Specialty Drug

advertisement

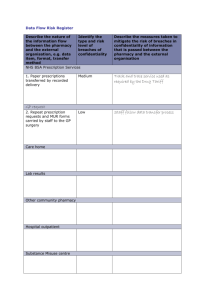

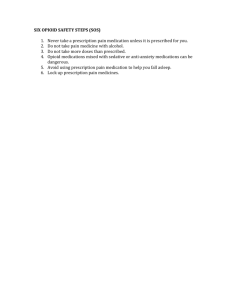

Prescription Drug Utilization & Opioid Abuse July 16, 2013 Mona Chitre, PharmD, CGP Vice President, Pharmacy Management Excellus BlueCross BlueShield Pharmacy Management: Market Landscape • Impact of Prescription Benefits • Specialty Medications • Price Increases • Trend Management Opportunities • Opioids Why are Prescriptions important: •#1 Benefit: Most commonly used benefit • 67-70% use the drug benefit each year • 12-15 prescription fills per person per year •#1 Cost: Drugs are the top cost driver Service Bucket PMPM Allowed: Rx extracted from buckets and consolidated Drug (Rx and Medical Benefits) $ 94.03 Physician $ 93.44 Outpatient $ 70.93 Inpatient $ 60.96 How does Rx affect benefit plans? Medical Benefit • • • • • • • Hospital Physician Office Outpatient Facility Clinics Infusion centers Home Infusion DME • Drug Costs: 5-8% of total medical cost ($20-$25 pmpm) Pharmacy Benefit • Retail Pharmacy • Mail Pharmacy • Specialty Pharmacy • Drug Cost : 20-25% of total health care cost ($75-$85 pmpm) Prescription Benefit Medical Benefit Cancer Diabetes Antidepressants Hypertension Rheumatology Psoriasis Contraceptives Hemophilia Vaccines Multiple Sclerosis Immunoglobulins Hyperlipidemia Osteoarthritis PPIs Asthma Enzyme Replacement Glaucoma Pulmonary Arterial Hypertension Today’s pharmaceutical benefit reality $20 – generic Rx $200 – brand Rx $2,200 – specialty Rx SPECIALTY PHARMACEUTICALS 7 New Technology: Specialty Drugs General Description: • High Cost • Biologics • Pharmacy or Medical Benefit (Oral, Injectable, Infusion) • Monitoring Required • Targeted • Chronic or genetic conditions with still an unmet need Drug Condition Annual Cost Vectibix Cancer $100,000 Enbrel Rheumatoid Arthritis $16,000 Cinryze Hereditary $450,000 Angioedema Juxtapid Familial High Cholesterol $1,000,000 Top Ten Drug Projections Specialty Drug: Employer Impact Employer: 200 employees (450 total with coverage) • 5300 Prescriptions/ year • Average employer cost/Rx: $60 • Total Annual Rx cost for employer: $320,000 Specialty Drug Impact: Tykerb • Oral drug used in combination for breast cancer. • Incremental Added Cost: $55,000/ year 15% increase in Rx expense that year 10 Specialty Drug: Employer Impact Large multiple employer coalition: • • • • 41,000 covered lives Medical Drug PMPM: $14.47 (07-08) Medical Drug Trend: 50% over 2 years Specialty Drug Impact: – 2 of the covered members treated with Fabrazyme – Annual cost of > $518,000 This drug accounted for 8% of the medical expense 11 “Cancer Trends Demand Call To Action” The Tipping Point “At Memorial Sloan-Kettering Cancer Center, we recently made a decision that should have been a no-brainer: we are not going to give a phenomenally expensive new cancer drug to our patients” • Zaltrap v. Avastin – Same Efficacy – $11,000 difference Cost Trends 2012/2013 Sample Specialty Rx Approvals Drug Manufacturer Route Approval Launch (est) Annual Cost Oral Advanced renal cell carcinoma 1/27/2012 2/1/2012 $75,000/yr Genentech Oral Basal cell carcinoma 1/30/2012 2/7/2012 $75,000/yr Vertex Oral Cystic Fibrosis 1/31/2012 2/7/2012 $294,000/yr Corcept Oral Cushings Disease 2/17/2012 5/1/2012 $180,000/yr Pfizer/Protalix IV Gaucher Disease 5/2/2012 5/3/2012 $180,000/yr Genentech IV HER2-positive Breast CA 6/11/2012 6/25/2012 $71,000/yr Oral Familial High Cholersterol 12/21/201 2 Inlyta (axitnib) Pfizer Erivedge (vismodegib) Kalydeco (ivacaftor) Korylm (mifepristone) Elelyso (taliglucerase alfa) Perjeta (pertuzumab) Juxtapid (pertuzumab) Kadylca (traztuzumab emtansine) Indication Aegerion Genentech IV HER2-positive Breast CA 2/22/2013 2/1/2013 $1,000,000 $94,000 Pricing and Price Increases Case Study: Multiple Sclerosis New Technology: 2010: 2 New agents - 1st Combination drug and 1st Oral Agent Significant Price Increases: • 2006 Price - $ 15,000 • 2010 Price - $37,000 METRIC EHP 2 year Trend COST 40% USE 16% Mean Ingredient Cost Copaxone Compared with CPI $3,000 $2,800 $2,600 $2,400 $2,200 COPAXONE $2,000 Consumer Price Index $1,800 $1,600 $1,400 $1,200 2004Q1 2004Q2 2004Q3 2004Q4 2005Q1 2005Q2 2005Q3 2005Q4 2006Q1 2006Q2 2006Q3 2006Q4 2007Q1 2007Q2 2007Q3 2007Q4 2008Q1 2008Q2 2008Q3 2008Q4 2009Q1 2009Q2 2009Q3 2009Q4 2010Q1 2010Q2 $1,000 15 Drug Cost Trends: Upstate New York $250.00 $208.38 Average brand name drug cost * $185.89 $200.00 $167.74 $155.04 $135.58 $150.00 $120.05 $190 Difference $100.00 $100 Difference Average generic drug cost * $50.00 $19.63 $18.30 $19.12 $18.68 $19.28 $18.16 2006 2007 2008 2009 2010 2011 $0.00 Trend Management: GENERICS “Ask your doctor if a generic is right for you” Employer Impact: Case Study • Employer: 200 employees (450 total with coverage) • • • • Avg 12 Rx/person/yr: approx. 5,300 Rx Avg employer cost/Rx: $60 Generic Fill Rate: 65% (3,445 of the Rx are for generic) Total Annual Rx cost for employer: $318,000 • Generic Opportunity: Increase GFR to 70% • • • • 265 brand drug Rx changed to a generic option. Cost saving per Rx: $100 Savings to employer: $26,500 (8% of spend) Savings to employee: 200-$400+/year Each 1 point increase in GFR can reduce Rx spend by 2-3% Trend Management: Use Management Managed Rx Unmanaged Rx Generic Fill Rate 85.6% 74.2% Brand PMPM $54.38 $102.09 0.4% 26.7% Generic PMPM $24.42 $30.11 Generic PMPM Trend -9.2% 2.5% Total PMPM $78.80 $132.20 Total PMPM Trend -2.6% 20.5% Est Annual Spend $2,124,289 $3,237,091 Brand PMPM Trend $160.00 Total $ PMPM Measure $120.00 20.5 $80.00 $40.00 $0.00 201301 201302 201303 Managed Unmanaged Managed Trend Unmanaged Trend 201304 Data based on claims incurred January – April 2013 • Rx management programs: Generic Trial Program, Prior Authorization and Step Therapy encourage equally effective lower cost options to help manage trend and lower member out of pocket cost. • Groups with unmanaged Rx are incurring significantly higher Per Member Per Month (PMPM) costs than groups with managed Rx benefits Opioid Impact Balancing the need for opioids “Overdoses involving prescription painkillers are at epidemic levels and now kill more Americans than heroin and cocaine combined. States, health insurers, health care providers and individuals have critical roles to play in the national effort to stop this epidemic of overdoses while we protect patients who need prescriptions to control pain.” CDC Director Thomas Friedan M.D., M.P.H. Although evidence is limited, chronic opioid therapy (COT) can be an effective therapy for carefully selected and monitored patients with chronic non-cancer pain (CNCP). The American Pain Society and the American Academy of