bank and cash balances.

Revenue & Receipts Cycle

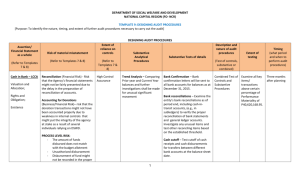

SUBSTANTIVE PROCEDURES

- Bank & Cash

R

EFERENCES

L

EARNING

O

UTCOMES

1. Understand and explain the financial statement assertions that are applicable to bank and cash balances.

2. Understand the risks of misstatement affecting bank and cash balances.

3. Describe the substantive audit procedures necessary to audit the assertions relevant to bank and cash balances.

4. Describe the substantive audit procedures to audit a bank reconciliation.

I

NTRODUCTION

- OVERVIEW

Bank & Cash balances

Consist of:

Bank accounts with one or more banks o Current account; o Call, deposit, savings; o Clearing.

Petty cash and other cash on hand

Method of payment from debtors o

Cash/cheque physically o Direct deposit into bank account o Electronic Funds Transfer (EFT)

I

NTRODUCTION

- ASSERTIONS

Bank & Cash balances: assertions applicable

Existence

Rights

Valuation

Completeness

R

ISKS

Theft of cash by staff or outside parties i.e. cash received from customer, but never deposited / recorded.

Lapping/rolling of cash by staff member.

Cash deposited , but never recorded (assertion affected?)

Deposit processed by bank, but not yet recorded, should be reconciling item on bank recon. What if not?

Window dressing : manipulation of current ratios.

Kiting with transfers : abuse of delay in bank processing time to overstate intercompany/intracompany bank account(s).

AN 10/72

S UBSTANTIVE P ROCEDURES

-E

XISTENCE

, R

IGHTS

3 rd party evidence

Auditor confirms directly

Use standard SAICA letter

Confirm well in advance

Auditor compares confirmation results with client’s records.

Bank confirmation

Bank will indicate:

all a/c’s in audit client’s name;

- balance of accounts;

- encumbrances, security.

7

S UBSTANTIVE P ROCEDURES

-C

OMPLETENESS

• Primary evidence for completeness: Bank Confirmation

• What if client has account with other bank than one confirming?

Perform other procedures to detect completeness risks :

Compare current year -> last year

Alert when performing other procedures e.g. inspecting minutes, budgets, deposits, payments

• Foreign bank accounts: enquire of management; alert if detect import/export transactions.

8

S UBSTANTIVE P ROCEDURES

-V

ALUATION

Bank confirmation

• Primary source of evidence

Bank reconciliation

• Unlikely that the balance per the bank confirmation will agree to the cashbook.

• Thus, should reperform the client’s bank reconciliation.

S UBSTANTIVE P ROCEDURES

-V

ALUATION

Bank Reconciliation as at 31/12/2012

Favourable balance per bank statement

Add: outstanding deposit (not processed by bank yet)

31/12/2012

Less: outstanding cheques (not processed by bank yet)

28/12/2012

22/12/2012

Favourable balance as per cashbook / bank control account in general ledger

Which balance will appear on the bank confirmation?

Which balance will appear in the financial statements?

R

14 300

(9 100)

(1 800)

(7 300)

R

72 500

14 300

77 700

10

S UBSTANTIVE P ROCEDURES

-V

ALUATION

Audit procedures: bank reconciliation

• Balances on bank reconciliation

• Casting and logic

• Cut-off on transactions in cashbook just prior to year end: these should be on bank statement before year end. If not on bank statement?

• Outstanding cheques and deposits on bank reconciliation:

- Are they indeed in the cash book (prior to year end)?

- Are they on the subsequent financial period’s bank statement?

S UBSTANTIVE P ROCEDURES

-V

ALUATION

Audit procedures: bank reconciliation (continued…)

• Last cheque issued for the year (“cut-off cheque number”):

- No number lower than cut-off number should be on subsequent financial period’s bank statement. If so, also on bank recon as outstanding cheque not yet through bank at year end!

• Long outstanding cheques and deposits (max 2 weeks): reasons

• Unusual reconciling items

S UBSTANTIVE P ROCEDURES

C

ASH

C

OUNTS

Procedures: “Cash on hand”

Observe closely the counting by cashier (never alone with money!)

Observe/reperform cashing up procedure:

Cash received

Cheques received

Credit card slips

Agrees with day’s total on cash register roll

- Shortages? Surpluses?

Tills/cashier booths counted separately. Why?

Deposit slips prepared by cashier, agree.

Agree bank statement

All documented on auditor work paper

END

Thank you!

Dankie!

Enkosi Kakhulu!!

14