Cash and Cash Equivalents Sample Problems

advertisement

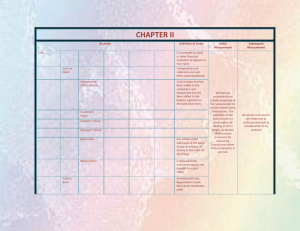

Cash and Cash Equivalents Sample Problems 1. The statement of financial position of Kwarta Company shows cash of 330,820. The following items were found to comprise this total amount: Checking account in Metrobank (outstanding checks as of year-end totaled 15,200) Savings account is Far East bank 105,200.00 30,800.00 Petty cash fund (including expense receipts for 250) 1,500.00 Cash on hand (undeposited sales receipts) 4,200.00 Sinking fund cash 35,000.00 Cash in foreign bank (in equivalent pesos) 65,000.00 Customers' check on hand Traveler's Check 14,000.00 Manager's Check 23,120.00 Short term treasury bills 52,000.00 What is the correct amount of cash? 2. Kuton Company’s checkbook balance at December 31, 2012 was 180,000. In addition, Kuton held the following items in its safe on that date: Check payable to Kuton dated January 2, 2013 in payment of a sale made in December 2012, included in December 31 checkbook balance- 65,000. Check payable to Kuton deposited December 15, but returned by the bank DAIF- 20,000. Check drawn on Kuton’s account, payable to a vendor, dated and recorded on December 30 but not yet mailed to payee as of December 31, 2012- 15,000. What is the correct cash balance of the company? 3. Green Company’s general ledger showed a balance of 2,205,600 in its cash account on December 31, 2012. Included in this balance are the following items: DAIF checks returned by bank Savings account IOUs Postage stamps Bank draft Cash on hand Cash sinking fund 20,000.00 750,000.00 1,200.00 600.00 10,000.00 30,000.00 500,000.00 Customer's checks dated January 2013 Travel advances Traveler's Checks 5,400.00 4,000.00 8,000.00 What is the correct balance of cash? 4. Jennifer Incorporated established a petty cash fund of 5,000 for incidental expenses on June 1, 2012. At the end of the month, the count of cash on hand indicated that 670.40 remained in the fund. A review of the petty cash vouchers disclosed the following expenses had been incurred during the month: Office supplies Transportation Postage Miscellaneous Representation 341.60 1,321.40 780.00 837.60 1,000.00 What is the amount of cash shortage? Prepare the adjusting entry for the end of the month. 5. In your cash count of the petty cash fund of Canyon Company as of July 4, 2012, you found the following composition of its petty cash fund: Bills and coins counted Approved and signed petty cash vouchers Dated June 2012 Dated July 1-4, 2012 IOU from Joe Santos, an employee A check drawn by Juvy Victoria, an employee, dated July 15, 2012 2,450.00 3,300.00 800.00 1,400.00 2,000.00 The petty cash fund has an imprest balance of 10,000. The company’s reporting period ends on June 30. What is the correct balance of the petty cash fund? How much is the cash shortage or overage? Prepare the adjusting entry for June 2012 6. You are attempting to determine an apparent cash shortage that you believe resulted from an employee’s theft. You have assembled the following information for the month of March: Cash balance per books, March 1 Cash receipts for March per books Cash disbursements for March per books Cash balance per bank statement, March 31 Deposit in transit, March 31 Outstanding checks, March 31 Bank service charge for March 115,963.70 246,475.00 334,709.10 15,341.40 9,000.00 2,703.80 92.00 What is the amount of cash shortage? 7. In reconciling the book and bank balance of the cash account of Perlas Corporation, you discover the following for the month of December 2012: Balance per bank statement Balance per books Receipts not yet deposited Bank service charge Customer's check returned by bank marked DAIF 400,000.00 387,000.00 100,000.00 1,000.00 22,000.00 A paid check for 40,000 was recorded in the cash book as 4,000. Assuming no other errors were noted, what is the amount of the outstanding checks at December 31, 2012? 