Questions regarding the Whistleblower Provisions ( 1553)

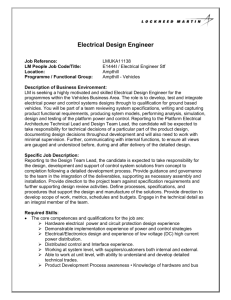

advertisement

D.C. Bar Labor and Employment Law Section April 6, 2009 New Whistleblower Protections for Government Contractors and Employees of State and Local Governments by Robert B. Fitzpatrick, Esq. Robert B. Fitzpatrick, PLLC Universal Building South 1825 Connecticut Avenue, N.W. Suite 640 Washington, D.C. 20009-5728 (202) 588-5300 (telephone) (202) 588-5023 (fax) fitzpatrick.law@verizon.net (e-mail) http://www.robertbfitzpatrick.com (website) Introduction • The American Recovery and Reinvestment Act of 2009 (ARRA), P.L. 111-5, 123 Stat 115, recently signed into law by President Obama, provides for nearly $500 billion in spending to stimulate the economy. • However, those who receive those funds should be aware that §1553 of the ARRA contains new protections for public and private employees who blow the whistle on gross mismanagement or waste of covered funds, danger to public health or safety related to covered funds, abuses of authority relating to the use of the funds, or violation of laws or regulations relating to the grant of the funds. Substantive Provisions • Broad Definition of Employer • Broad Scope of Subject Matter of Disclosures • Broad Class of Recipients of Protected Disclosures • Broad Scope of Protection • Broad Scope of Prohibited Reprisals Broad Definition of Employer §1553(g)(4)-(5) New whistleblower protections affect employers receiving covered funds as: • A contractor, subcontractor, grantee or recipient; • A professional membership organization, certification or other professional body, agent or licensee of the federal government, or a person acting in interest of an employer receiving covered funds; or • A state or local government and any contractor or subcontractor thereof receiving covered funds. “Covered Funds” §1553(g)(2) Any contract, grant or other payment received by any non-Federal employer if: • Federal government provides any portion of money or property that is provided, requested or demanded; and • At least some of the funds are appropriated or otherwise made available by the ARRA. Broad Scope of Subject Matter of Disclosures §1553(a)(1)-(5) Disclosures are protected if they contain information that employee reasonably believes evidences: • Gross mismanagement of an agency contract or grant relating to covered funds; • Gross waste of covered funds; • Substantial and specific danger to public health or safety related to implementation or use of covered funds; • Abuse of authority related to implementation or use of covered funds; • Violation of law, rule or regulation related to an agency contract (including the competition for a contract) or grant, awarded or issued relating to covered funds. Scope of the Five Practices About Which one can Complain • The five types of disclosures covered by sections 1553(a)(1)-(5) are stated in language that is virtually identical to the language contained in the federal Whistleblower Protection Act (WPA). See 5 U.S.C. 2302(b)(8); see also Broida, A Guide to Merit Systems Protection Law and Practice, ch. 13: Prohibited Personnel Practices. • Further, the language of the WPA is routinely construed by the MSPB and the Federal Circuit. See, e.g., Smart v. Dept. of Army, 98 M.S.P.R. 566 (2005); Downing v. Dept. of Labor, 98 M.S.P.R. 64 (2004). Presumably the inspector generals and federal courts will look to that body of jurisprudence to interpret these provisions. • An abuse of authority (§ 1553(a)(4)) is specifically defined in § 1553(g)(1). Gross Mismanagement of Agency Contract or Grant §1553(a)(1) • “Gross mismanagement” for the purposes of the WPA has been defined as a management action or inaction which creates a substantial risk of significant adverse impact upon the agency’s ability to accomplish its mission. White v. Dep’t of the Air Force, 63 M.S.P.R. 90, 95 (1994). • The Federal Circuit has held that in determining whether an employee has made a disclosure protected by the WPA, the court must look for evidence that it was reasonable for the employee to believe that the disclosures revealed misbehavior described by the Act. Lachance v. White, 174 F.3d 1378, 138081 (Fed. Cir. 1999); Chambers v. Department of Interior, 515 F.3d 1362, 1367 (Fed. Cir. 2008). • In the context of gross mismanagement, the test is whether a disinterested observer with knowledge of the essential facts known to and readily ascertainable by the employee could reasonably conclude that the actions of the government evidence gross mismanagement. Lachance at 1381. Gross Waste of Funds §1553(a)(2) • In order to make a disclosure of a “gross waste of funds” for the purposes of the WPA, courts have held that the disclosure must uncover more than a debatable or de minimis expenditure. The disclosure must uncover an expenditure that is significantly out of proportion to the benefit reasonably expected to accrue to the government. Embree v. Dept. of Treasury, 70 M.S.P.R. 79, 85 (1996); Crews v. Department of Army, 217 F.3d 854 at *2 (Fed. Cir. 1999); White v. Dep’t of Air Force, 391 F.3d 1377, 1381-82 (Fed. Cir. 2004). • Disclosure of a “gross waste of funds” for the purposes of the WPA is also governed by the Lachance test - to be protected, the employee must have had a reasonable belief that