Template 9 - E

advertisement

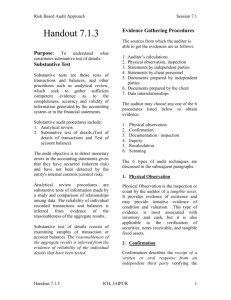

DEPARTMENT OF SOCIAL WELFARE AND DEVELOPMENT NATIONAL CAPITAL REGION (FO- NCR) TEMPLATE 9: DESIGNING AUDIT PROCEDURES [Purpose: To identify the nature, timing, and extent of further audit procedures necessary to carry out the audit] DESIGNING AUDIT PROCEDURES Assertion/ Financial Statement as a whole (Refer to Templates 7 & 8) Cash in Bank – LCCA Valuation and Allocation; Rights and Obligation; Existence Risk of material misstatement (Refer to Templates 7 & 8) Reconciliation (Financial Risk) - Risk that the Agency’s financial statements might not be fairly presented due to the delay in the preparation of reconciliation of accounts. Extent of reliance on controls (Refer to Templates 7 & 8) High Control Assurance Substantive Analytical Procedures Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement Description and nature of audit procedures Substantive Tests of details (Test of controls, substantive or combined) Bank Confirmation – Bank confirmation letters will be sent to all bank accounts for balances as at December 31, 2015. Accounting for Donations (Business/Financial Risk)– risk that the donation transactions might not have been accounted properly due to weakness in internal controls that might put the integrity of the agency at stake as a result of several individuals rallying on DSWD. Bank reconciliations – Examine the entity’s bank reconciliations as of period end, including cash-intransit accounts, (e.g., in subledgers) to verify the proper reconciliation of bank statements and general ledger accounts. Investigate any unusual items and test other reconciling items based on the established threshold. PROCESS LEVEL RISK: - The amount of funds disbursed does not match with the budget allotment - Unauthorized disbursement - Disbursement of fund might not be recorded in the proper Cash cutoff – Test cutoff of cash receipts and cash disbursements for transfers between different bank accounts at the balance sheet date. 1 Extent of testing Combined Test of Controls and Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Timing (what period and when to perform audit procedures) Three months after planning Assertion/ Financial Statement as a whole Risk of material misstatement (Refer to Templates 7 & 8) (Refer to Templates 7 & 8) Cash – MDS, Regular Existence Valuation and Allocation; Rights and Obligation; Extent of reliance on controls (Refer to Templates 7 & 8) Substantive Analytical Procedures Substantive Tests of details Extent of testing (Test of controls, substantive or combined) Timing (what period and when to perform audit procedures) period Voucher may be paid twice Reconciliation (Financial Risk) - Risk that the Agency’s financial statements might not be fairly presented due to the delay in the preparation of reconciliation of accounts. High Control Assurance Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement Accounting for Donations (Business/Financial Risk)– risk that the donation transactions might not have been accounted properly due to weakness in internal controls that might put the integrity of the agency at stake as a result of several individuals rallying on DSWD. PROCESS LEVEL RISK: - The amount of funds disbursed does not match with the budget allotment - Unauthorized disbursement - Disbursement of fund might not be recorded in the proper period - Voucher may be paid twice Advances to Special Disbursing Officers Description and nature of audit procedures Employee Fraud (Financial/Control Risk) - Possible loss or misappropriation of unutilized cash Bank Confirmation – Bank confirmation letters will be sent to all bank accounts for balances as at December 31, 2015. Combined Test of Controls and Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Three months after planning Full Substantive Procedures Examine all key items/ transactions Within three months after Bank reconciliations – Examine the entity’s bank reconciliations as of period end, including cash-intransit accounts, (e.g., in subledgers) to verify the proper reconciliation of bank statements and general ledger accounts. Investigate any unusual items and test other reconciling items based on the established threshold. Cash cutoff – Test cutoff of cash receipts and cash disbursements for transfers between different bank accounts at the balance sheet date. Low Control Assurance Trend Analysis – Comparing Prior year and Current Year balances and further 2 Cash Count – Surprised count shall be performed before yearend and rollforward procedures will be Assertion/ Financial Statement as a whole (Refer to Templates 7 & 8) Existence; Risk of material misstatement (Refer to Templates 7 & 8) Extent of reliance on controls (Refer to Templates 7 & 8) advance, caused by non appearance of the beneficiaries during the scheduled pay out, still in the hands of the SDO due to late liquidation/refund of unused fund. Substantive Analytical Procedures Description and nature of audit procedures Substantive Tests of details Extent of testing (Test of controls, substantive or combined) investigations shall be made for unusual significant movement done to account for transactions from cash count date up to December 31, 2015 Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement Agreement of subledger and general ledger - Agree receivables subledger to the general ledger control account. Investigate any unusual items and test other reconciling items based on the established testing threshold Timing (what period and when to perform audit procedures) above certain percentage of Performance Materiality of P40,620,168.95. planning Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Three months after planning PROCESS LEVEL RISK: - The amount of funds disbursed does not match with the budget allotment - Unauthorized disbursement - Disbursement of fund might not be recorded in the proper period - Voucher may be paid twice Accounts Receivable Valuation and Allocation; Existence; Reconciliation (Financial Risk) - Risk that the Agency’s financial statements might not be fairly presented due to the delay in the preparation of reconciliation of accounts. Low Control Assurance Verification of existence – Verify the existence of receivables through confirmation or, when appropriate, examination of subsequent cash receipts, or examination of other supporting 3 Full