C21EF_C4

advertisement

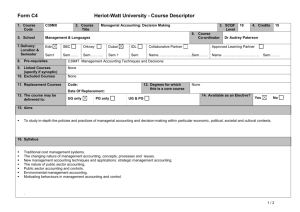

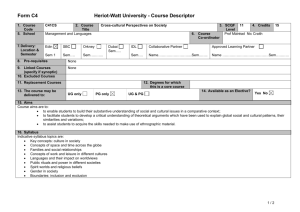

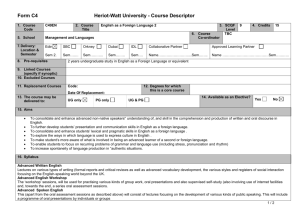

Form C4 Heriot-Watt University - Course Descriptor 1. Course Code C21EF 2. Course Title Emerging Financial Markets 3. SCQF 11 4. Credits Level 6. Course Professor David Cobham Co-ordinator 15 5. School Management and Languages 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem 2 Sem……. Sem……….. Sem 2 Sem…. Name…………………….....Sem..…... Name …………………………………Sem……….. 8. Pre-requisites 9. Linked Courses (specify if synoptic) 10. Excluded Courses 11. Replacement Courses Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: UG only PG only UG & PG MSc Finance and Management Option for MSc International Accounting and Finance, MSc Investment Management, MSc Finance 14. Available as an Elective? Yes No 15. Aims This course aims to supplement the understanding acquired by students of mainstream finance during the year, and to apply it to the specific circumstances of emerging financial markets. This exposure is also designed to assist students with definition of possible dissertation topics and data sources. 16. Syllabus o o o o o o o o Financial repression and liberalisation The institutions, and formation, of macroeconomic policymaking in emerging financial markets The relationship between finance, economic growth and poverty The structure of financial intermediation in emerging markets Structure of savings and informal financial markets Microfinance Crises and regulation in emerging financial markets The role of foreign direct investment and foreign-owned banks in emerging markets 1/2 Form C4 Heriot-Watt University - Course Descriptor 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Scholarship, Enquiry and Research (Research-Informed Learning) Students will, by the end of the course o o o Personal Abilities be familiar with the leading research themes and public policy debates in emerging financial markets understand the interdependence of financial markets and contagion effects be able to analyse the current status and policies of emerging markets Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT During the course, students will o o o adapt and apply mainstream financial theory to the framework of emerging markets be prepared for professional involvement in the emerging financial markets in either the private or public sectors prepare and present their views on recent academic literature in a seminar setting 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Continuous assessment Examination 2 hr Duration of Exam (if applicable) 40 60 Examination 2 hr 20. Date and Version Date of Proposal Date of Approval by School Committee Date of Implementation Version Number 2/2 Diet(s)