Currency derivatives

advertisement

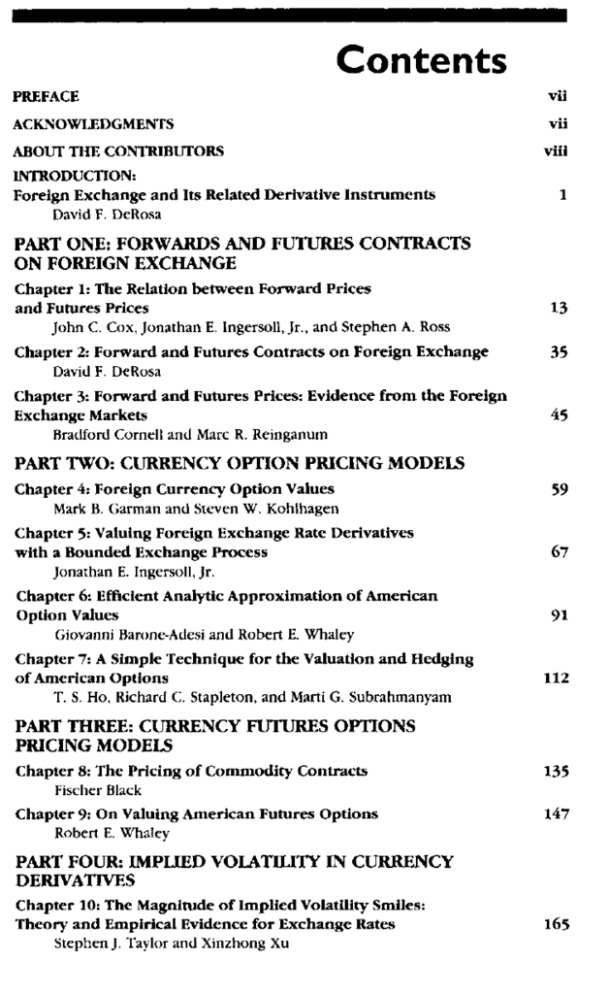

INTRODUCTION: Foreign Exchange and Its Related Derivative Instruments David F. DeRosa PART ONE: FORWARDS AND FUTURES CONTRACTS ON FOREIGN EXCHANGE Chapter 1: The Relation between Forward Prices and Futures Prices John C. Cox, Jonathan E. Ingersoll, Jr., and Stephen A. Ross Chapter 2: Forward and Futures Contracts on Foreign Exchange David F. DeRosa Chapter 3: Forward and Futures Prices: Evidence from the Foreign Exchange Markets Bradford Cornell and Marc R. Reinganum PART TWO: CURRENCY OPTION PRICING MODELS Chapter 4: Foreign Currency Option Values Mark B. Carman and Steven W . Kohlhagen Chapter 5: Valuing Foreign Exchange Rate Derivatives with a Bounded Exchange Process Jonathan E. Ingersoll, Jr. Chapter 6: Efficient Analytic Approximation of American Option Values Giovanni Barone-Adesi and Robert E. Whaley Chapter 7: A Simple Technique for the Valuation and Hedging of American Options T. S. Ho, Richard C. Stapleton, and Marti G. Subrahmanyam PART THREE: CURRENCY FUTURES OPTIONS PRICING MODELS Chapter 8: The Pricing of Commodity Contracts Fischer Black Chapter 9: On Valuing American Futures Options Robert E. Whaley PART FOUR: IMPLIED VOLATILITY IN CURRENCY DERIVATIVES Chapter 10: The Magnitude of Implied Volatility Smiles: Theory and Empirical Evidence for Exchange Rates Stephen J. Taylor and Xinzhong Xu Chapter 11: The Term Structure of Volatility Implied by Foreign Exchange Options Xinzhong X u and Stephen J. Taylor PART FIVE: JUMP PROCESS AND STOCHASTIC VOLATILITY MODELS FOR CURRENCY DERIVATIVES Chapter 12: Dollar Jump Fears, 1984-1992: Distributional Abnormalities Implicit in Currency Futures Options David S. Bates Chapter 13: On Jump Processes in the Foreign Exchange and Stock Markets Philippe Jorion Chapter 14: Pricing European Currency Options: A Comparison of the Modified Black-Scholes Model and a Random Variance Model Marc Chesney and Louis Scott PART SIX: BARRIER, BINARY, AND AVERAGE CURRENCY OPTIONS Chapter 15: On Pricing Barrier Options Peter Ritchken Chapter 16: Pricing and Hedging Double-Barrier Options: A Probabilistic Approach Helyette Geman and Marc Y o r Chapter 17: One-Touch Double Barrier Binary Option Values Cho H. Hui Chapter 18: Pricing European Average Rate Currency Options Edmond Levy PART SEVEN: QUANTOS OPTIONS AND EQUITY WARRANTS WITH SPECIAL CURRENCY FEATURES Chapter 19: Understanding Guaranteed Exchange-Rate Contracts in Foreign Stock Investments Emanuel Derman, Piotr Karasinski, and Jeffrey S. Wecker Chapter 20: The Perfect Hedge: To Quanto or Not to Quanto Christopher D. Piros, Ph.D. Chapter 21: Pricing Foreign Index Contingent Claims: An Application to Nikkei Index Warrants Ajay Dravid, Matthew Richardson, and Ton-sheng Sun