Substantive Procedures Assertion/ Financial Statement as a whole (Refer to Templates 7 & 8) Risk of material misstatement (Refer to Templates 7 & 8) Extent of reliance on controls (Refer to Templates 7 & 8) Substantive Analytical Procedures Description and nature of audit procedures Substantive Tests of details Extent of testing (Test of controls, substantive or combined) Timing (what period and when to perform audit procedures) documentation. Loans Receivable Valuation and Allocation; Existence; Reconciliation (Financial Risk) - Risk that the Agency’s financial statements might not be fairly presented due to the delay in the preparation of reconciliation of accounts. Low Control Assurance Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement Agreement of subledger and general ledger - Agree receivables subledger to the general ledger control account. Investigate any unusual items and test other reconciling items based on the established testing threshold Full Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Three months after planning Combined Test of Controls and Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Three months after planning Verification of existence – Verify the existence of receivables through confirmation or, when appropriate, examination of subsequent cash receipts, or examination of other supporting documentation. Due from GOCCs Valuation and Allocation; Rights and Obligation; Existence PROCESS LEVEL RISKS: - The agency might have purchases that are not included in the Annual Purchase Plan (APP) - The agency might have sent invitations to bid for unfunded purchase request - Multiple POs resulting to double payment to suppliers - Unauthorized purchases - Related assets, expenses and High Control Assurance Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement Agreement of subledger and general ledger - Agree receivables subledger to the general ledger control account. Investigate any unusual items and test other reconciling items based on the established testing threshold Verification of existence – Verify the existence of receivables through confirmation or, when 4 Assertion/ Financial Statement as a whole (Refer to Templates 7 & 8) Risk of material misstatement (Refer to Templates 7 & 8) Extent of reliance on controls (Refer to Templates 7 & 8) Substantive Analytical Procedures payable, if on account, might not be recorded in the proper period. Due from LGUs Valuation and Allocation; Rights and Obligation; Existence Inventories Valuation and Allocation; Rights and Obligation; PROCESS LEVEL RISKS: - The agency might have purchases that are not included in the Annual Purchase Plan (APP) - The agency might have sent invitations to bid for unfunded purchase request - Multiple POs resulting to double payment to suppliers - Unauthorized purchases - Related assets, expenses and payable, if on account, might not be recorded in the proper period. Reconciliation (Financial Risk) - Risk that the Agency’s financial statements might not be fairly presented due to the delay in the preparation of reconciliation of accounts. Description and nature of audit procedures Substantive Tests of details Extent of testing (Test of controls, substantive or combined) Timing (what period and when to perform audit procedures) appropriate, examination of subsequent cash receipts, or examination of other supporting documentation. High Control Assurance Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement Agreement of subledger and general ledger - Agree receivables subledger to the general ledger control account. Investigate any unusual items and test other reconciling items based on the established testing threshold Combined Test of Controls and Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Three months after planning Full Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of Three months after planning Verification of existence – Verify the existence of receivables through confirmation or, when appropriate, examination of subsequent cash receipts, or examination of other supporting documentation. Low Control Assurance Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement 5 Observation of physical inventories - Evaluate management’s instructions and procedures for recording and controlling the results of the entity’s physical inventory counting. Observe the performance of the entity’s count procedures Assertion/ Financial Statement as a whole (Refer to Templates 7 & 8) Risk of material misstatement (Refer to Templates 7 & 8) Extent of reliance on controls (Refer to Templates 7 & 8) Substantive Analytical Procedures Existence Description and nature of audit procedures Substantive Tests of details (Test of controls, substantive or combined) and perform test counts. Trace test counts to the entity’s inventory compilation and determine that the inventory compilation accurately reflects actual inventory count results. Confirmation of inventories held by others - If significant, confirm inventories held by others at the physical inventory date and trace confirmed quantities to the inventory compilation; consider observing these physical inventories as well. Reconciliation of inventory compilation with general ledger Review the reconciliation of the valued physical inventory compilation with the general ledger account balances and the perpetual inventory records. Investigate any unusual items and test other reconciling items based on the established testing threshold. Valuation in accordance with accounting policies - Test the valuation of inventory to verify that it is performed in accordance with 6 Extent of testing P40,620,168.95. Timing (what period and when to perform audit procedures) Assertion/ Financial Statement as a whole (Refer to Templates 7 & 8) Risk of material misstatement (Refer to Templates 7 & 8) Extent of reliance on controls (Refer to Templates 7 & 8) Substantive Analytical Procedures Description and nature of audit procedures Substantive Tests of details Extent of testing (Test of controls, substantive or combined) Timing (what period and when to perform audit procedures) the entity’s accounting policies and applicable financial reporting framework. Net realizable value testing - Test the provisions to reduce the valuation of inventory to net realizable value, (e.g., obsolescence and other reserves) and verify that appropriate adjustments are made in