Outline of Chapters 14,16,17,23 & 24

advertisement

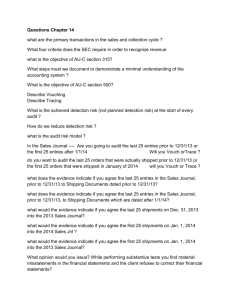

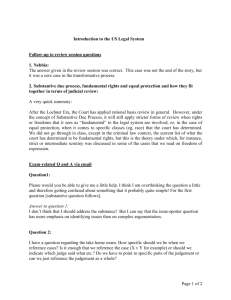

Outline for Final Old Material: Objectives of the following sections of the auditing standards AU-C Section 200 Overall Objectives of the Independent Auditor and Conduct of an Audit in Accordance with GAAS AU-C Section 315 Understanding the Entity and Its Environments and Assessing the Risk of Material Misstatement AU-C Section 500 Audit Evidence AU-C Section 700 Forming an Opinion and Reporting on Financial Statements Independence .. our definition Management Assertions – identify which one apply (if in doubt, Tad's favorites are Occurrence, Completeness, Accuracy, Existence, Completeness, and Valuation & Allocation;) Reporting (Unmodified, Qualified, Adverse, Disclaimer) --Material misstatement: either Qualified or Adverse (depends upon whether the misstatement can be compartmentalized or is pervasive) --Scope Limitation: either Qualified or Disclaimer of Opinion Management refuses to sign rep letter, or Attorney won’t return letter Do you know the difference between a Qualified for Scope limitations and a Qualified for accounting issues ? Do you know the first sentence of each paragraph? Audit Risk 1. Definition 2. Model: AAR = IR x CR x pDR pDR = AAR / (IR * CR) or pDR = AAR / RoMM Audit Approaches & Type of tests performed CR = Low or CR = MAX; pDR = Low or pDR = MAX Reduced level of control risk or primarily substantive Extent of tests of controls, extent of substantive testing Tests of Controls Substantive tests Substantive tests of transactions Substantive analytical procedures Tests of details of account balances Chapter 14 & 16 Sales and Collection cycle Credit sales transactions Collections or Cash receipts transactions Cash Accounts receivable Sales Vouching, tracing Cutoff at 12/31/15 Last 25 entries in Sales Jnl before 12/31/15 First 25 entries in Sales Jnl after 1/1/16 Last 25 shipments before 12/31/15 First 25 shipments after 1/1/16 Last 25 entries in Cash Receipts Jnl before 12/31/15 First 25 entries in CR Jnl after 1/1/16 Last 25 entries in Cash Disbursements Jnl before 12/31/15 First 25 entries in CD Jnl after 1/1/16 From which audit reports will you decide if you find a material misstatement? You should know the first sentence of each paragraph in the report. Three types of substantive tests Substantive tests of transactions Substantive analytical procedures Tests of details of account balances Tolerable misstatement / Tolerable Error / Performance Materiality Confirmation process Types of receivable confirmations Alternate procedures Audit Sampling for Tests of Details of Balances Project the sample results to the population Consider allowance for sampling risk Chapter 23 Audit of Cash Balances Separation of Duties Bank reconciliation / Proof of Cash - what they are used for Cutoff Bank Statement Bank Confirmation Tests of Bank Transfers Chapter 24 Completing the Audit Contingent Liabilities / Contingent Losses SFAS 5 Contingencies: probable, reasonably possible, remote Inquiry of Client’s Attorneys Letter of Inquiry The response is often called the “Attorney Letter” Subsequent Events: the two types of subsequent events Letter of Representation or Management Representation Letter This is very different than the Management Letter What audit report do you issue if management will not provide a Letter of Representation? You should know the first sentence of each paragraph in the report. Analytical Procedures: three stages, when required AU-C 260 Communications with those charged with Governance Other than internal control matters AU-C 265 Communicating Internal Control related matters identified in an Audit Significant Deficiencies, Material Weaknesses Discussed but not on the Final Dual Dating Subsequent Discovery of Facts