the disclosure uncovered a “gross waste of funds”. Substantial and Specific Danger to Public Health or Safety §1553(a)(3) • For the purposes of disclosure of a “substantial and specific danger to public health or safety” under the WPA, it has been held that “revelation of a negligible, remote, or ill-defined peril that does not involve any particular person, place or thing, is not protected.” Sazinski v. Dep’t of Housing & Urban Dev., 73 M.S.P.R. 682, 686 (1997). It has further been held that disclosure of a danger only potentially arising in the future is not a protected disclosure. Herman v. Dep’t of Justice, 193 F.3d 1375, 1379 (Fed. Cir. 1999). Rather, as indicated by the statutory language, the danger must be substantial and specific. Id. In determining whether an alleged danger meets this test, relevant considerations include the likelihood of harm resulting from the danger, when the alleged harm may occur, and the nature of the potential harm. Chambers v. Department of Interior, 515 F.3d 1362, 1369 (Fed. Cir. 2008). • For the purposes of the WPA, such a disclosure is also governed by the Lachance test - to be protected, the employee must have had a reasonable belief that the disclosure uncovered such a danger. Abuse of Authority Related to Implementation or Use of Funds §1553(a)(4), (g)(1) • § 1553(g)(1) defines abuse of authority as “an arbitrary and capricious exercise of authority by a contracting official or employee that adversely affects the rights of any person, or that results in personal gain or advantage to the official or employee or to preferred other persons.” • For the purposes of the WPA, such a disclosure is also governed by the Lachance test - to be protected, the employee must have had a reasonable belief that the disclosure uncovered such an abuse of authority. Violation of law, Rule or Regulation Related to Agency Contract or Grant §1553(a)(5) • For the purposes of a disclosure of a “violation of law, rule, or regulation” under the WPA, the courts have held that to make a protected disclosure, a whistleblower need only disclose what he reasonably believes is an imminent – not an actual – violation of a law, rule, or regulation. See, e.g., Reid v. Merit Sys. Prot. Bd., 508 F.3d 674, 678 (Fed. Cir. 2007). • In Drake v. Agency for Int’l Dev., 543 F.3d 1377, 1381 (Fed. Cir. 2008), the court held that whether an employee’s disclosure was based on a reasonable belief regarding a violation of a law, rule or regulation turns on the particular facts of the case. (citing Herman v. Dept. of Justice, 193 F.3d 1375, 1382 (Fed. Cir. 1999)). Broad Class of Recipients of Protected Disclosures §1553(a) Disclosures are protected under the Act if the employee makes them to: • Recovery Accountability and Transparency Board (socalled RAT Board is a body established by Section 1521 of the ARRA “to coordinate and conduct oversight of covered funds to prevent fraud, waste, and abuse); • Agency’s inspector general; • Comptroller General; • Member of Congress; • State or federal regulatory or law enforcement agency; • Person with supervisory authority over employee; • Court or grand jury; • Head of a federal agency; or • A representative of any of the above. Broad Scope of Protection §1553(a) • The Federal Circuit has previously construed the WPA’s protections (5 U.S.C. §2302) to exclude disclosures an employee makes in “merely carrying out his required, everyday job responsibilities.” Langer v. Dep’t of the Treasury, 265 F.3d 1259, 1267 (Fed. Cir. 2001). • By contrast, §1553(a) of the new ARRA expressly includes disclosures “made in the ordinary course of an employee’s duties” in the definition of protected activity. Broad Scope of Prohibited Reprisals §1553(a) • Section 1553(a)’s language regarding “prohibition of reprisals” explicitly provides that employees of employers covered by the act may not be “discharged, demoted, or otherwise discriminated against as a reprisal for” making disclosures protected by the act. • Like other statutes with phraseology identical or similar to the phrase “otherwise discriminated against,” presumably the phrase will be broadly construed to include employment actions such as oral or written reprimands, lateral transfers, reassignment of duties, as well as many other actions that “might well have dissuaded a reasonable worker from making or supporting a claim.” Burlington Northern & Santa Fe Ry. Co. v. White, 548 U.S. 53, 68 (2006) (quoting Rochon v. Gonzales, 438 F.3d 1211, 1219 (D.C. Cir. 2006). • Comparison with the WPA does not seem to be particularly helpful in this regard, since the “personnel actions” covered by that act are much more narrowly and explicitly defined. See 5 U.S.C. § 2302(a)(2)(A). Procedural Provisions • • • • • • Investigations (§1553(b)(1)-(4)) Burdens of Proof (§1553(c)(1)) Determinations (§1553(c)(2)) Lawsuits (§1553(c)(3)) Remedies for Employee (§1553(c)(3)) Judicial Enforcement of Agency Action (§1553(c)(4)) • Judicial Review (§1553(c)(5)) • Waiver of Rights (§1553(d)(1)-(3)) • Notice Posting (§1553(e)) Non-Preemption Provision §1553(f)(1)-(2) • Section (f)(1) states that nothing in § 1553 may be construed “to modify or derogate from a right or remedy otherwise available to an employees.” • Section (f)(2) states that nothing in this section of the ARRA “may be construed to