Securitization by Muhammad Imran Usmani

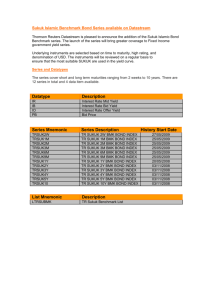

advertisement

SECURITIZATION By Dr. Muhammad Imran Usmani Presen Outline Presentation • Introduction • Shari’a Perspective on Securitization • Types of Sukuk • Securitization of Musharakah • Securitization of Murabaha • Securitization of Ijarah Presen Introduction • In normal conventional market, security is a document, representing receivable amounts owed by the issuer in favor of the holder. • Normally the amounts secured by a security are interests bearing loans. Different kinds of securities Bonds issued by a company Bonds issued by a government Debentures Certificates Notes Treasury Bills Shari’aPresen Perspective • Securities representing a loan or debt (such as bonds) cannot be sold or purchased. • If they are sold at a price higher or lower than their face value, it is considered as “Riba” • If they are purchased at their face value (Bai al Dayn), this involves “Gharar” and hence prohibited. • However, securities may be assigned to a third party at par value.The difference between sale and assignment (HAWALA) is that transfer in HAWALA is with recourse while transfer in Sales in without recourse. Presen Securitization Definition “Issuing certificates of ownership, against an asset, investment pool or business enterprise.” • If the securities represent the proportionate ownership of the holder in illiquid or tradable assets, the trade of such securities is permissible. • The sale of such security will be tantamount to the sale of holder’s proportionate share in the assets. Presen Types of Sukuk Ijara Sukuk Sukuk of ownership in leased assets Issued with the aim of selling the asset so that holders of Sukuk become owners of the assets. Sukuk of ownership of usufructs of assets Issued with the aim of leasing the asset so that holders of Sukuk become owners of the usufruct of the assets. Sukuk of ownership of services Issued for the purpose of providing services through a specified provider so that Sukuk holders become owners of these services. Presen Types of Sukuk Musharaka Sukuk Issued with the aim of using the mobilized funds for establishing a new project, developing an existing project or financing a business activity on the basis of any of partnership contracts. Participation certificates – represent projects or activities managed on the basis of Musharaka. Mudaraba Sukuk – represent projects or activities managed on the basis of Mudaraba. Investment Agency Sukuk – represent projects or activities managed on the basis of an investment agency by appointing an agent to manage the operation. Presen Types of Sukuk Murabaha Sukuk Issued for the purpose of financing the purchase of goods through Murabaha so that Sukuk holders become the owners of Murabaha Commodity Salam Sukuk Issued for the purpose of mobilizing funds so that the goods to be delivered on the basis of salam come to be owned by the Sukuk holders Istisna’ Sukuk Issued for the purpose of mobilizing funds to be employed for the production of goods so that the goods produced come to be owned by the Sukuk holders Presen Types of Sukuk Muzara’a (sharecropping) / Musaqa (irrigation) Sukuk Issued for the purpose of using the mobilized funds for financing a project so that Sukuk holders become entitled to a share in the crop as per the agreement. Mugharasa (agricultural) Sukuk Issued for the purpose of mobilizing funds so that Sukuk holders become entitled to a share in the land and plantation. Securitization of Musharakah Presen Musharakah Securitization • Musharakah is a mode of financing which can be securitized easily. • Especially in case of big projects where huge amounts are required. • Every subscriber can be given a Musharakah certificate, which represents his proportionate ownership in the assets of the Musharakah. • After the project is started, these Musharakah certificates can be treated as negotiable instruments. Certificates can be bought and sold in the secondary market. Presen Musharakah Securitization Essential Conditions • Profit earned by the Musharakah is shared according to an agreed ratio. • Loss is shared on pro rata basis. • All the assets of the Musharakah should not be in liquid form. Portfolio of Musharakah should consist of non-liquid assets valuing more than 33% of its total worth. Presen Musharakah Securitization Essential Conditions • However, if Hanafi view is adopted, trading will be allowed even if the non-liquid assets are less than 33% but the size of the nonliquid assets should not be negligible. • Whenever there is a combination of liquid and non-liquid assets, it can be sold and purchased for an amount greater than the amount of liquid assets in combination. Presen Difference Musharakah Certificates Conventional Bond • Represents the direct pro • Has nothing to do with rata ownership of the the actual business holder in the assets of the undertaken with the project. borrowed money. • If all the assets of the joint project are in liquid form, the certificate will represent a certain proportion of money owned by the project. • The bond stands for a loan repayable to the holder in any case, and mostly with interest. Presen Musharakah Securitization Securitization of Musharakah can be used for: • Construction of Projects and factories • Expansion Projects • Working Capital Finance Securitization of Murabaha Presen Securitization of Murabaha • Murabaha is a transaction, which cannot be securitized for creating a negotiable instrument to be sold and purchased in secondary market. • However, if the Murabaha paper is transferred, it must be at par value; not more, not less. • A mixed portfolio consisting of a number of transactions including Murabaha, may issue negotiable certificates subject to certain conditions. Presen Conditions • In Murabaha Securitization, pool of asset should consist of Ijarah valuing more than 33% of its total worth. • However, as described earlier if Hanafi view is adopted, trading will be allowed even if the non-liquid assets are more than 10% of its total worth. • Investors will have a Mudaraba relationship with the Manager of the Pool. Presen Conditions • Investors in the pool will have Musharakah relationship and each one will be proportionate owner of the pool. • Profit will be shared according to an agreed ratio between the Pool and the Manager. • Share of the pool will be further divided among the investors according to the rules of Musharakah. Securitization of Ijarah Presen of Ijarah Securitization • It is possible to create a secondary market instrument for the financiers on the basis of Ijarah. • The lessor (owner) can sell the leased asset wholly or partly either to one party or to a number of individuals to recover his cost of purchase of the asset with a profit thereon. • This purchase of a proportion of the asset by each individual may be evidenced by a certificate, which may be called 'Ijarah certificate’. Presen of Ijarah Securitization • Ijarah certificate represents the holder's proportionate ownership in the leased asset. • The holder will assume the rights and obligations of the owner/lessor to the extent of his ownership. • The holder will have the right to enjoy a part of the rent according to his proportion of ownership in the asset. Presen of Ijarah Securitization • In the case of total destruction of the asset, he will suffer the loss to the extent of his ownership. • These certificates can be negotiated and traded freely in the market and can serve as an instrument easily convertible into cash. • Essential Condition “It’s essential that the Ijarah certificates are designed to represent real ownership of the leased assets, and not only a right to receive rent.” THANK YOU