practicequiz1b

advertisement

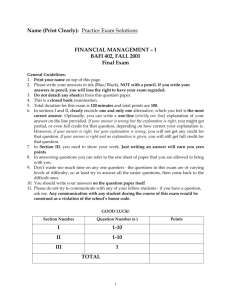

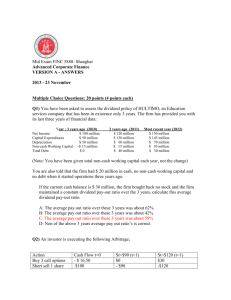

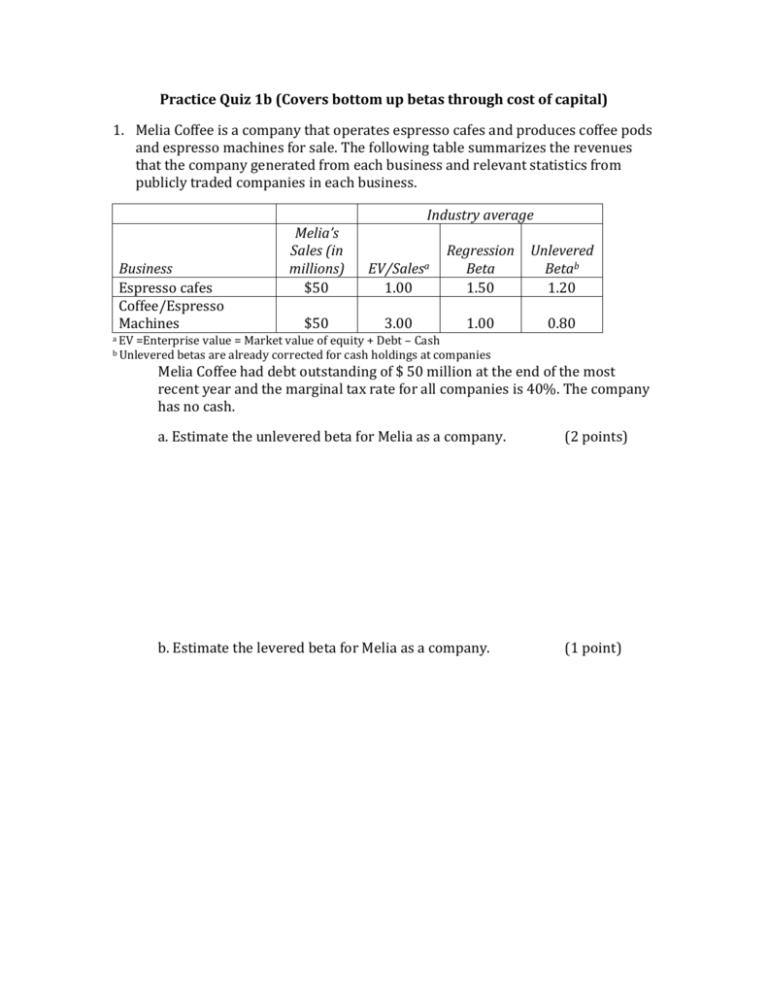

Practice Quiz 1b (Covers bottom up betas through cost of capital) 1. Melia Coffee is a company that operates espresso cafes and produces coffee pods and espresso machines for sale. The following table summarizes the revenues that the company generated from each business and relevant statistics from publicly traded companies in each business. Industry average Business Espresso cafes Coffee/Espresso Machines Melia’s Sales (in millions) $50 $50 1.00 Regression Beta 1.50 Unlevered Betab 1.20 3.00 1.00 0.80 EV/Salesa a EV =Enterprise value = Market value of equity + Debt – Cash b Unlevered betas are already corrected for cash holdings at companies Melia Coffee had debt outstanding of $ 50 million at the end of the most recent year and the marginal tax rate for all companies is 40%. The company has no cash. a. Estimate the unlevered beta for Melia as a company. (2 points) b. Estimate the levered beta for Melia as a company. (1 point) 2. You have been asked to assess the impact of Microsoft’s attempted acquisition of Yahoo! and have collected the following information (in billions) on the two companies: Company Market value of Equity Market value of debt Cash Regression beta Business Microsoft 300 0 60 1.2 Software Yahoo! 0 0 2.8 Internet services 60 While you believe that the regression beta is a reasonable estimate of the beta for Microsoft as a company, you do not trust the regression beta for Yahoo! The average unlevered beta for the internet services business is 2.00 and the marginal tax rate for all firms is 40%. a. Assuming that cash as a percent of Microsoft’s value has remained unchanged over the last two years (the regression period) and that the firm has never used debt, estimate the unlevered beta of just being in the software business. (1 point) b. Assume that Microsoft plans to use its entire cash balance to buy Yahoo! Estimate the beta for Microsoft after the transaction. (2 points) 3. You are trying to estimate the cost of capital for Lumberger Inc., a paper & pulp company, and have been provided with the following information: The unlevered beta for paper & pulp companies is 1.05 There are 100 million shares outstanding, trading at $20/share, and the book value of equity is $ 1 billion. The firm has $ 1 billion in debt outstanding (in book value terms), with interest expenses of $ 40 million a year. The debt has a weighted average maturity of 8 years. The company also has $ 50 million in operating lease commitment, each year for the next 6 years. The bond rating for the company is A+, with a default spread of 1.50% over the riskfree rate. The risk free rate is 3.5% and the equity risk premium is 6%. The marginal tax rate for all firms is 40% but the effective tax rate is 25%. a. Estimate the market value of debt for Lumberger, including the lease commitments. (2 points) b. Estimate the cost of capital for Lumberger. (2 points)