8. The following data related to Jennifer Services Incorporated were gathered: Balance per books Balance per bank statement Receipts not yet deposited Outstanding checks Bank service charges Interest credit by bank 30-Nov-12 270,311.00 294,771.00 21,270.00 40,525.00 295.00 5,500.00 31-Dec-12 148,986.00 32,925.00 35,191.50 158.00 4,925.00 Other information: Receipts and disbursements per books during December are P1,072,850 and P1,195,536.50, respectively. Total credits reflected in the bank statement amounted to P1,065,620. Check #137412 for P2,300 recorded by depositor as P3,200 in error. Customer check for P5,947 deposited on December 28, 2012 was found to be uncollectible. Interest for P625 chargeable to Jennyfer Services was erroneously charged by the bank to the company. No sufficient fund checks in the amount of P5,000 was returned by the bank and redeposited by the company during December. No entry was made on the books for the return or redeposit. Prepare a proof of cash. 1. Leona Company had the following account balances on December 31, 2011: Cash in Bank- current account Cash in Bank- payroll account Cash on Hand Cash in Bank- restricted for equipment acquisition on 2012 Treasury bill purchased November 1, 2011 to mature on February 1, 2012 4,000,000.00 1,500,000.00 500,000.00 1,000,000.00 2,000,000.00 The cash on hand includes a P 200,000 customer check payable to Leona Company, dated January 15, 2012. What should be reported as “cash and cash equivalents” on December 31, 2011? a. P 9,000,000 b. P 7,800,000 c. P 8,800,000 d. P 5,800,000 2. On December 31, 2011, Tigres Company had the following cash balances: Cash in Bank Petty Cash Fund Time Deposit, one year, due March 1, 2012 Saving Deposit 5,000,000.00 50,000.00 1,000,000.00 500,000.00 A check of P 100,000 dated January 15, 2012 in payment of accounts payable was recorded and mailed on December 28, 2011. How much “cash and cash equivalents” should be reported on December 31, 2011? a. P 6,550,000 b. P 6,650,000 c. P 5,650,000 d. P 5,450,000 3. The “cash” account in Jen Company’s ledger on December 31, 2011 showed a balance of P 5,250,000 which included the following: Petty Cash Fund 50,000.00 Undeposited receipts, including a post-dated customer check of P200,000 Cash in Bank Cash in Sinking Fund Expenses paid out of collections, not yet recorded IOUs signed by employees 1,300,000.00 2,500,000.00 1,000,000.00 250,000.00 150,000.00 5,250,000.00 At what amount should Jen Company report as “cash” in the December 31, 2011 statement of financial position? a. P 3,650,000 b. P 3,850,000 c. P 4,650,000 d. P 4,050,000 4. Enipr Company had the following account balances at December 31, 2011: Cash on Hand and in Bank Cash restricted for bond payable due on June 30, 2013 Time Deposit Saving deposit set aside for dividend payable on June 30, 2012 5,000,000.00 2,000,000.00 6,000,000.00 1,000,000.00 In the December 31, 2011 statement of financial position, what total amount should be reported as “cash and cash equivalents”? a. P 12,000,000 b. P 14,000,000 c. P 11,000,000 d. P 13,000,000 5. On April 1, Jennifer Company established an imprest system petty cash fund for P 10,000 by writing a check drawn against the general checking account. On April 30, the fund contained the following: Currency and coins Receipts for office supplies Receipts for postage still unused Receipts for transportation 3,000.00 4,000.00 2,000.00 600.00 On April 30, the entity wrote a check to replenish the fund. What is the amount of replenishment under the imprest fund system? a. P 10,000 b. P 6,600 c. P 7,000 d. P 3,000 6. During the audit of Maganda Company on December 31, 2011, the following data are gathered: Balance per book Bank charges Outstanding checks Deposit in transit Customer note collected by bank Interest on customer note Customer check returned NSF Depositor's note charged to account The correct cash balance amounts to ____. a. P 4,300,000 b. P 5,300,000 c. P 4,250,000 d. P 4,000,000 4,000,000.00 10,000.00 950,000.00 1,200,000.00 1,500,000.00 60,000.00 250,000.00 1,000,000.00