preempt, preclude, or limit the protections provided for public or private employees under State whistleblower laws.” Investigations §1553(b)(1)-(4) • Complaints of reprisal are to be filed with inspector general (IG) of appropriate government agency having jurisdiction over the covered funds. • IG conducts investigation of complaint and prepares report. • As discussed herein, the statute contains no time limit within which to file a complaint with the appropriate IG. Burdens of Proof §1553(c)(1) • The complainant must prove that a protected disclosure was a “contributing factor” in the reprisal • The complainant may meet this burden by use of circumstantial evidence, including evidence that the official undertaking the reprisal knew of the complainant’s protected disclosure, or evidence that the reprisal occurred within a period of time after the disclosure such that a reasonable person could conclude that the disclosure was a contributing factor in the reprisal. • The burden then shifts to the employer to show by clear and convincing evidence that the employer would have taken the action allegedly constituting reprisal, even in the absence of the complainant’s protected disclosure. Determinations §1553(c)(2) • Head of agency concerned with covered funds makes the determination • Whether there is “sufficient basis” to find a prohibited reprisal • No required evidentiary hearing or administrative appeal Lawsuits (De Novo) §1553(c)(3) • Civil actions may be filed after exhausting administrative remedies • Exhaustion includes: • Discontinuance of IG’s investigation; • Issuance of agency head’s order denying relief; or • Passage of 210 days after submission of complaint. • Must file in U.S. district court in which alleged reprisal occurred • Not subject to amount in controversy requirements • As discussed herein, the statute contains no limitations period governing the filing of such a lawsuit. Remedies for Employee §1553(c)(3) • • • • • Affirmative action to abate reprisal Reinstatement with back pay Compensatory damages Employment benefits Other terms and conditions to restore employee to pre-reprisal position • Award of costs and expenses, with reasonable attorneys’ and expert fees • No express caps or limits on damages • No punitive or exemplary damages available, reserved to government in enforcement actions Judicial Enforcement of Agency Action §1553(c)(4) • When it is found that a reprisal occurred, an order is issued by the head of the agency granting some form of relief, and if a person fails to comply with the order, the head of the agency may bring an enforcement action in U.S. District Court. • In such an action, the court may grant “appropriate relief, including injunctive relief, compensatory and exemplary damages, and attorneys’ fees and costs.” Judicial Review §1553(c)(5) • Any person adversely affected or aggrieved by an order issued under §1553(c)(2) (under which the relevant agency either denies that reprisal occurred or finds that reprisal occurred and orders relief) may obtain review of the order’s conformance with §1553(c) and any related regulations in the U.S. Court of Appeals for the circuit in which the alleged reprisal occurred. • Standard of Review: Administrative Procedure Act’s guidance – court decides relevant questions of law, interprets statutory provisions and determines meaning and applicability of agency action. Waiver of Rights §1553(d)(1)-(3) No waiver of substantive or procedural rights by any: • Agreement, • Policy, • Form or condition of employment, or • Pre-dispute arbitration agreements unless contained in collective bargaining agreement. Notice to be Posted §1553(e) • Section 1553(e) requires that any employer receiving covered funds shall post a notice of rights and remedies provided under this section. • Nowhere, does the statute delegate to an agency the responsibility to prepare such a notice, and even though funds are being doled out, no such government-issued notice has been approved. • In the interim, employers ought to prepare their own home-grown notices. See the draft prepared by Jack Burgin published in his February 27, 2009 blog, Poster for Stimulus Bill Whistleblower Provision, Our Own Point of View, Feb. 27, 2009, available at http://ourownpointofview.blogspot.com/2009/02/post er-for-stimulus-bill-whistleblower.html. Inspector General’s Right to Interview Officers and Employees of the Recipient of Covered Funds • Does § 1515, which provides for Inspector General access to certain records and employees, apply to investigations being conducted by Inspector Generals under § 1553 of whistleblower complaints? • Employees should be aware of 18 U.S.C. § 1001 which requires imprisonment for anyone who knowingly and willfully: • Falsifies, conceals, or covers up by trick, scheme, or device a material fact; • Makes any materially false, fictitious, or fraudulent statement or representation; or • Makes or uses any false writing or document knowing the same to contain any materially false, fictitious, or fraudulent statement or entry. Contours of Protected Activity • The removal of documents and electronically stored information (ESI) from the workplace by employees is increasingly a major problem for employers. • With Mass Layoffs Comes the Potential for Mass Misappropriation, Posting of Kurt Kappes & Jim McNairy to Trading Secrets Law Blog (Feb. 10, 2009, 17:52 EST), available at http://www.tradesecretslaw.com/2009/02/articles/tradesecrets/with-masslayoffs-comes-the-potential-for-mass-misappropriation/ • Michelle Goodman, Stealing a Slice of the Company Pie, ABCNews.com, Jan. 22, 2009, available at http://abcnews.go.com/Business/Economy/Story?id=6699815&page=1 • Tracy L. Coenen, Fraud and the Economy: Correlation or Coincidence?, Wisconsin L. J., Jan. 16, 2009, available at http://www.sequenceinc.com/index.php?option=com_content&view=article&id=301:fraud-andthe-economy-correlation-or-coincidence&catid=15:recent-articles-apress&Itemid=64 • Keep Your Documents Close and Your Flash Drives Closer, Posting of Chad Wiener to E-Discovery Bytes (Feb. 4, 2009, 11:30 EST), available at http://ediscovery.quarles.com/2009/02/articles/corporate-recordretention/keep-your-documents-close-and-your-flash-drives-closer/ • Niswander v. The Cincinnati Ins. Co., 529 F.3d 714, 2008 U.S. App. LEXIS 13284 (6th Cir. 2008) (majority sets forth a six-factor balancing test for determining whether employee’s delivery of confidential documents to her attorney was reasonable) Scope of Actions Constituting Retaliation • • • • • Section 1553(a) prohibits the discharge or the demotion of an employee as a reprisal for a covered disclosure. It also states that such employee may not be “otherwise discriminated against as a reprisal” for a covered disclosure. SOX has identical language. See 18 U.S.C. 1514A(c). Most commentators assume that the language “otherwise discriminated against” will be as broadly construed as the Supreme Court construed the language of § 704(a) in Burlington Northern & Santa Fe Ry. v. White, 548 U.S. 53 (2006). The ARB in Melton v. Yellow Transportation, Inc., ARB No. 06-052, ALJ No. 2005-STA-2 (ARB Sep. 30, 2008), stated: “[W]e see no reason not to apply the Burlington Northern materially adverse test to the STAA [Surface Transportation Assistance Act] and the other retaliation statutes that the Department administers.” One member of the panel (Judge Beyer) declined to adopt the Burlington Northern test; whereas two members (Judge Transui and Chief Judge Douglass) adopted the “materially adverse” standard set forth in Burlington Northern. Ernest F. Lidge III, What Types of Employer Actions are Cognizable Under Title VII? The Ramifications of Burlington Northern & Santa Fe Railroad Co. v. White, 59 Rutgers L. Rev. 497 (2007) Scope of Actions Constituting Retaliation Post-Burlington Northern • • • Ginger v. District of Columbia, 527 F.3d 1340, 1343-44 (D.C. Cir. 2008) (movement of police officers from night shift to rotating shift). Williams v. W.D. Sports, N.M., Inc., 497 F.3d 1079, 1090-91 (10th Cir. 2007) (former employer’s opposition to plaintiff’s claim for unemployment compensation benefits) Kassner v. 2nd Avenue Delicatessen Inc., 496 F.3d 229, 242 (2d Cir. 2007) (alleged changes of work stations and work shifts for waitress established genuine issue of material fact on question of adverse employment action) Contributing Factor §1553(c)(1)(A)(i) • • • The complainant’s burden is merely to establish that reprisal was a “contributing factor”. Several courts have discussed “contributing factor” causality. For example, the D.C. Court of Appeals has had the opportunity to define the term “contributing factor” which is contained in the D.C. Whistleblower Protection Act (D.C. Code Ann. § 1-615.52(a)(2))) which defines a “contributing factor” as “any factor which, alone or in connection with other factors, tends to affect in any way the outcome of the decision.” See Crawford v. Dist. of Columbia, 891 A.2d 216 (D.C. 2006);see also Johnson v. Dist. of Columbia, 935 A.2d 1113 (D.C. 2007). A “contributing factor” appears to be akin to a “motivating factor,” phraseology contained in the 1991 Amendments to the Civil Rights Act of 1964, and the phrase, a “contributing factor” would appear to not incorporate any notion of “but for” causation. See, e.g., Gross v. FBL Financial Servs., Inc., No. 08-441 currently pending decision from the Supreme Court. See oral argument transcript of March 31, 2009 http://www.supremecourtus.gov/oral_arguments/argument_transcri pts/08-441.pdf Circumstantial Proof of a Reprisal: Knowledge Alone? • § 1553(c)(1)(A)(ii) “Use of Circumstantial Evidence. A disclosure may be demonstrated as a contributing factor in a reprisal for purposes of this paragraph by circumstantial evidence including: (I) evidence that the official undertaking reprisal knew of the disclosure; or (II) evidence that the reprisal occurred within a period of time after the disclosure such that a reasonable person could conclude that the disclosure was a contributing factor in the reprisal.” • Does § 1553(c)(1)(A)(ii)(I) mean that knowledge alone is circumstantial evidence that there was a reprisal because of a covered disclosure, shifting the burden to the employer to demonstrate by “clear and convincing” evidence that the action taken against the complainant would have been taken in any event? Circumstantial Proof of a Reprisal: Temporal Proximity Alone? • § 1553(c)(1)(A)(ii) “Use of Circumstantial Evidence. A disclosure may be demonstrated as a contributing factor in a reprisal for purposes of this paragraph by circumstantial evidence including: (I) evidence