Pain Medicine expert panel 21 Statistics • Overdose deaths involving opioid pain relievers (OPR) have increased and now exceed deaths involving heroin and cocaine combined. OPR involved in 14,800 deaths in 2008 • More ED visits related to misuse or abuse of pharmaceuticals compared to use of illicit drugs Prescription Drug Overdose Deaths, 2008 26% OPR Overdose Deaths 74% Other Rx Drugs • By 2010, enough OPR were sold to medicate every American adult with a typical dose of 5 mg of hydrocodone every 4 hours for 1 month • 17 percent of teens say they have used a prescription medicine at least once in their lifetime to get high or change their mood. * Significantly lower than 2009 levels 22 Impact to Stakeholders in Healthcare • 40 people die every day from overdoses involving opioids such as hydrocodone, oxycodone and oxymorphone • The average annual cost per capita for opioid abusers has been calculated at $16,000 compared to $1,800 for nonabusers Wasted healthcare dollars • Nonmedical use of OPR costs insurance companies up to $72.5 billion annually in health-care costs 23 Excellus BlueCross Blue Shield Team Clinical Pharmacy Management Medical Director Behavioral Health Non-Clinical Special Investigations Unit Data Analytics Communications 24 Opioid Mailing Suboxone® Initiative Identification and Stratification Align Formulary Integrated Approach 25 Prescribing Summary - Cover Letter 26 Example Report 27 Results of Opioid Mailing Pharmacy Billing Errors Fraudulent RXs by MD staff Stolen Prescription Pads Negative Urine Drug Screen Suboxone® Provider testament 28 Provider survey What frequency of mailing is appropriate? Was mailing helpful? 6.3% More frequently 12% 32.4% Yes 88% Same No 61.3% Less frequently Based on 330 respondents Action Taken 25% Did you take action? 20% 21.60% 18.50% 15% 41% 59% Yes 10% No 5% 9.10% 1.50% 0% Contacted other prescriber Contacted Contacted Contacted insurance patient listed pharmacy company 29 Step Three - Promoting Outpatient Detoxification • Suboxone® - Under the Drug Addiction Treatment Act (DATA), limited to physicians who meet certain qualifying requirements (authorized training, addiction medicine specialty) • Physician Engagement: – Upstate New York has a shortage of physicians who can prescribe Suboxone® for opioid dependence • Advantages of therapy: – Withdrawal symptoms can be managed safely and effectively in their home environment that incorporates support from the family. – Significant MEDICAL cost savings. Medical costs associated with inpatient detox can cost upwards of $1,200/day. Outpatient detox costs the health plan less than $300/day (excluding drug costs). • Disadvantages of therapy: – High cost – Inappropriate use 30 Results Decrease in inpatient detoxification by 10 percent over a two year time period (2009 – 2011) Detox Medical Claims Expense $3,000,000 $2,194,857 $2,016,609 $2,000,000 Approximate 22% savings in Medical costs for the same time period Significant increase in members utilizing Suboxone® therapy. $1,718,065 $1,000,000 $2009 2010 2011, est 31 Last Thoughts Insurers — the bad guys in so many policy debates — can do a lot of good, keeping better track of the number and types of controlled substances policyholders are receiving. The New Drug Crisis: Addiction by Prescription Time Magazine Monday, Sept. 13, 2010 32