, for example, long the pound, has pound denominated assets that exceed in value their pound denominated liabilities. • A person that is short the pound, has pound denominated liabilities that exceed in value their pound denominated assets. Futures Fred Thompson 7 What is an exposure? • Liabilities > assets = net exposure (short) • If you are borrowing Yen to buy $ denominated assets? Are you short or long? • Who is long? • Who is long on $? Who is short? Futures Fred Thompson 8 Hedging • To hedge a foreign exchange exposure, one takes an equal and opposite position from that of the exposure. • For example, if folks are long the pound, they would have to take an offsetting short position to hedge their exposure. • One who is long in a market is betting on an increase in the value of the thing, whereas with a short position they are betting on a fall in its value. Futures Fred Thompson 9 You Can Hedge with Financial Derivatives! • Contracts that derive their value from some underlying asset – Forwards – Futures – Options – Swaps Futures Fred Thompson 10 For example • Vanilla bond -- coupon and principal – First stage decomposition – Second stage decomposition – Options • What assets underlie currency derivatives? Futures Fred Thompson 11 Currency Futures Currency Futures • Traded on centralized exchanges (illustrated in Figure 1 later) • Highly standardized contracts – Size [A&C$100K, £62.5k, €125k, ¥12.5m] & maturity [delivery date] • Clearinghouse as counter-party • High leverage instrument – Daily settlement – Margin requirements Futures Fred Thompson 13 Currency Futures • Performance Bond or Initial Margin: The customer must put up funds to guarantee the fulfillment of the contract - cash, letter of credit, Treasuries. • Maintenance Performance Bond or Margin: The minimum amount the performance bond can fall to before being fully replenished. • Mark-to-the-market: A daily settlement procedure that marks profits or losses incurred on the futures to the customer’s margin account. Futures Fred Thompson 14 Sample Performance Bond Requirements From the CME, 15 March 2000 Currency Futures Australian Dollar British Pound Canadian Dollar Deutsche Mark Euro Futures Initial Maintenance $1,317 $975 $1,620 $1,200 $642 $475 $1,249 $925 $2,430 $1,800 Fred Thompson 15 How an Order is Executed (Figure from the CME) Example A US manufacturing company has a division that operates in Mexico. At the end of June the parent company anticipates that the foreign division will have profits of 4 million Mexican pesos (P) to repatriate. The parent company has a foreign exchange exposure, as the dollar value of the profits will rise and fall with changes in the exchange value between the P and the dollar. Futures Fred Thompson 17 Example, continued • The firm is long the peso, so to hedge its exposure it will go short [sell P] in the futures market. • The face amount of each peso future contract is P500,000, so the firm will go short 8 contracts. • If the peso depreciates, the dollar value of its Mexican division’s profits falls, but the futures account generates profits, at least partially offsetting the loss. The opposite holds for an appreciation of the peso. Futures Fred Thompson 18 Gain Underlying Long Position Change spot value Change in futures price Futures Position Loss Example, continued • The previous diagram can be used to illustrate the effect of a change in the value of the peso. • An increase in the value of the peso increases the dollar value of the underlying long position and decreases the value of the futures position. • A decrease in the value of the peso decreases the value of the underlying position and increases the value of the futures position. Futures Fred Thompson 20 Example, continued • On the 25th, the spot rate opens at 0.10660 ($/P) while the price on a P future opens at 0.10310. • The market closes at 0.10635 and 0.10258 respectively. • The loss on the underlying position is: • (0.10635-0.10660)P4 mil. = -$1,000 • The gain on the futures position is: • (0.10310-0.10258)8P500,000=$2,080 Futures Fred Thompson 21 Gain and Loss on Underlying and Futures Position Day 1 Underlying Long Position Gain P4 million $2,080 Change spot value -0.00025 Change in futures price -0.00052 $1,000 Futures Position P500,000 x 8 Loss Example, continued • On the 28th, the spot rate moves to 0.10670 ($/P) and the price on a P future to 0.10285. • The gain on the underlying position is: • (0.10670-0.10635)P4 mil. = $1,400 • The loss on the futures position is: • (0.10258-0.10285)8P500,000=-$1,080 Futures Fred Thompson 23 Gain and Loss on Underlying and Futures Position Day 2 Underlying Long Position Gain P4 million $1,400 0.00032 Change spot value 0.00035 Change in futures price $1,080 Futures Position P500,000 x 8 Loss Example, continued • On the 29th, the spot rate moves to 0.10680 ($/P) and the price on a P future to 0.10290. • The gain on the underlying