that the official undertaking reprisal knew of the disclosure; or (II) evidence that the reprisal occurred within a period of time after the disclosure such that a reasonable person could conclude that the disclosure was a contributing factor in the reprisal.” • Does § 1553(c)(1)(A)(ii)(II) mean that proof of temporal proximity between the disclosure and the alleged retaliatory act alone sufficient circumstantial evidence to shift the burden of proof to the employer to demonstrate by “clear and convincing” evidence that the action would have happened in any event? • Undoubtedly, the IG’s and the courts will debate as to what constitutes temporal proximity. Temporal Proximity • Jones v. Bernanke, 2009 U.S. App. LEXIS 4539 (D.C. Cir. Mar. 6, 2009) (Employee’s negative performance reviews following closely behind employee’s request for an EEOC hearing may, on remand, support an inference of retaliation even though it occurred almost a year after the initial filing of charges.) • Hamilton v. Gen. Elec. Co., 2009 U.S. App. LEXIS 2725 (6th Cir. Feb. 12, 2009) (Employer’s increased scrutiny over employee after employee filed EEOC complaint and termination only three months later sufficiently established temporal proximity and causation requirements). • Fabela v. Socorro Indep. Sch. Dist., 329 F.3d 409 (5th Cir. 2003) (Employer’s justification of decision to terminate employee based partially on employee’s “unsubstantiated EEOC charge” 5 years earlier sufficiently established causation requirement) • Troy B. Daniels & Richard A. Bales, Plus at Pretext: Resolving the Split Regarding the Sufficiency of Temporal Proximity Evidence in Title VII Retaliation Cases, 44 Gonz. L. Rev. ___ (forthcoming 2009), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1286132 • Justin O’Brien, Note, Weighing Temporal Proximity in Title VII Retaliation Claims, 43 B.C. L. Rev. 741(2002) Clear and Convincing Evidence • • Once the complainant has demonstrated that a protected disclosure was a “contributing factor” in the reprisal, the agency must find for the complainant unless the non-Federal employer demonstrates by “clear and convincing” evidence that the non-Federal employer would have taken the action constituting the reprisal in the absence of the disclosure. Clear and convincing evidence is “[e]vidence indicating that the thing to be proved is highly probable or reasonably certain.” Peck v. Safe Air International, Inc., ARB No. 02-028 at 6, ALJ No. 2001-AIR-3 (ARB Jan. 30, 2004) (citing BLACK'S LAW DICTIONARY 1201 at 577 (7th ed. 1999)) (emphasis added). This standard of evidence is a higher burden than “preponderance of the evidence,” but less than “beyond a reasonable doubt.” Duprey v. Florida Power & Light Co., 2000- ERA5 at 4 (ALJ July 13, 2000), aff’d, (ARB Feb. 27, 2003) (citing Grogan v. Garner, 498 U.S. 279 (1991)). As the Eleventh Circuit observed in a nuclear whistleblower case employing the same burdens of proof, “For employers, [the clear and convincing evidence standard] is a tough standard, and not by accident. Congress appears to have intended that companies in the nuclear industry face a difficult time defending themselves.” Stone & Webster Eng’g Corp. v. Herman, 115 F.3d 1568, 1472 (11th Cir. 1997). Clear and Convincing Evidence • “Clear and convincing” evidence has been defined for purposes of MSPB proceedings in 5 C.F.R. 1209.4(d) as that “measure or degree of proof that produces in the mind of the trier of fact a firm belief as to the allegations sought be established.” See also Price v. Symsek, 988 F.2d 1187, 1191 (Fed. Cir. 1993) (“evidence which produces in the mind of the trier of fact an abiding conviction that the truth of a factual contention is highly probable”); Broida, A Guide to Merit Systems Protection Board Law and Practice, ch. 13: Prohibited Personnel Practices. Extensions of Time to the IG • Section 1553(b)(2)(B) contains rather extraordinary provisions regarding extensions of time for the IG to complete his/her investigation. • Without an extension, the IG investigation is to be completed within 180 days. Section 1553(b)(2)(B)(i) provides that the complainant can agree to confer an extension of time on the IG and (B)(ii) provides that the IG, on his/her own, may extend the period for not more than 180 days, provided the IG provides a written explanation for the extension. • This language seems to suggest that, with complainant’s consent, the IG can obtain virtually unlimited extensions of time; whereas without the complainant’s consent, the IG is limited to a single extension of 180 days and must provide a written explanation. Reasonable Belief Test: Objective or Subjective? • • • • The language of the statute (“the employee reasonably believes” (§ 1553(a))) is virtually identical to §806 of SOX, and §806 has been construed to establish an objective reasonable belief standard. See, e.g., Tuttle v. Johnson Controls Battery Div., 2004-SOX-76 (ALJ Jan. 3, 2005) (where the ALJ explained, “Protected activity is defined under SOX as reporting an employer’s conduct which the employee reasonably believes constitutes a violation of the laws and regulations related to fraud against shareholders. While the employee is not required to show the reported conduct actually caused a violation of the law, he must show that he reasonably