accordance with the entity's accounting policies and applicable financial reporting framework. Property, Plant and Equipment Valuation and Allocation; Rights and Obligation; Reconciliation (Financial Risk) - Risk that the Agency’s financial statements might not be fairly presented due to the delay in the preparation of reconciliation of accounts. Low Control Assurance Trend Analysis – Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement Existence Agreement of subledgers with general ledger - Obtain a schedule of property, plant and equipment, including capitalized leases, and related additions, disposals, reclassifications and depreciation, depletion and/or amortization (PPE subledger) and agree balances to the respective general ledger accounts. Additions and disposals - For significant additions (including capitalized labor, borrowing costs and other acceptable costs) and disposals during the period, 7 Full Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Three months after planning Assertion/ Financial Statement as a whole (Refer to Templates 7 & 8) Risk of material misstatement (Refer to Templates 7 & 8) Extent of reliance on controls (Refer to Templates 7 & 8) Substantive Analytical Procedures Description and nature of audit procedures Substantive Tests of details Extent of testing (Test of controls, substantive or combined) Timing (what period and when to perform audit procedures) examine invoices, capital expenditure authorizations, leases and other data that support these additions and disposals. Depreciation - Test depreciation expense in a manner responsive to our combined risk assessment with reference to the entity’s accounting policy and applicable financial reporting framework. Impairments of property, plant and equipment - Use information obtained during the audit in determining whether management has identified appropriate indicators of impairment and verify that appropriate adjustments are made in accordance with the entity's accounting policies and applicable financial reporting framework. Supplies Expense Cutoff; Occurrence; PROCESS LEVEL RISKS: - The agency might have purchases that are not included in the Annual Purchase Plan (APP) - The agency might have sent invitations to bid for unfunded High Control Assurance Trend Analysis - Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement. Also, comparing 8 Test of Transactions – Identify key items/transactions and traced to supporting documents and check the appropriateness of dates of recording. Combined Test of Controls and Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Three months after planning Assertion/ Financial Statement as a whole Risk of material misstatement (Refer to Templates 7 & 8) (Refer to Templates 7 & 8) purchase request Multiple POs resulting to double payment to suppliers - Unauthorized purchases - Related assets, expenses and payable, if on account, might not be recorded in the proper period. PROCESS LEVEL RISKS: - The agency might have purchases that are not included in the Annual Purchase Plan (APP) - The agency might have sent invitations to bid for unfunded purchase request - Multiple POs resulting to double payment to suppliers - Unauthorized purchases - Related assets, expenses and payable, if on account, might not be recorded in the proper period. PROCESS LEVEL RISKS: - The agency might have purchases that are not included in the Annual Purchase Plan (APP) - The agency might have sent invitations to bid for unfunded purchase request Extent of reliance on controls (Refer to Templates 7 & 8) Cutoff; Occurrence; Repairs and Maintenance Cutoff; Occurrence; Substantive Tests of details Extent of testing (Test of controls, substantive or combined) month to month balances to identify unusual fluctuations. - Training Expense Substantive Analytical Procedures Description and nature of audit procedures Timing (what period and when to perform audit procedures) Materiality of P40,620,168.95. High Control Assurance Trend Analysis - Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement. Also, comparing month to month balances to identify unusual fluctuations. Test of Transactions – Identify key items/transactions and traced to supporting documents and check the appropriateness of dates of recording. Combined Test of Controls and Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95. Three months after planning High Control Assurance Trend Analysis - Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement. Also, comparing month to month balances to 9 Test of Transactions – Identify key items/transactions and traced to supporting documents and check the appropriateness of dates of recording. Combined Test of Controls and Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of Three months after planning Assertion/ Financial Statement as a whole Risk of material misstatement (Refer to Templates 7 & 8) (Refer to Templates 7 & 8) (Refer to Templates 7 & 8) - Subsidy – Others Cut-off Multiple POs resulting to double payment to suppliers - Unauthorized purchases - Related assets, expenses and payable, if on account, might not be recorded in the proper period. Employee Fraud (Financial/Control Risk) - Possible loss or misappropriation of unutilized cash advance, caused by non appearance of the beneficiaries during the scheduled pay out, still in the hands of the SDO due to late liquidation/refund of unused fund. Extent of reliance on controls Substantive Analytical Procedures Description and nature of audit procedures Substantive Tests of details (Test of controls, substantive or combined) identify unusual fluctuations. Low Control Assurance Extent of testing Timing (what period and when to perform audit procedures) P40,620,168.95. Trend Analysis - Comparing Prior year and Current Year balances and further investigations shall be made for unusual significant movement. Also, comparing month to month balances to identify unusual fluctuations. Test of Transactions – Identify key items/transactions and traced to supporting documents and check the appropriateness of dates of recording. Conclusion: Based upon the risk assessment procedures further audit procedures have been designed that are sufficient and appropriate to carry out the audit. 10 Full Substantive Procedures Examine all key items/ transactions above certain percentage of Performance Materiality of P40,620,168.95 Three months after planning