Slide 1: Lecture 1 - Du Pont Identity Welcome to Lecture 1 on the Du

advertisement

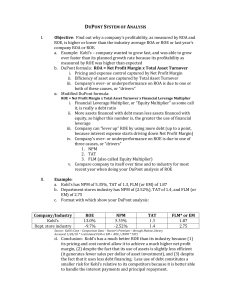

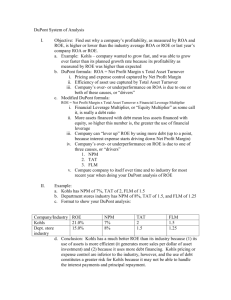

Slide 1: Lecture 1 - Du Pont Identity Welcome to Lecture 1 on the Du Pont Identity. Slide 2: Financial ratios What is a Du Pont Identity? Basically, Du Pont Identity is a way for us to look at the different components of the financial ratios: Return on Assets (ROA) and Return on Equity (ROE). The Return on Assets (ROA) is calculated as: ROA = Net Income / Total Assets = NI / A The Return on Equity (ROE) is calculated as: ROE = Net Income / Total Equity = NI / E It is good to always memorize these two formulas for ROA and ROE, because they are the basic formulas from which all the Du Pont Identities are derived. And so, if you know these two basic formulas by heart, you will be able to derive the Du Pont Identities yourself, without having to memorize all the identities. Slide 3: Du Pont Identity (DPI) for ROA Let’s start with the Du Pont Identities for the ROA. How do we get from the basic formula of ROA = NI/A to a more involved formula/identity for the ROA. We do this by formula manipulation. Taking the basic formula: ROA = NI/A We multiply and divide the right-hand-side of the formula by S, giving us ROA = (NI/A) x (S/S) (Note that S/S = 1, which means that we are multiplying the right-hand-side by 1, which gives us the original formula of NI/A.) Switching the denominators on the right-hand-side of the new formula, we get ROA = (NI/S) x (S/A) This is the first identity for the ROA formula. Looking closely at this new formula, we see that (NI/S) is what we normally call the profit margin, and (S/A) is what we normally call the asset-use efficiency ratio (AUE). Therefore, ROA can also be written as: ROA = Profit margin x Asset-use efficiency That’s it! With a few strokes of the pen, we now have two identities for the ROA formula. Slide 4: Numerical Example Let’s work through a simple numerical example of calculating ROA using one of the identities. Given the following data: NI/S = 0.1 S/A = 2 Calculate the ROA. ROA = (NI/S) x (S/A) Plugging the numbers for NI/S and S/A into the ROA identity, we get ROA = 0.1 x 2 = 0.2 This gives us a Return on Assets of 20%. Slide 5: What is S/A? Remember when we were looking at the first identity for ROA, we have ROA = (NI/S) x (S/A) What does the second term on the right-hand-side of the formula, S/A, represent? Again, S/A is what is referred to as Asset-use efficiency. What it literally means is the dollar amount of sales generated per dollar amount invested in assets. Slide 6: DPI for ROE Next, let’s move on to the Du Pont Identities for ROE. How do we get from the very basic ROE formula of ROE = NI/E to a more involved form of the formula such as this one: ROE = (NI/S) x (S/A) x (1 + D/E)? Again, this is done by formula manipulation. First, multiply and divide the right-handside of the basic ROE formula by S: ROE = (NI/E) x (S/S) Switch the denominators in this new formula, and we get ROE = (NI/S) x (S/E) This is the first identity for the ROE formula. Going one step further, multiply and divide the right-hand-side of this first identity by A: ROE = (NI/S) x (S/E) x (A/A) Switch the denominators between (S/E) and (A/A), and we get ROE = (NI/S) x (S/A) x (A/E) This is the second identity for the ROE formula. An aside: Why do we call these formulas identities? This is because we should get the same answer for ROE when we calculate it using any of these formulas/identities. Looking closely at the second identity for ROE, we see that NI/S is what is commonly referred to as the profit margin, S/A represents asset-use efficiency, and A/E (Total Assets / Total Equity) is what is commonly referred to as the equity multiplier. Therefore, we now have the third identity for ROE: ROE = Profit margin x Asset-use efficiency x Equity multiplier. Again, with just a few strokes of the pen, we have derived three different identities for the ROE formula. Slide 7: Variables in ROE Let’s take a closer look at the second ROE identitiy. ROE = (NI/S) x (S/A) x (A/E) What are the variables we will need in order to calculate the ROE using this formula? We will need the values of Net Income (NI), Sales (S), Total Assets (A), and Total Equity (E). Slide 8: One step further We could stop at three identities for the ROE and be satisfied, but we finance people are adventurous. So, we go on. We know from the accounting balance sheet identity that the value of the total assets (A) must equal the sum of the values of total debt (D) and total equity (E): A=D+E So, given this balance sheet identity, we can rewrite the equity multiplier, A/E, as follows: A/E = (D + E)/E = (D/E) + (E/E) = (D/E) + 1 = 1 + D/E Slide 9: One step further (cont.) Going one step further with the second ROE identity of ROE = (NI/S) x (S/A) x (A/E), we plug A/E = 1 + D/E into this ROE formula to get ROE = (NI/S) x (S/A) x (1 + D/E) This is the fourth identity for ROE. Now, looking closer at this new identity, we see that NI/S is profit margin, S/A is assetuse efficiency, and D/E is the familiar debt-equity ratio. Therefore, we have our fifth identity for ROE: ROE = Profit margin x Asset-use efficiency x (1 + Debt-equity ratio) Slide 10: Summary – ROA DPI To sum up, we have found three Du Pont Identities for calculating ROA: 1. ROA = NI/A (basic formula) 2. ROA = (NI/S) x (S/A) 3. ROA = Profit margin x