believed the employer violated one of the laws or regulations enumerated in the Act. Thus, the employee’s belief “must be scrutinized under both subjective and objective standards.”). Nonetheless, it may be argued that the Congress’s language incorporates a subjective reasonable belief test. In other words, if complainant can demonstrate that he/she actually believed that there was one or more of the prohibited practices referenced in § 1553(a)(1)-(5), then even though an objectively reasonable person might well not have had such an opinion, the complainant’s disclosure is nonetheless protected. • Given the uniform construction of §806 of Sox, this argument would not appear to have much traction. Lawrence D. Rosenthal, To Report or Not to Report: The Case for Eliminating the Objectively Reasonable Requirement for Opposition Activities Under Title VII’s Anti-Retaliation Provision, 39 Ariz. St. L. Rev. 1127 (2007) Retaliation – Counterclaims • • • • • • An issue that has arisen with some frequency recently is whether an employer’s counterclaims against the employee are actionable retaliation. We can expect this issue to arise in § 1553 litigation. Gross v. Akin, Gump, Straus, Hauer & Feld, LLP, 2009 U.S. Dist. LEXIS 16427 (D.D.C. Mar. 3, 2009) Plaintiff employee sued Defendant for age discrimination. During discovery, employer found information to support counterclaim. Plaintiff counterclaims for retaliation based on exercise of rights under the ADEA and DC HRA. Court dismisses employee’s counterclaim, holding that counterclaim is not actionable under Burlington Northern because: • Plaintiff was not an employee of Defendant when Defendant filed the counterclaim, • Counterclaim could not actually dissuade Plaintiff from filing his claim, and • Rule 13 of Fed. R. Civ. Pro. required Defendant to file counterclaim in this case. Retaliation - Counterclaims • • • • • Darveau v. Detecon Inc. 515 F.3d 334, 343 (4th Cir. 2008) - Court holds that “filing a lawsuit alleging fraud with a retaliatory motive and without a reasonable basis in fact or law” constitutes adverse employment action required to support a claim of retaliation for bringing a suit under the FLSA against an employer. Hernandez v. Crawford Bldg. Material Co., 321 F.3d 528, 532 (5th Cir. 2003), plaintiff sued for race discrimination and employer counterclaimed for theft, employee counterclaimed for retaliation based on employer’s counterclaim and trial judge dismisses employee’s counterclaim for lack of lack of proof. • Fifth Circuit reverses and dismisses, noting that district courts in other circuits have held that filing a suit or counterclaim can support a lawsuit premised on a theory of retaliatory employment action. See Beckham v. Grand Affair of N.C., Inc., 671 F. Supp. 415, 419 (W.D.N.C. 1987); EEOC v. Va. Carolina Veneer Corp., 495 F. Supp. 775 (W.D.Va. 1980) Timmerman v. U.S. Bank, N.A., 483 F.3d 1106 (10th Cir. 2007) - Court holds that a meritorious counterclaim, based on plaintiff’s directing bank funds to her own account, would not support a retaliation claim, relying on Bill Johnson’s Restaurants, Inc. v. NLRB, 461 U.S. 731, 743 (1983) (refusing to enjoin a “well founded lawsuit . . . even if it would not have been commenced but for plaintiff’s desire to retaliate against [defendant] for exercising [his/her] rights.”) Walsh v. Irvin Stern’s Costumes, No. 05-2515, 2006 WL 2380379 (E.D. Pa. Aug. 15, 2006) Court holds that threatening to accuse plaintiff of a crime is an adverse employment action. Zakzrewska v. New School, 543 F. Supp. 2d 185 (S.D.N.Y. 2008) - Plaintiff, in a discrimination case, sought to amend her complaint to add a retaliation claim because she learned in discovery that Defendant had been covertly monitoring her personal emails. Court allowed the amendment on grounds that a jury might conclude that such activity (even if unknown to plaintiff at the time of the monitoring) might persuade a reasonable person not to file a discrimination complaint. Retaliation - Counterclaims • In evaluating whether a claim by an employer against an employee constitutes actionable retaliation, the courts often look to the Noerr-Pennington doctrine. • California Motor Transport Co. v. Trucking Unlimited, 404 U.S. 508, 511 (1972) • United Mine Workers v. Pennington, 381 U.S. 657 (1965) • Eastern R.R. Presidents Conference v. Noerr Motor Fright, Inc., 365 U.S. 127 (1961) Total Absence of Statutes of Limitations • Section 1553 nowhere sets forth a time limit within which to submit a complaint to the appropriate Inspector General. • And, nowhere does § 1553 set forth a time limit within which a civil action must be filed after the employee has exhausted administrative remedies. • Some have suggested that for one or both time limits, the courts should look to the four year federal catch-all statute of limitations which was last discussed by the Supreme Court in Jones v. R.R. Donnelly & Sons Co., 541 U.S. 369 (2004) (construing 28 U.S.C. § 1658 which reads as follows: “Except as otherwise provided by law, a civil action arising under an Act of Congress enacted after the date of enactment of this section may not be commenced later than 4 years after the cause of action accrues." 