position is: • (0.10680-0.10670)P4 mil. = $400 • The loss on the futures position is: • (0.10285-0.10290)8P500,000=-$200 Futures Fred Thompson 25 Gain and Loss on Underlying and Futures Position Day 3 Underlying Long Position Gain P4 million $400 0.0001 Change spot value 0.00005 Change in futures price $200 Futures Position P500,000 x 8 Loss Example, continued • For the three days considered, the underlying position gained $800 in value and the futures contracts yielded $800. • The hedge was not perfect as the daily losses on the futures were less than the gains on the underlying position (day 2 and 3), and the daily gains on the futures exceeded the losses on the underlying position (day 1). • In this example, the imperfect hedge yielded additional gains. Futures Fred Thompson 27 Example, continued • Suppose you wanted to close the futures position (without making delivery of the currency). • The position is simply reversed. That is, you would go long 8 P futures, reversing your current position and closing out your account. [offsetting trade] Futures Fred Thompson 28 Additional Information For additional information on currency futures, visit the following sites: • The Chicago Mercantile exchange • The Futures Industry Institute Futures Fred Thompson 29 Currency Options Currency Options • A currency option is a contract that gives the owner the right, but not the obligation, to buy or sell a currency at a specified price at or during a given time. • Call Option: An option that gives the owner the right to buy a currency. • Put Option: An option that gives the owner the right to sell a currency. • How are currency options simultaneously both put & call options? Futures Fred Thompson 31 Currency Options • American Option: An option that can be exercised any time before or on the expiration date. • European Option: An option that can only be exercised on the expiration date. Futures Fred Thompson 32 Currency Options • Exercise or Strike Price: The price (spot exchange rate) at which the option may be exercised. • Option Premium: The amount that must be paid to purchase the option contract. • Break-Even: The point at which exercising the option exactly matches the premium paid. Futures Fred Thompson 33 Currency Options • If the spot rate has not yet reached the exercise price [S<X], the option cannot be exercised and is said to be “out of the money.” • If the spot rate equals the exercise price [S=X], the option is said to be “at the money.” • If the spot rate has surpassed the exercise price [S>X], the option is said to be “in the money.” Futures Fred Thompson 34 Call Option • The holder of a call option expects the underlying currency to appreciate in value. • Consider 4 call options on the euro, with a strike price of 152 ($/€) and a premium of 0.94 (both cents per €). • The face amount of a euro option is €62,500. • The total premium is: $0.0094·4·€62,500=$2,350. Futures Fred Thompson 35 Call Option: Hypothetical Pay-Off Profit Payoff Profile $1,400 152 152.5 0 148.15 -$1,100 152.94 Break-Even -$2,350 Out-ofLoss the-money At In-the-money 153.5 Spot Rate Put Option • The holder of a put option expects the underlying currency to depreciate in value. • Consider 8 put options on the euro with a strike of 150 ($/€) and a premium of 1.95 (both cents per €). • The face amount of a euro option is €62,500. • The total premium is: $0.0195·8·€62,500=$9,750. Futures Fred Thompson 37 Profit Put Option: Hypothetical payoff at a spot rate of 148.15 Payoff Profile Break-Even 148.05 0 -$500 150 148.15 -$9,750 Loss In-the-money At Out-of-the-money Spot Rate Option Pricing & Valuation • Value of a call option at maturity – S-X, where S-X>0 [otherwise value is zero], = Intrinsic value • Value of a call option prior to maturity – Intrinsic value + Time value Time Value is a function of: Time to expiration, volatility, domestic & foreign interest rate differentials Futures Fred Thompson 39 Comparing Futures and Options The value of a futures contract at maturity (date t+n) to purchase one unit of foreign currency will be: Value 0 Zt,t+n St+n The value of the futures contract is zero at maturity if the spot rate at maturity is equal to the current futures rate. Consider now the value of an option to purchase one unit of foreign currency at that same price (i.e. a ‘call option’ with a strike price X equal to Zt,t+n): Value 0 X St+n The value of the call option begins increasing when the exchange rate becomes larger than the exercise price - when the option becomes ‘in the money.’ But we’re missing something. While a futures contract has an expected return of zero, the value of the option looks like it is always positive… Value 0 X St+n Hence, anyone taking the opposite side of the transaction (‘writing’ the option) will demand a premium (C) that makes the expected value zero once again: Value 0 C X St+n Regardless of the outcome, the option’s value is reduced everywhere by the certain payment of its premium. The value of an option to sell one unit of foreign currency (a ‘put’ option) at a strike price equal to a corresponding futures contract price will have similar properties: Value 0 X St+n Swaps Foreign Currency Swaps A currency swap is an exchange of debt-service obligations denominated in one currency for the service on an agreed upon principal amount of debt denominated in another currency. A currency swap is often the low-cost way of obtaining a liability in a currency in which a firm has difficulty borrowing. A pair of firms simply borrow in currencies they have relative advantage borrowing in, and then trade the obligations of their respective loans, thereby effectively borrowing in their desired currency. Dell computers would like to borrow in Swiss Francs to hedge its ongoing cash flows from that country… Dell SFr Nestle would like to borrow in Dollars to hedge its sales to the U.S... Dell $ Nestle SFr But both firms are relatively unknown to the respective credit markets, and thus anticipate unfavorable borrowing terms. Dell $ Nestle SFr But an investment bank comes along and suggests that each borrow in the credit markets that are comfortable with them... Dell $ Nestle I-Bank SFr …and then the investment bank will give them sufficient cash flows each period to cover the obligations of these loans... Dell Nestle $ $ Sfr I-Bank SFr …in return for making the payments in the foreign currency that exactly match the other firm’s obligations. Dell Nestle Sfr $ $ $ Sfr I-Bank SFr In other words, the swap effectively ‘completes the market’. Giving each firm access to the foreign debt market at reasonable terms. Dell Nestle Sfr $ $ $ Sfr I-Bank SFr The All-In Cost of a Swap Clearly, the relative magnitudes of the respective payments determine each firm’s ultimate cost of borrowing. This cost is called the ‘all-in cost’. It is the effective interest rate the firm ends up paying on the money that it raised. It is the discount rate that equates the NPV of future interest and principal payments to the net proceeds received by the issuer. IRR Swaps vs. Forwards Notice that on a one-year loan, a currency swap is no different than a one-year forward contract. In fact, a currency swap can really be thought of as a firm taking a domestic currency loan and purchasing a series of forward contracts to convert the payments into known foreign currency obligations. The implied forward rates need not equal the actual forward rates, but taken as a whole, should resemble an average forward rate over the term of the loan. Comparative Borrowing Advantage Swaps only exist because there are market imperfections. If firms can access foreign and domestic debt markets at equal cost, clearly swaps are redundant. One important reason that currency swaps are so useful is that firms engaged in a swap need not each have an absolute borrowing advantage in the currency in which they borrow vis-a-vis the counterparty. In fact, it is quite likely that Nestle has better access to both the U.S. and Swiss debt markets than Dell. Comparative Advantage Key Points 1. A firm wishing to hedge foreign currency exposure has five main financial hedging tools which facilitate doing so: forward contracts, money market hedges, futures contracts, foreign currency options, and currency swaps. 2. Forward contracts have the benefit of being tailor-made, with quantities and timing matched to the needs of the firm. Forward contracts are typically quite costly over longer horizons, as the market becomes highly illiquid. 3. Money market hedges are equally flexible, but depend on a firm having equal access to domestic and foreign credit markets. Key Points 4. Futures contracts, traded on highly liquid exchanges, have the benefit that they can be sold on the market before the maturity date. As a result, futures contracts are particularly useful for hedging exposures whose maturity is uncertain. 5. On the other hand, futures contracts are standardized in terms of timing and quantities, and therefore they rarely offer a perfect hedge. 6. Options contracts allow a firm to hedge against movements in one direction while retaining exposure in the other. 7. Options are particularly useful in hedging exposures that are highly uncertain with respect to timing and magnitude. Key Points 8. Currency swaps offer firms the ability to borrow against long-term foreign currency exposures when access to foreign debt markets is costly. 9. Currency swaps converts a domestic liability into a foreign one via what are effectively a bundle of long-dated forward contracts between two firms. 10. The effective cost of a currency swap is its ‘all-in cost’ the effective rate of interest that the firm ends up paying on the constructed foreign liability. 11. Currency swaps require only that firms have differential relative - rather than absolute - advantage in accessing debt markets.