Reporting Interfund Activity - The California State University

advertisement

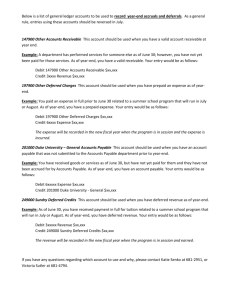

Reporting Interfund Activity Sedong John, Director, Financial Services / SFSR Kelly Cox, Associate Director, Financial Services / Accounting Chancellor’s Office April 23, 2015 Learning Objectives • This session will provide principles, rules, guidance and scenarios in determining when it is appropriate to use: • Transfer object codes, • Cost Recovery /Abatement, and • If and when Loans are to be recorded. April 2015 Year-End Legal Training 2 Revenue/Expense, Transfer, or Loan • Revenue is inflow of resources recognized at the point of entry to an organization and expense is outflow of resources recognized at the point of exit from an organization. Revenue and expense should not be recognized multiple times. • Movement of resources between entry and exit within an organization is a transfer, loan, or cost recovery/reimbursement. April 2015 Year-End Legal Training 3 Revenue/Expense, Transfer, or Loan (cont.) • Transfer is giving up of resources within an organization with no expectation of repayment. • Loan is temporary provision of resources with an expectation of repayment. April 2015 Year-End Legal Training 4 Reporting Interfund Activity (GASB 34, paragraph 112) (a) Reciprocal (exchange) interfund activity (1) Interfund loans (2) Interfund services provided and used (b) Nonreciprocal (nonexchange) interfund activity (1) Interfund transfers (2) Interfund reimbursements April 2015 Year-End Legal Training 5 Reciprocal – Services vs. Non-Reciprocal – Reimbursement Reciprocal – Services • A sale or purchase of goods and services between funds for a price approximating their external exchange value. • The recipient fund should record the receipt of revenue in the appropriate cost recovery revenue object codes. • Interfund activity within the university should be eliminated for consolidated legal basis reports and GAAP financial statements. April 2015 Non-Reciprocal – Reimbursement • Repayment from the fund responsible for particular expenditures for the fund that initially paid for them. • The recipient should record the reimbursement as an abatement against the original expenditure. Year-End Legal Training 6 Non-Reciprocal – Transfer • An interfund flow of resources without equivalent flows of resources in return and without a requirement of repayment. • Transfer should be recorded as transfer-out in the provider fund and as transfer-in in the recipient fund. • Transfer of funds from Extended Education to CSU Fund 485 based on the BOT’s authorization • Transfer to debt service fund for debt payment. April 2015 Year-End Legal Training 7 Reciprocal – Loan • Interfund loan amounts provided with a requirement for repayment. • Interfund loans should be reported as receivables (due from) in the lender funds and interfund payable (due to) in the borrower fund. • If repayment is not expected within a reasonable time, the balances should be reduced and the amount should be reported as a transfer per GASB 34. April 2015 Year-End Legal Training 8 Principle: • Money collected should be used for intended purposes for which it was collected. • Transfers should be used only when necessary to meet a CSU policy, BOT resolution, and external funding requirement (i.e. staging of debt service or work-study). • Unless transfer is necessary, the provider fund should record expenses to their natural classification to indicate the nature of expenses. April 2015 Year-End Legal Training 9 Enterprise Funds Principle: • Transfers should be avoided outside of each Self-Support funds group except for the allowable transfers described below: • As required for Debt Service Payment • Work Study, if the fund is allowed to contribute to the Work study program, then a transfer out to CSU fund 409 is allowed. • CSU policy, BOT resolution, or Legislation. April 2015 Year-End Legal Training 10 Self-Support funds group “Established CSU fees” per EO 994 section 2.4 • Parking Fees = CSU fund 472-474 (except 471:Fines) • Student /Campus Union Fees = CSU fund 534-536 • Housing Fees = CSU fund 531-533 • Health Center Facility Fees = CSU fund 452-454 • Extended Education Fees = CSU fund 441-444 April 2015 Year-End Legal Training 11 Systemwide Revenue Bond Program • Transfers should be avoided since the gross revenues are pledged for debt service and revenues should be used for the intended purposes in which it was collected. April 2015 Year-End Legal Training 12 Decision Tree: Interagency Transaction April 2015 Year-End Legal Training 13 Services vs. Reimbursement Decision Tree: Interagency Transaction • Has a service been provide? • If yes, record a Cost Recovery Revenue. April 2015 Year-End Legal Training 14 Services vs. Reimbursement (cont.) Decision Tree: Interagency Transaction • If No service has been provided, Abate against the original expense, if in the current year. • If the original expense was in prior year (PY), use PY Expenditure Adj 690002. April 2015 Year-End Legal Training 15 Services vs. Reimbursement (cont.) • Cost Recovery Revenue: When a good or service is provided, the credit should be record to the appropriate Cost Recovery Revenue object code. • Abatement: Repayment from Fund B for a particular expense when Fund A initially paid for them, the credit should be recorded as an Abatement against fund A’s original expenditure or prior year expenditure adj. Ref: Legal Manual Chapter 29 – Section 3.9 April 2015 Year-End Legal Training 16 Scenario #1: Construction Expense • Facilities plans to do a scheduled maintenance lighting upgrade throughout the grounds on campus. They determine that each unit; Housing, Parking, Extended Ed and CSU Operating will contribute $100,000 to the project. • How should they record the pooling of these resources and project expenditures? April 2015 Year-End Legal Training 17 Scenario #1 Construction expense: Answer 101100 – SWIFT Cash Main fund Parking* EE* CSU Op* Housing* $400,000 ($100,000) ($100,000) ($100,000) ($100,000) ($400,000) $100,000 $100,000 $100,000 $100,000 $400,000 $100,000 $100,000 $100,000 $100,000 607009-Capital Equipment $15,000 607021-Capital-Design Other $25,000 607033-Capital-Construction Other $355,000 607037-Capital-Insurance Premiums 607033-Capital-Construction Other Total Cost Per Program $ 5,000 * Note: Funding from the other funds is based on campus’ determination but should be based on a methodical hierarchical cash flow model (ex. Interest Earnings loss) and only transferred as costs are incurred. April 2015 Year-End Legal Training 18 Scenario #1 Construction expense: Answer • Why? • Cost are captured by Established CSU fees (aka CSU fund) at the Natural classification (aka the expenditure). • It eliminates systemwide for both Legal and GAAP reporting. • SRB Financial Statements can more readily report the activity to our bond holders by relying on campus data. April 2015 Year-End Legal Training 19 Scenario #2: Scholarship Expense • Extended Education collects tuition fees for their Spring courses. A portion of these fees the Dean determines s/he wants to allocate towards a scholarship program. After going through the proper campus protocols and determining the awardees it is time to issue the payments to the students. • What is the process to issue these awards to the students and the related 1098Ts? April 2015 Year-End Legal Training 20 Scenario #2: Scholarship Expense: Answer • Expend the scholarship award directly out of the Extended Ed Operating fund (CSU fund 441) within FOC 609005-Other Student Scholarships/Grants or more appropriate FOC. • No transfer to the campus Financial aid fund. • Cost are captured by CSU fund at the Natural classification. • SRB Financial Statements can more readily report the activity to our bond holders by relying on campus data. April 2015 Year-End Legal Training 21 www.calstate.edu April 2015 Year-End Legal Training 22