28 USC § 1658(a)). Clearly, § 1658 would only apply to a civil action, and would not resolve the time period for filing with the IGs. Total Absence of Statutes of Limitations • Others have suggested that the ongoing debate among the federal courts regarding the time limits for federal ADEA may provide some answers. See Price v. Bernanke, 470 F.3d 384 (D.C. Cir. 2006); Burzynksi v. Cohen, 264 F.3d 611 (6th Cir. 2001). Garcetti Trumped • Garcetti v. Ceballos, 547 U.S. 410 (2006), involved the First Amendment Free speech protections for government employees. The plaintiff was a district attorney who claimed that he had been passed up for a promotion by criticizing the legitimacy of a warrant. The Court ruled that because his statements were made pursuant to his position as a public employee, rather than as a private citizen, his speech had no First Amendment protection. • Section 1553(a) specifically states that an employee who makes a disclosure “in the ordinary course of an employee’s duties” is a protected disclosure. • Thus, the lawyer in the employer’s office of general counsel who blows the whistle is protected, and some rather troubling ethical issues shall have to be resolved. • Internal auditors and compliance officers, who make disclosures, are protected, and similarly there are some troubling “ethical” issues to be resolved. FEDERAL ACQUISITION REGULATION (FAR): Contractor Business Ethics Compliance Program and Disclosure Requirements • On Nov. 12, 2008, the new FAR rule (73 Fed. Reg. 67064), was issued, requiring federal contractors and most subcontractors to make mandatory disclosures to agency Offices of Inspector General and Contracting Officers whenever they have “credible evidence” of criminal violations, a civil False Claims Act violation, or a “significant overpayment” in connection with the award, performance, or close-out of a government contract or subcontract. These requirements took effect December 12, 2008. In addition they contain a “look back” requirement for certain criminal or civil False Claims Act violations and significant overpayments that occurred before that date. Reinstatement • Section 1553(c)(2)(B), which provides that an agency head’s order may include reinstatement, makes no reference to front pay as an alternative. • Presumably, the courts will read that alternative into the statute as they did under Title VII of the 1964 Civil Rights Act with the proviso that reinstatement is the preferred remedy. Like Title VII, there may be a dispute as to whether judge or jury determines the amount of front pay. Compensatory Damages • Section 1553(c)(3) provides that the complainant in a civil action may seek “compensatory damages”. • Compensatory damages are nowhere defined in the statute. • Thus, the agencies and the courts shall have to determine whether so-called hedonic or loss of enjoyment of life damages are awardable; whether tax bump relief is encompassed; whether lost opportunity damages are obtainable; and whether lost future earnings are permissible. • Some guidance may be gleaned from the courts’ interpretation of similar language in other statutes. For example, the whistleblower protection provisions of the Energy Reorganization Act, 42 U.S.C. § 5851, and the Wendell H. Ford Aviation Investment and Reform Act for the 21st Century (AIR 21), 49 U.S.C. § 42121, also provide for compensatory damages and do not define the term. DOL has construed the term to include damages for emotional distress, humiliation, and loss of reputation. See, e.g., Hobby v. Georgia Power Co., ARB No. 98- 166, ALJ No. 1990ERA-30 (ARB Feb. 9, 2001). Attorneys’ Fees • Section 1553(c)(2)(C) provides that the agency head’s order may require the employer to “pay the complainant an amount equal to the aggregate amount of all costs and expenses (including attorneys’ fees and expert witnesses’ fees) that were reasonably incurred by the complainant for, or in connection with, bringing the complaint regarding the reprisal . . .” • Given that the Congress did not use its usual language providing for an award of reasonable attorneys’ fees, but rather used the phraseology “reasonably incurred,” does that suggest that fees will only be awarded to complainant to reimburse him/her for fees that they actually paid to a lawyer? In other words, are contingent fees in any jeopardy as a result of this unusual language? Attorneys’ Fees • Section 1553(c)(3), in describing the relief available to the plaintiff in a de novo civil action, states that “the complainant may bring a de novo action at law or equity against the employer to seek compensatory damages, and other relief available under this section…” (italics supplied) • The question naturally arises as to what does the reference to “other relief available under this section” mean. Does this sweep in the full panoply of relief described in § 1553(c)(2) and § 1553(c)(4)? Unquestionably, there will be major battles regarding the remedies available to plaintiffs in (c)(3) actions. Attorneys’ Fees • Section 1553(c)(2)(C) also contains yet another oddity. • It states that the “aggregate amount of all costs and expenses . . . that were reasonably incurred by the complainant . . . [shall be] determined by the head of the agency or a court of competent jurisdiction”. • The addition of the latter phrase seems odd and potentially suggests that fee fights alone may be taken to federal District Court for resolution. • A