Asset-use efficiency Slide 11: Summary – ROE DPI As well, we have found seven Du Pont Identities for calculating ROE: 1. ROE = NI/E (basic formula) 2. ROE = (NI/S) x (S/E) 3. ROE = (NI/S) x (S/A) x (A/E) 4. ROE = Profit margin x Asset-use efficiency x Equity multiplier 5. ROE = ROA x (A/E) 6. ROE = (NI/S) x (S/A) x (1 + D/E) 7. ROE = Profit margin x Asset-use efficiency x (1 + Debt-equity ratio) Note: The fifth identity is derived by plugging ROA = (NI/S) x (S/A) into the third identity: ROE = (NI/S) x (S/A) x (A/E). Slide 12: What does it mean? What does all this mean? It means that, when we calculate ROA and ROE, we get to see the different components that contribute to the return on assets and return on equity. For example, with the ROE formula: ROE = Profit margin x Asset-use efficiency x (1 + Debt-equity ratio) we see that the return on equity is affected by three variables: the profit margin, the asset-use efficiency, and the debt-equity ratio. If a company wants to increase its return on equity, it will have to increase profit margin, improve asset-use efficiency, or increase debt-equity ratio. In fact, given that the debt-equity ratio is calculated as the value of total debt divided by the value of total equity, to increase ROE, the company will have to increase debt or reduce equity. So, the model says, to increase ROE, we must do one or more of the followings: Increase profit margin Increase asset-use efficiency Increase debt Decrease equity Slide 13: Numerical Example - ROA Now, without further ado, let’s work through a numerical example. Let’s start with one of calculating the ROA. Given the following information, find the return on assets. Net Income = $1,000 Total Assets = $10,000 Sales = $15,000 Writing down the information given in the symbols we have used in this lecture, we have NI = $1000 A = $10000 S = $15000 The ROA identity we could use is: ROA = (NI/S) x (S/A) Plugging the numbers for NI, A, and S into this formula, we get ROA = (1000/15000) x (15000/10000) = 0.1 = 10% The return on asset is therefore 10%. Slide 14: Numerical Example - ROE Now let’s move on to a numerical example for ROE. Given the following information, calculate the ROE. Profit margin = 8% Sales = $20,000 Total Assets = $50,000 Total Equity = $30,000 Net Income = $1,600 Rewriting the information given in the symbols we have used in this lecture, we have NI/S = 0.08 S = 20000 A = 50000 E = 30000 NI = 1600 Which ROE identity should we use? The decision is usually based on what information we have on hand. In this case, because we have the numbers for A and E, the easiest ROE formula to use is: ROE = (NI/S) x (S/A) x (A/E) Plugging the numbers we know into this formula, we get ROE = 0.08 x (20000/50000) x (50000/30000) = 0.05333333 This gives us a return on equity of approximately 5.33%. Slide 15: Numerical Example - ROE calculation (cont.) Left blank – unused as the space was not needed during the lecture. Slide 16: Numerical Example – missing variable Let’s move on to the next numerical example. Here, we are given an ROE and a bunch of information, and we are then asked a slightly different question: What is the value of one of the missing variables? Given the following information, calculate the value of total debt, D. Profit margin = 8% Total equity = $30,000 Net Income = $5,000 ROE = 16.67% Asset-use efficiency = 0.5 Writing down the information in the symbols we have been using, we have NI/S = 0.08 E = $30000 NI = $5000 ROE = 0.1667 S/A = 0.5 Where do we start? First, we know the value for ROE, and we also know how ROE is calculated. Which ROE identity to use though? The ROE formula that is often used is: ROE = (NI/S) x (S/A) x (A/E) We know that ROE = 0.1667, NI/S = 0.08, S/A = 0.5, and E = $30000. With these numbers, we can figure out the value for A, the total assets. Once we obtained A, we can calculate the value for debt, D, by using the balance sheet identity: A = D + E. So, without further ado, let’s do this. Plugging the numbers for all the known variables into the ROE formula, we get 0.1667 = 0.08 x 0.5 x (A / 30000) Dividing both sides by 0.08 x 0.5 = 0.04, we get 0.1667 / 0.04 = A / 30000 Multiplying both sides by 30000, we get (0.1667 / 0.04) x 30000 = A This gives us A = 125000. Slide 17: Numerical Example - Missing variable (cont.) We now have A = $125000 E = $30000 We also have the balance sheet identity: A=D+E Plugging the numbers for A and E into this formula, we get 125000 = D + 30000 Subtracting 30000 from both sides, we get D = 125000 – 30000 = 95000 Therefore, the total debt value is $95,000. Slide 18: Numerical Example - Missing variable (cont.) Left blank – unused as the space was not needed during the lecture. Slide 19: Practice, Practice, Practice Practice is the secret to passing any finance course. In this practice problem, you are given a whole bunch of information. Net Income = $5,000 Sales = $62,500 Total Assets = $125,000 Total Equity = $30,000 Total Debt = $95,000 ROE = 16.67% The exercise is to pretend that you do not have the value for one of the variables. For example, let’s say that we forgot what the value of Net Income is. Can you find it using the ROE Du Pont Identity? The answer is, as always, yes we can! Try this exercise on your own, and see if you can derive each of the numbers by using the other numbers given and the ROE Du Pont Identities. Here ends the lecture on the Du Pont Identities. Thank you for attending.