similar issue arose in anti-discrimination litigation against the federal government where the plaintiff did not want to challenge a favorable finding of liability, but only wanted to challenge the adequacy of the fee award. See, e.g., Scott v. Johanns, 409 F.3d 406 (D.C. Cir. 2005). Interplay Between Civil Actions and Petitions for Review to the Court of Appeals • It is unclear whether the party dissatisfied with the agency head’s order can seek de novo proceedings in federal district court and/or and an APA review in the Court of Appeals. • It seems clear that only the complainant can bring a de novo in federal district court. But, any person “adversely affected or aggrieved by an” agency head’s order may obtain review in the Court of Appeals. • It is not clear how it would play out if the employer petitioned to the Court of Appeals before the complainant initiated a civil action. • And, it is not clear whether the complainant has two choices in certain circumstances. If the complainant is dissatisfied with an agency head’s order that denies relief, in whole or in part, it is clear that the complainant can sue de novo in federal district court, and, as he/she is seemingly “adversely affected or aggrieved by an order,” seemingly also able to file a petition for review to the Court of Appeals. Thus, there may be circumstances where complainant does not want full de novo review, but only legal review (e.g., the legal propriety of the fee award), and therefore a petition to the Court of Appeals may be the wiser course of action. Camel’s Nose Under the Tent • Section 1553(d)(2) prohibits pre-dispute arbitration agreements to resolve disputes involving alleged reprisals under this statute except in the circumstance where there is a collective bargaining agreement. • Is this the first volley in the battle to come to eliminate pre-dispute arbitration agreements generally in employment cases? See Arbitration Fairness Act of 2009, H.R. 1020, 111th Cong. (2009), available at http://www.opencongress.org/bill/111-h1020/text. Settlement • In light of the extraordinarily sweeping language of § 1553(d)(1) stating that “the rights and remedies provided for in this section may not be waived by any agreement, policy, form, or condition of employment . . .”, a question arises regarding settlements. • That language is so broad that, on its face, it would seem to prohibit settlement agreements wherein, in exchange for consideration, the complainant waives all rights and remedies under this statute. • Immediate guidance on this language would seem to be needed. General Release’s Effect on Qui Tam Claims • • • United States ex rel. Ritchie v. Lockheed Martin Corp., 2009 U.S. App. LEXIS 5269 (10th Cir. Mar. 6, 2009) (Court enforced release where the allegations of fraud had been disclosed to the government before the relator signed the general release; Judge Briscoe dissented on the release issue) U.S. ex rel. Al-Amin v. George Washington University, 2007 WL 1302597 (D.D.C. May 2, 2007) (Court held that a general release, which became effective two days after the relator filed her qui tam complaint, was unenforceable because it was contrary to public policy concerns reflected in the False Claims Act.) United States ex rel. Radcliffe v. Purdue Pharma L.P., 2008 U.S. Dist. LEXIS 81688 (W.D. Va. Oct. 14, 2008) Court held that general release did not bar qui tam action. See also, United States ex rel. Green v. Northrop Corp., 59 F.3d 953 (9th Cir. 1995); United States ex rel. Hull v. Teledyne Wah Chang Albany, 104 F.3d 230 (9th Cir. 1997); United States ex rel. Gebert v. Transp. Admin. Servs., 260 F.3d 909, 916 (8th Cir. 2001); United States ex rel. Longhi v. Lithium Power Techs., Inc. 481 F. Supp. 2d 815 (S.D. Tex. Mar. 23, 2007) (Court declined to enforce the general release to preclude the qui tam claim); United States ex rel. Bahrani v. Conagra, Inc., 183 F. Supp. 2d 1272, 1275-78 (D. Colo. 2002); United States ex rel. DeCarlo v. Kiewit/AFC Enters., Inc., 937 F.Supp. 1039, 1043-47 (S.D.N.Y. 1996); Tolling Agreements • Unlike the Department of Labor (OSHA) in SOX cases, will tolling agreements be honored by the IG’s? At least one ALJ has held that a tolling agreement entered into by the parties in furtherance of settlement negotiations in a SOX case was ineffective. See Szymonik v. TyMetrix Inc., 2006-SOX-50 (Mar. 8, 2006). • The EEOC in its Compliance Manual specifically states that such tolling agreements are to be respected. EEOC Compliance Manual, ch. 2-IV(D)(3) (May 12, 2009), available at http://www.eeoc.gov/policy/docs/threshold.html (“The time requirements for filing a charge may be waived by the parties by mutual agreement, thereby allowing a charging party to file a charge beyond the 180/300-day statutory time limit. For example, the parties may agree to waive the limitations period so they may engage in private negotiations . . .”). Are Inter-State Agencies Covered? • Section 1553(g)(5) is silent with respect to inter-state agencies like the New York Port Authority, the Delaware River Basin Commission, the Great Lakes Basin Compact, the Interstate Water Commission on the Potomac River Basin, the Appalachian Regional Commission, the Chesapeake Bay Commission, Metropolitan Washington Airports Authority, and the Susquehanna River Basin Commission.